I’m a complete failure, at least as far as Harvard is concerned. I wanted to go to Harvard ever since I was a kid after watching the movie Legally Blonde. I love learning, and to me being at the world’s best university seemed like the pinnacle achievement in a young lifetime. Fast forward to the present, and I’m a three time Harvard reject. Someday, I will probably need to send them a thank you note because my life would be so different right now if not for this lucky break. Continue reading “I’m Thankful to Be a Three Time Harvard Reject”

I’m a complete failure, at least as far as Harvard is concerned. I wanted to go to Harvard ever since I was a kid after watching the movie Legally Blonde. I love learning, and to me being at the world’s best university seemed like the pinnacle achievement in a young lifetime. Fast forward to the present, and I’m a three time Harvard reject. Someday, I will probably need to send them a thank you note because my life would be so different right now if not for this lucky break. Continue reading “I’m Thankful to Be a Three Time Harvard Reject”

Category: Student Loans

Why I’m Starting a Flat Fee Student Loan Consulting Business

I have no idea how businesses get your cell phone number. Somehow, a bunch of scumbag student loan robo-calling businesses have mine. I received a call from somewhere in North Carolina on Monday URGING me to press 1 to speak to a private loan counselor NOW. If you type in ‘student loan consult’ into Google, there are fewer than a half dozen legitimate options. The ones that do exist are ridiculously expensive. There is a massive need for objective, math-based, flat fee student loan consulting. Hence, I have decided to offer consultations for a one time fee. Continue reading “Why I’m Starting a Flat Fee Student Loan Consulting Business”

Why Increased Access to Student Loans Is Mostly Just Good for Greedy Colleges

A paper by the NY Fed that came out recently should embarrass our nation’s colleges and universities. The researchers found that whenever the federal government increases access to subsidized or unsubsidized student loans, colleges take away the majority of this extra help through tuition increases. For every $1 of extra aid intended to help needy students, universities take away 60 cents of it through increasing their tuition prices. Clearly, greedy colleges cannot keep their hands out of the federal student loan cookie jar. Continue reading “Why Increased Access to Student Loans Is Mostly Just Good for Greedy Colleges”

Why Student Loan Forbearance Is the Worst Thing You Can Do

I’m going on my sixth month now of offering flat fee consultations to help folks make a personalized plan to conquer their student debt. After months of studying the federal student loan program, I built a free spreadsheet that over 1,500 people have used to avoid losing out on thousands of dollars in savings by refinancing with companies like SoFi or using the PSLF program. Clearly, helping people with student loan debt is a passion of mine. Let me share with you another free bit of advice. Student loan forbearance is one of the worst things you can do when making a repayment plan. Continue reading “Why Student Loan Forbearance Is the Worst Thing You Can Do”

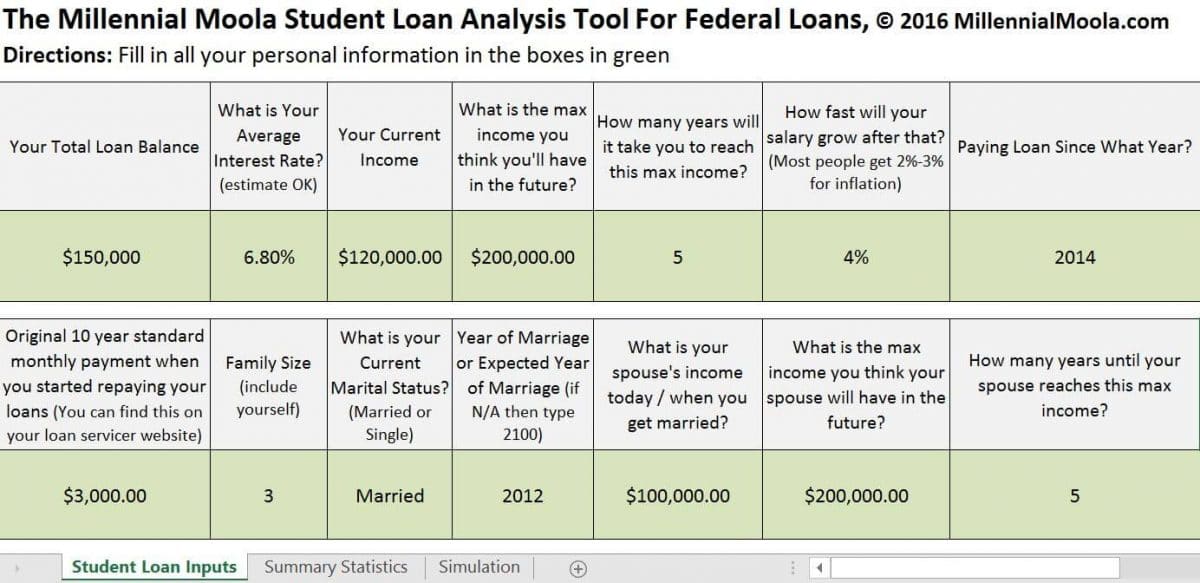

Millennial Moola’s Student Loan Analysis Tool Could Save You Thousands

I’ve been working behind the scenes for months now to produce a simple, free spreadsheet to help with one of the greatest financial problems of our generation, that of student loans. I finally have a student loan analysis tool to share with you after many hours of work, and I’m very excited about it. Click below to download it while you read the rest of the article.

The Millennial Moola Free Student Loan Analysis Tool

Continue reading “Millennial Moola’s Student Loan Analysis Tool Could Save You Thousands”

What a Half Million Dollars in Potential Student Loan Savings Looks Like

Amber and Danny Masters are like any other married couple, except they have $591,158.21 in student loans. Their interest rates are sky high at an average annual rate of 6.8%. Unlike many couples in America, they are very serious about paying off this debt. They’ve rearranged their budget to prioritize making extra payments. Additionally, they even started a personal finance website, redtwogreen.com, to track their progress and to achieve their goal of being debt free. Since I’ve started a side hustle consulting for people with six figure student loan balances, I wanted to use my proprietary simulation tool to show you how this couple has more than a half million dollars in potential student loan savings waiting for them. Continue reading “What a Half Million Dollars in Potential Student Loan Savings Looks Like”

Can I Ever Pay Off These Massive Student Loans?

This case study is a fascinating look into why the higher education system is broken in America. We will call this reader Jane to protect her anonymity. I’ll describe her situation rather than quote what she told me. She has $388,000 in debt from a single, consolidated loan directly from the federal government at an interest rate of 6.75%. Continue reading “Can I Ever Pay Off These Massive Student Loans?”