Why are there so many articles in the newspaper that complain about how the middle class is being crushed and how retirement is an impossible dream? Is it really impossible for a family to afford to retire eventually? The reality is that we just don’t save very much in this country and thus everyone depends on Social Security. Retirement is a problem of math.

Understanding The Chart

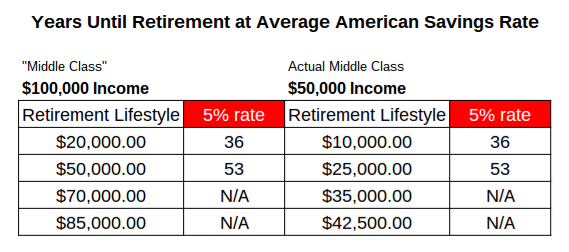

I decided to take a look at two typical households with different incomes. I’m assuming these households make the same inflation adjusted income for the duration of the working life, and that the investment account they put their savings in compounds at a real return of 5% annually. This means they put it in something like a S&P 500 Index Fund that earns 8% while inflation is 3% or something like that. So what does this chart tell us? It explains why the government decided Social Security would be mandatory for the majority of citizens because we refuse to plan ahead for our own futures.

The Typical American Household’s Major Financial Problem

The average savings rate in America today stands right around 5%. That level is hardly enough to ever retire on with any typical living standard. Notice the $100k household can only afford to retire at a meager $20,000 living standard after a 36 year working career. If they hope for a $50k existence they still must toil until their mid 70s.

The problem with these numbers is that they are actually too optimistic. The median household income in America is about $52,000 which is supposed to represent the household on the right. To reach a poverty level $25,000 lifestyle you have to work for 53 years. AND THIS IS FOR THE 50th PERCENTILE! That means half of households make more and half make less. So for half the country they would never be able to reach a non poverty standard of living in their older years. A lot of people become physically unable to work much sooner than mid 70s. Can you imagine a bunch of seniors trying to lift heavy loads with bad backs and weak knees?

Also, my 5% real return assumption is too optimistic for the average person. If you started off earning 5%, you have to knock off 1% for a financial helper. You also need to take away another 1% from mutual fund expenses. It’s probably also fair to take another 1% that you lose to market timing and transaction costs when you inevitably fire your adviser after a period of bad performance. You are left with a 2% real return, which will push the numbers back into allowing the median household to retire sometime in their mid 80s. This is the America that we were living in pre-1930s. This is why the average household depends on Social Security because it unknowingly sets itself up for a horrible retirement in its absence.

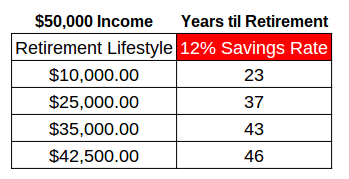

Poverty among seniors was very high back in the 1930s. A lot of seniors had to move back into their children’s homes because there was no other option. The idea that FDR had was essentially a forced pension savings plan except it was one that was never based on real pension math. They realized in the 40s and 50s that the 2-4% total tax was way too low so they increased it to 12.4% between you and your employer. So let’s take a look at the years until retirement with a 12% savings rate.

Notice how the number of years you work til hitting your sixties lines up with the $25,000 living standard for someone with the median income in America. This outcome is what the government decided it needed to do since people refuse to save on their own for retirement. The max Social Security benefit isn’t $25,000 a year for someone with a $50,000 income, which shows why Bush tried to privatize a portion of Social Security because people that know how to save and invest are actually getting a rotten deal.

Notice how the number of years you work til hitting your sixties lines up with the $25,000 living standard for someone with the median income in America. This outcome is what the government decided it needed to do since people refuse to save on their own for retirement. The max Social Security benefit isn’t $25,000 a year for someone with a $50,000 income, which shows why Bush tried to privatize a portion of Social Security because people that know how to save and invest are actually getting a rotten deal.

If the Millennial Generation Depends On Social Security We’re In Trouble

Clearly, the bottom third of the savings distribution will depend on this program like their lives depend on it. They will retire with very little to support themselves and have to hope that a program with bad pension math will be around to help them. The clear takeaway for you is that if you are saving 5% like the average American, that is not enough. You need to increase your savings to at least 15% between you and your employer as most contribute a match on 401k contributions.

By saving less than 5%, you are implicitly saying you are ok betting your life and your family’s life on Washington politics. The compromise to fix Social Security will likely involve some combination of increased taxes and raising the retirement age. The good news is that if you save at least 15%, you will not need to read the paper with great attention because it won’t matter to you.

My best advice is take your freedom into your own hands. If you save a quarter of your income you’ll give yourself the freedom to walk away in your 50s even! The reason why retirement is impossible for the middle class is that they rely on others to do their saving for them. When you delegate something like your financial health to these guys,

you are in for some real trouble. Don’t put your future into the hands of a country with $16,000,000,000,000 in debt. Save at least 15%.