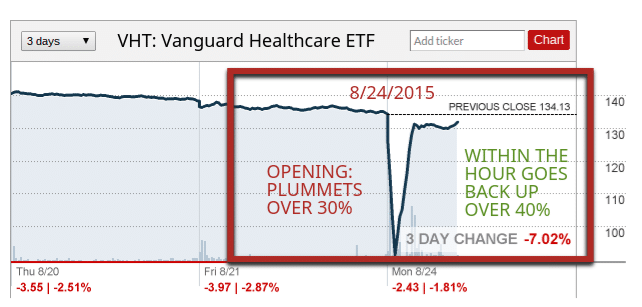

What in the world! Was Vanguard hit by a flash crash or algorithmic trading attack?!?!?!??!?! Look at this Yahoo finance chart above showing the 3 day stock price of VHT, Vanguard’s Health Care Sector ETF. Check out what just happened this morning. The ETF’s price plummeted on opening from over $130 a share to almost below $90 a share, over a 30% drop. In less than an hour it recovered over 40% to about $130 a share.

Vanguard appears it was hit with some sort of flash crash like we had in 2010 or perhaps order manipulation by high frequency algorithmic trading. Thanks to Kian Mikhchi from Scenic Futures, LLC in Houston for noticing this first and pointing it out to me or I totally would’ve missed it. I’m at a complete and utter loss for words. The Vanguard Group, which was not really affected too much in the Flash Crash of 2010, needs to put out some sort of explanation immediately. Full disclosure I used to work for this company. A collapse in an ETF market this bad would have been a catastrophic injustice for anyone holding this security that might have executed on it this morning, losing over a third of their money because of something fishy going on down at the exchanges.

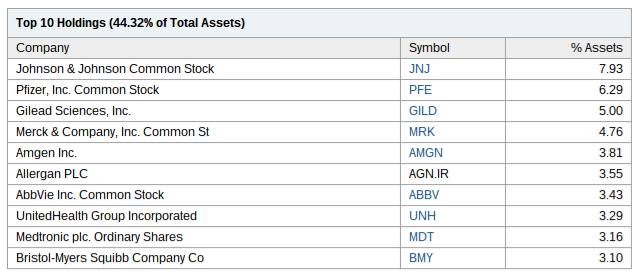

Here’s why I’m so convinced there is something really bad behind this price move. The VHT is not some small time ETF with a tiny market cap and wide bid ask spread. This is a $7 billion fund, absolutely massive in a world where $50 million ETFs are abundant. Also the stocks that make up this ETF are big time blue blood names in healthcare. Look at the top 10 holdings VHT below:

These companies could not possibly have dropped 30% collectively in stock price at the opening bell, only to recover more than 40% back to their original level, especially given the trend of the VHT ETF price was pretty steady and trending negative over the past couple days, indicating nothing big was going on.

Big Downside of ETFs Exposed, Vanguard Hit by a Flash Crash

Mutual fund orders are executed at the closing Net Asset Value. There is much less room to make mistakes because your price for your shares is calculated based on the fair market value of what it holds. The owners of the Vanguard Health Care Fund would have gotten a slight hit of a couple percent based on today’s negative market tone, while any poor souls holding the Vanguard Health Care ETF that sold this morning got a Net Asset Value that was OVER 30% AWAY FROM THE UNDERLYING VALUE OF THE STOCKS THAT THE ETF OWNED!!!!!!!!

I know people that aren’t in the markets may not realize how big a deal this is or don’t know why I’m so shocked but this is big people. When the world’s largest mutual fund company and King of Indexing is affected by 30% intraday moves in the NAV of their ETFs it’s time to start looking really hard at these unknown actors in the market, guys talked about in Michael Lewis’s Flash Boys among others. Somebody somewhere was able to move a $7 billion ETF billions of dollars away from the underlying value of the stocks it invests in for mom and pop investors. This reality means that I am going to start thinking about shifting more of my personal assets away from ETFs and towards actual holdings if at all possible.

If Vanguard can be impacted in this big of a way, no ETF is safe.

Follow up, it’s bigger than I thought, Blackrock’s iShares unit was hit too https://www.google.com/finance?q=NYSEARCA:IUSG

another update, futures trading on NASDAQ suspended, apparently this stuff was widespread, so much for the protections added on the exchanges after the flash crash