Amber and Danny Masters are like any other married couple, except they have $591,158.21 in student loans. Their interest rates are sky high at an average annual rate of 6.8%. Unlike many couples in America, they are very serious about paying off this debt. They’ve rearranged their budget to prioritize making extra payments. Additionally, they even started a personal finance website, redtwogreen.com, to track their progress and to achieve their goal of being debt free. Since I’ve started a side hustle consulting for people with six figure student loan balances, I wanted to use my proprietary simulation tool to show you how this couple has more than a half million dollars in potential student loan savings waiting for them.

Key Background Information in this Analysis

Amber and Danny aren’t just any average American workers. Danny is a dentist and Amber is a lawyer, explaining how their combined loan balance is so massive. The vast majority of the debt is in Danny’s name, but since they file jointly for taxes we will assume that all income and debt is joint.

Total balance: Danny:$561,403. Amber: $29,755.21, for a total of $591,158.21 all in direct federal loans.

Interest rate: 6.8% average. Lowest interest rate is 5.4%, with highest at 7.9%.

Family Size: 3

Employer Status: Private, for-profit employers. No intention of working for non-profit employers in the next 10 years, so not eligible for tax free loan forgiveness through the PSLF program.

Annual combined income today: $290,000 today ($250,000 for Danny, $40,000 for Amber)

Combined income in 10 years: $500,000

Current Federal Repayment Plan: REPAYE program

Other plans they’re eligible for: Old Income Based Repayment plan (IBR), Pay As You Earn plan (PAYE), the Standard 10 Year Repayment Plan, or private refinancing

Considering Only Federal Repayment Plans First

Since Danny took out his loans between 2011 and 2016, they are eligible for all the major federal repayment plans except for the new Income Based Repayment plan, which requires you to be a new borrower as of July 2014.

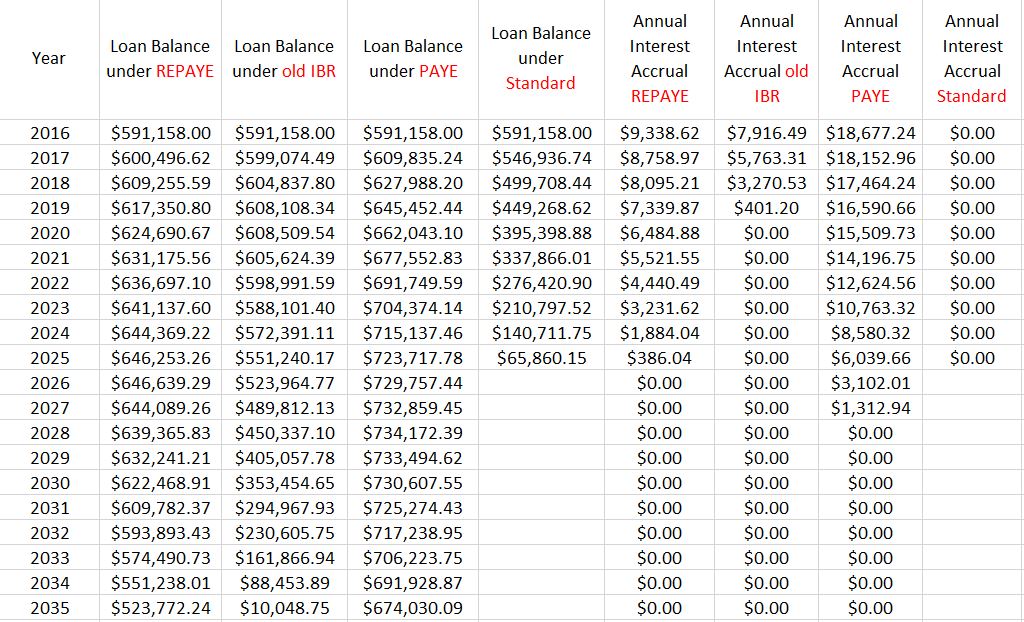

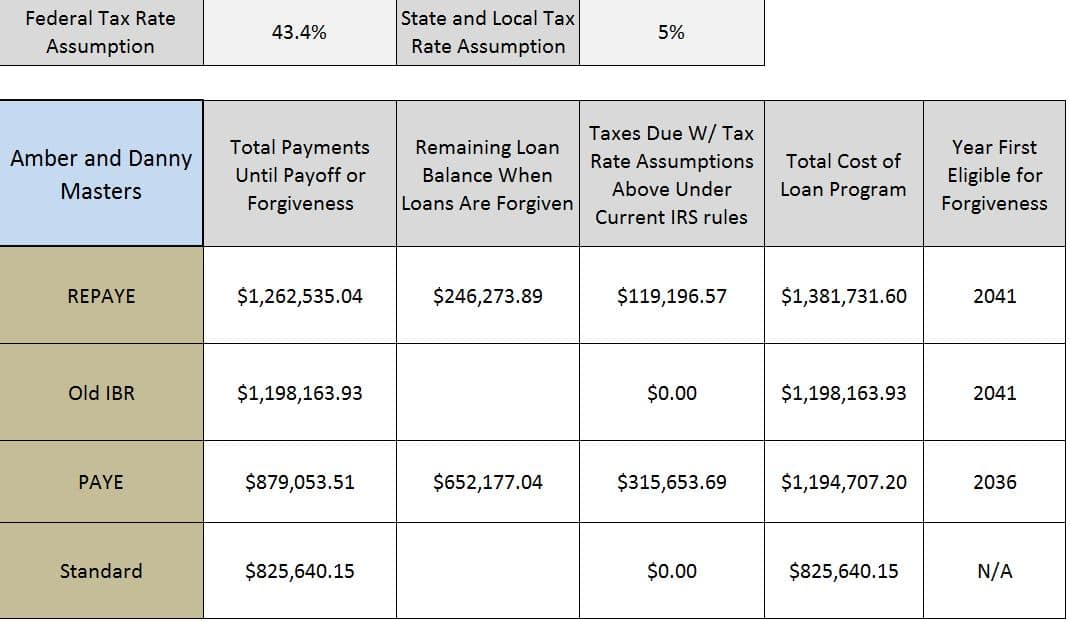

All the federal plans except the Standard 10 year repayment plan take your income, subtract 150% of the federal poverty line for your family size, and multiply by a set percentage of 10%-15% of your income to determine your monthly payment. There are a lot of rules surrounding how much you pay and what your maximum monthly payment is under the different plans. I use all of the facts and input them into the spreadsheet I built to find out what the different repayment plans will cost Amber and Danny. If you are curious what this analysis would look like for your situation, you can always email me at [email protected]. Here are the summary results of the simulation. I assumed they made no extra payments for simplicity purposes.

the results

REPAYE is touted as being a great new repayment plan option for the countless Americans with student debt. It can be a fantastic option, but not for everyone. Of course, you would do well to run the numbers for yourself or hire someone to run them for you.

The different federal payment plans have a forgiveness feature for people who work for private employers. After 20-25 years of income based repayments, you can file to have your remaining student loan balance forgiven by the government. However, the IRS treats this forgiveness as income, so you have to pay taxes on the remaining balance. For a dentist/lawyer couple, I assume they will pay the highest federal rate existing today of 43.4% and a state/local rate of 5%. The total cost of the repayment plans is the total payments plus the taxes due at the end of the period when the balance is “forgiven.”

After the highest cost REPAYE plan, the old IBR and PAYE come in at about the same price for different reasons. Old IBR results in complete payoff because of the higher 15% of income going to payments. PAYE only requires only 10% of income going to payments, and thus a large balance gets forgiven after the relatively short 20 year loan forgiveness period. Unfortunately, they would have to pay taxes on the $652,000 balance.

The Wild Card That Could Result in Over a Half Million Dollars in Potential Student Loan Savings for Amber and Danny

Amber and Danny’s website Redtwogreen.com shows they have the accountability and budgeting to pay down their debt fast. Amber and Danny are not your normal dentist/lawyer couple with a flashy car and McMansion house. They live in a low cost of living area and are doing everything they can to reduce expenses while still having a fun life.

The FinTech revolution (financial technology) birthed countless new startup student loan refinancing companies. Gone are the days where you needed to go down to your local national bank branch and get ripped off with a terrible interest rate on your private student loans. SoFi and Common Bond are just two examples of companies that offer online student loan refinancing applications. They have affiliate programs, but I don’t have access to the links yet, so if you refinance with them let me know.

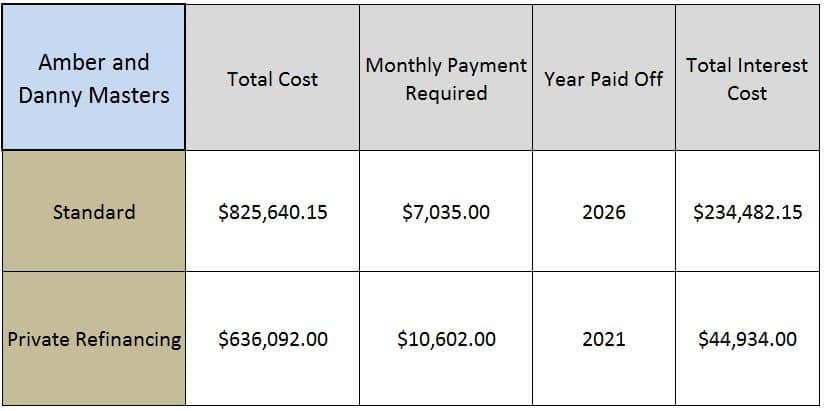

Both of those private student lenders currently advertise interest rates as low as 2.15% for variable five year loans and 3.5% for fixed rate five year loans. However, they only give those rates to people with fantastic credit and low debt to income ratios. Even so, what if Amber and Danny applied for a private loan? What if they got a reasonable interest rate lower than what they have now? Say they decided to take their frugality to top form by devoting a lot of resources to paying down this debt. I will assume that they refinance into a five year, private five year variable rate loan with an average interest rate of 3% over the term. I use an amortization calculator to develop the figures.

What’s the Catch?

Compared to the highest cost REPAYE plan, Amber and Danny would SAVE $745,000! So if the savings are so high, what is the risk? First of all, the monthly payments are much higher. If their income is $290,000, a huge percentage of their paycheck would have to go to making these over half million dollars in potential student loan savings a reality. First, they would only net about $200,000 after taxes. Second, they would need to devote about $120,000 of that to student loans, a steep figure. However, they could still live on $80,000 and be more than comfortable.

The main concern I would have is that private loans do not have as stringent protections as federal loans. While the interest savings are substantial, each private lender has a different policy with regards to what happens to your balance in the event the primary income earner dies or becomes disabled.

For that reason, if Amber and Danny decided to refinance their federal loans to private ones, they should make sure they get a full disability policy on Danny since he’s the primary income earner. They should also have a large term life policy on Danny. The disability policy should cost 2%-3% of the income protected. The term life policy should be much cheaper than that but cover five times or more of Danny’s income. With these two protections, I would feel great suggesting to Amber and Danny that they refinance their federal loans to private loans.

There is a chance they might not qualify for sufficiently low interest rates to make the savings worth it. In that case they should devote any funds they have towards paying down their loan balance in its existing form. They should apply to several different loan companies to see which one will give them the lowest rate.

Do You have loans? Get this kind of analysis for your own personal situation Straight from millennial moola

Most student loan aid officers at universities have no idea what they’re talking about. They aren’t bad people, they just do not know how to build spreadsheets and calculate different amortization schedules. When an aid officer tells a future veterinarian that all student debt is good debt, don’t listen. They probably didn’t take very many college math classes.

As far as I’m aware, there is no other service available at the price. I only charge a one time fee. I give a complete picture of your student loan options with my spreadsheet analysis. Moreover, I answer any questions you might have through email or a phone call. Contact me at [email protected] and see if you too could save a massive amount of money on your student loans. Hopefully, for your sake, I will not find a half million dollars of potential student loan savings. If I do, I want to find as many ways to save you money as possible as I did with Amber and Danny.

What would you do if you had almost $600,000 in student debt? Why would anyone become a dentist with such high costs, as it’s way more expensive than I ever thought. Any other suggestions for Amber and Danny? Comment below and don’t forget to check out their story at RedTwoGreen.com

Wow great analysis! I never knew all of this went into student loans as I do not have any but I think it is great what you are doing here and your fee is very generous. I am sure your business will grow out as you have great knowledge on the subject, I learnt quite a lot from this post so thanks!

Thanks Stefan. We will see. There’s certainly a large need out there and very little understanding of all the options that people have

Wow, some fascinating figures here Travis. This is quite the analysis. I’ve been following their story a bit as well and am always inspired by their hard work and diligence. Great post.

Good on them for being public about it and getting serious about paying it down. I had a client recently tell them that she decided to just give up and not think about it anymore before she changed her mind and decided she wanted to pay down her debt. Since they are in the top 1% of people being serious about paying down their massive student loans, I shudder to think what the future holds with these giant loan balances that will continue to grow that have been guaranteed by the taxpayer

Thanks Brian 🙂

Whoa! That’s a lot of student loan debt. However, at least there’s a high income attached with those loans, which is why I think doctors and dentists are willing to take on that kind of debt: they will most likely make a much higher income than other professions. Your break down is really impressive.

It’s pretty terrifying though. If you go through medical or dental school you dang well better not have a change of heart and decide to work in a non profit because you’ll owe half a million if you do

EXACTLY. You really have to commit to your career if you take on this kind of load.