Looking at the latest New Jersey pension performance report made me realize how doomed pensions are for average people in America. If you work in the public sector, you need to be using a 403b and IRA to shelter as much as you can for your golden years. I seriously doubt all but the strongest funds will be able to pay their obligations in 30 years when many Millennial Moola readers will retire. This is mostly due to impossible public pension investment assumptions, and I have the numbers to prove it.

Bonds Yield Almost Nothing

Towers Watson, an expert in pension benefits, found that the average allocation to bonds in pension plans is 35%-50%. Right now the 10 year Treasury yield is about 1.61%. If one assumes that the average credit quality of these bonds is in the mid to lower AA range, you could round up and assume an average return of 2% from this 35%-50% of pension portfolios.

However, I inspected the New Jersey asset allocation and found that 85% of their bonds have maturities of less than 10 years. Because they are taking less interest rate risk, the 2% return assumption is charitable at best.

The US Stock Market Performed Incredibly Well the Past Several Years

Paradoxically to the average person, stock market performance is typically better after a long period of poor results. OVer the past 50 years, the S&P 500 returned about 10% annually. Over the past five years, the broad US stock market returned about 11%. The long term Price Earnings ratio is about 15. The current Price Earnings ratio stands at about 22.

If there was ever a time where public pension investment assumptions would be correct, it should be now. After all, US stock market returns were great the past several years. Additionally, bonds have continued to rise in price to unheard of levels. How have public pensions actually performed?

We can look at New Jersey’s performance as a representative example to answer the question. Their funds returned 5.5% over the past three years and 6.2% over the past five years even during a strong bull market in US equities. As I mentioned, the US stock market earned almost double these numbers.

Why Did Public Pension Investment Assumptions Fail to Meet Expectations?

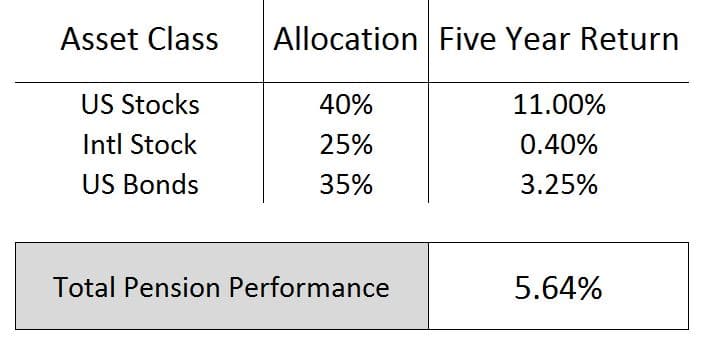

The broad bond market as represented by Vanguard’ total bond fund returned about 3.25% over the past five years. The broad international stock market returned about 0.4% annually over the same five year period. Here is a hypothetical return for a portfolio of 40% US Stocks, 25% International Stocks, and 35% US Bonds for the past five years.

Coincendentally, this figure is close to what New Jersey earned over the period.

Return Possibilities For the Next Five Years

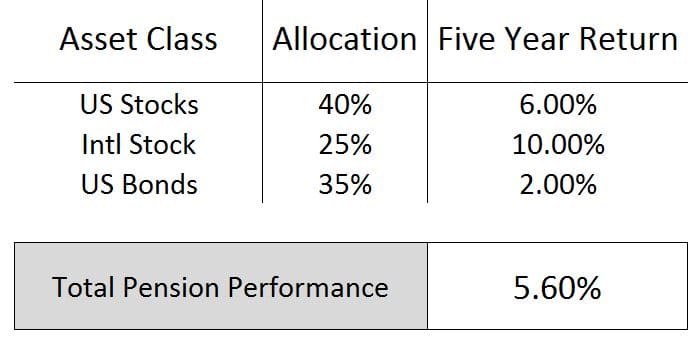

The US stock market has done so well the past seven years, it could easily return a modest or even negative performance over the next five. I will assume broad US stocks earn 6% over the next five year period. I will use the 2% return assumption for bonds. I will also assume that international stocks recover some and earn 10% a year in the next five year period. Here is a hypothetical pension performance using the same allocation.

Why then are public pension investment assumptions expecting 8% a year?

The answer is somewhat simple. Most public pension investment assumptions are around 8% a year. If state and local governments used a more realistic 5.5% as I outlined here, they would have to contribute hundreds of billions of dollars a year to keep them funded. In fairness, pensions used to earn this 8% figure easily from a combination of stocks and bonds. However, this was back in the 1980’s, 1990’s, and early 2000’s when you could regularly find high quality bonds yielding above 6% and the stock market turned in yearly double digit returns. Now you are lucky to find one yielding above 2%.

Governments are notoriously slow to adjust to new information. We are nearing the end of a 30+ year bull market for bonds, which make up 40% of many pension portfolios. Unlike bull markets for stocks which depend on a surging economy and corporate profits, bull markets for bonds are driven by interest rates.

Over these past several decades, interest rates have fallen like a rock. The 10 year treasury bond paid 14.59% interest in January 1982, but today the 10 year treasury pays approximately 1.6%. When interest rates fall, bond prices rise, and when interest rates rise, bond prices fall. The yield is the best guess of the long term return for a bond, which means Treasury bond holders will be lucky to get 1.6% on their money over the next 10 years. Legislatures are not taking into account that it is mathematically impossible for bond interest to fall much more. They naively look at historical bond performance figures and think that past performance is a guarantee of future results. If you ever read a financial adviser disclosure, IT IS NOT.

What States Are in The Most Trouble?

Many states such as New Jersey, Illinois, Kentucky, Connecticut, and others do not adequately fund their pension promises at this unrealistic 8% return assumption. Consequently, if you take their actuarial number down to 5.5%, the pensions appear to be on the verge of collapse. In fact, the most likely event is the collapse of many public pension funds. New Jersey Teachers’ Pension fund will be among the first to go. I estimate that it has seven to eight years left before the balance hits $0. Public pensions in Chicago could possibly be second, followed by the state of Illinois pensions, the other New Jersey pensions, then Kentucky and Connecticut pension funds.

What Will happen when the pension funds start failing?

When these funds fail, retirees will demand their benefits. States will have holes in their budgets as large as $10 billion or more. Quite possibly, the courts will protect pension payments as contractual obligations. If so, taxpayers will see huge increases in payments to state and local governments. In states without an ability to raise taxes like New Jersey, the state will probably default on bonds. On the other hand, if the courts rule against public pensioners, millions of retired teachers, police officers, firefighters, and municipal workers will lose most of their monthly pension benefits.

Clearly, public pension investment assumptions are a sham designed to kick the problem of underfunded pensions down the road to the next set of politicians. Start saving in retirement accounts now because the results will not be pretty.

What is you guess for stock and bond returns? What do you think should happen to public pensioners? Should they get their benefits cut or should taxes be raised? Comment below!

You’re absolutely correct. Reading this makes me angry. So many problems lie on the horizon…

From an investment perspective, I think many younger people don’t realize that their “safe” bond portfolio for their retirement is actually riskier than stocks due to the ridiculously low expected returns.

Technically it’s not as risky as stocks because we could see 90% declines in the market if the Depression is any guide. In the most bearish bond scenarios, bond index funds might lose 20% or something like that. Interest rates would most likely rise gradually. Losses would be offset by increasing coupon payments, and the more gradual the rise in rates the less extreme the loss. That said, the risk reward to me is way better with stocks than bonds. It’s like a guaranteed loss on your purchasing power with treasuries right now. Absurd people want to put their money in it. TIPS make much more sense to me

As a teacher, I’m so glad I don’t work in New Jersey! I really hope that the California pension fund will hold out long enough so that I can get some of my investment back. For instance, each month, I invest over $650 into the pension fund and my district is “supposed” to be matching it (it shows it is on my pay stub). Within the next couple of years, I’ll also have an additional retirement account to help support the pension. I still have about 15 to 20 more years of teaching to go so that should give me enough time to build up a cushion.

CALPERS current funded status is close to 72% as of June 2015 (that’s the last time they published approximate numbers). After the poor performance in 2016 it’s probably around 68% funded. That’s with a more conservative 7.65% rate of return assumption which is better than Jersey’s 7.9% assumption. That said, they still probably cannot get that. That means the ACTUAL funded ratio is probably around 55%-60%. Give it another decade and they might be at where New Jersey is now where teachers are not sure what their pension is going to look like over the next few decades. If you are over 40 in California you’re golden. If not, then sock a way a ton of money in 403bs and IRAs just in case.

That makes me feel a little better, but I think my pension is in the CALSTRS fund, not CALPERS. Any data on that one? I’m also over 40, so hopefully that means I’m looking pretty good. 😉

Another quick point: The New Jersey teachers’ pension was 28% funded as of June 2015 using their ridiculous 7.9% return assumption. Using a 1% lower discount rate for their liabilities, they are at 24% funded as I write this article. Much, much worse than California. We’ll get to see what the precedent will be when Jersey can’t afford to pay retirees pensions. Then the rest of us can plan better