Reader in Melbourne, FL: We’ve been renting for about a year now and we’re wondering if we should take the next step and buy a home before mortgages get really expensive and housing goes back up again. I work with the school system and make about $37,000 a year. My boyfriend is a firefighter and he gets about $60,000 a year. The place we are renting is $925 a month for a townhouse by the beach. We’d like to get a single family home since we’re thinking about marriage. These run about $200,000 and rent is about $1200 a month. Should we try and see if we could use an FHA first time homebuyer mortgage? My boyfriend won’t qualify because he had to walk away from a home he bought in 2008 but maybe I could do it? We don’t have very much saved up for a downpayment so that’s the only way we could afford buying right now, but it stinks feeling like we’re throwing money away and I know that I’ll be here for several years so I would like to put down roots.

Sincerely, Reader from Melbourne, FL

First Look: Renting vs Buying in Your Market

Thanks so much for writing! I really love getting financial questions from readers and doing my best to figure out how I would approach the situation. My first comment is on the affordability of your housing market. NYC and San Francisco are the two worst metro areas in the country for buying a house because of something called the price/rent ratio.

The way you calculate it, you take the market value of the place you live and divide it by the annual rent. In NYC and San Fran you could easily be looking at a ratio of 30 or more, meaning your apartment that fetches $3000 a month would sell for a seven figure sum. The reason people pay such extreme prices relative to the income you can generate from the property is because the rich view real estate in these locations as a store of wealth. People will always want to live in SF or NYC, so there is an inherent value to there that is worth a lot. It makes renting in these cities one of the biggest no brainers imaginable unless you are looking to take massive risk on the market value of the property in five to ten years, if you can afford the mortgage and tax payments that long.

The other extreme is when buying is an easy decision. This happens when the monthly rent is about 1% of the property value, which would result in a price to rent ratio of a little over 8. These kind of markets occur when there is very little cachet to owning a house and the people that could be homeowners have barriers to buying that make renting the only option in some cases. Think low income workers in a factory town, college students that can’t get together a down payment in a college town, or retirees living on a fixed income in parts of South Florida.

Melbourne sounds like it’s in between these two extremes. at $1200 a month vs a $200,000 purchase price, you’re looking at a Price/Rent ratio of close to 14, which makes home buying neither great nor terrible. In this case, the micro factors are going to win out instead of the broad macro factors. So since the affordability in your town isn’t great I’m initially leaning towards renting but let’s see more.

How Long You Stay in Melbourne Is a Big Factor

The fact that you want to make Melbourne your home is a good sign for buying. If you are going to be in a place for at least five years and aren’t worried about moving anytime soon, then buying is a sensible way to put down roots in your community. As an owner, you won’t need to deal with landlords and will have more stake in the community as your most valuable financial asset depends on how nice it is to live and work in your city.

People often view renting as throwing money away and that’s a ridiculous misconception. If you are renting a giant luxury apartment from a corporation that markets their complex like crazy, you ARE throwing money away; but it’s not because you are renting, it’s because you are spending a ton of money. If you rent a small apartment or split a house with roommates then you will come out vastly ahead of someone that buys a house and moves within five years. The transactions costs in real estate are truly ridiculous and should be ripe for change at some point. Real estate agents eat 6% of your sell price, transfer taxes usually take another 1-2% depending on where you are, and closing costs might take another couple percent. Assume for a second the total cost of selling is around 10% total. Since housing goes up at the rate of inflation long term, you could expect price appreciation of 2% a year in today’s environment. In our example that means you would be giving up 5 years of price gains from transactions costs.

We are ignoring the chance the housing market could go south and you could be stuck with an asset of lesser value. In that case your credit could be ruined if you need to walk away from the mortgage. Sure the house could appreciate, but most people I talk to that lived in their house for only a few years make very little money on selling it even in good markets.

Do You Want to Take on All the Responsibilities Your Landlord Covers Now?

That is a big question. You have appliances, lawn care, hurricane insurance, property taxes, heating pumps, air conditioning, and all kinds of hidden costs you don’t see when you rent. If you buy a house and your inspection guy missed something, you could easily be out $5,000 or more for that one item. Landlords are on the hook legally to provide a lot of things to you as a tenant. Sometimes, I think it’s justified purely from a hassle standpoint to rent because if you have a fair landlord it’s there job to take care of things for you.

If you or your boyfriend are really handy and can fix things easily that might be a plus in the buy column, but if you are not sure you could afford a big repair bill right now without going into a little credit card debt then I would absolutely wait and rent some more.

How Much House Should We Buy Relative to Our Income

Based on the info you gave me, you guys bring in about $100,000 pre-tax. Your jobs are very stable with a low risk of getting laid off. A banker would tell you that you could afford a $300,000 house if you put 20% down. That pre-canned advice is what gets so many millennials in trouble.

When you spend 3 times your combined income on housing, you have very little wiggle room in your budget. A huge chunk of your paycheck will be gone before you can touch it, and the bigger the house the more it sucks your time and material resources. Houses, especially larger ones, take a lot to maintain. That’s why I recommend never spending more than 2 times a couple’s combined income on a house because you will be able to save more and devote financial resources towards other things. This means a house less than $200,000 could work for you all but no more.

Because you are buying with your boyfriend, I would suggest a conversation with him about home ownership would mean. Financial decisions cause lots of stress in relationships, and owning a house 50/50 would be a disaster in the case of a breakup just because of the awkwardness and complication from trying to buy out the other person. It would be a much better arrangement to buy the house under one person’s name and the other could pay for the utilities, property tax and insurance, and other costs that can easily be cut off if the relationship doesn’t work out.

It’s not the most romantic thing in the world, but it’s the financially smart thing to do. I wouldn’t want to make the biggest financial decision of my life with anyone I wasn’t committed to legally long term, but that’s just me. I have friends that bought a house together before marriage and it worked out. I’m just saying there can be problems.

If you go down this route, I would suggest taking the individual affordability approach and buying a house no more than 2.5 times the higher income in the relationship. Given your boyfriend makes more in this case, you could afford a $150,000 place or less. Since that figure is lower than the one we came to if you buy as a couple, I like using that figure because it’s more conservative and wouldn’t force either one of you to change your lifestyle or sell the house if things don’t end in marriage.

Is a FHA First Time Buyer Mortgage an Option?

Because your boyfriend has already bought a house and he had to walk away because he was underwater, he cannot qualify. While you could qualify on your own, without him on the mortgage a bank will not approve you for more than $120,000 based on your income.

That reality means you won’t be able to afford a single family home with this financing option. If you go the traditional mortgage route you’ll need 20% down especially with your boyfriend’s prior credit hickup, so that’s $40,000 saved up before you can buy. You mentioned you don’t have that much saved up for a downpayment so it seems like buying a house is not accessible right now unless you buy something under $120,000 and you can use a first time FHA loan to put down only about $4,000.

Am I Missing Out on a Once in a Lifetime Opportunity to Buy Real Estate?

People in your community are probably betting on the rebound of the FL housing market if they are buying homes with a Price to Rent ratio of 14. There are a lot of reasons why real estate has recovered some. We have a better economy and even lower interest rates than we had before, thus making mortgages cheaper and shifting the demand curve in favor of buying.

However, when the Fed takes off the low interest rate support to the economy, borrowing will become more expensive. The cost of your mortgage will be higher, so housing prices could actually fall as the average buyer has more money that must go to interest. They will not be willing to pay as high of a nominal price because it would result in a much higher mortgage payment. Alternatively, interest rates could continue to stay low and the economy could continue to get better and we could see nice growth in the real estate sector.

Long term, the evidence points to housing prices expanding at the rate of inflation, making them a subpar investment to stocks and even long term bonds. Real Estate is not a game to get rich in regards to your primary residence. A house is best thought of financially as the place you will spend most of your time. It is an appliance. Hopefully it fills your needs and makes you happy, but it’s job is not to make you rich. People all too often forget that, and we get speculative bubbles where people buy more house than they can afford and go belly up in the crash. Use stocks and bonds to get rich over the long term, and use your house as a necessity that might give you a little profit once you eventually sell it.

The Verdict: Rent and Save as Much as You Can for the Future

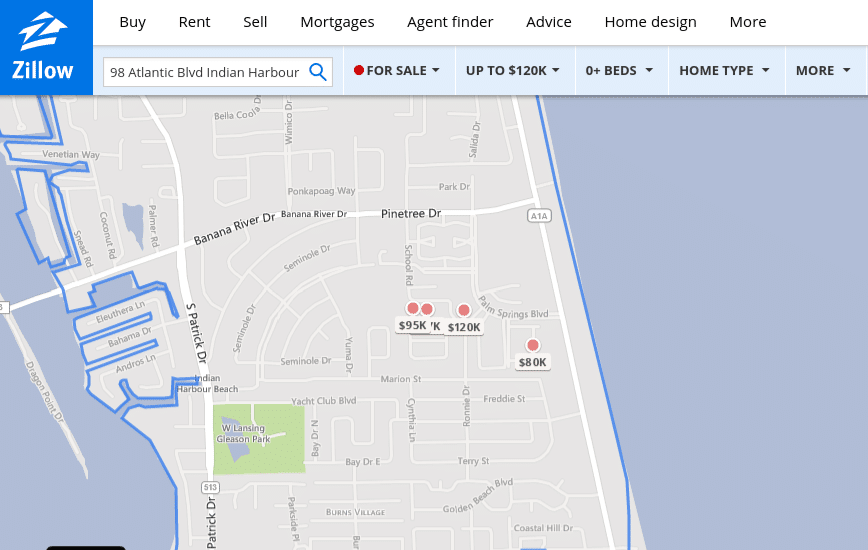

The thing that pushed me over the edge towards the rent side of the argument was my perusal of Zillow for houses under you budget of $120,000 in the area you want to live in. There’s nothing there except for a couple foreclosed condos in 55+ communities, which is not something that is an option for you two.

Since your only choice is between renting and reaching way above your budget for buying a home on your own, I think you should just keep renting and stash money in the bank. You will want to buy a decent family home at some point so it makes sense to prepare for that now by building up your low savings level so that you won’t have to wait once the time is right. Your rent is pretty low compared to your combined income. You are right around 10% of your pretax pay going to rent which is fabulous. That extra 15-20% more that most people blow on housing should be going to your IRAs and savings accounts each year. By year three you should have enough for a sizable downpayment.

It wouldn’t hurt to talk to a buyer’s real estate agent for a second opinion and to be made aware of the latest inventory. Often a realtor will electronically notify you of new listings that aren’t going to be publicly known for a few days or weeks. If some shockingly low priced residence comes up, you could pounce on it and seize the opportunity. If you started off in an apartment or condo, as long as you buy it cheap you could always rent it out when you’re ready for a single family home.

There are significant benefits to home ownership. There are also lots of hurdles, hidden fees, and downsides. Every case is specific to the individual, but the things that don’t change when I make recommendations are buy much less than you can afford, be cool with renting a lower end place to build your downpayment, and try to buy the house based on the lower of 2.5 times the higher earning partner’s income or 2 times your combined income as the maximum. You will free up a ton of money to use on other things. Good luck with the housing journey and thanks so much for writing in!

Because your boyfriend has already bought a house and he had to walk away because he was underwater, he cannot qualify. While you could qualify on your own, without him on the mortgage a bank will not approve you for more than $120,000 based on your income.

Well it all depends on your finances, if you have enough money to pay for the 20% down payment and a good debt to earning ratio then go ahead and buy the house otherwise stay happy with a nice rented home or prepared for financial hardships later on.