Dear TMONEY,

I have some unique choices coming up to make about my professional career. This doctor wants to quit. I am about to finish a fellowship in surgery, and I have been thinking about doing another fellowship. I don’t know if you’re familiar with the fellowship process but basically if you want to specialize further after residency you pick a program, generally three years in length, to hone your skills and do research. I would love to do a second fellowship or even pursue something totally different like journalism, but I have a debt load from medical school of about $120,000 that carries an interest rate of 6%. I was curious to hear about some of the financial implications of the choices I’m having to make. To give you some salary information, if I did the fellowship option I’d make about $60,000 a year for three years and if I followed the surgery route I would start at about $200,000, which would increase pretty rapidly over five years to $300,000 before growing more slowly. I don’t know how much journalists make but I’m guessing it is less than I would make even as a fellow.

Sincerely, Conflicted Doctor*

Dear Doctor,

The good news is you have options at your disposal, high income potential, and a manageable debt load from medical school compared to some out there. The way I see it, this decision is more than a financial one, but I’ll show you how I would think about the different options. Seemingly, these are 1) go straight into surgery vs. doing a 2nd fellowship, 2) quit and become a journalist right now, and 3) do surgery to become financially independent then reevaluate.

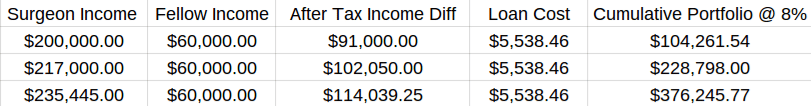

Option 1: Straight to Surgery vs 2nd Fellowship

You are giving up a very powerful income stream by forgoing this route. Based on your numbers of $200k that grows to $300k in just five years, I calculate an income growth rate of 8.5%. For simplicity’s sake, let’s assume you incur half the interest cost from your loans that you do if you do the fellowship since you could pay them off faster with more income. Since 6% of $120,000 is $7200 we are assuming you will get hit with half of that, $3600, because of the slower pace paying the loan back. Also, you must come up with the $3600 extra payment for student loans with after tax dollars, so the real cost is pre-tax; I will gross that up using a 35% tax rate. Since you’ve already completed one fellowship, I don’t expect there will be a significant financial return from doing a second, so I’m going to ignore the potential income benefits from a second specialization. Since the only money you actually keep is after tax I’m taking out money for taxes when looking at the income differential. This means you only keep 65% of the difference in income between surgeon and fellow. I am also going to assume an optimistic but realistic rate of return on investments of 8% as those savings could be invested in a portfolio earning money for you. These are some of the figures I come up with, each row is another year:

Net Cost (Portfolio you give up plus loan costs): $392,861.15

That’s pretty steep. Notice most of it is coming from forgone income. Even if you earned $50,000 more a year because of that second fellowship, on an after tax basis your payback period would be around 25 years using the same interest rate assumptions. We can say resoundingly that a second fellowship is not a good financial decision, barring any massive income increase (>$150,000 over a surgeon salary now) that you are expecting. It could still be a good life decision but I’m just supposed to give you the financial side of things.

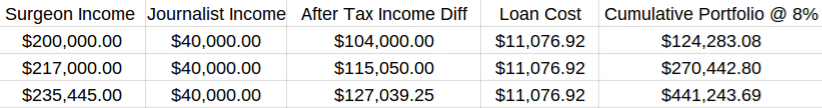

Option 2: Quit and Become a Journalist Right Now

Based on one journalism site, the starting salary for a journalist looks like it is right at $40,000 a year. I am going to assume this would be your income if you went this route. Since the $40,000 is less that you make now as a fellow, I am going to assume that you do not make the interest payments on your loans, so the full pretax hit is necessary to tally up to get an adequate view of the cost. For simplicity’s sake I’m still looking at the income differential with a 35% tax rate:

Net Cost: $474,474.46

As steep as the first cost was, this one is even steeper. Becoming a journalist is a horrible decision in terms of just dollars and cents. Even if you became a Pulitzer Price winner, the income would probably not be enough to make it a neutral decision. Unless you have wanted to be a journalist so badly the last several years of med school and residency and have been submitting articles to your local paper on the side because you just can’t help it, this is not a good option.

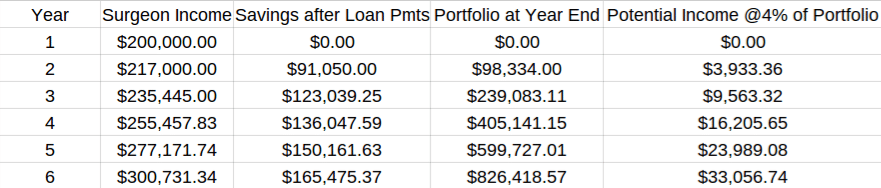

Option 3: Become Financially Independent Then Pursue Dreams

Because I like provoking thought and raising awareness to options readers didn’t know they had, I thought I would throw out this last option as food for the brain. Instead of quitting to do journalism or doing another fellowship, what if I told you that you could be financially independent in a few years and do whatever you want? This is a real possibility according to my numbers. I’m assuming that you are willing to live on the after tax income of a journalist of about $30,000 a year since you are considering becoming one. We will also suppose that you pay off your $120,000 loan with any extra money you have in Years 1 and 2. From that point on, any money above the $30,000 you need to live will be placed in an investment account which we will assume earns 8% annually. When you put money into investments, they have the ability to generate income for you. Most financial people assume you can convert 4% of a portfolio’s value each year for use as your annual income. Here are the figures I get:

Notice by the end of year six, you have enough to “retire.” I think what that really means to someone of your varied interests is that you will have the financial freedom to do anything you want to do, whether that’s write for your local paper, pick up another fellowship, take a risk and start an innovative new practice targeted at lower income communities, or something I can’t even think of. Your options are endless.

To the Doctor Wants to Quit, Here Are My Concluding Thoughts

You have a great problem: multiple options. We’ve looked at doing another fellowship or becoming a journalist and both of these are clearly not optimal financial decisions. If you are going to pick one though, choose the fellowship because at least there is a possibility of extra income over what you’d earn today from the second specialty to make the financial hit far less than the $392k I calculated above, though some negative financial hit is still likely. If you are lukewarm about your other interests like writing or other specialties, try working as a surgeon for a bit. If you can survive for six years you have the opportunity to support your living expenses through investments. That option seems very intriguing to me and it is one that is only available to you because of your high income potential in medicine. Best of luck and congrats on finally being close to the end of your formal medical education! That’s a major accomplishment!

*Reader Note: Emails for case studies that I receive are edited for clarity and to protect anonymity.If you are interested in having a case study done for your situation, message me on the Millennial Moola Facebook page or email me at [email protected]