The major loan types of loans are car loans, mortgages, student loans, credit card loans, cash advances, and loans from pawnshops and payday lenders. Each category has a different average interest rate charged each year for borrowing money, but one of those stands out as the most absurdly expensive, poverty trap creating weapon of mass financial destruction.

Loans used to buy physical assets like cars or houses typically carry lower interest rates. Next is student loans because of federal government involvement. After that comes credit cards and cash advances. Then way up in the stratosphere is the ridiculous expense of pawnshops and payday lenders. You should avoid using them at all costs.

Let’s Start with Credit Card Interest So We’ll Have a Comparison Point

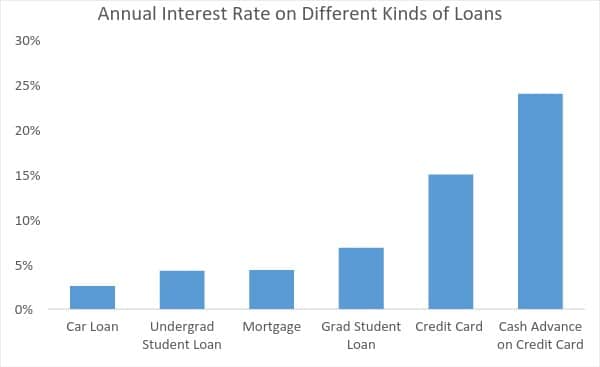

Credit cards are the most expensive way most middle class workers borrow money. Look at the chart below to see typical interest rates on loan categories commonly used by middle-income families with decent credit.

Credit cards and cash advances are so expensive that the interest rate is a multiple of the interest rate for the other categories. Paying off your credit card in full each month should be priority number one.

‘Plastic money’ is a weapon of mass destruction for the average American family. How many folks have you heard of that have $50,000 in credit card debt and totally wrecked credit?

A Ton of Families in America Don’t Qualify for Credit Cards Though

As expensive as credit cards are, it’s actually pretty hard to qualify for one if you’re not anywhere close to middle class. If you’re in the bottom quarter of the income distribution in America, ie making $20,000 and below, most companies will not give you a card. Personal finance blogs always tout the “top rewards credit cards” and “get 50,000 bonus miles and fly for free.” Those cards will not even touch someone that isn’t at least making a solid income with a good credit score.

If you lost your job and had a hard time keeping up with your bills, your credit score is going to be low too in addition to a low income. That means the only credit card companies that might even touch you would be the ones that charge the top end of the allowable interest rates with pathetic or no rewards at all. Realistically, financially vulnerable families might fall behind on credit card payments, settle the debt, and then they’re cut off from the system for years. How then does the bottom quarter to bottom third of America pay for basic things like car bills, rent, unexpected emergencies, etc?

Pawnshops and Payday Lenders: The True Weapons of Mass Destruction

Many low income Americans and undocumented immigrants need money to fulfill various financial needs and cannot get access to money from traditional lenders. These individuals might have extremely poor credit and be behind on multiple bills. Many live in extreme poverty and do not have a bank account. The lenders servicing this community must charge extraordinarily high interest rates because of sky high default rates in order to make a profit and stay in business. Just because this is necessary from a business standpoint for them to exist doesn’t mean it’s good.

Pawnshops and payday lenders are the most common lenders of last resort. If you outlawed them, there would probably be even shadier lenders outside of a regulated market that emerged (like the Mob anyone?). So I’m genuinely conflicted here because I wish they didn’t exist, but then if they didn’t maybe there would be enforcers walking around breaking people’s kneecaps.

Comparing Pawnshops and Payday Lenders Rates to Credit Card Companies

How would the chart look if we included these lenders used heavily by the most financially vulnerable? I will include a few of the loan categories used by the middle class from the earlier chart for comparison purposes. The vertical axis is a typical annual interest rate charge for each category of loan.

A pawnshop loan costs 30 times to 40 times as much as a mortgage! A payday loan costs almost 100 times to 150 times as much as a mortgage! The next time you see stories about the average American not having any money, you will know that the chart above is a big reason why.

Imagine life as a minimum-wage worker with children. Your primary income boost is the earned income tax credit, which comes once a year in April. What happens if you need a $500 car repair in August? Lower income people tend to drive older, less-reliable vehicles, so big repair bills are a common occurrence. Say you have already maxed out the small amount of credit that you qualify for based on your income, so where else can you go to borrow money?

Why Pawnshop Money is a Little Cheaper

Pawnshops charge very high rates of interest, but that interest charge is usually around one third of that charged by payday lenders. Why is that the case? After all, pawnshops deal with financially vulnerable customers, too. Why would customers ever visit payday lenders with this large discrepancy in the cost of borrowing?

The primary difference is that pawn shops receive collateral for their loan. A lower income customer could put up an engagement ring, guns, gold jewelry, or even a car title and get a loan this way. If she fails to pay the pawnshop back, the company can simply sell what she gave them as collateral. If she pays them back, they return her possession. The damage done to the pawn shop’s capital is far less with something of value to sell in the event of default. Hence, the lower costs result in lower interest rates compared to payday lenders.

Let’s assume that a prospective low-income borrower has no assets of value. The pawnshop would not be able to lend him money. He then must turn to the payday lender to get the cash for the car repair he needs.

Why do Payday Lenders Charge Such High Interest Rates?

A payday lender will only ask to see a customer’s paystubs and make him sign a promise to pay them back. The payday lender’s model involves an extremely high default rate on their loans. After all, a payday lender is a last resort for the poor and working class to get money.

Since a large percentage of their customers will fail to repay them, the payday lender charges 400% annualized interest, or more. They might defend this interest rate, as their customers generally only need the money for a couple weeks until they receive a paycheck. The payday lender has to accept the high risk that they will lose 100% of their money, so they might argue a 15% charge over the weekend to make this kind of loan is reasonable.

Furthermore, a payday lender cannot seize any assets like pawnshops do. After all, their customers are likely worse off than even pawnshop customers or they would not be seeking cash there. So payday lenders charge a higher interest rate.

We Have to Help People Realize Their Futures Get Wrecked when they Borrow from Pawnshops and Payday Lenders

A 6% after tax return in the stock market is a very good return. Low income borrowers are paying interest rates north of 100%-400% whenever they have a cash crunch. With a renewed focus on social justice issues driven by the Black Lives Matter movement, hopefully financial education and access to credit can be a part of the discussion.

Middle class workers facing a cash shortage pay only 15% on their credit card balances. Clearly, anyone in debt to a credit card company, pawnshop, or payday lender has no business even starting a 401k until he or she has paid off his or her loans. A prudent person can prevent these exorbitant interest charges with an adequate emergency fund to cover unexpected expenses.

Like what you read? Check out my book “Mastering Money in Your 20s and 30s” on Amazon!

Thanks for sharing Travis! Those payday loan interest rates are absolutely insane. It’s in stark contrast to the “worst case scenario” of credit cards. Once that cycle gets going it must be nearly impossible to escape. Keep fighting the good fight helping people conquer their personal balance sheets!

I’ve driven by payday loan stores many times and never really gave them much thought. It’s crazy and sad how easily one can dig themselves into a financial hole with them. Thanks for sharing this information and raising awareness.