HOT STOCKS NOW! You click links like these because the title is exciting, like a Hollywood breakup or new Panda baby at the zoo. Financial companies know this so they use absurd headlines to lure new investors in and try to make as much money on them as possible. I for one like my stocks like I like my bagels: plain. People often ask me about hot tech startups, IPOs, and what sector I think they should be in. I understand why people think this way because they get their investing advice from Mad Money. Investing for beginners is not nearly as hard as you think when you tune out the noise.

Investing for Beginners: Everything You See on TV is Meant to Be Treated as a Joke

While I’m working on making this blog sexier, I don’t yet have big green and red buttons to smash giving you random buy/sell advice like Mr. Cramer on CNBC. If you are a financial professional then you know that his “advice” is about as serious as a Kardashian wedding.

It terrifies me that people watch this guy’s show and literally act on his advice. Jim Cramer is a former hedge fund manager. Hedge funds traditionally make money by using techniques like leverage and taking long and short positions in a stock, which allow you to profit on good news and bad news. You’ll also see a set of twins peddling their “free options book” and suggesting you can earn 150% rates of return. All of these strategies are completely inappropriate for the average investor. You can try them but it’s gambling; no better than if you took a stack of hundreds down to the casino if you are a nonprofessional in the game.

It terrifies me that people watch this guy’s show and literally act on his advice. Jim Cramer is a former hedge fund manager. Hedge funds traditionally make money by using techniques like leverage and taking long and short positions in a stock, which allow you to profit on good news and bad news. You’ll also see a set of twins peddling their “free options book” and suggesting you can earn 150% rates of return. All of these strategies are completely inappropriate for the average investor. You can try them but it’s gambling; no better than if you took a stack of hundreds down to the casino if you are a nonprofessional in the game.

Please consider the incentives of the financial media when they report on stories. They do not care about your financial future. They care about advertising revenue. The low commission firms and low fee money managers will not give them nearly as much revenue as the high fee shops that encourage day trading and exotic strategies. So how does one invest for the long term if the financial media is out to get you?

The easiest way to invest if you want to avoid having to choose individual companies is picking a mix of index funds from a place like Vanguard, Schwab, Fidelity, or Blackrock (iShares). Any one of these firms are good places to start, and I think Vanguard and Schwab are the two I’d trust the most. They get paid a fee based on your assets each year, usually between 0.1%-0.2% for index funds. If you have no desire to do it yourself and want to pay an extra 0.25% the two best places to go are Betterment and Wealthfront. They let you start out with low account balances and give you advice and investment management (admittedly through online only channels) at one quarter of the typical fee. If you are a beginner and are ok paying the extra fee I’d call one those two online financial advisors and they’ll set you up (I didn’t receive anything for suggesting this, and will let my readers know if there’s ever a conflict of interest).

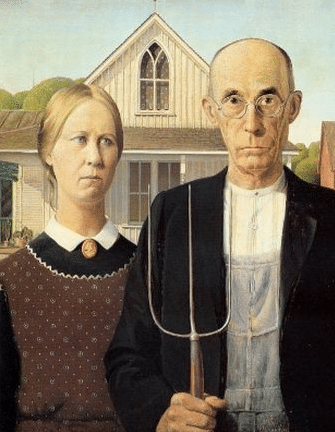

There are some reasons you’d want to avoid using Vanguard and other mutual fund companies to invest directly in individual stocks yourself. I have a lot of opinions on that, but unfortunately that’s another blog post. To whet your appetite for next time, I suggest any stocks you pick remind you of the painting I pasted in above.

Stay Boring My Friends!

Hi Travis,

Great blog! I’m new to investing so can you explain what a plain bagel stock is? My favorite bagel is cinnamon raisin with strawberry cream cheese. What sort of stock would you liken this too?

a plain bagel stock would be something like mcdonalds, southern company, exxon mobil, or coca cola. Basically it’s a company that’s not going away, has solid earnings, has a dividend, and would be considered blue chip. A strawberry cream cheese cinnamon bagel would be twitter or facebook. If you put too much of your diet in that basket, there’s a greater risk you’re taking a trip to the dentist

You mentioned Wealthfront & Betterment. What do you think about their tax loss harvesting (aka Direct Indexing) pitch? Wealthfront in particular says it adds 90 basis points or so in returns each year over equivalent ETFs held somewhere like vanguard. (More in states with a high marginal income tax). Thanks!

*more in states with a high state income tax

I think the tax loss harvesting feature these two companies provide makes their service valuable even to the most experienced investors. You would have to pay attention to the markets yourself to do tax loss harvesting and for 25bps (fewer in some cases with more assets) it pays for itself and then some. This feature is a huge advantage to the offerings Schwab and Vanguard provide in the advice space as they will not do tax loss harvesting. In Vanguard’s case they don’t have the technological sophistication to do it at scale and Schwab I imagine they do not want to risk getting bad PR for helping people “avoid taxes” even though it is ethical and should be done by any smart investor. For all these reasons Wealthfront and Betterment are the two best automated advice offerings by a long shot, no one else is even close.