Please read this Elite Daily article called “If You Have Savings in Your 20s You Have Done Something Wrong.” It’s so bad, it makes me want to have mandatory financial education classes in high school. The blog that inspired me to retire early, MrMoneyMustache.com, wrote a powerful response to this celebration of hyper-consumerism in America, but I wanted to write another post on it to emphasize just how bad the author is at math and save others from this attitude about money. From a financial professional’s point of view, not saving in your 20s is similar to saying, “yeah keep smoking a pack a day while doing McDonald’s breakfast lunch and dinner while drinking each meal down with a liter of vodka. I’m also going to break down some of the crazy ideas Elite Daily uses to sell the dream of spending like there’s no tomorrow.

Most Workers Need a Magnifying Glass to Find Their Annual Raise

The author states that you shouldn’t be trying to save an extra $200 a month when you could be networking with nights out on the town to get a $60,000 raise instead. First off, if you look at the actual stats on worker raises, the average person gets about a 3% raise a year. To assume that you will get a raise that amounts to more than the average household income in America is wishful thinking in the extreme. The vast majority of college grads go in to work, punch a metaphorical clock, and are happy about any raise between 3-5%. That rate is only a few percent above inflation, and for good reason. From my own experience, employers want to make you feel like you’re moving along and not stalling in your career. They will create new titles for what you’re already doing, encourage lateral moves between departments, and give one time bonuses all to make you feel like that big pay bump is right around the corner. Managing workers in corporate America is about selling false hope.

From my own and friends’ experiences working in large bureaucratic companies, I can tell you almost every firm besides startups, small businesses, and Big Tech is going to have a very regimented approach to raises. While the old adage it’s not what you know it’s who you know is true, even when you know the right people if you are expecting more than a 10% raise on a modest base salary you are being unrealistic. Eventually you might move up the ladder over several years and get a nice mid six figure salary, but for the most people that doesn’t come til your mid 40s and 50s. Even more people never make it out of middle management with that W2 barely cracking $100,000, a far cry from these mythic $60,000 raises that fall from heaven when you go drinking with coworkers.

There are Far Better Places to Network Than Bars

Maybe there are some examples my readers have that can enlighten me. If you’ve got some good bar promotion stories send them to [email protected]. I’ve seriously never heard of a person getting rapidly promoted from a connection made while drinking after work. I’m differentiating between work social events where there might be alcohol and going out to the “it” work bar and spending copiously for craft beer and skinny margaritas. If there are free corporate events sponsored by your department you should absolutely go to those. I’m knocking the habit of going out and spending $10 for three cocktails three times a week and believing it can bring you professional success.

While I like an occasional beer or glass of wine, if I increased my consumption any more I would probably have to start a serious workout program to keep off the weight. There’s a reason the dad bod craze has gone viral. It’s because guys that drink a lot of beer and don’t want to put their health first need a socially acceptable way to justify their drinking. If you combine this activity with the sedentary lifestyle of a modern day office worker, you might get a raise from all your networking but you might only live til 60 to enjoy it.

If you’re going to network, please be more original than a bar. Try going out and playing intramural sports, volunteering, taking road trips, and going to guest speaker events at your company. You will meet way more interesting people there. If you want to grow your career, get involved in activities that will lead you to successful people. With a couple exceptions, the high level executives at my company very rarely went out to bars. It was usually the middle level managers. So as far as growing your career goes, go to a corporate volunteering day. If you want a one night stand or an extra 30 minutes on the treadmill, go to a bar.

How $200 a Month Utterly Destroys a $60,000 Raise

Elite Daily says that $200 a month in savings isn’t even going to make a dent compared to a $60,000 raise. Your first reaction might be well duh $200 a month is nothing compared to a $60,000 raise forever. The amazing thing about compound interest though is that might not be true. I’m going to look at a hypothetical scenario where our worker, let’s call her Christine, saves $200 a month for 10 years and invests that money in an S&P 500 index fund that happens to grow at the historical annualized rate of return of 10%.

The comparison point is that she goes out drinking after work all the time and really lives the high life. Eventually after five years, she makes an amazing connection with a high level executive at a rival company and gets hired away, making an extra $60,000 a year on top of her already formidable $120,000 salary. So she’s pulling down $180,000 now wow! I’m assuming she’s in a place like New York City where there are a lot of supposed social opportunities at bars that might translate into a big salary.

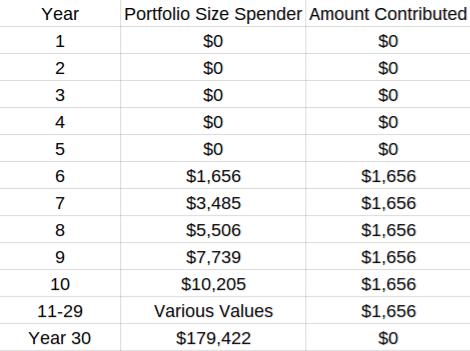

First off is scenario 1, where she saves for the first 10 years out of school at $200 a month then leaves the result in that investment plan until year 30. So she only contributes money in years 1-10. She is saving monthly so I compound her money on a monthly basis.

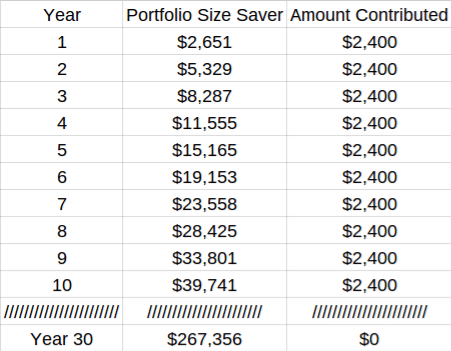

Now for scenario 2. We will say that she gets the $60,000 raise at the beginning of year 6 from all those hard nights out networking. Since she is living in NYC, I’m going to take out 40% for taxes because she doesn’t actually get to keep all $60,000. She will be in a high tax bracket and her marginal rate could possibly be more than that but I think 40% is a fair estimate. I’m going to assume that she saves at the national average savings rate, which is currently 4.6%. I’m assuming she is saving on an after tax basis and I will give her the same 10% return as in scenario 1. Since she probably only saves whatever is left over at the end of the year, I’m assuming she makes lump sum contributions at year end with annual compounding.

So to be clear, in the first example she saves $200 a month for 10 years and stops. In the second example she saves the average savings rate for that $60,000 raise she gets after year 5 and continues saving that for 25 years in the same investment program. AND SAVING $200 A MONTH KNOCKS THAT $60,000 RAISE SILLY! She saves almost $100,000 more by saving a small amount in the beginning of her career.

So it’s not $200 a month that doesn’t make a dent, it’s getting a $60,000 raise that doesn’t make a dent! Of course we are talking in terms of net worth, and if you follow Elite Daily’s financial advice you will have almost none. So if it’s paycheck Friday for you, triumphantly take $100 out of it and deposit it in a broad market index fund. Be secure in knowing that the $60,000 raise someone else is getting throwing back tequila with their boss will be frittered away into nothing.

So the takeaway is, invest all you can in your 20s because even a small amount today is more powerful than a mighty salary in the future. Have a great and frugal weekend you wealth builders!

I like this post more than I liked MMMs post on this.

I busted out my excel spreadsheet files and did the exact same thing you did.

I actually did this with an old roommate of mine who was/is debating getting an MBA. The net result is a difference of about 1,500,000 in favour of not getting the MBA.

Mostly attributed to the opportunity cost of not working for the year-2years (depending on the MBA), and the differential tuition/books costs compounded over 40 years.

You need to be in harvards top 2% of starting salaries of graduates (in terms of pay bump) to justify the MBA.

So, 98% of Harvard grads are losing out to the saver who doesn’t go.

Interesting stuff on the economics behind opportunity costs.