The financial advice establishment will tell you that a broad index of diversified bonds make up an important part of a diversified portfolio. Just put 20%-40% of your portfolio in something like Vanguard Total Bond Index Fund, and the volatility you experience in your portfolio can go way down. I don’t believe in this advice anymore. With the 10 year treasury yield at 1.60% as of this past Friday, I don’t think normal US government debt protects you from anything but an extreme deflationary event. You should at least know about another option that might provide better protection for your portfolio going forward, the inflation protected Treasury bond. Consider replacing all your bonds with TIPS in tax protected retirement accounts.

What Are Tips and How do they work?

The US government invented a new type of bond several years back. The bond issues coupons like others, but includes an adjustment for inflation every year. If the consumer price index shows 5% inflation, then Treasury Inflation Protected Securities (TIPS) add 5% to their principal value. The income from a TIPS bond is lower than regular treasury bonds, which do not adjust for inflation.

TIPS bonds with longer maturities have greater risk due to the treatment of the inflation adjustment. Say you had really high inflation of 10% a year for several years on a 20 year TIPS bond. The bond principal value at issue was $100. Every year $10 in inflation adjustment got added to the principal, and now it’s at $200. If interest rates rise, the value of that $200 is still less and falls in value. TIPS have a floor of $100 on the value you receive at redemption.

TIPS are less liquid that traditional treasury bonds. One reason is because TIPS bonds are traded in a negotiated fashion. Whenever you have to talk to someone to trade a security, it makes transaction costs be higher. That’s why large stocks that are heavily traded by computers cost less to trade than small issues of bonds that need lots of convincing for someone to buy.

How cheap is inflation insurance right now, and how could i buy it

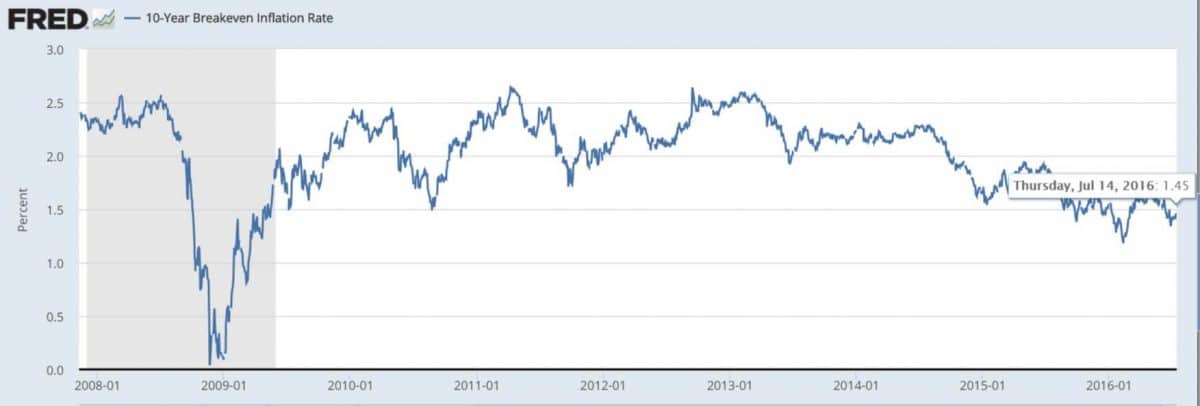

You can see how cheap or rich TIPS are by looking at the breakeven inflation rate. The breakeven inflation rate is the interest rate at which you would be indifferent between owning TIPS or regular treasury bonds. The current breakeven inflation rate (B/E) is about 1.45%. That means if inflation is higher than 1.45% a year, TIPS investors win. If inflation is lower than 1.45% a year for the next 10 years, traditional treasury investors win. How was the breakeven number traded over the past several years?

During the financial crisis, we experienced an extreme flight to safety and liquidity, meaning the ease of selling. Treasury bonds were considered the only sure place to put your money in that disaster. Even though TIPS are federal government securities, their performance suffered in 2008. They are not the de facto safe investment in the global marketplace. That’s why you see the number go to 0. In other words, you could have bought TIPS during the financial crisis at about the same yield as a normal treasury bond without any inflation protection at all. Investors were getting the inflation insurance for free.

Today, we are not quite at that same ridiculous environment where inflation protection is free, but we are close. With bond investors expecting only 1.45% inflation over the next 10 years, I would much rather wager that they’re going to be wrong than right.

When deciding what to buy in order to best protect yourself against inflation, Vanguard has found that TIPS with a 1-5 year maturity do the best job. That’s because they don’t have the problem of having years and years of inflation adjustments that push up the value of the bonds. Vanguard has a very low cost short term TIPS fund and ETF. If you want inflation protection for a cheap price, I suggest you take a look.

Where should I hold TIPS? What about my taxable account?

The only reason to own bonds period is because they reduce volatility in a portfolio. If you did not care about losing money over the short term, you could have 0% bonds your entire life. Most people need an allocation to bonds because of the dumb things they do in market crashes like sell their entire portfolios. TIPS yields are awful right now, but so are traditional bonds. TIPS yields are always quoted before inflation, and are currently at -0.29% and 0.11% for the 5 year and 10 year TIPS bond. The final return includes the CPI adjustment and is therefore positive. I would much rather have a bond that pays me 0.11% with the potential to earn much more than that if inflation is very high than own a traditional treasury bond that locks me in at 1.6% interest a year no matter what happens to interest rates.

To the extent you have bonds in your retirement accounts, see if they offer a TIPS fund. If you own the traditional bond fund, consider replacing all your bonds with TIPS. In a 401k, you might not have this option since the employer picks the funds. In your IRA, you definitely have this option since you pick the funds.

DO NOT put TIPS in your taxable account. The only bonds that belong in taxable accounts are municipal bonds, which pay tax free interest. The inflation adjustment on TIPS requires you to pay taxes during the entire time you own the bond, even though you receive no actual cash payment. That’s why the only place to own these TIPS bonds is in your retirement account.

why is most conventional advice on bonds wrong right now?

Everyone in the financial advice industry looks to the past to determine their return expectations. They think in terms of normal distribution curves, and avoid thinking of black swan type events. These people are employees after all! They have no incentive to make big calls, and a paper warning of the dangers of bonds would never be published at a large mutual fund company like Vanguard, Blackrock, Fidelity, or PIMCO. They have hundreds of trillions of dollars in bond fund assets they manage that pay them billions of dollars in investment fees. If a bear market happened in bonds, they could lose a huge percentage of their revenues.

Could I be wrong and could we see interest rates turn negative in the US like they are in Europe? Sure I could be wrong. That said, the last time we had interest rates this low was in the 1950s. Most countries around the world were still on the gold standard. Central banks never would have tried extreme quantitative easing like they have done this time to save the world economy.

A nominal yield of 1.6% on 10 year treasuries offers approximately zero upside for bonds, unless we have a Great Depression like event coupled with extreme deflation. If you buy short term TIPS, you have a little bit of protection against both events. If inflation takes off and crushes your stock portfolio, your bond portfolio would not decline by nearly as much. In the event of a deflationary reaction to the weak global economy, short term TIPS would maintain their $100 par value no matter how low interest rates fell.

Bond investors and traditional financial advisors right now gleefully accept the awful tail risk of inflation that comes with owning traditional treasury bonds in portfolios. Count me out. I see no reason to own traditional bonds with breakeven inflation and interest rates so low. Why should I give the government my money for free?

Do you like or dislike TIPS? Would you like to know more about them? Comment below and we can have a discussion.