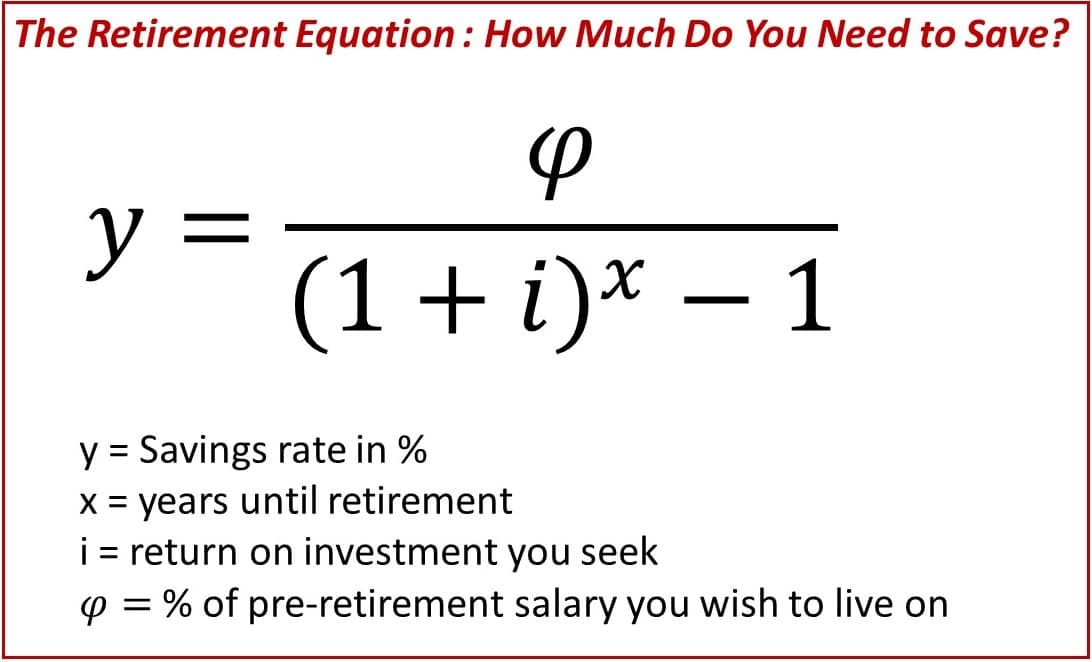

How much will you need to save to afford retirement? The life insurance agents and brokers you talk to give generic rule of thumb answers provided by their companies. “Save 8 times your income”, “Replace 75% of your salary”, and “Your portfolio should be 25 times your annual spending” are all popular suggestions. However, what if you want a mathematical answer to describe retirement? It can be described with one retirement equation, which is useless unless it helps to understand our personal finances on a deeper level. Let’s break down the one above and see how it can answer your questions about retirement.

Looking at Different Retirement Lifestyles

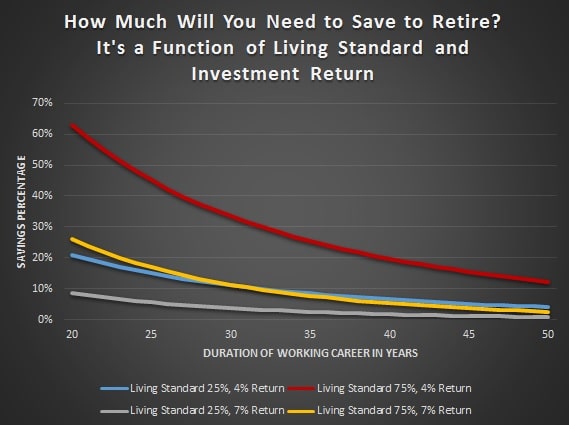

There are four variables above, so to graph the equation easily we need to set two of the variables to specific number values. To see how the relationship works, I will use two different values for living standard and two different values for return assumption. The living standard is what % of your pre-retirement salary you’ll need to live on. Most people say you need to replace 75% of your retirement income. So I’ll use 75% for this variable and 25% as well, with 25% representing a lower standard of living. If you made $100,000 a year at work, these percentages would be equivalent to living on $75,000 and $25,000 a year. Obviously, with a more frugal retirement lifestyle you can save less money while you’re working.

Looking at the return assumption, everyone who invests gets a rate of return. It can be high or low. Over the long run, most people will get something between 0%-12%, with a big concentration of values between 3%-8% depending on how high your fees are, how much stocks vs bonds you hold, etc. So I’ll use 4% and 7% for the return assumption, representing a conservative investor and a more aggressive investor with a higher stock allocation.

The two variables we are varying are saving percentage pre-retirement and number of years in your working career. You can see the inverse exponential relationship below. In particular, check out the red line, which represents most American workers who will live on 75% of their salary in retirement and achieve a 4% investment return. If you look at year 40 for that red line, you’ll notice the vertical axis shows 20% savings rate. You might look at that and scoff, but the equation actually does a great job. Whether you know it or not, you save about 12.4% each year in the form of Social Security. You pay 6.2% and your employer pays 6.2% as well. It’s a forced national savings system that gets converted to a pension when you retire. I’ve heard figures that Social Security income makes up about 40% of the income of most middle class retirees. The other ~8% in savings that is not coming from Social Security taxes is your 401k plan. Remember the most common behavior in corporate America is to save up to the match and then nothing else. The most common matching program is 1:1 up to 4%. In other words, the average American would save 4% and their employer would chip in 4% as well for a total of 8%. That worker probably invests in a series of sub-optimal mutual funds with high expense ratios. Hence 4% is probably a very fair estimate of the long term return of the average 401k pan.

I was very surprised that the difference between spending only 25% of your pre-retirement salary with a conservative investment return and spending 75% with an aggressive investment return was so small. That is represented by the blue and yellow lines. So if you save a lot, it seems like you can accomplish retiring in multiple ways. You can live on less or take more risk in the stock market. The gray line is how fast you retire with a 25% of pre-retirement salary lifestyle and a 7% investment return.

How Can This One Retirement Equation Describe Early Retirement? It’s All About Living Standard

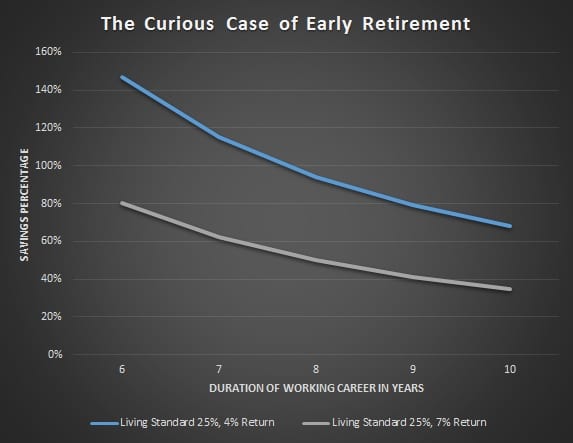

This equation explains retirement whether you want to take it conventionally at the age of 65 or if you want to go off the deep end and try to retire by 25. If you look at the gray line, you can see what you have to do starting with $0 in debt to retire at a very young age. Mr. Money Mustache, one of the most notable bloggers in the early retirement community, retired by 30 and has chronicled the financial decisions that helped him get there. He describes saving about 50% of pre-tax income after working for about 8 years, which you can see on the gray line above.

Check on the assumptions for these two lines. The gray line assumes an aggressive investment portfolio that earns 7% a year. That is a key ingredient of early retirement that does not get talked about enough. If you want to retire way earlier than most people, you MUST seek out higher return and risk being wrong. If you are and the Great Depression happens again, you’ll have the skills to work and put food on the table. Better yet, you could wait out the Depression in a rural area and plant your own crops in exchange for seed and a share of the harvest. Every early retiree I’ve ever met has an aggressive stock allocation, and that’s simply because of math. It’s really hard to retire early if you’re trying to live off the pathetic 2.4% the Vanguard Total Bond Fund is yielding right now.

Play Around With the Equation and Let Me Know What You Think

This is about sharing a more technical way of thinking about personal finance. Math doesn’t agree with everyone I get that. However, if you aren’t scared of your old TI-84, pull it out and have some fun. You can try setting other variables to set values and see how it affects other ones on a graphing calculator.

Plot the course you’re on now for retirement and see how long you’ll be working. As I demonstrated in the case of the average American worker and Mr. Money Mustache, the equation predicts the duration of a working career very accurately.

If you want to retire before 60, you must choose either a lower retirement lifestyle or the risk of a high stock market allocation. If you want to seek out the possibility of early retirement, you must be aggressive with your stock allocation and also live very frugally post retirement. The good news now is you can predict all the characteristics about retirement to get specific answers to your own personalized situation. I’d take a versatile math equation over a financial sales rep reading out of a corporate manual any day. Hope you enjoy and Happy New Year!

One thought on “The One Retirement Equation To Rule Them All”