I was talking to a surgeon friend of mine the other day and it hit me that its often the folks with the highest incomes that have the toughest time getting to the early retirement finish line. Lawyers have to deal with negative net worth thanks to law school for a long time until they finally make bank. Consultants, I-Bankers, and business types get a head start by making money right out of undergrad, but even then you don’t see that many folks retiring before 50. What gives? Why are so many millennials with big money jobs forced to work until they’re eligible for AARP? The truth is, if you have a six figure income you can retire way sooner than you think.

Why Rich Millennials Still Work in Jobs They Don’t Like

Our generation got to see the hyper consumption of our parents in the 90s and 2000s. We watched as houses grew in size, cars got sleeker lines with faster 0-60 times, and everything imaginable could be bought with 0% interest for the first 12 months. We were growing up after the economic malaise of the 70s gave way to the boom times of the 80s and 90s. When we faced the tragedy of September 11, we were told that the way to help our country was to go shopping.

Consumption has been drilled in our heads as the only acceptable way to live life to the fullest. Everything has to be big, exciting, and unique. That’s why we crave customized drinks from Starbucks, big one bedroom apartments in the middle of SoHo, and wardrobes full of slim fit suits.

The problem with this habit of brainwashed consumerism is that we can’t afford it all at once with the cash flow that we have while young. So credit card companies make it easy for us to go into debt to allow us to live the life now. Who knows if our older self will be around in 40 years so might as well get that car, house, wardrobe, vacation, wedding we’ve always wanted.

When you are in shackles from debt, you got to have income to meet the bills coming in. If you don’t, you won’t qualify for more loans to buy more stuff, and the house of cards falls. Brokerage houses used to use the term “golden handcuffs” to describe an agent that would sell or advise clients to do anything the bank wanted him to push because his lifestyle needs were so great he didn’t have a choice but to aggressively comply. Golden handcuffs turn you into a servant and being a servant stinks according to all the movies I’ve watched. The gold just distracts you from the fact that they’re still handcuffs so your confinement is concealed.

Avoid the Lifestyle and Pay Off Your Debt

My super intelligent friends that get grad school degrees sometimes have hefty debt loads that come with them. The mistake I always warn against is taking on more debt while you’re not done paying off what you already have. When you stack debt payments on top of one another you make holding onto your job even more important.

That surgeon friend I mentioned earlier chatted with me about how residencies are so tough, filled with 100 hour weeks sometimes, that you want to reward yourself on your days off. You might use retail therapy, or get into a habit of buying lattes, nice drinks out with friends, or high end dinners. These things are fine in moderation or even frequently as a really high income professional. I’m not opposed to modest treats. However, this splurge culture when carried over to your life with that new high income can be dangerous as you qualify for bigger ticket items.

You might buy a house, car, and more until you’ve maxed out what the bank will lend to you. If you are fortunate enough to be pulling in six figures, the loan officer is going to say yes for a long time before he or she says no. So the temptation of materialism in America is way more dangerous for a high income person than an average Joe.

Get rid of your student loan debt before buying a house that’s no more than two times you and your partners combined income. High income earners should be able to kill off all but the most intense loan burdens in less than two years. That’s not a long time to rent until you are ready to get a house in an area you think you’ll live in for a long time. You can live off a relatively small percent of your income, say 20-30%, and save and invest the rest and watch your net worth grow at freedom expanding levels.

If You Aren’t Happy at Work But Have High End Skill, With Your Six Figure Income You Can Retire In No Time

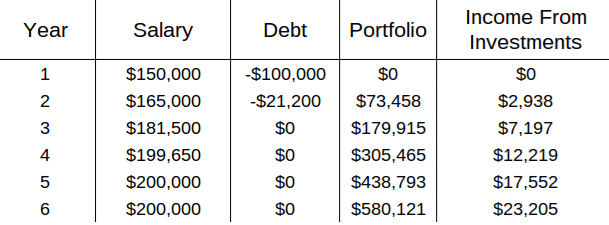

I decided to use a hypothetical example of a young professional with $100,000 in student loan debt that starts out earning $150,000. That salary gradually grows by 10% a year until it maxes out at $200,000. I’m assuming you can live off $25,000 as a single person, which is reasonable unless you live in NYC or SF or go out to eat and drink all the time (even in a high cost of living area I bet you could rough it in Jersey or Oakland). I’m assuming a 6% return on your savings and that you lose 30% to taxes. Also am assuming the same 6% interest rate on your loan and for simplicity sake you pay off the loan as a lump sum at the beginning of the year.

Given we were using a $25,000 a year living standard, this person could effectively retire at the end of year six in the workforce. When you adopt the philosophy of an absolute living standard being the norm rather than a relative standard, you can gain financial independence at a much earlier age.

When I speak of early retirement, what I really mean is “the date when you no longer need to put up with the junk that comes with work and you can filter what you do to include almost exclusively what you enjoy.” Some would call it financial independence, some would call it retirement, others would call it doing what you love. No matter what you call it though, this state is characterized by never using “paying the mortgage” as an excuse for maintaining the status quo ever again.

So if you’re fortunate enough to be in the elite company of American workers pulling down $100k or more, even if you have significant debt, you can walk away from the workforce, dump your overbearing boss, or join Doctors Without Borders on less than a resident’s salary in the same time it takes to get a Bachelor’s and Master’s degree.

Please don’t let the wizards of advertising in America target you in the news sites, TV channels, and magazines frequented by high income professionals. If you see their master mind trick attempts and recognize them as creative attempts at separating you from your freedom giving money, you can fight the urge and try to save instead.

If you avoid the lifestyle and pay down your debt, it’s clear that if you have a six figure income you can retire in six years.

Lifestyle inflation is huge. I live in NYC and have many friends that make a decent income. Some are better than others, but not many save their raises and bonuses every year and pretend they didn’t receive them like I do. I got a raise and bonus, let’s buy new suits, go on a spending binge trip, buy some more stuff online, and go to more dinners and brunches. No thanks. I’d rather live like I was one year out of college and bank the rest.

Where is your income tax in that table??

You spend about $25,000 a year. With a $150,000 salary, that would amount to around $40,000 in tax, $25,000 in spending, and $85,000 in saving. You can max your 401k and pay even less in taxes. If you work for a company that’s $18,000. If you are self employed, the limit is over $50,000. You could convert your retirement accounts to roth accounts with low taxes after moving to a lower tax bracket. You do not have to pay the max in taxes if you plan

Late comment to a great post. I am an early-career physician who is also blown away by how common it is for doctors to be stuck in their golden handcuffs late into their golden years. The problem, as you so eloquently laid out, is consumption. Living on $25k is not nearly as easy once you have a family, but the principles you discuss definitely still apply. Not planning to make the same mistake myself.

Unrelated comment: That picture at the top is of Baltimore City Health Commissioner Dr. Leana Wen. She’s been a very prominent figure in fighting opioid-related deaths and has been interviewed nationally for her work. You may want to pick another stock photo who isn’t a prominent figure.

Yeah amazing how many folks are beholden to lifestyle once they leave training especially. Lots of fancy cars and big houses, and the salespeople that make money off these items are more than happy to sign you up. Thx for the feedback on the photo

Where can someone get a 6% return on savings?

Annualized over the long term like 20 years in a diversified portfolio of index funds. Short term nowhere