Everywhere you turn, state and local politicians are talking about pension reform. If they’re not talking about it, they are having to deal with the consequences of years and years of underfunded pensions. Whether proposed reforms include more employee contributions, a higher retirement age, benefit cuts, or elimination of cost of living adjustments, the story is the same: pensions aren’t as good for teachers as they used to be. Teachers, if you were born after 1985, reconsider relying on your pension as your primary source of retirement security, especially if you work in one of the states with a severely underfunded pension. In place of a pension, I am going to show you alternatives you can use to fill the gap on your own with workplace retirement plans like 403b’s and Roth IRAs.

Wildly Optimistic Pension Accounting Could Spell Long Term Disaster

The average teacher pension fund today assumes it will be able to earn an 8% return annually. Is that possible? Consider the future expected returns of the two big asset classes that most people invest in, stocks and bonds. The stock market is fairly valued based on historical measures, but the large run up since 2009 make huge gains seem unlikely. Experts like John Bogle predict that the stock market will return something in the range of 6% annually over the next decade.

While expected stock returns are nothing to call home about, expected bond returns are terrifyingly low. The 10 year treasury note has been hovering around 2% lately. Since yield to maturity is a good estimate for what a bond can deliver in absolute return, we can think of bonds giving us 2% each year for the next 10 years on average.

So if you mix the 6% and 2% return expectations of stocks and bonds together, how can you get 8%? Also, these capital market expectations are BEFORE fees! Add in a group of highly paid analysts selecting active portfolio managers and the return possibilities get even worse with a potential 1% or more shaved off the top. So if you ignore how much money you have in your pension fund today and only think about how to get 8% a year in an environment where expectations from a balanced portfolio are around 4%, what would you do? The answer for most pension fund managers is take more risk.

Pension funds have been adding enormously to hedge funds private equity, venture capital, real estate, commodities, timberland, and other highly specialized asset classes. The folks who manage these funds are some of the best and the brightest with MBAs from Ivy League schools. However, in aggregate they ARE the market. In other words they can’t all succeed after fees. Once more, the fees pension funds are paying to these managers are massive. A typical fee for an index fund might run 0.05% at an institutional asset level. A typical fee to a hedge fund is 2% a year and 20% of all profits. If you assume that one of these exotic investments earned 10% a year before fees, which is more than double the return of a balanced portfolio, after fees you would net 6%. That’s 2% below your targeted return of 8%. This practice of hiring expensive investment managers is like doubling down with borrowed money at a poker table. The bet will work out for some pension funds, but will fail catastrophically for others.

So the first big reason to reconsider contributing to your pension fund is that most use this faulty assumption of high returns. In a zero interest rate world, it’s really hard to get the growth all of these pension managers are predicting. So what happens when the risky investment managers’ bets don’t work out or the public stock and bond markets undergo a period of decline? That means the state would have to move in and contribute billions of dollars just to keep the fund afloat.

The States Are Breaking Their Promises to Future Retirees Right Now

When I was trading the debt of cities and states in my former life as a bond trader, we looked at public pensions a lot. Traditionally, a state would invest a big pool of money for all the public workers to have a good pension in retirement. They hire an independent person called an actuary to come in and tell them how much money they need to contribute to make all their future obligations. That annual payment is called the ARC payment. States with responsible fiscal management pay close to 100% of their ARC payment each year. The ones that shirk this obligation do so at the peril of what’s called the funding ratio. This funding ratio takes the amount of pension fund assets and divides it by the pension fund liabilities, ie future benefit payments, to figure out how the health of the fund looks. Anything 80% or above is considered fine and anything below 60% is considered troubling.

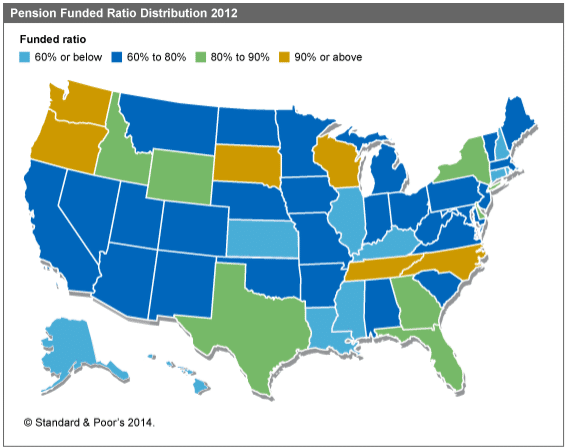

There are quite a few states in America today with historically low pension funding ratios. In some cases, their future promises outweigh their pension assets by more than double. While funding ratios aren’t concerning to an oil rich state like Alaska, they are really difficult for a poorer state like Kentucky. Take a look at the chart below from S&P, a credit rating agency. The states in light blue have pensions that are in really bad shape and the states in dark blue have pensions that are underfunded enough to be a problem.

So Connecticut, Rhode Island, Kansas, Illinois, Louisiana, Mississippi, Kentucky, and New Hampshire have pension funds with lower than 60% funding ratios (as of 2012). A bunch more states have pensions that aren’t moving towards crisis but aren’t healthy either.

If you live in one of the light blue states, really think twice before counting on your pension fund. Since 2012, the stock market did pretty well and helped out some of the states in the middle of the funding spectrum, but some states have continued to get worse! New Jersey and Pennsylvania are starting to struggle with pensions and who knows what states are next. So the downward pension death spiral has continued even with good returns in the stock market.

Illinois for example has continued to let the situation deteriorate. Their pension is the worst in the nation and without billions of dollars in contributions they will be breaking a lot of promises in a few decades.

How Did Things Get Like This and Can My Pension Run Out of Money?

Politicians discovered sometime in the last 50 years that they could use creative accounting as a means to cut taxes, increase social spending, or whatever else they had on their agenda. All they had to do to get the numbers to workout was contribute less than they were supposed to to keep the pension fund highly solvent. The media pretty much ignored these acts as the funding levels gradually declined. I suppose long term disaster doesn’t sell enough papers to warrant coverage. The unions representing public workers knew they could negotiate for better benefits because the costs weren’t measured upfront as governments use cash based accounting. That just means that your state or local government only has to balance the budget for the cash in and cash out today, not what they’ve promised in the future.

This reality means politicians were happy to accept union demands for higher benefits and not salary. These men would then proceed to not fund the very benefits they just agreed to, knowing the result would be pushed far down the line onto someone else. Hence, there is an enormous problem of incentives when it comes to running a pension fund.

Since a pension is an obligation to public workers, it is much safer than the private equivalent. There are often state constitutional protections for the sanctity of public employee retirement benefits. The problem is that there might not be any money there to pay them. What will likely happen down the line is a lengthy series of court battles where state governments and retiree organizations sue each other over benefit payments and one side or the other will win. I can’t predict who that’s going to be. Truly there will be political pressure like there was in Detroit to not cut pension payments to retirees by 50%, but if the failure is an entire state and not just a city, it might be too large to avoid such a drastic measure.

Are There Exceptions? What If I Like the Idea of a Pension?

Most pension funds are going to be ok. They will pay out a very high percent of what you expect in benefits, and they will kick the can down the road as long as possible to do this. If you are extremely afraid of the stock market, can’t handle investing your own money, or know for sure you will be working for the same school district for 30 years then by all means take the pension.

With a pension, you will at least have a seat at the table and be able to negotiate some sort of retirement benefit. If you invested all your money in the stock market and it crashes, there won’t be public pressure to replace that money unlike the case of a pension fund that collapses.

So if you have been contributing to it already and are sure that teaching is going to be your career then go ahead and participate in the pension fund. Just do it with eyes wide open that it’s not going to be as generous in the past and you could probably do much better handling matters on your own.

What To Use Besides a Pension

The good news is that there are often great alternatives to pensions for teachers. More and more states are offering 403b plans or other 4 – something plan offering lots of tax free space to save for retirement. You can see if your employer will offer a match to your retirement plan that you can invest yourself in lieu of participating in the pension fund.

You will get to contribute to the 403b tax free out of your paycheck. If you save 10% and your employer chips in another 4% match, you could be looking at a portfolio of millions of dollars in your older years. Furthermore, you won’t need to depend on the health of the pension plan for your retirement. You will have flexibility and be able to work for other school systems, private or parochial schools, or another employer in another industry entirely. The pension fund offers no such flexibility. Most require you to work for 6 years before you see a dime in benefits.

I’ll tell you a tale of an elderly gentleman I knew who retired from a large private employer where I grew up. He was encouraged to take a pension but he opted out and invested for his own retirement instead. Within about 10 years of his retirement, the pension ran into trouble and had to renegotiate reduced payments with retirees. Meanwhile, he had a large portfolio paying him dividends and interest far in excess of the small pension payment he would’ve got. While public pensions are safer than private ones, when the money isn’t there to pay billions of dollars in payments, what do you expect will happen? The politicians are certainly not going to double tax rates to make all the payments. They will seek large concessions that must include hurting retirees pocketbooks.

In addition to your workplace retirement plan, save in your Roth IRA. You can open this account anywhere and fund it up to $5,500 a year. The money grows tax free and when you take it out at retirement is tax free as well. Pairing this with a 403b, 457, or other workplace retirement plan where you actually own the investments can give you a large nest egg for a secure retirement.

Get Educated and Control Your Own Future

With pension funds around the country in such bad shape, you owe it to yourself to take charge of your future. Especially if your employer requires hefty employee contributions to the pension fund, you will probably be much better off diverting that into a 403b or 457 plan at work and getting an employer match. Try to invest in low cost mutual funds in these plans as the less you pay in costs translates to more money in your pocket.

Watch out for these states that aren’t funding their pensions. It’s a highly dangerous practice. If you are an educator, call your state representative and senator and ask them why they can’t make the annually required contribution to the pension. By not holding up their end of the bargain, they’re shortchanging future teachers who will pay into the system for years and then not get a fair shake at the other end.

And remember, no one cares about your financial future as much as you.