Stock markets were down 5% this week, in some cases even more depending on what part of the world you are looking at. We have seen oil fall almost 60% from its peak this year, and Emerging Markets are down over 25% from peak. I made the mistake of checking my investment account on Friday, only to see that my losses have been in the five figures in the past week alone. With markets in Asia opening down at least 5% this morning, I should have another solid four digit dollar loss by the end of the day unless there’s some kind of reversal or Fed speak that suggests they are delaying the rate hike that’s coming. AHHHH what should I do!!!! I’m on a Eurotrip right now. Should I sell everything and hurry back to the US before my holdings fall so much that I can’t even afford a plane ride back? One of the most important things to learn when you put a ton of money in stocks is how to love losing money in investing.

Under 40? Losing Money is Freaking Awesome

If you were born before 1975, a stock market plunge should be met with warmth usually reserved for hugs with family and close friends. While this is not necessarily true for me since I’m spending down my assets, most people are not as crazy as me where they attempt retirement in their 20s. You probably have an income that you can put to work in the cheaper markets if you so choose. Check out these examples to see what I mean.

What if I told you that a new Honda Fit could be yours for $15,000? Sounds pretty decent right?

Wait a second. The Honda Fit you were considering buying just got discounted 25%. There might be even more discounts coming on the horizon, or the price could go back up, you don’t know for sure. However, now you can buy the same car for the price listed below:

Which buy would be the better value given that they are both the same car? It’s not a trick question its the car on the bottom where you save $3,750.

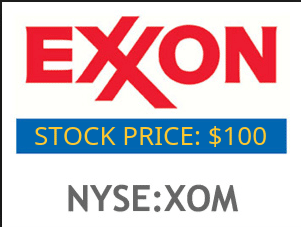

Now for another question, which one is the better deal below:

IT’S THE $72.50 ONE!!! The $72.50 per share Exxon stock has less risk than the $100 per share Exxon stock. However, individual investors constantly act like risk is lower when the stock price they pay is higher. That’s nuts. It’s just as nuts as thinking that a new Honda Fit at $15,000 is a better deal than a new one at $11,250. Exxon has gone from a dividend yield in the low 3’s to over 4%. That alone could pay for your early retirement as you live off of one of the world’s most profitable companies. Could Exxon go broke? Could it go to 0? Of course. However, the entire stock market is unlikely to go to 0. That means if you can find 10 different companies in different industries that look like Exxon and you buy them, you are getting involved in the stock market at far lower risk than you had just a few weeks ago because there is less money to lose.

Say you had $100,000 to spend. If Exxon was at $72.50, you could buy almost 1,380 shares. If you had to pay $100 a share, you would end up with 1,000 shares. Your ownership share of the company is almost 40% higher with this lower stock price (!!!!) That means you get more dividend income, more profits coming to you, more long term appreciation potential, etc. However, most people out there will panic in the face of a market selloff, lock in permanent losses, and behave as if a Honda Fit at $11,250 is scarier than a Honda Fit at $15,000. Human emotions of fear and greed get the better of us. That’s why people like to buy high and sell low, when you are supposed to do the opposite. It’s because people only hear about all the money their neighbor made after the market rose 20% and they can’t miss out, then when it falls they don’t want to lose any more so they bail.

Most folks under 40 are accumulators not spenders. That means every high stock price you pay is a lower ownership share in American corporations that you can sell one day to fund retirement, charitable endeavors, and other financial goals. You should not just hope for market crashes, you should root for them! Pick up stocks on the cheap and benefit while others are panicking. While you calmly max out your 401k, you are gaining the benefit of dollar cost averaging while people around you are dumping cheap assets.

Why I Don’t Need to Panic Just Yet

There are several reasons the length of my Euro trip overseas will thankfully not have to be cut short. The first is that I have control of my budget and am maintaining a very low burn rate. Currently, my average daily spending has been close to $30, meaning I’m out a little more than $1500 for the trip so far, $1800 if you include the airfare from the US to Norway. I have a highly variable spending rate. I could eat cheaper food, use couchsurfing, and hitchhike, but I’ve been living it up instead. If I needed to save money, it’s as easy as making different life decisions or just going back to the Ukraine where it’s really hard to spend more than $15 a day.

Also, I have an adequate emergency fund that can fund about 2 years worth of expenses. Since I probably don’t need reserves this large, I put a little bit of money in the stock market on Friday when I saw a bunch of key indexes down close to 3%. I will likely lose more money in the short term on that investment based on how Asian stocks are opening. However, I am more than willing to be wrong short term so that I can be very right long term. Luckily, I had some money to put to work to put my money where my mouth is. If the markets continue to fall, I might put a bit more into the markets, making sure that I do not dip below 15 months worth of expenses given my desire to maintain adequate liquidity as an “early retiree.”

When It’s OK to Panic (And What You Can Do About It)

If you feel like you will sell all your stocks: That means your risk tolerance is not enough to stomach your current investment allocation. Maybe dial your stock allocation down 10% in your total portfolio so you can regain your sanity and confidence to stick with it. For example you could move from 50% stocks 50% bonds to 40% stocks 60% bonds. While this is the wrong kind of behavior in the face of a selloff, it’s so much better than getting out completely so it’s an acceptable coping strategy.

If you don’t have an adequate emergency fund: Try and avoid selling anything and quietly and calmly work as hard as you can to make extra money to fill it back up again. Pick up any extra hours that are available at your job and see if you can save until it hurts to build up these savings that you’ll need if the downturn gets worse.

You own stocks on margin or wrote put options: This kind of activity in a steep selloff can threaten your solvency. To avoid going bankrupt try and see if you can close out before losing more money. This is one of the few times I would think locking in your loss makes sense because if your account keeps going down the result could be a bankruptcy filing and you don’t want that over what was supposed to be a little fun speculation.

Your expenses are almost all fixed: That’s OK. Just cut down on whatever you can and try to live really lean. The fixed expenses can be covered by your income hopefully so try and use savings to bolster your emergency fund and to invest in the markets above your minimum spending level.

Some Final Thoughts on How to Love Losing Money in Investing

I wanted to share one of my favorite Bible passages because I think it puts things into perspective when relatively non consequential things happen in life like losing money in the stock market.

Luke 12:24-26

24“Consider the ravens, for they neither sow nor reap; they have no storeroom nor barn, and yet God feeds them; how much more valuable you are than the birds! 25 And which of you by worrying can add a single hour to his life’s span? 26 If then you cannot do even a very little thing, why do you worry about other matters?…”

I’m a big fan of doing your best not to worry. Once you are able to laugh off losing thousands of dollars in a few days you can afford to take calculated risks on opportunities other folks would not because of emotions. With emerging markets down soooo much and oil below $40 a barrel, I have to figure low growth in China doesn’t go on forever, the dollar eventually weakens, commodity prices eventually go higher, and inflation goes back over 1%. If any of those things happen someday, we will look back on these different corners of the markets that have been so battered so badly and say, “Geez those prices were good deals.”

Because at the end of the day, if the apocalypse happens your portfolio should be diversified with something with actual value like guns, ammunition, seeds, and the skills to use them. So keep buying stocks as they fall and keep practicing how to grow vegetables because both will probably be good for you long term.