I was buying a Coca-Cola the other day and that got me thinking how much money I would be losing if I made it a habit several times a day for a lifetime. While I was having these thoughts, I saw the guy in front of me at the convenience store ask for a pack of cigarettes, which he paid for with the crumpled up $20 bill in his pocket. Then I started wondering, sure this Coke would cost a bundle if I drank a bunch of them every day and got obese or had another health complication from all that sugar, but how much would it cost me if I was addicted to smoking?

People are always talking about the health consequences of smoking, but what about the financial consequences? When I ran some back of the envelope calculations, I was stunned that smoking was so much more expensive than I ever thought. I felt like I needed to get these numbers out there so people can share this with family and friends that might need extra encouragement to get over the hump in trying to quit.

Let’s Pick Three Hypothetical American Workers

I want to show how smoking has a different financial impact on various kinds of workers. Therefore, I figured looking at three different types would help show that smoking costs much more than how much you spend at the cash register, and these costs are hidden.

The first worker is the quintessential Suburban professional. She is super busy and stressed out with life, kids, etc. so she turns to the occasional puff to take some of the weight off her shoulders. A pack where she lives costs more than it should but it’s reasonable and she only goes through about two packs a week. She doesn’t run out for smoke breaks at work often, and she mostly enjoys smoking on the weekends or with meals. She is a white collar casual smoker.

The second is a blue collar worker in NYC with a solid union job that comes with good retirement benefits. He is going to get a pension for his years of dedicated service. Everyone smokes at the construction sites he works at, but the high cost of smokes in NYC limits his consumption. I assume he goes through five packs a week since the workday is tough and physical and smoking helps to relieve that toll. The cost per pack in NYC is out of control expensive otherwise the five packs a week might be more. He is a moderate smoker.

The third is a Southern worker that gets the benefits of lower cigarette costs by living in a tobacco producing state. He has a small pension and a little bit of retirement savings. Because the cost is lower, he likes to indulge and occasionally smoke two packs a day, for a total of ten on average per week. He is a heavy smoker.

Assumptions and Inputs for the Simulation

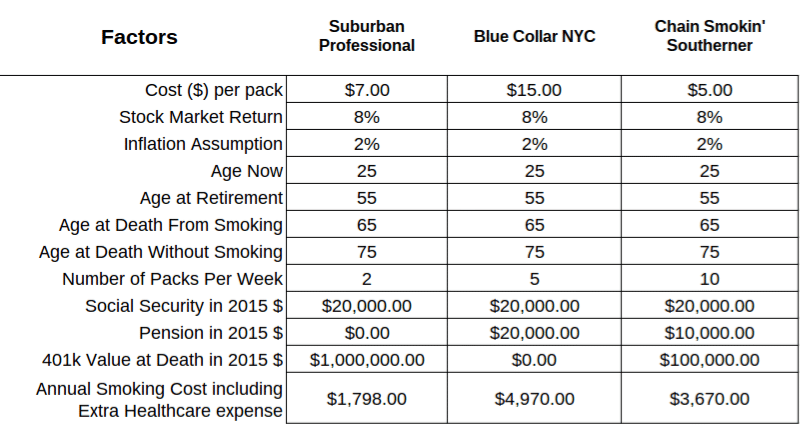

Some of my assumptions will be the same for all three. I am going to use the same inflation rate of 2% and the same return on investments of 8%. I will also say that their retirement accounts growth slows to 4% after they stop working, and that their lives will end 10 years before they would otherwise without smoking per the CDC’s estimate of smoking’s impact on life expectancy.

We will start them out at the same age, 25. I’m gonna say they all work for 30 years followed by a period of 10 years in retirement, with the 10 years of lost life used for calculation of smoking costs. The sources I looked up suggested under Healthcare reform insurance companies can charge smokers 50% more for premiums, so I added in another $1,000 a year in extra insurance expenses. I also checked out a study that suggested smokers face an additional $70 yearly in out of pocket medical expenses not covered by insurance. That seems ludicrously small to me but I figured why not go ahead and assume that is correct. If it’s much larger that only makes the figures look that much worse.

Here are the inputs going into this simulation below:

One extra bit of info I want to explain is the pensions and retirement account values. Just to make things easy everybody has the same Social Security. Our working class folks get a pension of some sort and the white collar professional has a sizable 401k at the time of passing. Both the social security and pension payments during the 10 years of premature death are counted in the financial costs.

I also penalize the spending on cigarettes at the proper rate of how much money you are forgoing by not investing instead. I assume a reasonable but optimistic 8% annual return on money that you could have placed in a tax deferred retirement account instead of buying Marlboros. I take into account inflation, but I only use general inflation. To be honest, I should probably use a higher rate since medical inflation is much higher and cigarettes continue to outpace inflation as new taxes seem to be added every year. So take this analysis with a grain of salt because the actual expenses are probably even higher.

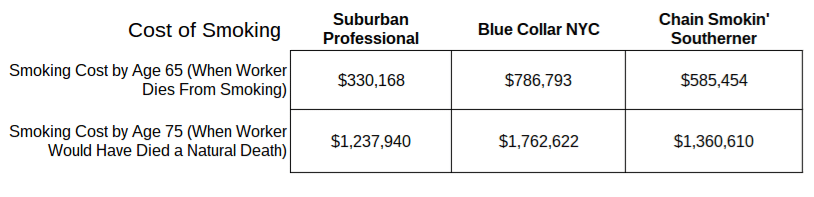

These Costs Blew Me Away, Here are the Results

These numbers show a couple things. First, the cost up until the time of death are highest for the working class folks that spend a lot more on the actual cigarettes themselves. Since they don’t have as many financial assets, the direct cost of smoking is the main primary factor as well as the lost retirement income during the ten years they would have been alive if they hadn’t smoked. The casual smoking suburban professional does not have as many expenses directly from purchasing cigarettes, but endures a much higher tally once we look at the appreciation in her portfolio that never happens because of her early demise.

Presumably the money here would be passed on to heirs after it has grown into a substantial sum, or spent on the family’s well being while the worker is living. For the blue collar guys, their families lose out on 10 years of retirement income coming in from their pensions and Social Security that could make a huge difference in the financial security of the household. The professional worker has a much smaller piece of wealth to pass along for the well being of her offspring.

However you slice it, the cost of smoking for all three of these workers amounts TO WELL OVER $1 MILLION!!!! This is an enormous amount of wealth that is not going to their families or future generations. This money is going straight to American Tobacco companies and the pension funds that get extra solvency from the premature deaths of these workers.

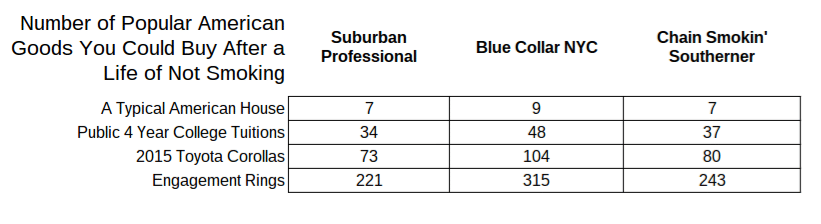

Stuff You Could Buy With All This Money

I figured smoking costs would come in somewhere in the low six figures over a lifetime, but the seven figure number really surprised me. Take a look at the chart above. Our blue collar NYC construction man could afford 9 median American houses over his life if he just quit smoking. To put it another way, our suburban professional could send 34 children to college at a 4 year public university. The chain smoking southerner could afford 243 engagement rings at over $5,000 a pop. It’s one thing to look at the cost in dollars but another to visualize this massive amount of money in terms of other things you could buy with it.

Give Yourself a Massive Raise and Future Wealth For Your Family, Stop Smoking

Cigarette companies are incredible profit machines. Warren Buffett once commented that cigarettes cost a few cents to make, are sold for a few dollars, and people are incredibly brand loyal. Tobacco companies have been very good investments in the past because of these business characteristics.

Politicians bemoan stagnant incomes of the average American worker and rising inequality, but the facts here suggest that getting folks to quit tobacco would do more to combat these problems than Bernie Sanders policies ever could. The next time you are tempted to light up, think about the fat cat executives at Big Tobacco pulling down huge bonuses off the money they are taking from you and your family. I’m hopeful that for those not motivated enough by the known health impacts that smoking brings, the financial impact will give you or your friends and loved ones pause before committing one of the worst acts of financial self sabotage: lighting up a cigarette.

One thought on “I Had No Idea Smoking Was This Expensive”