It’s been a good year here at MillennialMoola.com. I’ve gotten a kick out of writing for you all and finally putting digital pen to paper on a lot of my best ideas. I started blogging not to make money, but to help, entertain, and educate people on all things financial. It’s been really fun, and now that I have figured out a lot of the technical aspects of website management, I’m hoping a for a prosperous 2016. In the interests of being transparent and helpful to anyone who’s thinking about starting their own website, I wanted to include my web traffic, income, and expenses for Millennial Moola 2015.

Millennial Moola 2015 Top 10 Articles

- How to “Retire” in Your 20s 2,830 Views

- Is Alfred Morris the Smartest Financial Mind in Football? 1,447 Views

- Chicago Is One Recession Away From Going Bankrupt 1,224 Views

- Why You Should Be Mad About Those Red Starbucks Cups 1,169 Views

- The $1 Million Mistake Most People Make In Their 20s 995 Views

- My $5 a Month Phone Plan and How You Can Get it Too 667 Views

- The Real Reason Donald Trump Is Running for President 611 Views

- Was Vanguard Just Hit By a Flash Crash? 405 Views

- How to Marry a Sugar Momma or Sugar Daddy 393 Views

- How to Find a Frugal Girlfriend 390 Views

Media Appearances

I got interviewed on two really cool shows in 2015. My first was The Dave Plier Show on WGN Radio. I did that interview via my $5 a month phone plan at my hostel in Iceland early morning on a Sunday. I was saved only by the fact that I’ve never heard a mouse stir before 10am on a Sunday at a hostel, so the sound quality was pretty good.

I took a chance on getting an interview on the SoMoney show later on, which has had over a million downloads. The host, Farnoosh, has worked with people like Jim Cramer and has interviewed people like Tim Ferris, Tony Robbins, and Mr. Money Mustache. I was very lucky to get on the show to be quite honest. I had a ton of fun talking about all kinds of technical investment stuff and got to practice interview technique. I did this one in my hostel in Krakow, and was super relieved when the sound held out long enough to do the whole interview.

In 2016, I’m hoping for more interview opportunities to help people toward financial independence. You can catch the Dave Plier interview and the So Money interview here and here.

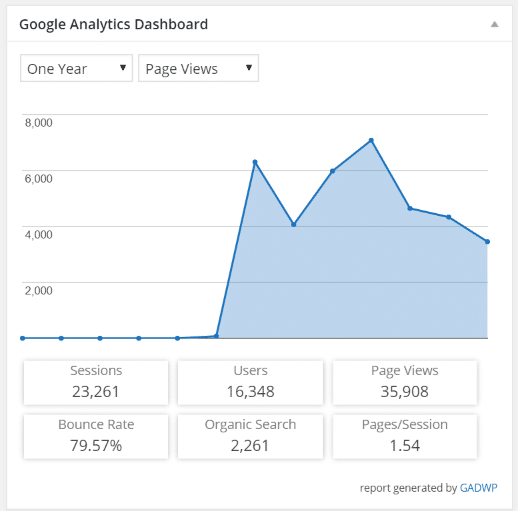

Traffic: Good For a Niche Personal Finance Website

I started this blog around the beginning of June, so this site has existed for about 7 months. I think the first bit of advice I’d give to anyone starting a blog or website is to not stress about your traffic. Some weeks you’ll have lots of time to write and other times you’ll be busy with friends and family, as I’ve been for the past couple months I’ve been back from being abroad. To date, we’ve had 35,908 page views in 2015. I had no expectations going into this, and I’m pretty pleased with that. Of the other personal finance blogs I’ve seen, some had better traffic and plenty had less, so it’s encouraging to have others read your stuff.

The first month I had a huge spike in traffic from the How I Retired in My 20s article. That was where virtually all of the views came from that first month. Reddit, Bogleheads, and other social media sites accounted for the vast majority of those views. The blog subsequently got banned from those sites because I posted links to this blog there. To be honest, I didn’t read the rules for the forums about posting links to your own blog even if you think the links are really relevant to what the forum is about. So to anyone starting a blog, don’t post links to your own stuff anywhere. Be active in forums and put the link to your site in your signature under your user profile so people can click it if they want. By getting banned from those sites, I’ve hurt myself a little by preventing users and readers from posting articles from MM on Reddit and Bogleheads because of that mistake. Maybe eventually I’ll get unbanned though, so it’s not that big of a deal. If anyone is a member of the Personal Finance or Financial Independence subreddits you could do me a solid by messaging the moderators and asking to get Millennial Moola reinstated 🙂

A highlight of traffic in August and September was my Chicago is Going Bankrupt article. It got shared a ton on social media primarily from folks who live there. I still stand by my analysis because the city’s prospects certainly aren’t getting any better, and it takes a while for municipal bankruptcy scenarios to play out. Another really successful article was The Real Reason Donald Trump is Running for President. I had no idea when I wrote that back in July how relevant it would be right now. However, the reasons he’s running amusingly are even truer now than they were back then. Definitely check that article out if you haven’t already.

The past few months, life has gotten in the way of blogging as much as I was before. I have dropped off to about 1-2 posts a week from the 3 I had been doing while I was traveling. I fully intend to get back to that 3 posts a week level after the holidays are over. From my daily traffic reports, I know a lot of my traffic comes from folks when they’re at the office in need of something to get them through the day, and I don’t want to disappoint. I remember how hard it was to watch the clock go by too and have no intention of leaving you stranded.

Blog Income: Nothing to Write Home About

I’ve experimented with affiliate ads in this blog, and they will always pose a conflict of interest because the fact I could get income from these advertisers could influence my reviews or advice. The good news is in 2015, I had very few dollars to be conflicted from. I only earned $30 from my Republic Wireless article and about $100 from book sales that I’d attribute to this website. So all in all, let’s say the income was about $130. I think I could drastically increase this if I was as aggressive about revenue opportunities as other sites are. In 2016, I will probably experiment with credit card referral programs, more affiliate programs, Google adsense, and potentially even private advertising to see if I can make this site more of a money maker rather than a money drainer.

Blog Expenses: Not Too Bad

My blog related expenses in 2015 were pretty tiny, excepting the new laptop computer I bought. The promotional hosting rate I got at Dreamhost was around $3 a month. This will increase to about $9 a month after a full year of hosting. So 7*3 = $21 for website maintenance fees. I use WordPress so the site administration is free.

I did buy a new $520 Asus Zenbook which I would consider a blog expense. I was writing on a Samsung Chromebook, but I found the Google Docs ecosystem would have taken me more time to learn than I wanted to spend. It might be fair to ridicule me for this since I do run a frugality/personal finance website, but I wanted to include cool new graphs and excel formulas like I made in the One Retirement Equation to Rule Them All article. I intend to increase the bells and whistles of this blog to make it more fun and increase traffic in 2016, so I need the operating system and Office that I’m already familiar with to accomplish this. So total blog expenses were $541. Total net income is therefore minus $411, which is a great tax writeoff!

Social Media Report Card

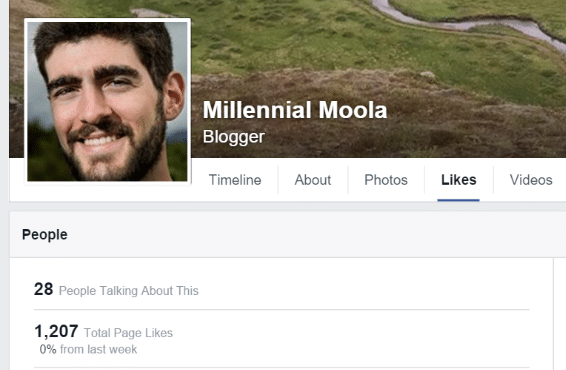

2015 has been a great year for building up a following on Social Media sites, particularly on Facebook. My Millennial Moola page there has 1,207 likes, which is more than a few of my favorite established personal finance sites. It seems like my efforts have had the biggest effect there, and I’ve been less successful on Twitter, Instagram, and Google+ (which I maintain just for the supposed search engine benefits). I only have 99 followers on Twitter and just under 200 on Instagram. I have no idea if all that stuff matters because at the end of the day you want people to be on your site reading stuff not on these other big social media sites because they get the benefit of ad dollars. It is important though for readers to be engaged to keep blog momentum going, so for that reason I try to maintain several different social media sites. Eventually if I continue to be less successful on these other venues I might shut a few down to consolidate my focus on the pages I perform the best with. It’s probably best to figure out what site you enjoy posting to the most and focusing on that page rather than spread yourself too thin. I use the Buffer application to post across several different mediums. It’s been a big time saver. If you’re so inclined you can check me out on these links for all my social pages: Facebook, Instagram, Twitter, Google+ .

2016 Goals

I’m hoping for a big increase in traffic for the year ahead driven by a higher volume of awesome blog posts. This will obviously depend on me writing helpful and entertaining stuff, but you, my readers, have been tremendous in 2015. You’re telling coworkers about the blog and my book; you’re sending me emails at [email protected] with ideas and financial questions. You’re calling me with suggestions. The success I’ve had thus far has been because of you, and I’m very grateful. The motivation I get for writing is mostly from the reader feedback I get, so comments on articles, shares on Facebook, Twitter, etc. really help me to keep going.

I’m hoping I can get out my second book sometime in 2016. I’ve been working on it the past few months which is one reason why my volume of articles has dropped a little. It is going to be a beginner’s guide to personal finance, so I will be thrilled to release it and you’ll be the first to know here at Millennial Moola when it’s done.

Get the discount champagne bottles and the box wine out y’all because 2016 is going to be a great year of saving, traveling the world, and journeying towards financial freedom. I wish you and your family the best and thanks for supporting this blog with your eyeballs and enthusiasm.

Have you started your own blog? Are you an established blogger already and have advice for me on traffic and comparison points where you were at after a few months at it? Comment below!

As someone who has been writing on the web with much less success for some time (at least when measured in page views) – mad props! Really great work.

I’m surprised, though, that you didn’t mention any of the experiences that might have been partially fueled by this blog. Weren’t you interviewed on a radio show? That must have been a really cool experience.

Oh yeah, I got interviewed on the Dave Plier Show and the So Money Podcast with Farnoosh Toorabi. I’ll have to add in a section about that. There’s talk in 2016 about a TV Show so we’ll see where that goes. Thanks James

Congrats! My affiliate income is seriously even less than yours and I get about 80k page views per month. Definitely on my resolution list of things to fix in 2016 🙂

If you break down my hourly rate though, I think I make like $0.05 am hour 🙂