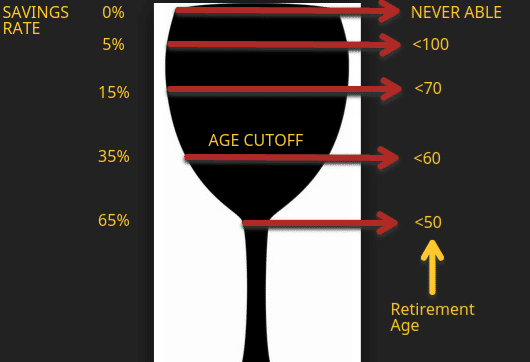

Have you ever wondered how different people can afford retirement at different ages? What is the magic sauce that allows one person to afford retirement in their 40s while another person works until they are 75? The good news is we can show this in terms of a wine glass instead of a more boring bar graph or pie chart. Think about the shaded area representing percentages of American workers and the age cutoffs shown with red arrows. The spending examples I use should be viewed in the context of a household with a solid middle class income. You can discover when you will retire by looking at this glass!

Have you ever wondered how different people can afford retirement at different ages? What is the magic sauce that allows one person to afford retirement in their 40s while another person works until they are 75? The good news is we can show this in terms of a wine glass instead of a more boring bar graph or pie chart. Think about the shaded area representing percentages of American workers and the age cutoffs shown with red arrows. The spending examples I use should be viewed in the context of a household with a solid middle class income. You can discover when you will retire by looking at this glass!

The Early Retirees

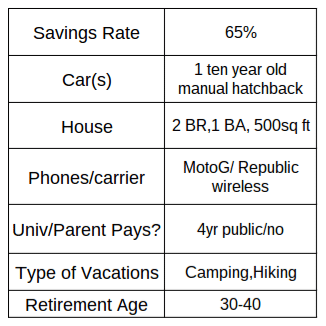

The stem of the wine glass represents the couple percent of the population that retires before 50. There are not very many people in this category and retirement ages vary widely between late 20s and late 40s. They have very small houses and few if any large consumer goods like cars, motorcycles, or boats to maintain. They save significantly over and above max 401k contributions every year.

The Mass Frugal

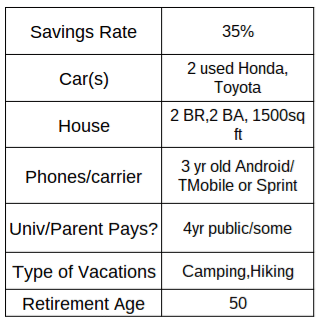

The bottom third of the Bowl of the glass represents the Mass Frugal. There are a fair amount of people in this category, but it is certainly not the most common group. You will see them walking away from work in their 50s. They typically save around a third of their salary and take a conservative approach to living and spending. Coupon clipping, mowing their own lawns, and driving reliable used cars are common traits of this group. They probably max their 401ks and save a little on top of that as well.

The Responsible Citizen

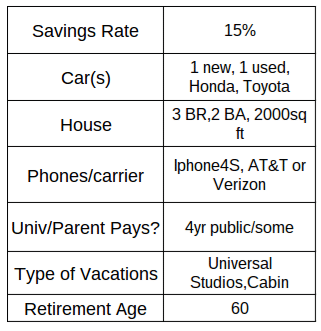

The middle third of the bowl represents the plurality of us. This hard working core of America reads their retirement brochures and sees 15% savings recommended so they listen and sock away a little more than what gets matched every year. They might have an IRA with a few hundred thousand in it in addition to a well funded 401k by the time they retire and use Social Security as an income supplement in retirement.

The middle third of the bowl represents the plurality of us. This hard working core of America reads their retirement brochures and sees 15% savings recommended so they listen and sock away a little more than what gets matched every year. They might have an IRA with a few hundred thousand in it in addition to a well funded 401k by the time they retire and use Social Security as an income supplement in retirement.

The Average Joe

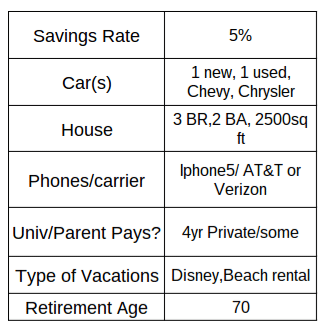

We will call the well meaning but financially challenged group at the top third of the bowl of the wine glass the Average Joe’s. They might put away a few percent each year in a 401k that gets matched but not much more than that. They can expect to retire sometime in their 70s or 80s on the same lifestyle that they are used to and can be found working part time jobs in their golden years to supplement their Social Security checks.

We will call the well meaning but financially challenged group at the top third of the bowl of the wine glass the Average Joe’s. They might put away a few percent each year in a 401k that gets matched but not much more than that. They can expect to retire sometime in their 70s or 80s on the same lifestyle that they are used to and can be found working part time jobs in their golden years to supplement their Social Security checks.

The Spenders

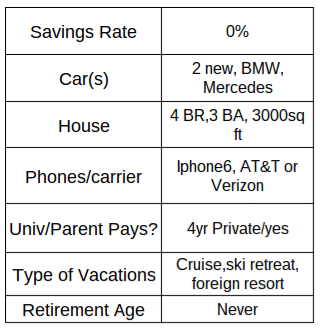

Finally, the folks that save nothing are represented by the rim area of the wine glass. They will be retiring on government assistance after their bodies give out and they are physically unable to work anymore. These folks eventually end up in assisted living facilities with bills paid for by Medicaid. Some might be able to retire to a low cost of living area and live only on Social Security of about $15,000 a year for a few years but their retirement is not pleasant.

Finally, the folks that save nothing are represented by the rim area of the wine glass. They will be retiring on government assistance after their bodies give out and they are physically unable to work anymore. These folks eventually end up in assisted living facilities with bills paid for by Medicaid. Some might be able to retire to a low cost of living area and live only on Social Security of about $15,000 a year for a few years but their retirement is not pleasant.

Discover When You Will Retire By Looking at Your Savings Rate

The age at which you can afford to walk away from your job is determined primarily by how much you are placing in an investment account like a 401k, 403b, or IRA. You get the freedom to determine when you will be able to afford to retire. Early retirees need to put away at least half of their compensation. If you desire to be swinging golf clubs by 50 you’ll need to save about a third of your income. If you are cool with the societal norm of retirement in your 60s then try and put away maybe 10% of your income matched by 4-6% from your employer 401k contribution. If you are comfortable waiting until your 70s then you need to be putting away around 5%. Obviously if you save nothing you will not afford retirement except in a very spartan fashion provided by Social Security.

The flip side is whatever savings rate you have right now can predict your future retirement age. If you are only putting away 5% you will not be retiring before your 70th birthday with any reasonable living standard. So take a moment and see what percent of your salary is going into your retirement savings accounts and general savings and ask if you are cool with your projected future retirement age.

When do you want to retire? Does your current savings rate reflect this wish? Did you know that you could control your retirement date by how much of your pay you put away? Did I name all the parts of a wine glass correctly? I always love getting your comments!

Love the wine glass comparison, very original! We maximize our spending by spending mostly on things that add value to our true happiness. With that in mind, we’re less than 3 years away from early retirement. Our expenses are hovering around 20-25% of our gross income, without counting payroll taxes and I agree that extreme savings can get you to early retirement in a very little short time.

That’s incredible! Good to hear of others pursuing the same goals! You have a great blog by the way people should search it , enchumbao.com

Thanks! The more of us that are out there showing through example that early retirement is possible, the better it is for society as a whole. Happy travels!