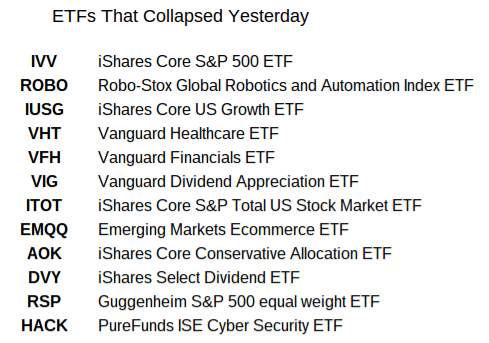

We learned a lot yesterday in Flash Crash 2.0, some of which completely changed what I thought I knew about investing. Dozens of stocks and ETFs, and perhaps many more, separated from reality and thousands of investors were robbed of millions, if not billions of dollars. My article yesterday was specific to the Vanguard Healthcare ETF that collapsed over 30%, but now that the dust has settled we can see that there were many more ETFs than that that fell apart. It’s clear ETFs are no longer safe for folks not being helped by professionals.

We learned a lot yesterday in Flash Crash 2.0, some of which completely changed what I thought I knew about investing. Dozens of stocks and ETFs, and perhaps many more, separated from reality and thousands of investors were robbed of millions, if not billions of dollars. My article yesterday was specific to the Vanguard Healthcare ETF that collapsed over 30%, but now that the dust has settled we can see that there were many more ETFs than that that fell apart. It’s clear ETFs are no longer safe for folks not being helped by professionals.

This list is just what I was able to put together after a few minutes on reddit. I believe that yesterday’s market failure puts the entire $3 trillion ETF industry in grave danger, and I believe ETFs are no longer safe to use for the non professional investor. I will continue to use some ETFs for my personal portfolio, mostly when it is too difficult or expensive to source the underlying holdings, but now we must live with the reality that market execution orders are dangerous for this once stable investment product. Let’s break all this down in detail so you can get what happened if you don’t consider yourself a finance person.

What is an ETF?

An ETF was created to be the faster, more nimble version of a mutual fund, but what’s a mutual fund? The mutual fund, ie the Vanguard S&P 500 Index Fund being an example, is a pool of money that buys lots of stock. When you put $1000 in one of them you get a proportional share of all the holdings of the fund. That means you get to own as little as a couple dollars worth of stock, which was previously impossible and too costly. The benefits of owning a small amount in so many stocks is you get diversification benefits previously available only to the ultra rich and institutional investors.

So why have ETFs? Mutual funds only price once at the end of the day, versus ETFs that can be traded at any time during the day. Mutual funds are also pretty costly to run as you need fund accountants, heavy regulations, rules to prevent excess transactions costs, and more. Plus, if you’re Vanguard and you refuse to pay fees to the big brokerages like Merrill Lynch and Morgan Stanley, they won’t put your fund on their investment platform. Only mostly crappy mutual funds are available there because they are the only ones willing to pay big money to the platforms in exchange for steering clueless investors to their inferior products with high expenses. If you start an ETF, these advisors can just buy your product direct from an exchange.

In theory an ETF should never deviate too much from the underlying value of its holdings, ESPECIALLY a stock ETF. The reason is that there are arbitrageurs like Susquehanna International Group among others that make sure the ETF price doesn’t get too far away from the value of the stocks in it by buying the ETF if it’s too low or buying the stocks in it if the ETF is too high. There are a bunch of market makers whose job it is to provide stability to the ETFs out there.

Where Did the Market Makers Disappear to Yesterday?

Before the disaster struck, it was rare for an ETF to deviate more than a few percentage points away from the underlying holdings. Market makers generally did a pretty good job protecting the integrity of ETFs by making sure people got fair prices when they bought or sold them.

Yesterday though, we say 1200 halts in trading thanks to the circuit breakers installed in 2010 after Flash Crash 1.0. Of the 1200 halts in trading, 600 of them were for ETFs. In other words, if not for the circuit breakers there would have been even more volatility. That’s incredibly embarrassing. ETFs should not experience more volatility than stocks it makes no sense. With a stock, you have one security that could go up or down a ton based on specific news. Imagine a new cancer drug succeeds or the company’s CEO is indicted for fraud, the stock could easily go up or down double digit percentages. However, an ETF is a broad based fund with hundreds of holdings or more. The diversification that provides should insulate it from big changes in price.

If you look closely at the data from yesterday, DYV, the dividend ETF from Blackrock, fell over 30% while its large holdings never fell more than 11%. That means the value of that $13 billion ETF decoupled from its giant company holdings by BILLIONS of dollars. We saw Apple fluctuate over the course of minutes between $92 and $97 a share. GE went up and down 8% many times over the course of the hour. Individual stocks were clearly affected but ETFs got hit much worse.

That means the market makers solicited by the big fund companies to protect their ETFs completely failed at their job. They probably saw the volatility and stepped out of the way to avoid getting run over. In the absence of market makers to protect the ETFs, the stop loss orders on these ETFs were triggered without anyone to match the buy and sell orders so these ETFs went into free fall.

The Difference Between Market and Limit Orders, and How if You Didn’t Understand the Difference You Were Destroyed Yesterday

I have transacted in a lot of companies’ stocks where I’ve found it advantageous to use limit orders instead of market orders. When you enter a market order to buy 100 shares of IBM, it tells the computer go buy me 100 shares of stock in IBM and do it at any price you can find. Usually for frequently traded stocks like IBM that’s no problem. For smaller stocks with not a lot of trading volume, you can get hurt if you put out a naked buy or sell order.

A limit allows you to protect yourself by saying, ok if IBM is at $100 a share, sell it if you get at least $99.50. That should execute immediately because the current market price is above that level. If you didn’t have limit order protection the actual execution price could be at a much lower level than you thought, particularly for thinly traded stocks.

What happened yesterday was that say you owned VHT the Healthcare ETF that I wrote about in my earlier article. You decide ok I have some funding needs for my retirement this month so I’m going to sell 100 shares with a sell order. That order would’ve said go out and sell 100 shares at whatever price you get. When the market collapsed, the previously stable share price plunged from $130 to $90, and it would have executed at $90 a share, only to see it go back up in value to $130 again.

How Individual Investors Just Got Robbed

Who is the most likely to put in an unprotected buy or sell order? An everyday average joe regular investor. Limit orders are confusing even for me, and I’ve entered a bunch of them. I always double check myself to make sure I didn’t get the direction or price wrong before I press enter.

Anyone who listened to Vanguard or Blackrock or Schwab and believed that ETFs were just another version of a mutual fund that tried to place a sell order yesterday could have lost as much as investors did over the course of the entire 2008 Financial Crisis over the course of less than an hour.

Vanguard has repeatedly said that high frequency trading is good for investors, and that they benefit from reduced transactions costs because of increased liquidity. WHERE WAS THAT FREAKING LIQUIDITY YESTERDAY IN A PERIOD OF CRISIS!?!?!?!?!?!?

I’m furious!!! The reason is that average investors got screwed and the very high frequency trading firms that Vanguard and others have defended just made a boatload of money. Virtu Financial was out bragging about it. The CEO just said that they had one of the most profitable days in their history because of the market crisis Monday. He said that his firm was “made for days like this.” While the firm might have been acting ethically and just reacting to changes happening in markets, if they did anything to cause or exacerbate the volatility that’s illegal. The SEC must start asking tough questions to get to the bottom of this.

Let me ask a general question. Would you rather have transactions costs be 0.1-0.5% to buy and sell stocks or would you rather run the risk that your fund or stock could go down 40% in value based on nothing? High frequency traders created this crisis with their algorithms that destroyed the normal market activity yesterday. I was of the same opinion as Vanguard before this happened. I felt like high frequency traders definitely shaved off fractions of points for themselves, but I didn’t think they were creating the kind of environment where a decade’s worth of profits could be stolen from someone in one day. What’s even more ridiculous is that you would go brag about it like Virtu’s CEO did.

Why ETFs Are No Longer Safe, Unless You Use Limit Orders

If dozens of ETFs could collapse more than 40% in value, they aren’t safe to use. Vanguard and other large financial companies will tell you otherwise because they have trillions of dollars under management generating billions of dollars in fees for themselves. They will say this was a one off event and they are doing things to make sure it doesn’t happen again, but that’s not true. The Flash Crash happened in 2010, and it just happened again.

If the SEC doesn’t figure out what happened and reverse all the trades that happened yesterday, then average investors will have been swindled out of tons of money because the market makers and sponsoring companies behind the ETFs failed yesterday.

Any benefits of ETFs over mutual funds just disappeared with the risk that you could get 40% below fair market value for the holdings of that ETF. If ETFs are more at risk of flash crashes, then why would you put your money in them when there are other long term investment vehicles that give you more protection?

Advisors and others will continue to use them because they are an innovative financial product that gets around a lot of the challenges of doing business in the financial industry. For the record, I think it’s OK to keep using them, you just need to use limit orders every time. If you don’t know how to do that, you probably shouldn’t be using ETFs. Using limit orders is the only way you will make sure that you don’t get unfair execution.

Switch Your New Money to Mutual Funds

Unless you are a multimillionaire, a mutual fund is going to meet all your needs. You can put the money in and be guaranteed you’ll get the exact NAV of the holdings at the end of the day. No 40% drops or collapses in liquidity, you’ll get what the holdings are worth.

High frequency traders can’t benefit off mutual funds because they are slow moving dinosaurs that are built for long term saving and investing. You don’t need fancy limit orders and you can just set it and forget it. Vanguard has outstanding mutual funds. In fact, I think that the lesson of this crisis is that boring is better. Use mutual funds instead of ETFs where at all possible. The differences aren’t that great, and any benefits I might have touted for ETFs are no longer relevant in my mind because of what happened yesterday.

Or, Gasp, Invest in the Actual Stocks Themselves

I wouldn’t recommend this course of action for anyone not interested in devoting a ton of time and energy to understanding finance and investing, but ETFs publish the list of all of their holdings online. If you have a couple hundred thousand to invest, why wouldn’t you just look up the list of the stocks in the ETFs you want to invest in, and just buy them directly?

ETFs can shut down and deliver unexpected capital gains, charge you high fees, make strange transactions because of arbitrary index changes, and now collapse 40% away from the value of their underlying holdings. Why not just go back to owning actual stocks? Scottrade is an expensive option now in the financial world and they used to be the cheapest on the block with $7 trades. Firms like Motif Investing and Robin Hood are building new models where trades for individual stocks are near free or completely free. I am looking forward to using these new firms for more of my investing needs.

My Takeaway

Mutual Funds will always have a big part to play in helping average Americans save for houses, retirement, cars, college, and more. If you would have asked me last week, I would have said ETFs had a big part to play as well. Now I’m not so sure. I think you would do much better to put your money in Mutual Funds and the actual stocks themselves. American financial companies have a LOT of explaining to do, and regulators have a LOT of investigating to do. I’d suggest they look at the high frequency trading firms that were supposed to be good for us. Because somebody caused markets to collapse yesterday and robbed average mom and pop investors of millions or even billions of dollars, and those person deserve to go to jail.