I checked out a budget for a friend in Philly recently because she expressed a desire to cut her spending to save for early retirement. While trying to find areas in her budget to cut back, I was really distracted by how much she was paying in taxes. I thought it would be really beneficial as we get close to the end of 2015 to talk about understanding where all the money in your paycheck is going. To do this, we will analyze the paycheck of my friend (let’s call her Charlotte), to see how she pays European levels of taxes in one of America’s largest cities.

Your Pre-Tax Salary Always Makes You Think You are Richer Than You Are

Taxes make the big salary number you get on an offer sheet very deceiving. Charlotte has a hefty $70,000 pre-tax income. That figure is much higher than the median household wage in America, and she’s only one person. If you lived on chump change and goodwill in college, $70,000 sounds like more money than you’ve ever dreamed of. Even though her pre-tax salary looks so good, her biweekly paycheck is only $1,885. Over 26 pay periods per year, that amounts to $49,033. Since her pre-tax salary is $70,000, her effective or average tax rate is 30%. How is that so high, you ask?

The First Culprit: Federal Income Tax

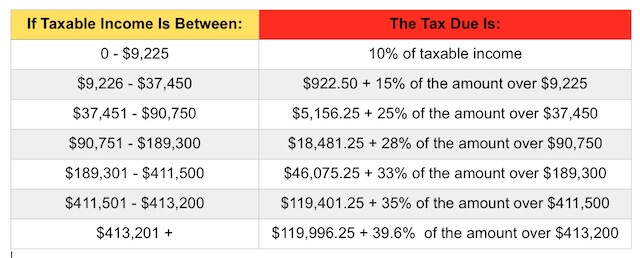

Check out the tax rates table below. It only covers federal income tax. The one addition needed to figure out most individual Americans’ tax bill is the $4,000 personal exemption and $6,300 standard deduction. In other words, most people get $10,300 of income that they pay $0 in taxes on. So just add that number to the tax table below and you can figure out to the dollar how much you would likely owe for a given level of income in federal income taxes.

Charlotte takes $70,000 and subtracts $10,300 that everyone gets without having to pay any taxes. She now looks up at the table for where the resulting figure $59,700 goes. It falls in between $37,451 and $90,750. So her total federal income tax bill is $5,156.25 plus 25% of the difference between $59,700 and $37,451. Once you add all the numbers up, her total federal income taxes come out to $10,718.50.

The Next Foe: State and Local Taxes Take a Bite

Philadelphia is one of the few cities in the country that charge an income tax. Philly’s is on the high side at 3.92%. The state of Pennsylvania charges a flat income tax rate of 3.07%. So in total she must pay 6.99%, starting from the moment she makes any money. Quick aside, I find it hilarious that the government loves to charge right below big whole numbers like Wal-Mart does to get people to think they’re getting a deal on a $2000 Television that they list at $1999.99.

Anyhow, 6.99% of $70,000 is $4,893. Conveniently, this is just below the level of the standard deduction of $5,400, which means she will not be able to deduct the total from her federal income taxes unless she has a lot of other deductible expenses.

The Big Rub: Paying For Social Security and Medicare When You Know You’re Not Getting What Seniors Have Today

It is much better to work for somebody else than work for yourself in today’s tax environment, so Charlotte actually gets a break here. If you work at a company, hospital, university, non-profit, etc, you must pay 6.2% of your income (up to $118,500) to pay for Social Security. Medicare taxes are 1.45% of your total income up to $200,000, when the rate jumps a little. Collectively, these taxes are known as FICA. So the average worker is going to be paying 7.65% from dollar $0 for our major welfare programs in America.

If Charlotte worked for herself, she would have to pay her share and the share of her employer. So you would take the rate above and double it. That’s right: your employer has been paying 7.65% of your compensation in addition to the 7.65% you’ve been paying ever since you started working. You should go up to whoever hired you and thank them for paying half of your FICA taxes; it’ll make their day. Incidentally, that’s why you hear about companies going to such great lengths to call you a contractor. If they are able to classify you that way, you get hit with their 7.65% share on your own tax forms.

I had an prospective employer in college try to do that to me once. In addition, they wanted me to sign a three year non-compete agreement. After reading the contract, I left it on the desk unsigned and told them to have a nice day because I wasn’t interested anymore. Hopefully that helps someone out there advocate for their right to be treated as an employee.

Since Charlotte works for a high class organization, she only pays the 7.65% employee burden for Social Security and Medicare. On $70,000 of income, that amounts to $5,355.

All Taxes Combined Make This Philly Worker Look a Lot Like a German One

If we add up federal, state, and local income taxes, the total amount is $20,966.50. If you take that figure and divide by Charlotte’s $70,000 pre-tax salary, her average tax rate is 30%. Check out this cool chart below of income tax rates for German workers. Right now euros are close enough to dollars that they could be considered equivalent in this chart.

The black line is the tax rate on each additional dollar once you are at a specific income level. That is, at 100,000 euros of income, you would lose 42 cents on the next dollar you make to taxes. The relevant figure, however, is the average tax rate in red. That’s the rate you actually pay because it accounts for lower tax rates at lower income brackets and higher tax rates at higher income levels. Coincidentally, the red line crosses 70,000 at about 30%. So German workers are paying about the same tax rate as Charlotte is in Philly, except Charlotte’s benefits are nowhere near European level. Sure, once you take into account the health insurance deductions in Germany, you might be ahead in Philly, but then you would have to consider Charlotte’s health, vision, and dental premiums a tax and compare that.

The big takeaway is that my friend Charlotte is not one of these millionaires and billionaires that politicians are always talking about. She is by all definitions a middle class worker that makes a solid income, yet must lose 30% of her income to the government.

How to Reduce Your European Levels of Taxes To American Levels as a Middle Class Worker in Philly

Luckily, Charlotte has a few options available to her to reduce the big bite that comes out of her paycheck. She can contribute to a pre-tax 401k or 403b plan at work, which will reduce her taxable income. This is especially valuable for the part of her salary that falls in the 25% tax bracket. Recall from earlier that she has $59,700 – $37,451 = $22,249 that falls into the 25% bracket. She could contribute up to $18,000 a year to one of these retirement accounts and not pay the 25% federal income tax due. She would owe it when she pulls it out, but if she plans to retire early, she could convert the money in the plan to after-tax Roth contributions thanks to her lower tax bracket. She can save $4,500 just by maxing out this account. In reality, saving $18,000 for retirement only costs her $13,500 in take home pay. Unfortunately, Pennsylvania is the only state in the country that does not allow you deduct state income taxes, probably because they know you’re probably going to be somewhere less expensive like Florida.

I loved the time I lived in Philly. I had great friends, went to a cool church, and even met my girlfriend there. I lived there in spite of the really crappy tax environment. I would say if you want to live there as well, you should take advantage of the suppressed housing demand. You could totally live in a neighborhood where you don’t have to compete with Penn students and Center City young professionals and come close to break even from the 4% wage tax you lose. If you’re going for early retirement in a place like Philly, NYC, or even SF, utilize the city to your advantage. There are tons of potential customers out there: you can tutor, dog-sit, open a Craigslist moving company, or sign up for medical research. You can always overcome ridiculously high taxes with more income, and cities give you a great opportunity to earn that income. Want to be a bartender? Great; there are thousands of options. Ever thought of working as a waitress at a decent restaurant on the weekends? You could try that too. Make sure as much of your income as possible is going in pre-tax retirement accounts and save as much as you can in low cost index funds after that. Anyone in the country no matter where they live can retire early. You just have to take advantage of the special characteristics of the city you live in. Whether your savings is enhanced from big city earnings opportunities in Philly or low cost apartment rentals in central Florida, you can dream the impossible dream of early retirement. If the government gets 30% of your income, live off 20% and save 50%.

What do you think about high tax rates in the Northeast? Were they worth paying for the better social and professional opportunities you had? Comment below.

NC has a 6% income tax. Though I wouldn’t trade it now, I did a comparison to south Florida cost of living when comparing an offer I had there to the NC job offer. The cost of living for increased rent/real estate in South Florida made the increase in income tax in NC a break even for overall cost of living.