Fake. Duplicitous. Phony. Surreal appearance underlying the dark truth of the willingness to take advantage of anyone in its way. I could be talking about Chris Christie’s support of Donald Trump. Unfortunately, I’m not. If you take a look at trading levels, there are a lot of individual investors out there that could lose their shirt when New Jersey bonds default. I’ve written two pieces on the coming disaster of New Jersey’s finances, here and here. Sometime in the next 10 years, the state will have no money to pay its bills. The scary part is, the bond market is completely ignoring it. There are people today paying premium dollars for bonds that could be close to worthless in 10 years. The rating agencies and other institutional investors are wrong because there has never been a looming financial crisis quite like this before. Here’s the evidence.

Small Odd Lot Trades in New Jersey Bonds Show How Dangerous the Market Has Become

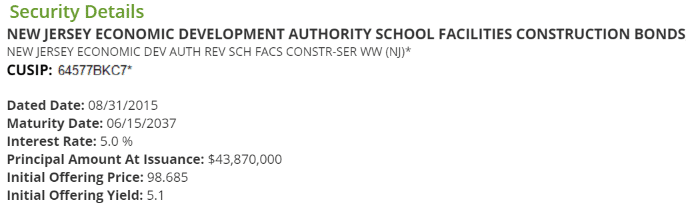

I’m going to take you into the arcane world of municipal bond trading. I worked in this market, trading billions of dollars in bonds for mutual funds. It is an incredibly hard market to find trade data for unless you have the $20,000 a year Bloomberg terminal or you know what you are looking for. Consider this bond below. I culled the information from the EMMA tool at the MSRB website. You can find data like this at emma.msrb.org.

Now for a plain English explanation. This bond is a New Jersey Transportation Program revenue bond. It matures in 2045, probably has a call option in 2025, and pays a 5% semi-annual coupon. The current rating for this bond is A- by S&P and Moody’s. Remember a call option allows the issuer to take away your bond and give you back par ($100) at the stated date. In other words, if New Jersey can bring a deal to market to replace this bond at lower than 5% interest in 2025, it will do that and make money. If it can, you will lose an attractive interest rate. If it cannot, you get stuck with a bond that is worth less than what you paid for it. Here’s a few examples of how this bond traded on Wednesday March 2, 2016.

What you see above is the retail municipal bond market at work. In an ideal trade, the big bank acting as broker buys a large amount of municipal bonds from an institutional customer in the morning, say $2 million worth, and sells it in chunks of $10,000-$500,000 until they run through them. To make money, the bank marks these bonds up, usually by 1-2 points. Up above, you see an interdealer trade for $105.487 and eventually a customer purchase for $107.361. The difference between these two prices is close to $2, or ‘two points’. Wall Street banks will pay what they need to pay to get magical numbers that average investors like. There really is not a lot of thought that goes into most individual bond buying. In most cases, a retail broker literally says “I want 4% New Jersey paper maturing in 25 to 30 years with this dollar price” and the computer spits out this bond for him to buy.

Here’s another example. This bond would be called “New Jersey Eco” for shorthand in the trader world. It matures in 2037 with a call option probably in 2025.

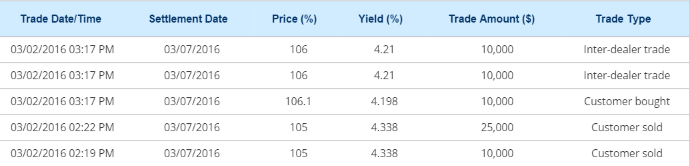

Here is the trade data:

Notice these bonds are trading within a tighter range. However, that range is still centered around a $105 to $106 dollar price. It looks like the retail broker is making a $1 commission on this bond.

New Jersey Bonds Have a Structure Similar To Your Bum Friend Who Always Needs Hand Outs

I’m going to try and make an analogy to make the problem here clearer. Imagine you have a bum friend (New Jersey) who has income way lower than expenses. He has a ticking time bomb of triplets on the way (unfunded pensions) but is not setting aside money for their care. He turns to you (investor) to get a loan to pay for his immediate cash needs. He makes his payments on time, but he continues to ask for a new loan to pay back the old one each time the bill comes due (rolling over the debt). The problem is, eventually your bum friend will have no money to even pay the interest payments on what he owes you.

New Jersey has multi billion pension payments coming due and no way to pay them. I predict this will happen in about eight to nine years, just before these bonds above become callable. New Jersey will lose access to the market for these bonds and will not be able to refinance the debt, leaving them with little choice but to try and default through a settlement with creditors.

In Short, Investors in New Jersey Bonds Are Being Duped

Right now, high income individuals like doctors, lawyers, and small business owners are putting money into New Jersey bonds because of the nice state tax exemption they receive. They are being led to believe by the rating agencies, who are asleep at the wheel here, that these bonds have a minimal default risk. However, are the rating agencies really considering what might happen to these bonds, which are only appropriation pledges of the state? Appropriation is one of the weakest forms of state pledge to bond holders. The State literally only has to legally pay the debt if it feels like it. Most states always pay the debt because if they did not they would lose access to the market. However, when Detroit went bankrupt, the bonds were a higher class called general obligation. Legally, bond holders should have the right to raise taxes, seize city assets, and collect city revenues until the bill was paid. A judge ruled partly against these investors and they got about 70 cents for each dollar invested.

However, in the case of New Jersey, do you think a federal judge will allow hundreds of thousands of retirees to have their pensions cut 50%? No, the state will try and force some settlement on bondholders. The taxpayers in New Jersey pay so much already there is no room to raise revenue, much as in the city of Detroit.

Why Is the Market For New Jersey Bonds Irrational Right Now?

New Jersey bonds make up billions of dollars of the municipal market. All the biggest mutual funds hold debt from the state in huge numbers. Most of the large mutual funds must hold them because the benchmarks they compare themselves to have a lot of New Jersey paper. What’s more, a lot of these mutual funds have rules about investment grade minimums to buy a bond. Right now New Jersey is rated A-, three notches above the lowest investment grade rating of BBB-. Also, the market is so starved for yield, people have convinced themselves that somehow New Jersey is a safe place to pick up some spread to put in their portfolios. They are choosing between places like New Jersey, Illinois, Puerto Rico, Tobacco bonds, and distressed hospital systems, so it is not an easy task.

So the institutional buyers are holding it because it has not fallen out of their benchmarks and provides some extra yield. Most of these funds are judged over a one to three year time horizon, so naturally they do not need to be concerned about what happens to the bonds in five to ten years. The Wall Street banks can sell the stuff because all that matters is that they can make a fair commission for the work they do. They just need a story and a yield that they can sell. They would never try and sell a retail buyer a bond that is about to default, but they will not hold your hand and try to prevent a bad purchase ten years down the line. Average investors are buying these bonds because the yield is so high compared to what else they can buy.

Finally, the global economy has conspired to push down interest rates to rock bottom levels again. With much of Europe sovereigns trading at negative levels, it’s no wonder that international investors have bought lots of Treasury bonds. Since municipal bonds get compared to treasuries for their attractiveness measures, this global fixed income rally has caused yields in municipals to fall. Since New Jersey is a part of this tax exempt bond world, its yields have fallen too. This is like a 0.100 hitter on the Yankees getting a $100 million contract extension because his teammates have been getting big contracts too. It makes no sense. New Jersey should be a credit story, not a rate story.

My thoughts are to avoid New Jersey bonds at all costs. If you live there, I would suggest giving up the tax exemption you gain by buying them in favor of a broadly diversified national municipal bond mutual fund. The rating agencies might eventually wise up after the Chris Christie / Donald Trump variety show stops distracting the media from the cataclysmic financial disaster awaiting future New Jersey budgets. Just remember, there are numerous market forces keeping the price above $100 a bond. That $100 is what you will get back at maturity. I expect a lot of New Jersey municipal bond investors will get interest payments for several years and eventually a funding crisis could cause them to get cents on the dollar for their claim.

Don’t end up like Chris Christie at a Trump rally, be skeptical about buying New Jersey bonds. Especially when fools are paying $107 per $100 bond for something that could end up being a next to worthless promise.