I got a really interesting email from a millennial missionary reader in Malawi. I’ll call him Kirby to preserve his anonymity. Kirby is a 20 something college grad, but he has no retirement plan or other employer savings program. This is a really common problem for workers in the ministry, as churches and other nonprofits tend to not put a lot of thought into benefit programs, or can simply not afford them. What’s a guy to do when he wants to be responsible and prepare for his future but has no organized program to help him do it? Here’s the email below, edited for length and clarity.

I am 21 years old, and I just graduated from college last May, with no debt. I have been living in Malawi Africa for about 3 months now, and I am committed to be here for 2 years total. I have raised support to be here, and I am with a missions agency who planned my budget. With all of that in mind, I have a monthly take home of $1500 a month and I am able to save between 500 and 600 dollars a month. My question for you, is where and how to start investing. To my knowledge, there is no employer match program, and I haven’t set up any special type of savings account, be it IRA or Roth IRA. Right now my money is just sitting in a bank account and waiting to be invested somewhere!

My future plans are still a bit unclear right now. There is a chance that I stay on in my current role. If that happens, I would return home for a short time to reconnect with my supporters and then return in the same role, and the same financial situation. I may also decide to return home and attend some sort of grad school. The third possibility, is that I return home and get a more ‘normal’ job. If I do decide to return home after these two years, I will definitely need to purchase a car and find place to live, whether it be renting or buying a house. Where should I start?

How to Think About Saving As a Millennial Missionary

Kirby is right that there is no formal program or employer match to help him start saving for retirement. Luckily, he’s in a great position because of his monthly savings amount and low tax bracket. I’ll assume that the 500 to 600 a month is after all miscellaneous spending needs, tithing or charitable contributions, and extra side costs.

The first thing anyone should do is set up a savings account for a rainy day. I read a staggering statistic that said 62% of Americans do not even have $1,000 in a savings account. 21% do not even have a savings account period! These are horrific numbers. The figures clearly show why there are so many payday loan, fast cash, and other fly by night pawn shop kind of places that make such a killing off of average working class people. If you do not prepare for unexpected expenses, you turn over control of your life and your ministry to people who only care about getting paid back. From the sound of it, Kirby already has a stash of money sitting in a bank account for unplanned expenses. That’s great news. If it’s more than $1,000 then you literally are better off financially than a majority of Americans. While most people will tell you to have six months expenses set aside, I think 3 months is fine. As you spend about $1,000 a month, that means you need about $3,000 in a savings account.

Since this savings account seems to already be set up, the next step is retirement savings. You mentioned not being sure about grad school, but I’ve exciting news for you. You can save for retirement and education expenses at the same time in the same account, and you don’t need to worry about what you’ll spend it on until later.

How Low Income Workers Like Missionaries Can Use Roth IRAs to Get Awesome Benefits

Kirby might not have known this, but Roth IRAs have a contribution limit of $5,500 a year, which corresponds very well to his $500 to $600 a month in savings. He could put $458 a month ($5,500 divided by 12) into a Roth IRA and it will grow tax free. He is eligible for a Roth IRA as his income is below the IRS threshold of $116,000 a year as a single person. If he was married, the income limit would be $183,000. In terms of whether a Traditional or Roth IRA is better for him, one only need to look at his tax bracket. With taxable income of about $1,500 x 12 = $18,000, his tax bracket is pretty low. The IRS allows you to earn a little bit of money without being taxed each year. For most, that amount is determined by summing the personal exemption and the standard deduction. These figures are $4,000 and $6,300 for 2015 for a total of $10,300 in earned income before Kirby pays any income taxes. The next $9,225 are taxed at a 10% rate, so his marginal tax rate is 10%. Since about half his income isn’t taxed and the other half is taxed at about 10%, his effective tax rate is about 5%. Would you rather pay 5% in taxes now and never pay taxes again, or would you rather get the 5% tax savings but have to pay an unknown tax rate on a lot of money far into the future? It’s clear he should pay the tax now and use the Roth IRA.

Here’s another reason the Roth IRA is by far the better choice in his situation. The IRS allows you to pull money out of the Roth IRA penalty free for educational expenses like room, board, and tuition. This means saving in a Roth IRA allows you to grow your money tax free, which can then be pulled out penalty free for education. If it turns out you don’t need it for education, it gets to stay in your tax free account where it will continue to compound for your retirement. The IRS allows you to pull your contributions out of the Roth IRA first, so the benefits of using one are enormous. Roth IRAs can even be used to fund the first several thousand of a down payment for a house. I don’t know why the government likes Roth IRAs so much more than Traditional IRAs, other than the program came along later. For a low income individual like a millennial missionary, a Roth IRA is without a doubt the best savings vehicle for your future.

How to Open a Roth IRA With Only $1,000

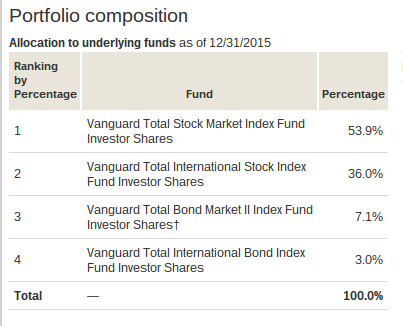

You will need a little start up money to meet the minimum, but once you have $1,000 you can set up a Roth IRA online in no time at all. Because you are starting from a low asset level, you don’t need to worry about fancy things like investment advice, rebalancing, and diversification for a while. You can start with the Vanguard 2060 Target Retirement Fund. Check out the portfolio allocation below. I got it straight from the Vanguard website.

It’s about 90% stocks and 10% bonds, all invested in Vanguard index funds. These funds hold thousands of different stocks, so you will basically get a return similar to the world stock market. Is it perfect? No. However, Vanguard’s retirement funds have an aggressive stock allocation when you are young and need to focus on aggressive growth. The funds also have a very low expense ratio of 0.18%, which will cause your money to grow faster as you pay lower fees. At this low asset level, the online investment advisory services do not make a ton of sense. Once you’ve saved in the Roth IRA for several years and have more than $20,000, maybe you can begin to think about getting it professionally managed. I wouldn’t worry about it before this point.

The fund minimum is $1,000. Once you have the account set up and funded with this small amount, you can make automatic deductions from your bank account straight to the mutual fund. I think the $458 figure is good because you’ll basically max out the Roth IRA every year while retaining some extra cash for a rainy day. When you are finished with the mission program, you could have over $10,000 saved for your future, especially if the stock market recovers between now and then. If you have less than that, it’s because you were able to buy lots of shares of stock at low levels compared to future decades. To start you need to visit Vanguard.com and search for a button or type into the search bar how to open an account. You’ll link the account to your bank account and can transfer the starter $1,000 in this way to your new Roth IRA. Since you live in Malawi right now, I’d list your parents or a friend’s address on the account so you don’t have to explain how you’re overseas.

Even A Millennial Missionary Can Become A Millionaire By Using Roth IRAs

No one goes into the ministry for the money. Several of my master’s degree wielding, very intellectual pastor friends have shown me their paychecks. You’re much better off financially doing anything else. That’s not the reason they choose this noble profession though. They do it because they have a deep concern for their fellow man and a passion for their faith, and they want to share that faith with others. All too often, missionaries and ministers are not given the financial education and help they need to retire one day, and I hopefully this article helps some people out there in similar backgrounds. After serving God abroad, the very least you deserve is a comfortable retirement if you desire one. If you want to continue your calling for your entire life, then you’ll be blessed with additional financial resources that will allow you to help others.

I’ve written in the past that not contributing to a Roth IRA in your 20s can be a million dollar mistake. The reverse is true as well. If you start making regular contributions to Roth IRAs in your early 20s, I have no doubt that one day you’ll have a million dollars if you keep at it. There are not very many millionaire missionaries out there because most will put any extra money in a savings account. That account will earn less than inflation and grow at a pitiful rate, all while you’re paying outrageous banking fees that further reduce your account balance. I would suggest that Kirby get started with a Roth IRA at Vanguard to get his money protected from taxes for the future. He’ll also learn how to lose money gracefully when stocks fall, which will make him a better investor long term as he doesn’t panic the next time the stock market takes a dip.

Anyone with income below the levels I listed above can take advantage of Roth IRAs just like Kirby. You don’t have to be a millennial missionary to do so. The only caveat is first you need to check and see if you get an employer match in a 401k program. Get 100% of your match before doing anything else. After that, max out your Roth IRA and over time you’ll build up an unbelievable amount of tax free savings. I wish Kirby the best of luck as he does God’s work in Malawi.

Any other suggestions or encouragement for Kirby? Post comments below!

I’m a missionary to Africa as well and this is invaluable information for me. Thank you!

HOWEVER, and this is important, I think you will be heavily penalized by the IRS if you try to open an IRA in the same year that you are claiming the FEIE (Foreign Earned Income Exclusion). Many of us use the FEIE every year, but it doesn’t get along with the IRA at all. I just wrote about it here last night: https://vagabondfinances.com/investing-2/why-the-roth-ira-is-everyone-elses-best-friend-but-not-yours/. I hope I’m wrong, but I think the FEIE and IRA together is a significant error that a lot of missionaries make. (If it isn’t appropriate to give the link above, please delete it. No problem. I just want people to be aware of this costly mistake.)