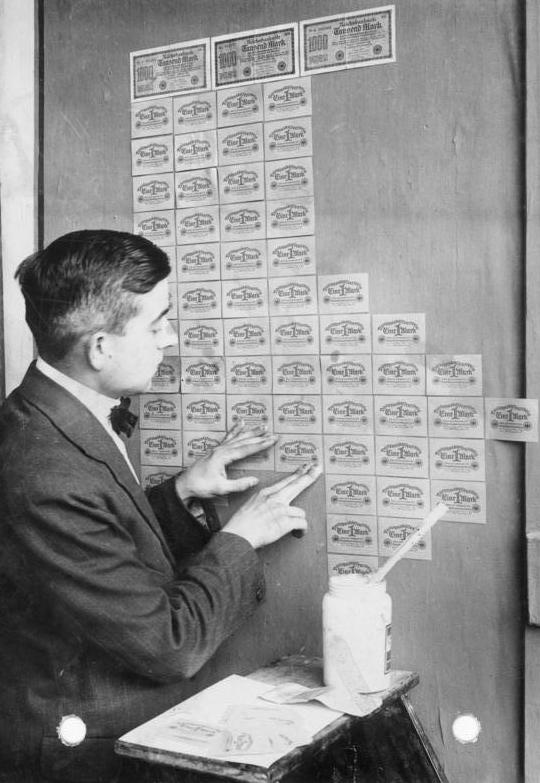

Historically, the German economy is famous for hyperinflation in the 1920s. Workers would earn paychecks and immediately go try to spend them. Consequently, their currency lost significant value every day. Average families needed wheelbarrows to carry their cash to the market to buy bread. We now have the opposite problem where Germans should hide money under the mattress because interest rates there are negative. Poor Germany.

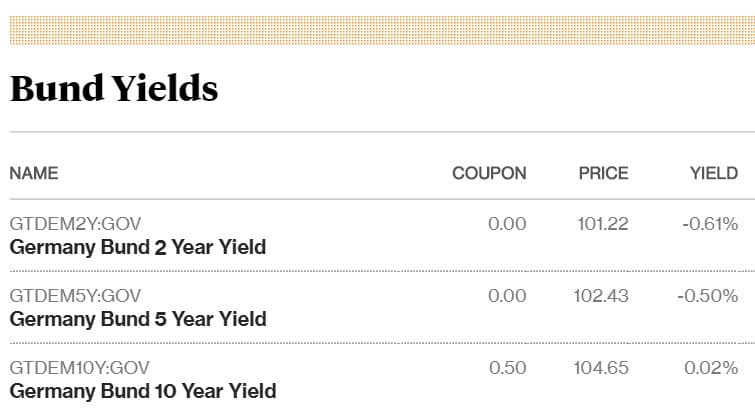

CURRENT GERMAN BOND YIELDS ARE PATHETIC

Notice that the two and five year bund yields are -0.61% and -0.5% respectively. If you give the German government 100 euro, in five years they would give you back 97.52 euro. Why would any investor accept such a crazy result?

The market expects deflationary pressure for many years in Europe. Consequently, their central bankers turned on so much quantitative easing it makes a monsoon look like a light rainshower.

SOMEONE PLEASE START A GERMAN PERSONAL VAULT COMPANY

Germans should hide money, but the question is where. Culturally, mattresses have been the preferred destination. However, since I am the grandchild of a Depression survivor, I have some suggestions.

- Inside a giant bratwurst

- In the bottom of a cup full of really dark beer

- Inside your Lederhosen

- Behind the back tail light of your Volkswagon

- Within a fancy German safe so you can feel rich

- Behind the soccer goal at the Bayern Munich stadium (maybe it will bring them good luck)

- Wallpaper so you can keep a good eye on your savings

- Might as well have some under the mattress just to keep the cliche true

- Under your solar panels

- Buried deep within the castle walls so you can make a treasure map

IN ALL SERIOUSNESS, GERMANS SHOULD HIDE MONEY

Why would you knowingly invest in something that would return less that what you paid for it? Due to current market conditions, Germans now find themselves in this predicament. You probably have international bond positions paying negative interest rates and do not even know it. Target date retirement funds including the ones from Vanguard hold large positions in international bonds despite their negative yields.

Investors accept these negative interest rates because they believe European deflation will cause the value of their initial investment to grow more than the nominal value declines. Namely, even though 100 euros would be 97.50 euros in five years, deflation of 2% or 3% would make the purchasing power 102 euros or something like that.

While you could justify buying a German bond with a negative yield this way, why not take the risk yourself and bury your euros in the back yard for five years? You would come out ahead of the professional investor. Most of all, you would have a hilarious story to tell your kids.

What do you think of the ridiculous negative interest rates around the world? Would you invest in German bonds if you were a German? Have a funny place where you would hide your money? Then comment below!

Why not broad-based equity investments? It seems likely to beat the mattress. 🙂

Depends. 97.50 euro after 5 years after starting with 100 euro is probably much better than what investors have been getting on their money in European stocks lately.

I like hiding money with the stack of toilet paper. My roommates don’t know how to change the tp. Will never be found.

Sounds like a genius method, unless they accidentally use it to wipe themselves then that would suck