I’ve never visited a payday loan store in my life, but if you drive around the streets of many communities in America, you see them everywhere. Pawn shops, their close cousins, are similarly ubiquitous. I’m not talking about the the cute specialty stores dealing in high end collector merchandise on the History Channel. Most pawn shops take your wedding ring as deposit and give you a $500 loan with 20% interest. Pawn shops are just another way to get a super high interest loan. Also, how are there so many check cashing places at convenience and corner stores in lower income communities? Why do you get dozens of credit card offers a year in the mail? The answer to all these questions is the same: most Americans save almost nothing.

How Bad Is the Problem?

The short answer is really, really bad. According to a survey done by Google for GoBankingRates.com, most Americans have less than $1,000 in their bank account. In fact, a full 62% of Americans do not meet this $1,000 threshold. That’s almost two out of every three people. You’ve surely experienced an unexpected large bill in your life. Think how it made you feel and how you thought about paying for it. Most financially stable people suck it up and write the check. It hurts, but once you’ve transferred the money it’s over with. For people who do not save, they seek out one of the shady financial institutions that will lend someone with no credit money for ridiculously high interest rates.

It really does blow my mind that we think teaching people trigonometry is more important than basic financial literacy. If you go to one of these fast cash places, then you are going to get obliterated financially. If you go into credit card debt, take out a pawn shop loan, or get a cash advance, you guarantee someone else a rate of return at least double that of the stock market.

Millennials Don’t Suck as Much As Their Parents

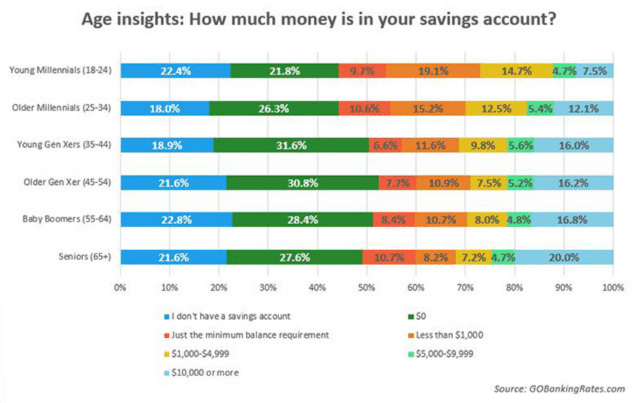

If you take a look at the numbers, the worst savers are actually older. What I mean is that a higher percent of people 35 and older have nothing saved compared to the Millennial generation. Check out the graph below from this Google survey.

You can see that there’s more dispersion amongst older people. That is, you’re either likely to have saved a lot or nothing, but not as much in between. People seem to carry their bad savings habits throughout life.

Policy Implications For This Shocking Financial Fact

I’m generally in favor of things like Health Savings Accounts, high deductible insurance, and allowing people to opt out of Social Security. The problem with all of these beliefs is that if you look at the astonishingly bad household finances in America, most people could not function this way. The average person lives paycheck to paycheck and can barely replace their tires without having to go into debt.

For Obamacare, this means the majority of people could not handle a deductible of any size, much less the $5,000+ deductibles the program has designed. Without unemployment insurance, people would be out on the street and homeless if they lost their job since they act as if their paycheck will go on forever. Without Social Security, a solid number of Americans would work until they die because they would be forced to.

Evidence of the Zero Savings Society Has Been Staring Me in the Face, I Just Didn’t Realize It

When I was in college, our landlord would ask for payment on one check. I was always the one who wrote the check since it was a large amount and the rest of the guys paid me back. The reason I had to be the one to do this was that the rent was over $1,000 and no one else had enough money to pay the bill and wait for others to pay them when they got around to it. If they had written the check, they would have incurred minimum balance penalties.

When I was working, I had a two month rotation in a large mutual fund company’s retirement division. Day in and day out, we were dealing with people whose only savings in life was their 401k plan. Most of the folks who called needed cash for a host of different reasons, and they were desperate. One guy called to get a hardship loan out of his plan so he could avoid eviction. Another man called because he needed money to pay a lawyer in a legal dispute. The thing that everyone who called had in common was a big bill with no money anywhere else to pay for it.

Another thing I noticed when I was working is how many people signed up for a car loan in the first few months of getting a regular paycheck. I realized not a single one of them had enough money to buy the car they wanted outright, so they financed their purchase with credit, thus locking them into their 9 to 5 existence for the life of their loan.

We Need a Consumer Financial Self-Protection Bureau To Protect Consumers From Themselves

We already have the CFPB, established by the Dodd-Frank financial legislation. It was dreamed up by Democratic lawmakers like Elizabeth Warren to protect consumers from the financial industry. However, when you look at how pitiful most people’s savings habits are, we do not need protection from Wall Street. The average person needs protection from themselves. Unless you have had some major healthcare problem, have to support a bunch of children as a single parent, or have some kind of disability, there’s no excuse for saving less than $1,000, especially after several years of work. To get that level of money, all you need to do is save $1 a day for three years. Even minimum wage workers can find $1 a day in their budget. If they can’t, they have no self control and ability to budget.

The educational system in America has failed its citizens. The problem is that no one teaches kids why saving is important. I was in public school my whole life. Not once did a teacher tell us that credit card companies charged ridiculous interest rates and we should never carry a balance. Not one time did someone tell me I should get an emergency fund with three months expenses in it. The only time the stock market was mentioned was in the context of a stock picking contest with little practical value to most people’s lives. Junior Achievement came in one time and gave us a couple valuable lessons in middle school, but that was literally it.

Republicans like to rail against federal government agencies, but they really should support a financial protection agency whose sole job is to protect people from their own dumb behavior like going into debt to purchase consumer goods or saving nothing. When you put away less than $1,000, you’re asking to be taken advantage of by predatory lenders. We need federal level educational support for average folks to learn about saving. Pet Republican programs like Health Savings Accounts, Roth IRA’s, 401k’s, high deductible health insurance, and Social Security privatization can never be successful for the average voter unless people learn about their personal finances. Yes it can be boring and yes there are a lot of people out there who don’t like thinking about money, but it’s absolutely necessary. Elizabeth Warren, Bernie Sanders, and other Democrats shouldn’t be blaming Wall Street for America’s financial problems; they should be blaming the average American voter for saving almost nothing.

Why do you think most Americans spend everything they make? Is the system to blame? Do predatory lenders help keep average folks in the dark so they can make more profits? Comment below!

For what it’s worth, I think savings accounts as a measure aren’t perfect – I don’t have a savings account and keep less than $1,000 in a checking account, but have $5,000 in a “safety net” fund on Betterment.