You’ve graduated from college and are the proud new owner of a professional job with salary and benefits to boot. First off, congratulations. Second, learn how to save for retirement the right way. It will allow you to retire a decade before most people, or even sooner. Managing your retirement investments well is surprisingly easy. Twenty and thirty somethings should save for retirement as soon as possible. Here’s how to do it.

Start With Your Employer’s Retirement Plan

If you have a retirement plan through work, you should look there first. The biggest overlooked benefit in the country right now is employer matching programs. Most employers will offer to match a set percentage of your contributions to an investment account dedicated for your retirement. A common number is the 4% match. For every dollar you contribute, your employer would chip in up to 4% of your total compensation. That means if you save 4% of what you make and put it towards your 401k, 403b, etc. , your employer would chip in another 4% and you would have a total savings rate of 8%.

Most states will give you a state income tax deduction for contributions to workplace retirement plans. What this means is that most single people with incomes above $47,000 and married couples with joint income above $94,000 will be better off contributing to a 401k, 403b, or other pre-tax workplace retirement account than opening their own Roth IRA. Say you were a veterinarian in New Jersey making $90,000 a year. You are in the 25% federal income tax bracket and 6.37% state income tax bracket. Since each dollar gets taxed at over 30%, you might as well make a pre-tax 401k contribution. A Roth retirement account allows you to put in money that’s already been taxed. That money grows tax free and can be withdrawn at 59.5 years of age tax free as well. Using this veterinarian as an example, she would need to be taxed at a rate higher than 31.37% to make a Roth IRA a better choice than a pre-tax 401k. While taxes might very well be increased in the future, the current tax savings she would get from using a 401k are good enough that I would lean towards saving through the retirement plan at work on a pre-tax basis. My general rule of thumb is check with HR to see if your state makes you pay income tax on 401k or 403b contributions. If this savings is state income tax free and you make more than $47,000 single or $94,000 married, use the pre-tax retirement account at work first before thinking about any kind of IRA.

Many states do not allow you to deduct contributions to traditional pre-tax IRAs from your income. By not participating in your pre-tax workplace retirement plan, you give up the state income tax benefit. If you saved in a Roth IRA, what happens if you retire to Florida, a state with no income tax? You would have paid New Jersey state income tax unnecessarily. Usually, workplace retirement plans receive even more tax benefits than IRAs, so when you are investing look there first.

What About Roth IRAs? I Thought They Were the Best Retirement Accounts Ever Created?

Roth IRAs are self directed, after tax contributions that never get taxed again as long as you wait until 59.5 years old to withdraw. You will see them marketed heavily in the personal finance world because not paying taxes sounds awesome, and it is. However, you should do a rational analysis of your situation and not just sign up for one cluelessly. If you live in a high tax state like NY, CA, NJ, etc. and make a professional income, you will probably want to use a pre-tax 401k, 403b, or whatever plan is offered at work. If you earn a modest income that you expect will rise significantly in your future, like future surgeons during residency, then contributing with after tax dollars and using a Roth IRA might make a lot of sense.

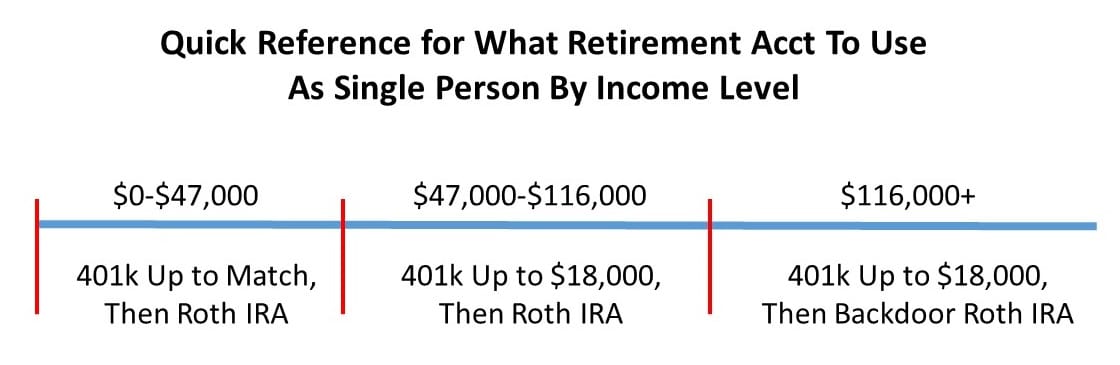

Just remember that the first thing you should do is go to your HR office and ask if they have a matching program for retirement. They will know what you mean by that. If they do, ask what you need to do to make sure you get all the match available. This is free money. It’s equivalent to $100 bills being left all over the street, and all you have to do to get them is bend over and put them in your pocket. Once you’ve done that, if you have a modest income and want control over your own investments, you can decide between opening a Roth IRA or continuing to save in your retirement account. A quick rule of thumb is if your income is greater than $60,000, you should be using the pre-tax 401k. If you make less, it is really a toss up between a Roth IRA and the 401k. Either one is fine. If you make more than $116,000, then you should max out your pre-tax 401k (contributing $18,000) and pay for tax advice how to contribute to a Roth IRA using a legal loophole called “the backdoor Roth IRA.”

If you are married, then just change the categories above to $0-$94,000, $94,000-$183,000, and $183,000+. The rationale behind these income breakdowns is simple. For a single person, the 25% federal income tax bracket starts at about $37,000 plus $10,300 for tax free deductions, which comes to $47,300. Anything below that income level and it probably makes sense to lock in a very low 15% tax rate on your retirement contributions today and enjoy tax free savings later in life. Anything taxed at 25% and above you might as well take the bird in hand and get the tax break now. You will be able to afford to save more for retirement. Also, a ton of people relocate in retirement to low or no income tax states, so it makes sense to take advantage fully of the 401k plan to avoid paying state income taxes to places where you won’t be living in retirement.

Why do financial advisors (FA’s for short) push IRAs and Roth IRAs so much? Most FA’s get paid in the form of an assets under management fee. If they invest $100,000 for you, they will charge you 1% of that sum, which comes out to $1,000. The percent they charge seldom goes down with larger account balances. The FA’s just try and offer more service in exchange for not having to cut the fee. In contrast, if they gave you consultative advice on your 401k it would likely be a one time kind of thing where they could only charge a one time flat fee. Would you rather have an annuity stream of a few thousand a year or 5 billable hours one time for $200 an hour? It’s an easy answer. The advisors will choose the continuing stream of assets under management revenue every day. Hence, they are much more likely to suggest an IRA to you even when it might not be in your best interest to move your money into one.

The advice you will receive from advisors is usually well intentioned. However, everyone from your car salesman to your doctor has a conflict of interest, no matter how honest they are. They will be looking out for their own interests and you should be looking out for yours. If an advisor suggests that you move your money out of a 401k to an IRA under his or her management, ask about the difference in fees and taxes, such as when you own company stock in a 401k. Just be aware this conflict of interest exists in the financial advice field. Make sure you are not better off contributing to your 401k instead.

What If Your Workplace Retirement Account Stinks?

I define a horrible 401k or 403b plan as anything that restricts your investment options to funds that charge higher than 1% annual expense ratios. It is stunning how many workplace retirement plans fall into this category. Sometimes, they do not even have a matching contribution. If you have a 401k that really stinks, you might want to use it even over cheaper options like opening an IRA at Vanguard.

The main reasons are the employer match and state income tax savings. If you get matching contributions at work, then this is like a 100% return on your money. It could take around 100 years for a Vanguard IRA to beat an average 1% fee stock mutual fund if you get a 1:1 match. The employer matching does not exist for IRAs, so you must take advantage of this workplace retirement program incentive first, even if the 401k is lousy. For state income taxes, the math is not as powerful but the analysis is similar. In New Jersey, the 6.37% tax deduction you get for contributing to a 401k does not exist for IRAs. You would have to incur over six years of 1% expense ratios to make a Vanguard IRA the more attractive option. Most millennials will change jobs multiple times over the course of their careers. The likelihood you will stay at that job for longer than that six year break-even period is relatively low. Hence, you could use the 401k and when you quit you can roll it over into your own IRA and switch into cheaper investment options.

How to Use Various Retirement Accounts (401k, IRA, 403b, etc)?

If you use a workplace retirement plan, investing is easier than with an IRA because there are fewer choices. With a 401k or 403b,the employer selects a bunch of approved mutual funds you can invest in, and those are your only options. Choose the best combination of simple and low cost that you can. You will be able to identify the low cost funds by looking at the expense ratios. Hopefully there will be a target retirement fund that invests in a lot of different funds and gets more conservative as you get older. If you have this option, you should probably use it because it is so straightforward.

The best target retirement funds available today are the ones from Vanguard because of the low fees. In general, a target retirement fund will have a year attached to it, like Target Retirement 2050 Fund. That year corresponds to the date you expect to retire. All you need to do is pick one fund in this case, as target retirement funds already consist of multiple different asset classes. There is no benefit by using more than one. If you do not have a target retirement fund option, I would look for the cheapest US stock fund and the cheapest international stock fund and split my contributions 50/50. The goal is to pay no more than 0.2% in annual expenses every year and use index funds wherever possible.

You should not worry about how much your retirement account goes up and down from day to day, week to week, or even year to year. You are usually investing for a date 30 years or more into the future. Over that time period, stocks beat bonds 100% of the time because you get extra return from taking additional short term risk. As you get older you should gradually add more bonds to your portfolio because you have less time to make up losses, but when you’re young you should be aggressive because you’ll end up with more money. Bonds are awful right now, so you should use as few of them as possible.

To review, if you use a workplace retirement plan, go for the cheapest funds, try to keep your contributions balanced between US and International, weight your contributions more heavily towards stocks, and if you have the option of a target retirement fund go ahead and use it unless the fees are really high. Go with the one with the farther away date because it will be more aggressive and bonds have a terrible risk/reward profile right now. If you use an IRA, you can select any investments you want. I would go with Vanguard because of the simplicity and low fees they provide. Select the target retirement fund closest to your year of expected retirement and then focus on earning more money and contributing all you can. Your annual charges will be less than 0.2% of your assets compared to 1% or more at most other places. If you want to be more aggressive and save a little bit on fees you could go with 50% Total Stock Index and 50% Total International Stock Index funds and pay about 0.10% annually in fees. If you have no clue and do not want to touch your own IRA, I think the best option for getting it managed for you is Betterment, an automated investment management service. You can support this blog and get up to 6 months of service free if you sign up here.

Betterment charges 0.15%-0.35% annually of what they manage for you depending on how much you have invested with them (the larger the $ amount the lower the percentage fee). Compare that to a traditional full service advisor who will charge 1% or more and you can see what a deal that is. Betterment uses low cost Vanguard ETFs, so they save you a ton in underlying investment fees. They also do automatic rebalancing, which is a relatively sophisticated way to lower investing risk. Finally, they offer a more customized portfolio than the Vanguard target retirement funds will be able to since those funds are hundreds of billions of dollars in size. They use lower cost investments than the target retirement funds, but with their extra management fee I expect Betterment would cost about 0.10% more than the simple target retirement option if you have $100,000 or more invested with them. If I had no idea what I was doing, I would seriously consider them to manage my IRA or even taxable accounts. Another company you can look into is Wealthfront, which manages your first $15,000 for free. Betterment has lower fees for larger account sizes and since inertia is real and you probably will not switch between providers once you sign up, I think Betterment is the better choice. A notable exception is if you have stock options with large publicly traded tech firms. In that case Wealthfront can provide valuable tax advice on how to sell these options in a way that makes sense. Betterment is located in NYC and seems to focus on the everyday investor. Wealthfront is in San Francisco and thus has a big focus on tech workers out there.

Twenty and Thirty Somethings Should Save For Retirement by “Rolling It Over”

One of the biggest financial mistakes you can make is cashing out your 401k when you change jobs. Usually you will not have a ton of money in your employer retirement plan after a few years of work, so they will try to send you a check in the mail and wipe their hands of you. A lot of people just take this check and deposit it in the bank, unaware that they just cost themselves 35% or more in taxes that they didn’t have to pay. Whenever you leave your job, you can take your 401k money and move it to your own personal IRA. If that money is pre-tax, it goes into a Traditional IRA. If the money came from a Roth 401k, it would go into a Roth IRA.

Think of your IRA as a collection box. Over your career you will change jobs many times. You might have a dozen or more 401k’s before your career is done. At each point when you change jobs, make a habit of calling your financial institution to move the money into your IRA. The contributions continue to be tax protected and grow faster. Not only do you get huge tax advantages, there are huge legal advantages that come with retirement accounts as well. 401k’s, IRAs, 403b’s, and other retirement plans enjoy immunity from many kinds of lawsuits, the most important being those stemming from bankruptcy filings. Say you have unpaid medical bills or have a multimillion dollar judgment against you in court; you might have to file for bankruptcy. However, any assets in your retirement accounts are fully protected. This benefit should be particularly interesting to folks in occupations targeted by lawsuits like doctors and small business owners.

There are very few reasons you would not want to roll over your 401k to an IRA once you leave your job, but they do exist. Most all of them involve if you have more than $116,000 in income as a single person or $183,000 as a married couple. Rolling over your 401k could make backdoor Roth IRA contributions more difficult. If you bought company stock in your 401k you could incur unnecessary taxes by rolling it over to an IRA. Those are two most common exceptions to this blanket rule that you should always “roll it over,” and these two exceptions apply to very, very few people. If have a solidly six figure income, it will pay dividends to have a trustworthy tax person help you unless you want to learn the details of the tax codes yourself.

How Much Is “Enough” For Retirement Savings?

A good rule of thumb is if you want to retire in your 50’s, you will need to save at least 15%. If you are OK putting off retirement until your 60’s, then it is probably OK to save 10% for retirement. You can include your employer match in your calculations. For example, if your employer gives you a 4% match, you should be saving at least 6% of your total compensation to afford retirement by your mid 60s. If you wanted to walk away in your mid 50’s, you need to save 11% of your pay instead of 6%.

In case you want to go for extreme early retirement, your savings percentage must be ridiculous, ie at least 50% of your pay. The good news is most people can save 6% along with the aid of a tax deduction from your 401k, so if you are reading this article there is no chance you will retire in poverty.

Stick With What You Know and Don’t Try For Home Runs With Retirement Savings

When you put money away for your older years, you aren’t trying for home runs. You don’t need to pick the next Facebook or Google, and you should certainly not try to figure out when the stock market is going up or down. Unless you are a financial professional, stick to what you know and have your accounts perform well long term by going with low cost index funds.

Over a long period of time, the graph of your retirement account will look smooth and exponential. Over a short period of time, the graph of your retirement account could look like an earthquake reading. For this reason, you should never panic. Make sure you invest for the long term, and try not to look at your account statement more than once a year. Even when you take a look, do not feel the need to change anything. Avoid expensive financial advice and wait until you have a lot of assets so you can get better service for a better price. Remember you can save up to $18,000 in a workplace retirement account as an employee of an organization. In addition, you can save $5,500 in an Individual Retirement Account. All of this money is tax free. If you are self employed, you might be able to save even more than these amounts using a solo 401k or SEP IRA. Saving for retirement helps you to save on taxes, to protect yourself from lawsuits, to earn more on your investments, and to enable you to walk away from a steady income stream one day. Get started and don’t look back.

Any questions about retirement accounts, Roth IRAs vs 401ks, or info above? Disagree with some of my rules of thumb? Comment below!

*Disclosure: the Betterment link provides income to this blog, which could potentially color my advice on which provider to use for automated investment management. That said, I wouldn’t recommend it if I didn’t think it was the best option. When I can make money and do good at the same time, that’s a great point of intersection.

Like the advice. Consistent with your past blogs.

Can you share a bit about asset allocation for traditional (60s), early (59s), and extreme early retirement?

Would love to hear what your allocation looks like as well and how it may change depending on how your life changes.

Everyone’s asset allocation starts out aggressive, with at least 80% in stocks. The traditional model of 60 year old retirement would have you start increasing bond holdings in your late 30s to end up with something between 40% to 60% stocks by retirement. The earlier model would have a little more in stocks because you have a longer period to retire. The extreme early retirement portfolio depends on your preferences. I prefer to take a lot of stock market risk and if I’m wrong and lose a lot of money I have the flexibility to pick up side jobs like tutoring to lower my cash burn rate. If it does really well, then I retired from my corporate lifestyle sooner than I might have otherwise. If bonds give you 2% over the next 20 years best case scenario, why would you allocate much to them? All of Vanguard’s advice is backward looking when we had 40+ years of declining interest rates. You can either save way more to account for how bad bonds are or you can take more risk and be willing to do side hustles for income if you’re wrong. I like the latter.

As always, excellent advice. I appreciate you sharing your wealth of knowledge.

I am hesitant to invest in international index funds. I appreciate the advantages of a diversified portfolio to minimize risk, but I’m concerned with the international market considering what’s going on outside the US at the moment. Should I take the plunge to diversify now, knowing that retirement is decades away?

I’ll use South Africa as an example. When I went there in 2011 the rand to USD ratio was 7:1. Today it’s 15:1. The Mexican Peso is similar. The euro has been devalued over 30% as well. International funds offer better dividends, more attractive valuation ratios, and less exposure to technology stocks, all things that would make me more inclined to invest abroad. My own holdings are about 2/3 international, 1/3 US right now. When you are hesitant to invest in something because of big losses, that’s often a good sign of that asset class being more attractive. You could still lose a lot of money and international stocks could continue to crash. However, because they have already fallen so much I’d put the probability of that continuing to be lower.