If you put your money in a bank or credit union in the USA, the government guarantees your deposits up to $250,000. While you could lose a lot of money to fees if you bank with a major financial institution, the money in your account is secure. This is one of the biggest lies in the American financial system. The average working class person loses more from saving in a bank account over time than the wealthy lose during stock market crashes. If your bank is riskier than the stock market, why do so many people entrust their life savings to these companies? The compounded effects of inflation, taxes, and bank product placement ensure that frugal people that favor banks accounts over brokerage accounts will stay working class.

The Interest On Your Savings Account Hides Massive Losses on What Your Money Can Buy

How much do savings accounts pay these days? At many banks, you are lucky if you can get anything at all. A Bank of America savings account earns you a pathetically low 0.01% as of this article’s publication. If you go to your local credit union, you might be able to increase that figure to 0.2%. If you are really aggressive and always look for the best deals, you can find online savings accounts that pay 1% with a bunch of caveats.

What is the long term rate of inflation? In the past 30 years, it has been more than 3%. Since most banks pay close to zero, you are losing 3% on your money every year without even realizing it. For non-financially inclined people out there, inflation is the rising cost of goods and services over time in an economy. Every year, movie tickets seem to cost more. The reason for this is inflation.

While the current rate of inflation is below 3%, it has been much higher in the past. That is why you should use long term averages when thinking about how much money you will lose in your bank account.

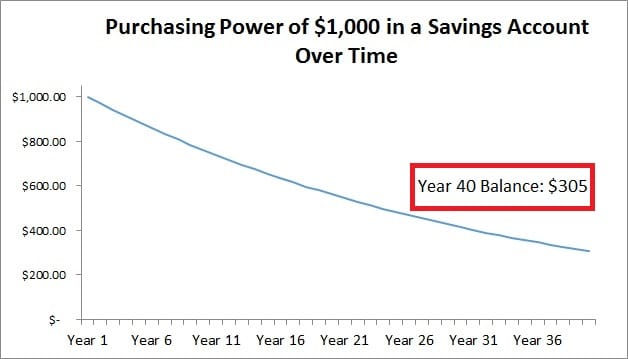

Most millennials reading this article have a 40 year time horizon or more for their savings. You can see how a hypothetical $1,000 deposit is reduced in value by 70% over a long period of time. This loss is all because of the evil inflation monster that destroys the value of your savings 24/7.

When Interest Rates Rise, Taxes Will Destroy a Lot of What Your Savings Account Earns

The top capital gains tax rate in America is 23.8%. For most average working class people that tax rate is actually 0%. However, when you save in the bank, you pay taxes on the interest you earn. Taxable interest income is taxed at a higher ordinary income tax rate. That will mean at least 25% of what you earn at the bank would be taken from you by the government. Contrast that to the stock market, where many working class people would pay nothing. The difference is huge.

If you earn 8% a year over a long period of time in the stock market, and pay minimal taxes, you will make a killing. Compare that to the savings account, where you lose 25% or more on the couple percent you might get paid one day by your bank to taxes. Anyone under 30 years old probably does not remember having to report interest income from your bank on your tax return. When savings rates return to more normal levels, your 2% yield is reduced to 1.5% after taxes. Meanwhile your 2% dividend might not be reduced at all and the remaining capital gains you get from stocks might be sheltered.

So not only do savings accounts not pay anything, you get slammed with taxes on the little bit you do make.

When Your Teller Doubles as an Insurance Salesman

Did you know that your teller might have an insurance license and earn major referral bonuses for steering you to certain financial professionals? Even otherwise ethical credit unions are renting out office space and making partnerships with expensive financial advisors and product salesmen. When you put most of your money in the bank, your large balance will cause the people working there to suggest the worst types of financial products imaginable.

You will be sold on variable annuities, financial plans that are really whole life pitches, and high commission mutual funds. For every policy the teller gets, he or she can earn multiples of their hourly wage and move up the career ladder. You can lose as much as 12% of what you invest with these people as a commission that goes straight to their companies’ pockets. Unethical financial professionals love to see a high savings balance because they know you are scared of risk or uneducated about it, and they take advantage of this knowledge advantage. The bank is riskier than the stock market because you could lose whatever remaining savings you have to horrible financial products.

So Where Should I Put My Money if the Bank is Riskier Than the Stock Market?

Everyone should have a financial plan. If you do not know how to make one or would rather go to a professional, pay an hourly or flat fee rate to get objective advice. You will absolutely lose money investing in the stock market. For that reason, you can use banks for short term savings goals. However, any money you desire to spend for longer term goals should be invested in stocks and bonds.

Since the long term expected return of stocks and bonds is above inflation, you can expect to earn a positive real return on your money. Invest in a balanced portfolio of index funds at a place like Vanguard, Schwab, or Fidelity if you feel comfortable doing it yourself. If you do not, check out an online investment management company like Wealthfront or Betterment, which will manage portfolios for 0.15%-0.35% a year in annual fees.

Keep about six months expenses in a savings or checking account. You can have less if you work in a safe career like education or healthcare and more if you work in a riskier career like finance or consulting. DO NOT make the mistake of having mid five figures or even six figures sitting around in the bank doing nothing. I have a lot of friends and family who keep massive amounts of money in the bank and will never see it grow. Find a book about index fund investing and open a brokerage account today.

Any other suggestions or comments, including bad banking experiences, please list below! If you click the Betterment link and decide to let them manage your money, you help support this blog. Thanks!

Excellent points! People are constantly telling me that they are afraid of the stock market and that it is not guaranteed. I try to remind them that although returns are never guaranteed, the stock market has a long and successful track record of beating inflation. On the flip side, a bank account has a long and successful track record of losing you purchasing power just as you pointed out above.

Every time I would rather take an expected real gain than a guaranteed real loss.

Inflation makes any savings account one of the riskiest long term investments on the planet, thanks Larry