Most financial advice is a ripoff, designed to make your advisors and their companies well off at your expense. One of my friends recently asked me whether his dad should use Fisher Investments. Despite their advertising that they put client interests first by operating on the fiduciary standard, their annual advisory fee is a ridiculous 1.25% for accounts greater than $500,000. Looking out for the client must happen after you pay their exorbitant fee. After discovering how expensive aggressively marketed financial advice firms tend to be, I realized it is tough to find a good advisor and know how much one should cost. To help, I am going to show you what you should be paying for financial advice. This could be one of the most important articles for the health of your pocketbook you ever read.

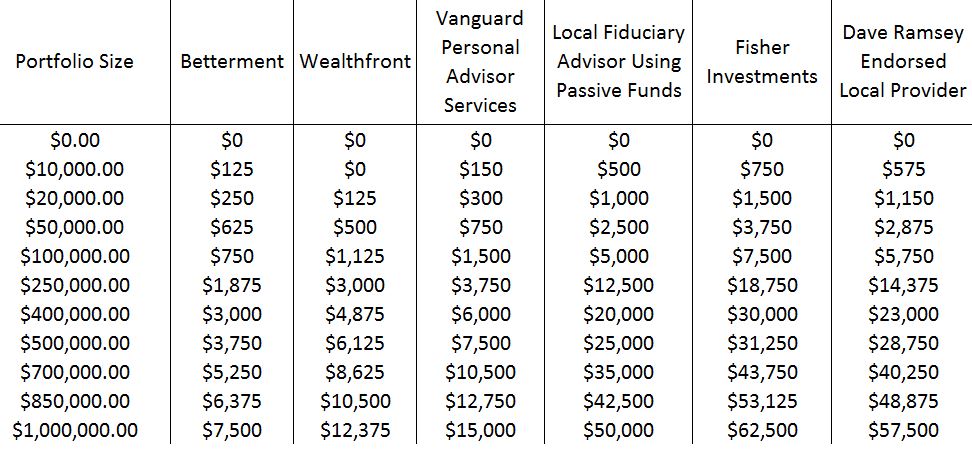

Hypothetical Advisory Fee Over Five Years, Not Including Fund Expense Ratios Or Transaction expenses

Looking at the above chart might shock you. Unfortunately, the typical household with a few hundred thousand in an advisory relationship buys their advisor the equivalent of a new car EVERY FIVE YEARS. Out of the options I surveyed for this article, Fisher Investments is the most expensive. That makes sense as I see their ads plastered all over the internet. A 70 year old white man with a 30 year old body smiles at the reader with a tagline, “Do You Have More than $500,000?” You can tell a lot about how expensive an advisor is based on how their ads look.

Additionally, notice how expensive Dave Ramsey’s endorsed local providers are. They are the second most expensive, second only to Fisher Investments. In fact, they would rank as the MOST expensive by a factor of more than four if I only looked at one year advisory fees. Ramsey makes money from commission-based salesmen for referrals. These advisors tend to work with lower wealth clients and usually earn huge upfront sale commissions for putting you in active mutual funds. Ramsey is great for getting out of debt. That’s when should stop paying attention to his advice.

What exactly is a fiduciary advisor?

If an advisor is a Fiduciary, he must put the client’s interest first when managing money. A Registered Investment Advisor is a fiduciary. A broker or wealth manager like you would find at Merrill Lynch is probably not.

Imagine my surprise then, when I discovered that Fisher Investments is in fact a fiduciary! Apparently, the standard must not include charging a reasonable fee for investment advice. The firm might not sell high fee or commissioned financial products, but if it takes 1.25% a year of your portfolio as a fee before investing for you that seems like the same thing to me. Fiduciary in a practical sense just means that an investment advisor is obligated not to sell you a sack of horse sh*t for your portfolio. He can charge whatever fee he wants before setting up a low cost portfolio for you.

Interview your advisor hard and limit what you pay him or her

Before entering into any advisory relationship, ask the advisor if he or she is a fiduciary. If the answer is no, walk away and do not work with them, period. They will try to explain away the fact that they operate ethically and they just have a different but equally valid business model. That’s baloney. You should not entrust your money to someone who will not tell you in writing that they manage your portfolio according to the fiduciary standard of care. That’s a legal term that means they can get sued for a lot of money if they do not act in your best interest.

Additionally, you need to pay NO MORE than 1% of your portfolio as an annual fee. Anything higher than this, and the advisor is likely lining his pockets at your expense. Many advisors need to charge more than 1% a year to make you a profitable client. I understand that, but you should not be doing business with them if that’s the case. There are so many fantastic low cost options available in the digital era of today that paying anything more than 1% a year is tantamount to highway robbery.

The Best, Great, DECENT, and Terrible Options to Receive Financial and investment Advice

| THE BEST VALUE:

The lowest cost investment advice |

Cost of Financial Advice: 0.25% a year with >$10,000 Who is it best for: Millennials (and everybody else too). If you want some of the most sophisticated investment management available to individual investors at a price 80% or lower than the most expensive financial advisors, look no further. They provide no financial planning except to clients with larger account sizes.

|

| GREAT VALUE:

Low cost financial planning and investment advice

|

Cost of financial advice: 0.3% a year Who is it best for: Retirees (but good for others as well). You get a team of CFP advisors or a dedicated advisor with a larger account. The fee also includes financial planning. That’s a great value if you are trying to figure out how much to spend in retirement or how to plan for financial goals. Examples: Vanguard Personal Advisor Services |

|

GOOD VALUE: Local Fiduciary Advisors <= 1% annual fees using primarily passive funds |

Cost of financial advice: 1% is an average yearly fee. If you have a large account size you might be able to negotiate it down to 0.75%. Who is it best for: If you want the professional who handles your money to be a part of your community, find a fiduciary advisor who uses low cost funds from Vanguard or DFA. Examples: Merriman |

|

TERRIBLE VALUE: Any advisor not on the fiduciary standard, or that charges >1% a year in fees |

Cost of financial advice: 1.25%-1.5% yearly, or a one-time upfront 5.75% fee Who is it good for: Advisors, and their brand new Mercedes S class. It’s not good for anybody else. Examples: Fisher Investments, Dave Ramsey Endorsed Local Providers, Big Bank brokers |

If You Go with the Best Option For Financial Advice

Betterment and Wealthfront are to the high fee financial advice industry as Uber and Lyft are to the dishonest part of the taxi industry. These two firms are perhaps the most consumer friendly innovation in personal finance since Vanguard created the first mass market index fund in the 1970s.

Neither firm includes financial planning in their incredibly low fee, which is perhaps the only drawback. They offer some financial guidance, but not full scale planning. Bloggers write plenty of articles as to which company is better. My answer is either one. Both of them are fantastic compared to the traditional way Americans obtain money management.

But what if you had to choose?

Betterment used to have a lower fee for a larger account size (0.15% a year for >$100,000 under their management). They tax loss harvest your portfolio and emphasize value stocks more. However, Wealthfront manages the first $10,000 free and charges a flat 0.25% for all account levels while emphasizing real estate and foreign stocks. They offer direct indexing for the US equity part of the portfolio where they buy the individual stocks in the market DIRECTLY and harvest losses at the micro level. They estimate it could add 2% a year to performance for taxable accounts. I believe that both companies use smart investment strategies.

Since tax loss harvesting does not matter for retirement accounts like IRAs, I would choose Betterment for any retirement investments of more than $100,000 because of the lower 0.15% fee (update: no advantage to either one at this point because both now charge 0.25%). For my taxable accounts I would choose Wealthfront because of the unique direct indexing feature. If I had less than $100,000, I would also choose Wealthfront as both companies charge 0.25% a year at this account size, except that Wealthfront manages your first $10,000 free.

For the ultimate smart decision making, consider using Learnvest for financial planning along with either one of these two companies to manage your investments. Learnvest charges a one time set up fee of $299 with a recurring monthly charge of $19 a month. They get into the nitty gritty of planning a budget, mapping out financial goals, and helping with basic financial questions like how much insurance you need.

If you are twenty or thirty something years old, why do you need to walk into an bland brick and mortar building to listen to a man or woman in a fancy suit sell you expensive financial products? Get with the times. The future of the advice industry is digital. These companies offer tremendously better value than most of their competitors, as you will see later.

IF YOU GO WITH the great OPTION FOR FINANCIAL ADVICE

Vanguard Personal Advisor Services (VPAS) is also a tremendously pro-consumer business offer. You get financial planning from a Certified Financial Planner PLUS investment management for your portfolio. All their services bundled together only cost 0.3% a year. Since my parents are not very savvy financially, I told them that if something ever happened to me that I would want them to hire Vanguard as their advisor. Betterment and Wealthfront are the better deals, but they require patience of dealing with an online only service.

With Vanguard you can call a living breathing human being at any time. The automated investment services provide almost constant availability to customer support representatives, but not financial planning anytime you want it. That is one reason why the service is well suited for people older than 50 as they would probably be less comfortable operating exclusively online. I know my parents would want to speak to someone about their money, which is another reason Vanguard provides a unique value to the advisor marketplace. Where else can you talk to someone about your money and receive a professional, unbiased viewpoint for 0.3% on $50,000 in assets?

The only downside here is that Vanguard moves slow and is very cautious with adding new features like tax loss harvesting. The company’s technology is always behind. One only need look at their website for proof. Additionally, they will be slow to use non-Vanguard funds, which means that their investment methodology will be hamstrung by what they have available in their suite of offerings. Also, your taxable returns could be lower with a more conservative tax loss harvesting approach. Their advice will be cookie cutter and perhaps overly simple. For a lot of people though, overly simple is what they need.

IF YOU GO WITH THE Good OPTION FOR FINANCIAL ADVICE

Some people want to go out with their advisor for a beer or lunch occasionally. Others like the idea of knowing where the advisor works so they can hold a real person accountable for their poor performance if the market tanks. I understand those feelings, though I still prefer the lower fees of the choices above.

Even so, your local fiduciary financial advisor probably offers a fair value for an important service. Their fee should be under 1% a year, and it should include investment management, financial planning, general financial questions, and tax suggestions. You should also expect estate planning guidance from your advisor.

Many local indepedent advisors started out at higher fee firms and realized that they wanted a better business model. Being a fiduciary allows them to put their client interests first when managing money. Going independent allows them to charge a lower fee of 1% or less because they do not need to support the parent financial firm’s profits. If the advisor charges more than this level, he might be in it for the money and I would tend to not trust him.

Finally, the advisor should recommend mostly passive funds. Vanguard and/or DFA funds are examples of great selections to look for in an advisor’s portfolio. Look for a Certified Financial Planner (CFP), Chartered Financial Analyst (CFA), or CPA (everyone knows what that is, lucky accountants who do not have to explain their credentials).

IF YOU GO WITH THE terrible OPTION FOR FINANCIAL ADVICE

At the risk of alienating some friends, you should never, EVER let someone manage your money who will not agree IN WRITING to uphold a fiduciary duty to you. In addition, you should never pay more than 1% annually in fees for the financial advice.

Fancy Merrill Lynch wealth managers who measure their career success by revenue generation? No way. Dave Ramsey endorsed advisors selling load mutual funds with upfront charges? You gotta be kidding. Ramsey lives in a giant mansion for a reason. Your acquaintance from college selling whole life insurance with low interest rates and complex expenses? Not an investment, or at least not a good one. He probably does not truly understand what he is selling. That glossy Fisher Investments mailing showing incredible active stock picking performance with the fiduciary standard and no hidden commissions? They back test results to make a hypothetical portfolio impressive enough to sign people up, and judging from the Bogleheads forum their salespeople rival the movie Boiler Room. Too bad their actual investors probably experienced a lower rate of return that they would never want to use in advertising.

If you are in one of these advisory relationships currently. GET OUT! You will be buying your advisor a new S class Mercedes over the next few years in fees. Go with one of the options above instead. There are great people working for these kind of employers. That’s not their fault, but you should encourage them to go to work for one of the good guys. Perhaps suggest that you would follow them to their own independent firm following the fiduciary standard if they started one. I would think there would be no higher compliment to pay someone in the financial advice industry than that.

Although i didn’t mention it above, watch out for worse than terrible

Even though advisors who charge high annual fees or hefty upfront commissions are bad for you, there is another kind of advisor who is even worse. He is the kind that invites you to fancy steak dinners, free investment seminars about the “scary stock market,” or who “specializes in guaranteed income for seniors.”

These guys (they are mostly men) sell variable and equity index-linked annuities. Fixed annuities are also not great for you, but are far less expensive and difficult to understand. Variable and equity index-linked annuities can have charges as high as 3.5% a year, or even more. While they provide some downside protection, they limit what you can earn in investing.

what are these strange sounding annuity investments and why should i watch out when someone tries to sell me one

Variable annuities provide an income guarantee that you will not outlive your money if the stock market falls. It is essentially an investment account wrapped in insurance that prevents any choices from being available not selected by the sponsoring company. Guess what they choose to offer? Mostly high fee active funds with huge expense ratios.

Equity index-linked annuities tie your returns to a stock market index. You can never earn less than 0%, but have a maximum cap on earnings, perhaps 6%. I read a contract for a friend once who bought one of these. If the stock market returns -10%, she earns 0%. If the market returns 20%, she makes 6%. If the market earns 3%, she still gets 3%. You have a tightly bound range of potential returns with this product. While reading the fine print, I noticed the range resets to from 0-6% to 0-4% after the first year. Additionally, if she pulls the money early, she must pay a 10% surrender charge to the insurance company. Her average return is therefore approximately 2% a year, with the potential to lose 10% of her money immediately if she needs to use it for something.

“Advisors” (these people should not be able to call themselves that in my opinion) can earn 10% or more as an upfront commission from selling you either a variable annuity or equity index-linked annuity. The surrender charges usually go towards paying back the sales commission, as the insurance company does not want to write such a steep check to an agent without reaping the profit. Unfortunately, lower income professionals, low information investors, and risk-averse savers are prime targets for annuity salesmen. Run from these people. Many of the worst abuses in the financial advice industry come from annuity sales.

quick hit summary

Some of the companies I mentioned have affiliate programs where I earn a small commission if you click on their links such as Betterment and Wealthfront. Some like Vanguard Personal Advisor Services do not. Others probably have affiliate programs but I trashed them in this article so am not including their paid links.

My philosophy is to give you the unvarnished, best knowledge I can so you can save money. I think Betterment and Wealthfront are the best two options for investing in history because they offer the lowest fees with the most sophisticated service. If you open an account of any size with them please click any of the links in this article. Thanks so much for supporting the site if you decide to do that. I’m finishing this at 2AM because I am passionate about this stuff, not because I need money. Too many of my friends have fallen victim to the financial advice ripoff.

If Vanguard sounds like it fits your needs better, awesome. If you love grabbing a Heineken with your advisor while watching a New York Rangers game, that’s great too. Just do the following things and it could make you rich:

- Demand a fee lower than 1% a year of your portfolio

- Require your advisor to submit in writing that he or she is a fiduciary

- Look for an advisor with a passive investing philosophy

I would love to continue the conversation. Were you shocked that advisors earn so much money over five years? Did you know about the insane value available now in financial advice thanks to information age technology? Should I open an investment advisory practice in between the costs I show here? What should I charge? Haha. Too bad my advice is free. Comment below!

I think a big part of the discussion should be are they only providing investment advice or are they also giving overall financial plan advice. If you need more than investment advice, they finding a fee only advisor who charges by the hour might be a good alternative. That way you are only paying when they need help instead of each quarter from your portfolio!

That’t a great suggestion as well. I looked around for flat fees too to see what I could find to choose from. Unfortunately most flat fee arrangements work out to a similar cost to the traditional 1% fee for portfolios under $1 million. I even found an advisor who limited the flat fee to accounts below that figure and made the fee asset based above that. Paying by the hour to get financial advice is a great way. However, as far as I am aware, only financial planners will accept payment this way. No investment advisor I’ve ever heard of will manage your portfolio for an hourly fee.

FISHER INVESTMENTS SHOULD BE BANNED BY THE BBB—THEY ILLEGALLY PAY THE SURRENDER FEES ON PROSEPCT’S ANNUITIES SO THEY CAN GRAB THE ASSETS AND CHARGE A 1.25 PER CENT ANNUAL FEE ON YOUR FUNDS FOR THE REST OF YOUR LIFE. TAKING PEOPLE OUT OF AN ANNUITY THAT GURANTEES YOUR PRINCIPAL WITH NO MARKET RISK—AND THEN THEY PUT YOU IN THE MARKET AND CHARGE THE 1.25% fee!!!! they should all be in jail

How could you use Learnvest along with Betterment or Wealthfront? Why would you pay both of those companies and not just go with Vanguard since their fee includes both?

Say you had $500,000 to invest. Betterment would only charge 0.15% and would give you a one off consultation with a CFP at that asset level. That alone might satisfy your financial planning needs. If you needed holistic goal planning, insurance planning, cash flow planning, estate planning help, and more, you could add Learnvest on top of Betterment to receive a financial plan. The cost in the first year would be 0.1% of that $500,000 portfolio, then 0.04% for each year after. That is cheaper than Vanguard’s 0.3% fee. Vanguard might be cheaper for someone looking for both financial planning AND investment management with a lower account balance.

If you only had $50,000 to invest, Learnvest’s fee would be 0.45% a year and Betterment’s would be 0.25%, for a total fee of 0.7%. Vanguard’s would only be 0.3% and might represent the better value for low account sizes if you needed financial planning too. If all you need is investing help, you should only be using Betterment or Wealthfront in my opinion. They are just better than any other providers with a lower fee to boot.

When can I schedule a one on one for personalized recommendations? Have me sweating over here…

Haha anytime Victoria. Send me an email [email protected]. Crazy how expensive getting financial advice is. Makes consultants look cheap 🙂

So you mean that if I bought an annuity for $100,000, my advisor would get a $10,000 commission? Damn!

In many cases, that’s correct. Usually the advisor has to split the commission with their company, so they might only take home 6%, with the rest going to their firm. That distinction doesn’t matter to you though. You pay the full 10%, which is hidden through large annual expenses and huge surrender charges if you ever try to get out of the policy

I got confused when my mom told me about her “tax-deferred annuity,” wanting her to steer clear of ridiculously high fees and commissions. But then I saw on google that a TDA is just another name for a 401k or 403b? I believe she’s in a public employee 403b plan, then. What are your thoughts on the TDA confusion?

It depends. In the not for profit world, people have 403bs instead of 401ks. They are similar but not the same. For example, TIAA-CREF dominates this space as a plan provider. Often times 403bs have a lot more options than 401ks. That means that you might have an annuity option and low cost index funds in the same plan. For the state of Florida, there are dozens of options and fund companies you can choose.

It depends on her plan’s documents. I’d look for disclosures of her annual expense ratio. She is likely using an expensive product, just not as expensive if she bought it from a guy on the street hustling old ladies for annuity sales. I guess I’m kinda a jerk to guys in that industry, and some people genuinely appreciate the guarantees they get. That’s fine just remember they won’t be worth anything if everyone needs to use them at the same time.

Another great post! Interestingly, I recently went through a round of looking into a range of “portfolio management services” companies. I talked with companies like “Franklin Street Partners” and “Calamos Wealth Management”. Costs were an absolute shock for me (even dwarfing some of the crazy numbers you show in your table). I ended up just doing it myself – putting long-term investments into a range of low-cost domestic and international index funds. (Essentially buying the market rather than trying to pick stocks or even sectors.)

All that said, however, your discussion seems to be missing something. It sort of reminds me of the days of “loaded” mutual funds. Why would anyone want to pay a sales “load” if they could put 100% of their money to work for themselves with a no-load fund? The answer: If that loaded fund delivers so much better return than the no-load fund that you net out a win over the next year or two. Do you have any idea how to determine and compare the bottom line value provided by all those companies?

That’s what the salesmen selling the funds would like you to believe BobL. In reality, over a 10 year period of time, close to 0% of loaded funds beat the index funds, and it’s almost entirely because of their high fees.

I did a cursory ‘passive funds beat active funds’ search on Google and found that between 60%-80% of large cap active funds failed to beat the S&P 500 over the past 10 years. That’s without including upfront sales commissions. If you added the 5.75% sales load, these active funds would get beat by the index about 90% of the time. If you compare a portfolio of active load funds with a portfolio of index funds, this would lessen the possibility of outperformance. If you extended the time period to 30 years, then loaded active funds would lose to index funds about 99% of the time.

An economist might ask, why would people get pouring money into something that performs so poorly, there must be an answer! There is, why does Fiat sell thousands of cars a year despite having one of the highest defect rates and lowest quality scores of any brand? They spend millions of dollars on marketing and get Jennifer Lopez to fake driving around in a Fiat in the Bronx. Active funds are similar. Sell hope, sell performance, sell excitement, then just don’t be around in 30 years to explain your poor results.

I didn’t show the high expenses of the funds that Merrill recommends, which are about 0.68% a year vs 0.15% a year for index funds. If you add that too, your 5 year cost would approach about 10% of the dollar amount you invest with them. That’s similar to the commissions you pay on variable annuities, which are supposed to be the worst of the worst!

Favorite quote: “Ramsey is great for getting out of debt. That’s when should stop paying attention to his advice.”

Ever since we started blogging about our journey out of $550k of student loans, we get tons of Q’s on the gospel of finance according to DR. I seriously want to carry around a card with this quote and pass it around when people ask me questions based on DR’s advice. Lots of peeps either forget or don’t realize that he’s getting money from endorsements etc. As I don’t just want to get out of debt, but would like to build significant wealth, I take some of his advice with a grain of salt.

I would even qualify that Ramsey is great for getting out of consumer debt. Some of his ideas I just can’t get on board with in paying off student loans (paying smallest loans first instead of paying highest interest first).

Thanks for recommending specific companies and sharing WHY. I think I didn’t really understand the “1% rule” until just now.

Glad it helped. Ramsey’s very entertaining and seems like a nice guy. Still, his understanding of investment math is suspect. He uses 12% as the figure for the long term stock market rate. That’s the average return not the compounded return. To show what I mean, say you earned 100% one year and -50% the next. Your compounded return would be 0% because you ended up where you started. Meanwhile your average return would be 25%. Using average returns exaggerates what investors can earn.

I think his debt advice is more motivational than anything. He encourages a lot of would be consumers to throw out their credit cards and commit to paying down debt, which leads to financial freedom. I can’t get too upset about that. Just know that he’s getting huge kickbacks from any professional he recommends and that you shouldn’t use any of them and then you can listen to the show for fun. Left a comment on your site Amber on the loans, I’d love to feature you for a case study. Let me know what you think

Well-presented argument; I believe you are actually providing a community service with this type of research. I live in Australia and like the USA we have a Financial Planning sector that has a history of poor advice and gross overcharging. In defense of the financial planning industry, however, I would like to make some points. Remember, it takes two to tango. In many cases bad advice is often a function of clients who do not want to think through or hear the truth. A financial planner who advises a client that to build wealth you need to spend less than you earn or that no financial planner knows what the price of shares, housing or any other asset will be tomorrow etc is likely to see his or her client walk out the door. A great many clients want a financial planner who can create wealth because they believe the planner knows things other less knowledgeable advisers do not and they are prepared to pay for it. Secondly, never underestimate consumer apathy and emotion. There is a whole body of evidence that clearly shows in consumer societies, like the US and Australia, a great many purchases are driven by irrational expectations and beliefs. This is why so many goods and services, which can scientifically be proven was worthless and a total waste of money, sell and keep selling.

That’s a great point about consumer emotions. I wonder if a more sober society like Germany sees fewer panic sellers in an event like the Brexit. The thing I’ll say about advisors is even some of the more expensive ones provide a good service. It’s extremely difficult to deal with a completely uneducated client. I get what you are saying about the client wanting to walk out the door if you don’t exude confidence, but at some point I think you let them go and hurt themselves. That kind of client in the US would be the most likely to get you sued.

I don’t know if you have the fiduciary standard in Australia or not. In the US, you can basically be a product salesman for the mutual fund and insurance companies or you can be an advisor. Unfortunately, the public thinks that both are the same thing and that’s the myth I’m trying to dispel

Another interesting question occurs to me regarding those robo advisors (like Betterment or Wealthfront): How do you think their performance would compare to what I could achieve if I bought the same exact portfolio of ETFs but manually rebalanced and tax-loss harvested once or twice a year?

Do you think they’ll do enough better to cover the extra costs? Also, do they make so many trades (rebalancing and harvesting) that they’ll turn my taxes into a nightmare?

Thanks.

I plan to do a more detailed post on this, but my initial thought is that both will perform better for taxable accounts if you are in the 35% bracket or above. Their tax loss harvesting algorithm is impressive. I’d do retirement accounts myself if you like investing.

If you are diligent about tax loss harvesting and rebalancing , i think doing it yourself is perfectly fine. A fee is still a fee. It’s a guaranteed 0.15 to 0.25% a year you won’t earn. If you do your taxes on tax software it should all upload automatically but yes there would be an enormous number of transactions.

You’re right on. It’s the trade-off between taking the time to learn this stuff yourself and paying someone to do it. I feel that way about so many things in life (paying for an oil change on my car versus YouTubing it, working with a realtor versus selling my house myself, etc). I’m very motivated to learn financial skills so my desire to work with an advisor is minimal. I wonder though if the benefit of working with an advisor is realized for average people since it encourages them to save more than they would normally. Maybe if you compared two average-joes and one average-joe works with an advisor who encourages him to save more and more. Even with the steep fee he is better off than the other average joe?

I think ANY average joe is infinitely better off with a Wealthfront/Betterment/Vanguard Personal Advisor. Average investors make terrible decisions. If you look at the difference between mutual fund returns and investor money weighted returns, it’s like 3% a year or more. I think people need to ask themselves if they’re saving ten times as much as they pay in fees, is that a good proposition? I sure think so.

Thanks for calling out Dave Ramsey and others! I feel the same way. He’s great for getting out of debt. That’s about it.

Personally, I wouldn’t use anything except Vanguard funds that I manage myself. Jim Collins philosophy on this is good enough for me. No “professional” or fancy software is going to bring you increased returns on his simple advice.

Plus, my blog focuses on the magic of real estate. Don’t leave that out!

Real estate is a great income generator. I think new companies like Fundrise might remove the headache barrier involved with rentals that’s prevented me from getting involved.

I would counter though that if you have total stock and total international stock in a taxable account, you have to tax loss harvest or else one of the roboadvisor portfolios would beat you on a after tax after fee basis

Yesterday I was helping somebody randomly in a Facebook group with her debt payments as she did not understand it. She thought that the only way to pay off her debt was the snowball method recommend by Mr. Ramsey, which can be beneficial for some but far from efficient. I think he is great at debt advise but would not go much further.

It is so easy to get caught up by somebody’s name that we often forget it is our money and we need to put the time in or we will lose money, not them. Having those high fees will severely damage somebody’s finances but because it says 1% people or like o that is nothing for a professional. Thanks for bringing the topic to light.

A lot of people get indignant about thinking a fee is too high BC “everybody charges it “. I can’t think of a sillier reason to justify compensation. Love companies like uber and Google that disrupt and destroy inefficient market actors. Unfortunately, most of the financial advice mkt is obsolete and needs to be eliminated . having consumers know what they are paying in fees is a good first start

This is the best post I’ve ever read on this topic. I am in the passive/DFA fiduciary camp – although I shop at Indochino, so maybe it’s time I downgrade my wardrobe, hah.

One option which was not mentioned is the growing contingent of fee-only advisors who charge a monthly retainer for financial planning ($79-$249/mo). Better aligning their value with the service they provide. The challenge is most people won’t pay for financial advice until they screw up or get burned, and others are not intelligent/informed enough to differentiate reasoned advice from a well-crafted sales pitch.

Also, the reason most fiduciary financial advisors charge 1% is the cost of acquiring a client in the first place. Trying to compete with the marketing dollars generated by a $20,000 fixed annuity commission is incredibly difficult. I would love to charge less than I do, but I wouldn’t be able to stay in business long enough to help anyone. That said, most firms could afford to lower their prices…I’ve met with over 1,000 financial advisors as a consultant and very few were worth the 1% fee.

Another interesting topic would be to explore whether betterment and wealthfront are sustainable at those prices. It’s easy to undercut your competition when you’re sitting on 70MM in VC money. When the burn rate starts to go up we will see if their prices adjust.

I’m fascinated by the cash burn question as well. That business model is unsustainable until they reach maybe $50 billion or so in assets, and they’re each at about $5 billion.

I looked into doing financial advice part time as a side gig and was blown away by the regulatory and startup costs. Licenses in every state if you don’t have the $100 million AUM to be SEC registered if I understand correctly. I love the flat fee monthly model for financial advice. Like you suggest,the uninformed middle class client is hard to pull away from the annuity sales world. Their misstatements about “the company pays me you don’t pay me” are staggering. Plus as a direct investor in markets the clients portfolio will fluctuate while the annuity value might move smaller amounts making ppl feel like that product is safer

On many occasions, that’s correct. Usually the advisor has to divide the commission with their company, so they might only take home 6%, with the rest heading for their firm. That differentiation doesn’t matter to you though. You pay the full 10%, which is hidden through large gross annual expenses and huge cave in charges if you at any time try to get out of your policy

“Most financial advice is a rip off”? I’d say that’s a typical, millennial way to separate, label, and then alienate an opposing viewpoint (perhaps you’re a Berkeley grad?); but that’s a separate conversation. I’ve been a financial planner for most of my adult life, and I can’t tell you how many times I’ve seen people do the following:

1). Take out a 30 year mortgage after age 55

2). Have more than one target retirement fund inside of a 401k

3). Max out a Roth IRA and a traditional IRA in the same tax year (or simply pick one vs. the other without understanding the advantages/disadvantages of each)

4). Take SSI benefits @ 62 without even calculating the ramifications

5). Take 401k loans or withdrawals to pay for children’s college expenses

6). Apply for life insurance after they’ve been diagnosed with cancer (spoiler alert: you can’t)

I could list 100 terrible financial moves here. I could maybe even concede that most “investment advice” is a rip off; but even then, as tax brackets change, global markets correlate more, unexpected life events occur…each family may need a custom set of advice to navigate their unique situations. Under $250k in assets? Sure, go with index funds of ETFs. But you can have a completely diversified portfolio with 15 individual equities, so even then is it the “best” decision? If you have to pay someone a few thousand dollars to avoid making mistakes that can cost you tens of thousands over a lifetime? What a screaming deal.

I agree if you’re paying a few thousand a year to make good financial decisions in life, then sure that’s a good deal. Many people are paying significantly more than that, and a lot of people below and above 250k are dealing with sub-optimal fees. Obviously financial planners as a group including commission based ones provide a valuable service. However, if I’ve got two plumbers that come to my house and one recommends a set line of products that he makes a large commission on and that costs me $5,000 to fix the problem and another charges me a flat $2500, it’s clear that the second guy is providing the better value.

Another example was when we had a hurricane hit our town and a bunch of construction guys came into the area. There was a tree on top of our house and a couple of guys with F-350s wanted to charge $10,000 for same day removal. Later that day, a bucket truck drove by and offered the same service for $3500. It’s not that the F-350 guys didn’t offer a valuable service, rather they were just charging way too much. That’s the analogy in my mind, and investors are voting with their feet having moved trillions into low cost passive investments and out of higher cost active and structured strategies like whole life and annuities.

My advice is that if you can not make your own decisions then you are doomed to failure.

Lol this guy is paid by the companies he endorses in this article and his own disclosure admits he is not an investment professional of any sort. Enjoy blogging in your mom’s basement for the rest of your life.

Thanks for this article MM! Do you know of anything comparable to Betterment, Wealthfront and Vanguard in Canada?

Well vanguard is actually in Canada already! So I’d start with them.

V. helpful article. Do Bettermernt or Wealthfront provide management advice for federal employees with the bulk of their retirement savings in the Thrift Savings Plan (akin to a 401K)? These cannot leave the TSP family of funds until age 59 without penalty.

Also, what are your thoughts on Creative Planning? Thanks!

They do not currently provide that, but I think the TSP should have some folks you can call to get advice. Never heard of creative planning

These fees need to be updated. Just FYI. Thanks!

Vanguard Personal Advisor fee 0.3%

$700,000 would cost $2,100

BUT YOUR GRAPH SHOWS vanguard would charge

$10,500 HUGE ERROR !

PLS EXPLAIN………….

KEVIN DEMPSEY

The title says the fees are calculated over 5 years, not one.

I would like to make a clarification on Dave Ramsey’s ELPS. The 5.75% is a practical understatement. Since we are dealing with commissioned sales people they probably are going to advise you to “move your money around” more than once in 5 years. This will greatly increase your costs and could lead to financial disaster. Although I am sure that all of DR’s ELPS have “THE HEART OF A TEACHER AND WILL WALK YOU THROUGH IT” I am afraid that they are going to walk you through the “POORHOUSE”.

Debating leaving my 1% financial advice company for Betterment. We are in retirement-saving mode and don’t have a lot of investment complexity or support needs. They have been great in getting us ‘analyzed’ in creating a financial plan and outlook, and getting us diversified. That all being done, we don’t have much interaction with them. The reduction is fees is an obvious plus to making a move – not sure what else would inhibit us from making the move . . . welcoming your thoughts!

You didn’t include any breakpoints in your Dave Ramsey ELP calculations (I am NOT an ELP). Was this an oversight? As an example, at a $1MM portfolio the sales load charged by the mutual funds company I am most familiar with would be 0% (there is a contingent deferred sales charge of 1% if a sale occurs in year one). So, at worst this investor is paying $10k, but if they hold for one year or more their actual cost to acquire the fund is $0, and they get advice from a rep (I understand, some reps are not of any value, but some are valuable). Maybe you could update your schedule to reflect actual costs at higher portfolio values?