A reader asked me to do a post on the attractiveness of the rental market vs the stock market right now, and I’m happy to oblige. After all, I want to write what you want to read so if you have suggestions send them my way at [email protected].

A reader asked me to do a post on the attractiveness of the rental market vs the stock market right now, and I’m happy to oblige. After all, I want to write what you want to read so if you have suggestions send them my way at [email protected].

In regards to taking the plunge into real estate for the first time, as with many answers in the financial world it depends. I think landlords could be in for a significantly higher return over the next decade than stockholders for a few reasons. They include a higher than average Price Earnings ratio for the stock market and overvalued bond market, realistic real estate valuations outside of big wealth centers, and extremely low interest rates that will magnify positive returns coming from inflation. If you enjoy being an entrepreneur, don’t mind taking risk with your credit, tying up large amounts of cash, and dealing with annoying renters, rental real estate could be a fantastic part of a diversified portfolio.

Reasons to Consider Becoming a Landlord

- Everything Else is Fairly or Overvalued

Bonds are barely yielding 2% right now, and that’s for the bonds that go up and down in value by 7% for every percent change in interest rates. Clearly, long term fixed income that used to be the bedrock of pension fund holdings has a terrible risk reward profile. Unless we have a Great Depression in the next 10 years any bonds longer than 10 years to maturity will prove to be one of the worst wealth building investments in history.

What about stocks? The Price Earnings ratio for the stock market is a barometer for whether stocks are overbought or oversold. The long run average is 15, and right now it’s at 21. That means stocks could fall about 30% and be at their long term average valuation level. To give a frame of reference, back in the 1990s in the height of the tech bubble the P/E ratio was well north of 30. Stocks could go up a good deal more but could also go down a lot. In other words, the stock market doesn’t look bad but it doesn’t look good either.

In the absence of other good investments, rental real estate starts to look good just because it isn’t lumped in with other categories. REITs by the way are a way to get exposure to real estate through mutual funds as they invest in commercial office buildings, apartment complexes and more. However, the valuations of these funds are highly stretched as investors are reaching for high income paying investments. Because of a weird part of the tax code, REITs must pay out most of their earnings as a dividend. That means their income is higher than the average mutual fund, and retail investors got excited and put a ton of money in REITs once the markets started recovering post 2008. By the way, if you’re ever offered the chance to invest in a non-traded or private REIT and you aren’t an institutional investment professional you shouldn’t go there. So rental real estate truly is a distinct asset class and can be considered partly because everything else looks so ho-hum.

2. Realistic Rental Valuations

In my hometown of Pensacola, FL, you can buy a lot of real estate for 100 times the expected monthly rental check or less. That means you can pick up a house for $100,000 that should rent for more than $1,000 a month. That’s the break-even point I like to recommend when thinking about real estate rental properties. Can you get 1% or more of the property value paid to you in rent every month? If the answer is yes then you’re in good shape.

Contrast this with overheated wealth centers like San Francisco and New York City. I’ve warned about buying property in places like this before, and I will echo that sentiment now. Real estate is not increasing for a rational reason in these cities in my opinion. Most people have this behavioral bias to own not rent, and in cities with swollen incomes there are tons of dollars chasing artificially controlled real estate supply thanks to zoning boards and regulations. There are lots of ways these market prices can collapse like loosening rules, drop in the tech or financial sectors, or tighter lending practices. It seems to me that a lot of real estate purchases now are made by rich people who believe a condo in NYC holds its value better against inflation than a piece of gold. Add in that they can use it for parties and hosting guests and there’s a rich premium being paid for this wealth preserving asset. That same premium doesn’t exist in places like St. Louis , Jacksonville, or Tulsa. If you want to go into real estate make sure you can find a property that meets the 1% of total value in rent per month test. Otherwise you might as well buy call options on Facebook and Goldman Sachs stock because that’s basically what you’re doing.

3. Positive Return from Inflation

This reason for renting has almost pushed me into buying a rental house. I think the interest rate situation right now offers an unprecedented opportunity for those not afraid of risk and dealing with rental headaches. When you borrow to buy a house, you get a fixed 30 year mortgage at a specific interest rate. Right now that rate is incredibly low. Most people will probably get mortgages in the 3-4% range. The rate of inflation today is below 2%, a historically low level. If that rate rises to the historical average of 3% or rises further to a high inflation environment, you will essentially be earning money just from owning an asset with fixed interest rate terms.

That is, if you have a 3% mortgage and inflation went up 5%, you made a real return of 2% without doing anything. If that increase in inflation allowed you to raise the rent as well, that’s a further income enhancement on the asset that you own. Meanwhile your rental payments are staying fixed. Leverage is the most attractive and dangerous part of owning real estate. When you buy with leverage you have to be really careful because you can be blown up in a hurry. Consider 2007-2009 in Miami. If you bought a house at the beginning of the period to rent out you would have seen your house plunge 70% in value. You would have had to use 10 years of rental income just to replace the loss in capital, a truly horrible result. Most people just had to walk away and damage their credit.

Even though there’s risk from leverage, I think you should evaluate it based on probabilities. In Pensacola, there are plenty of duplex style units available for around $70,000 to $80,000. The national household income is around $50,000 on average, so you’re looking at a multiple to national income of around 1.5. That is a pretty attractive multiple. What’s your downside? Maybe the local economy could go south and you could see that multiple drop to 1.25. Any lower and you would have to assume people would be stepping in to buy instead of rent, thus creating a floor on the value of the unit. So if you put 20% down, that’s probably all you will have to risk. Furthermore, if you get any inflation at all, you could be looking at really solid returns on your down payment.

Why You Wouldn’t Want to Be a Landlord

1. Major time commitment

This might shock some of you hearing me say this, but not all of life is about maximizing returns. Time is a huge cost and unless you hire a property manager and build this cost into your investment analysis, you could be spending lots of Saturdays calling plumbers and AC repairmen.

My own parents have been landlords now for over 20 years, and if you look at the amount of time my dad has spent mowing the lawn, fixing a leaky sink, removing tree limbs from the roof, and other handyman jobs, it probably isn’t worth it. I even got recruited over the years to help with the maintenance work. At one time my folks had two rentals and it felt like we were spending every other weekend working on one of them.

I think this time sink is avoidable if you hire a good property manager. For 10% of the rent, the manager should handle all tenant communication, repairs that need to be done, and showing the property when tenants move out. As a 20 something single rental owner the cost might not be worth it. Once you have a family and children, I think the cost could be well worth it.

2. Real life annoyance from tenants

Another thought is the unpleasantness of evicting a tenant who shirks his payment responsibilities. My parents got lucky and only had to deal with this once, but that one time was enough for them to consider selling their rental house. The family was evidently experts in the rental laws in Florida and begged and pleaded with my parents to not give them an eviction notice. My parents being understanding people, they believed their excuses for a time and then realized they were being had as the tenants avoided all communication. Once the tenants had finally been served the eviction notice, there was a long waiting period to get them out. All in I think they lost 4 months rent on the ordeal plus court costs and general uncompensated life frustration. You don’t have to deal with this in the stock market.

3. Down payment considerations

If the house’s value drops a lot, you will be tempted to walk away because you only put 20% down. You would damage your credit for the long period that the bankruptcy shows up on your credit report. If anyone in your family went through 2008, they know what I’m talking about.

The last caution I’d have would be tying up such a large amount of money in the down payment. You will need tens of thousands of dollars to own a rental property and that might take a while to accumulate. Meanwhile, someone who invests in the stock market can start right away and not wait around to take charge of their financial future.

A Hypothetical Example

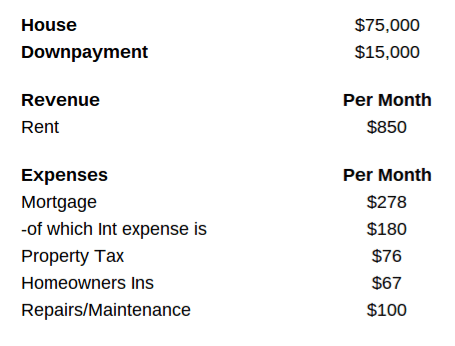

Let’s consider a real life example from my parents who live in Florida. They only have one rental home, a 2 bedroom duplex located in Northwest Florida. Zillow estimates its value at $75,000. Here is what the monthly income and expenses would look like along with the down payment if you wanted to buy it.

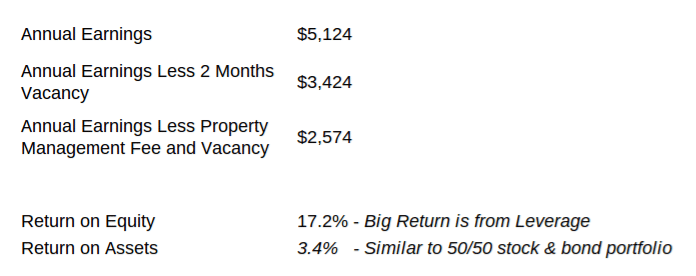

As far as the mortgage, only the portion that is interest is an expense. The part that goes to principal is a real return you’re getting, so the expenses I’m including are going to be the interest expense, property tax, homeowners insurance, and $100 a month to random maintenance or repair work that needs to be done. So what do our annual earnings look like?

So notice that I assume a 2 month vacancy each year for the property. A dangerous assumption when buying a rental is that it will be rented all the time. My parents usually had a 1 month vacancy max while they were getting a new tenant into the home but they also had the eviction problem. I think modeling 2 months takes away the uncertainty in the analysis.

Also I want to compare apples and apples, namely passive income with passive income, which is why I included the impact of a property management fee. It takes a big chunk out of the rent but is going to be worth it especially if you’re dealing with needy tenants. After accounting for two months of vacancy in the property, the 10% property management fee, and taxes and insurance, the investment still gives a pretty healthy return. However, notice where the 17.2% return is coming from, the leverage. You could take 20% down and invest it in a 50% stock 50% bond portfolio and get a very similar return expectation. It’s not that real estate is so special, rather you can magnify your modest returns from the mortgage you take out. If you shelter these gains with all the tax breaks given to landlords, rental property can be a very valuable wealth building part of your portfolio.

I didn’t consider the price appreciation in this property, and for good reason. It was purchases for $60,000 in the mid 1980s and is worth $75,000 today, a terrible 0.7% rate of increase each year. Clearly the market is saying that even though this is a duplex and not a mobile home, it should be thought of as a depreciating asset in real terms. If I use the past level of price increases for this home as a guideline, then after 10 years the price increase will cover the real estate commission from selling it. That’s another part of the analysis is if you planned on selling the house within a few years of buying it you could easily be left with a negative return from the fees you pay for selling.

I chose this $75,000 house because I don’t think there is a lot of downside in the price. If I ran the same numbers with a $250,000 house renting for $1500 a month in an economically volatile area, I could easily be looking at a large loss if the main employer in town shut down or the national economy cooled off. That’s why if you’re going to rent I like buying the housing stock at the lower end because it gives a lower chance of loss. If you buy more expensive houses you’re making a bet that the local economy will drive price appreciation. That’s why if I was going to consider renting a property it’d be one in a nice working class neighborhood with low crime and a low value to median income ratio.

This is a lot of thinking for a single investment. I generally prefer to be lazy and collect passive income through dividends if I can. Plus, if I change my mind next year about the course of my life and decide to become a monk and donate everything to charity, I can do that with stocks and sell the same day. With real estate, I’m stuck waiting around until someone buys my house.

So if you are a risk taker, like hustling for active income on the side, and have a less mobile lifestyle than I do (I’m traveling around the world right now, am in my 27th country in four months), renting out a house can be a great way to get good returns. In fact, my grandparents once told me a funny story of a couple they were good friends with. The man was a postal worker and the wife stayed at home. They started saving his paycheck aggressively to build up enough for a down payment, and whenever they had enough they would buy a home. Each year they would do this, until they built up a portfolio of rental properties that was so large, the wife had to be a property manager full time. My granddad said they retired as multi-millionaires despite his modest postal worker income.

If brokerage accounts allowed leverage at the same interest rates as borrowing for a mortgage you could achieve the same returns with a simple stock and bond portfolio. Just know that if you go into rental real estate you are doing it because of the big return you can get from borrowed money. There are many roads to financial freedom, just have a good plan and be ready to hustle a little if you decide to go the real estate rental route.

If you have any experience with rental real estate, whether it be great returns, natural disasters, tenant horror stories, or massive property price appreciation, I’d love to hear about it in the comments below!

Interesting read, thanks Tmoney

What are your thoughts on a cash only investment in real estate, where you take the mortgage interest out of the picture? You would not borrow money to invest in stocks because of the potential risk, should real estate be any different?

Instead of buying the property they want, people rent a home and then invest their leftover money elsewhere.

It is very difficult to tell that which one is better investment option between real estate and stocks. I would prefer investing in stocks because they not only increase profits every year but also increase the cash dividends. Stocks are often more liquid than real estate investments and borrowing against stocks is also much easier than real estate.

Retirement is not boring. It can be fun and an adventure. Just be smart on how you handle your finances.