As of about 11:30am today, The NYSE trading halt occurred because of some as of yet undetermined technical problem. On top of this major problem, Chinese officials stopped trading in their stock market because of a continued crash, United Airlines flights got grounded across the country, and the Wall Street Journal home page went down. What does all this mean? Should you panic and sell every stock you own? These kind of questions will send you into a frenzy if you are depending on investment income and don’t have a happy place to go to calm down and put things in perspective. However, a serious question remains: does this problem with the stock exchange mean that your money is at risk?

Understanding the Market Trading Structure

The great news for US investors is that the NYSE represents only one of the many places that stocks of US companies are bought and sold. There are plenty of other stock exchanges that remained open when the NYSE shut down, including the NASDAQ, Chicago Mercantile Exchange, Chicago Board Options Exchange, and Arca system. A large part of the securities you can buy or sell are still trading. One of the benefits of having a scattered market structure is when something like a trading glitch hits the markets and shuts down a major exchange, there are other options for the traders who manage your money in mutual funds to turn to.

Did the Glitch Affect the Value of the Stock Market?

Probably yes, but not for the reasons you might think. Because institutional investors know that they can still execute orders for a lot of their positions on other exchanges, the impact is going to be limited on your portfolio. However, whenever something like this happens like the Flash Crash in 2010, the markets go down some in the aftermath because of the uncertainty of how the glitch happened in the first place. Investors want to feel like they will be able to sell their holdings at any time, and when something happens that undermines that confidence they will demand lower stock prices to compensate them for that risk.

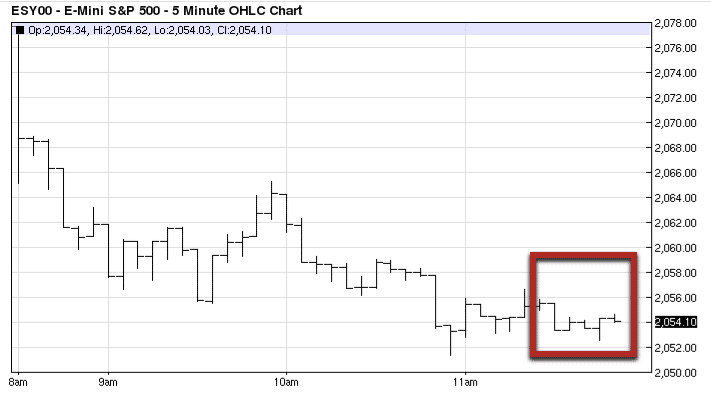

The cool part of this trading halt is that the futures contracts that track popular broad stock market indexes are still trading. Let’s take a look at the ESY00 contract that tracks the S&P 500 index. Look at the red box to see the price change during the NYSE trading halt. The time period in that box is approximately 11:30AM Eastern to 12:00PM Eastern on 7/8/2015.

The implied fall in the stock market value during this unusual event was less than 0.5%. This means that investors essentially view the scary headline as a non-issue.

Takeaways on a NYSE Trading Halt

If you are going to be worried about something, make it staying healthy mentally and physically, getting plenty of exercise, and having a large emergency fund to take care of your bills for several months in the event of an unwelcome financial surprise. The NYSE trading halt is a scary thing because something like that should not happen and it raises questions on the security of our cyber systems from hackers. Especially when United Airlines and the Wall Street Journal also went down due to curious technical difficulties around the same time today. The takeaway is that there will always be a worrisome headline in the news. Since you are powerless to do anything about it, have a balanced investment portfolio and sit back and relax and view the story as entertainment rather than a call to action. Today’s NYSE curiosity should be viewed as unimportant for the average investor. If you cut your expenses, continue to save and invest, and have a positive outlook, nothing can stop your drive to financial independence.

Take a break from trading and go smell the roses. By the time you’re done, they’ll probably have figured out what the problem was.