Millennials seem to put off everything. Maybe we’re just waiting around to start our families and move to the suburbs with the white picket fence like everybody else. But maybe not. I’ve seen a surge of friends and acquaintances creating a new housing obsession that’s taking away big bucks that could be going to making us financially independent. These dollars are getting shoveled into the McLoft.

Our Parents Beat Us to McHousing

Baby Boomers and Gen X were obsessed with McMansions, aka massive behemoths spread out in quarter acre lots cut from formerly wooded areas 40 miles from town. If you made a high income and had a medium to large sized family, you had to have one.

These McMansions are designed with extremely similar layouts and building plans to cut costs for developers, hence their “Mc” prefix. There were of course standardized housing developments before the boom years of the 80s and 90s, but they were a lot smaller in size. We’re talking 1000-1500 square feet units for a family of 4 kinda thing.

Then our parents came along and wanted to take full use of that mortgage interest deduction. Of course, the result was bigger houses. My guess is that a huge percent of high income professionals in this country over 45 who have very little saved for retirement live in McMansions.

Yes houses typically go up in value. However, they can be money pits and piggy banks. What if you didn’t get a big raise this year and you still want to go to Disney world? Take out a home equity loan and worry about paying it off later.

The Millennials Love Tall Ceilings Bro

Our generation doesn’t seem to care for the suburbs as much, but we’re enamored by 12 foot ceilings. We love exposed brick walls, industrial charm, and super tall windows. Just in case we play a game of chicken in our apartment with a center from the basketball team on our shoulders, we want to make sure that they don’t hit their head.

The problem with McLofts is that they’re super similar. The same economies of scale developers learned about in the suburbs are now being applied to these fancy urban dwellings. Except now, the developers come in and ask for taxpayer subsidies for their projects that “couldn’t get done any other way.” That’s appealing for a politician looking at an empty warehouse in their district and looking for the next hip thing.

We love urban cores, walkable neighborhoods, Ikea, and bottomless mimosas, and never letting our hipster jean legs ride too far below the knee. I’m not being a troll here I love living in cities and being close to everything it’s fun. I think I like either tons of people living super close together or almost no people living out in the wilderness.

Prices Really, Really Reflect Our Big City Vibes

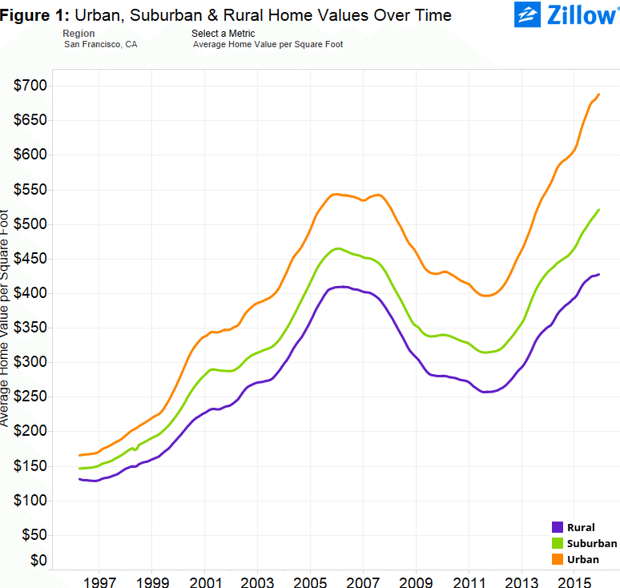

Check out this graphic below. It’s from Feb 2016 and shows only San Fran prices, but there’s a similar trend going on around the country. Urban housing is soaring.

We love urban housing so much we’re in a bidding war with all the hippies from the 60s that are trying to move back into the city. There are some places where urban house prices aren’t really that competitive w the burbs, notably in places with urban decline, but overall so many under 40 folks want to live in the city.

How to Capture Our Urban Preferences but Make Wise Financial Moves

Here it is in a nutshell. LIVE SMALL. Yes there are really expensive small apartments too, but as a general rule more space in the city is gonna mean a whole lot more money. For McLofts, that includes vertical space as well. It takes more money to heat and cool a huge 3D area like that. It’s fun to look at and live in for sure, but if you’re going to live in one, I think you should rent not buy.

After all our home prices are ridiculously high right now. Look at the absurd chart above showing the price moves since 2012. Also, McLoft type urban developments almost always come with an Homeowners’ fee. If you’re going to pay that every month and be dependent on management for your property values, then my view is you want to be able to get out of there if things go south.

Fight the McLoft Urge with Optimized, Small Apt Living

Live in the smallest space you’re cool with. It will save you so much money. The majority of your living expenses are going to go to housing, so if you cut that, it could be like shaving off the equivalent of 10 Starbucks lattes a day.

If you really like your large space that’s fine. I’m not trying to tell you what to do. If you have the money and can afford to that’s chill. However, if you’ve got student loans, aren’t saving for retirement, haven’t set up an emergency fund, etc, what do you need 12 foot ceilings for?

Let’s not make the housing mistakes of our parents, who have little saved for retirement despite having a fraction of the college education expense that we had. Supercharge your savings by not falling for the marketing ploys calling you to pay double what you need to for shelter. Get outside and hang out with friends and enjoy beautiful public spaces instead. Take advantage of the amenities of the big city without paying a fortune to maintain the cave you’ll spend a fraction of your time.

Great article, Travis. It’s important to highlight, like you’re doing here, that optimising housing costs isn’t just about forsaking the huge house in the countryside.

On a more personal level, I used to love city living in my early to mid twenties. These days, I’m quite comfortable with a life in the ‘burbs (no McMansion though!). There’s something about having a bit of space and quiet around me, and living closer to nature, that let’s me relax in a different way.

I’m just jealous of the Murphy bed in that NYC apartment! I think I’m more obsessed with tiny home spaces than large ones. But I can’t quite get my clutter down to live in one… yet. So I’ll just drool over spaces like that one for a while, and try to live within my means in the apartment I’ve got!