A pension crisis of epic proportions is unfolding in New Jersey right now, but if all you listened to was the presidential campaign trail you’d assume it’s the best managed state in the nation. In fact, New Jersey is a financial disaster. I’m a firm believer that you can’t just worry about your own financial situation as a millennial. You have to look around you and see what’s going on because if you don’t you could wake up one day and wonder how your taxes got to be sky high, or your city services aren’t being delivered, or how people aren’t getting their pensions. It is with this thought in mind that I want to tell you that New Jersey’s pension funds are projected to be totally broke by 2027. By my own calculation, I find the pensions will be empty by 2025. While this problem has been building over the past decade, Christie and his administration have misrepresented the fact that they’ve placed the state on the path to financial ruin by making one of the lowest pension contributions in the country. Now, Jersey’s pensions are about 50% funded using their own ridiculously high expectations for investment returns on their pension fund and the payments the state needs to make to catch up are not being made, so the funding ratio is going to continue to plummet. Let’s find out how this is happening and what you can do to protect yourself if you or anyone you know happens to live in New Jersey.

What Do I Mean That Jersey Isn’t Going to Make Good on All Its Pension Promises?

Right now, everything is hunky dory. Pensioners are getting paid, and there are no obvious payment issues. The reason for this is that if the state did something so drastic as to not pay retirees what they’re owed, they could sue and force the state’s hand to make hard decisions at exactly the wrong time for Chris Christie. If you were Governor and were forced to deal with a crisis now, you could choose aggressive pension reform that would reduce benefits, higher taxes, or some combination of the two. Maybe you could even try legalizing a controversial activity that could bring in sin taxes, and that’s exactly what Jersey did with legalizing sports gambling in 2012 so they’ve already tried that. I guess he could always try and legalize prostitution to get some more money.

To their credit, the trustees of pension funds in New Jersey aren’t sitting idly by as the fund entrusted to their care unravels before their eyes. They have sued Christie over backing off from the needed contributions to save the pension fund long term, and they were temporarily successful when a lower court ordered Christie to make the $1.5 billion payment to the pension fund that he was trying to avoid this year. The Supreme Court of New Jersey came in after that though and ruled he didn’t have to make the payment.

So basically the law of the land has been established in New Jersey. Christie or any other governor in that state in the future does not have to legally make the payments to catch up and save the pension fund. Since doing so would blow up the state’s current budget, it is eminently more attractive for a short sighted and unethical politician to kick the can down the road and do nothing while the future for Jersey retirees gets worse and worse, with little that can be done to change it down the line. So basically as the funding percentage of the pensions continues to decline, the state is setting itself up to aggressively cut pension benefits in the future. I feel like every public servant in New Jersey needs to know this, especially those in my generation in their 20s and 30s so they can drop out of the pension fund that won’t exist once they retire and take their financial future into their own hands.

How Did It Get This Bad

As recently as 2008, the pension fund was about 75% funded, certainly not a great level but not a bad one either. A fiscally sound funding ratio is about 80% because you can always play around the edges with tweaks and contribution changes to catch up easily all while giving yourself extra money for general rainy day funds. To be fair, the road to ruin has certainly been bipartisan.

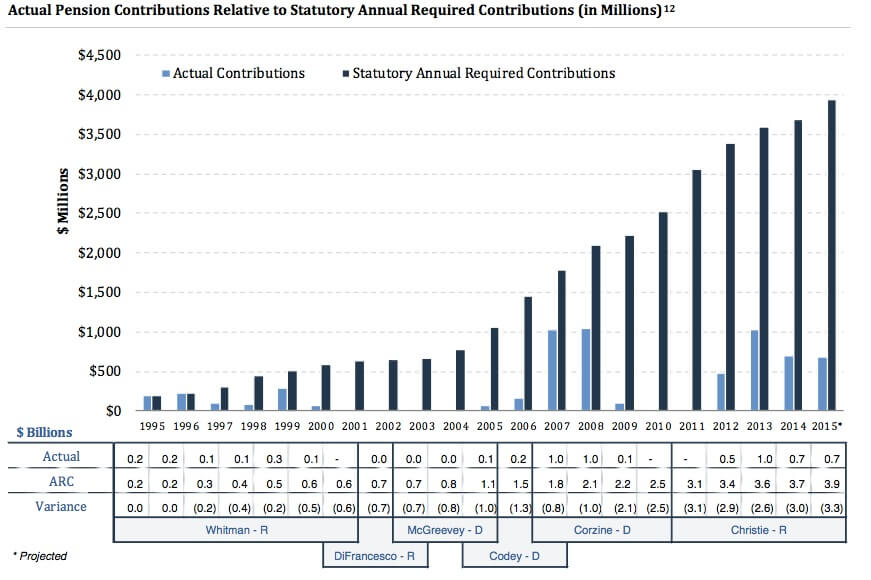

Look at the Variance part, that’s the most important line on this graph above. The actual payment is what the state contributed to the pension fund, which is represented by the light blue bars above. The ARC is what professional actuaries (the guys that do the math on retirement stuff) say the state must contribute to gradually get the fund to stable footing over time, which is represented by the dark blue bars above. Notice how Whitman began the process in the 90s of underfunding the pension so there would be more money to spend on other things. In other words, Whitman used a slight bit of dishonesty to juice the coffers and allow for tax giveaways or more social spending. McGreevy came in and was even worse, allowing the shortfall to double in actual dollar terms. Then Corzine comes in and the recession happens and he decides ok we’re not going to contribute ANYTHING to the pension. Christie comes in and has the political cover to say ok my predecessor didn’t pay up why should I have to? However, unlike Corzine the national economy was improving so that should have been the time that Christie manned up, faced New Jersey and said ok we have tough choices to make, and we got to take care of the pension fund or it’s going to mean financial disaster.

What Did Jersey Do, and What Can It Do Now?

So Christie actually did make an effort to fix the problem in 2011, or at least that’s how it appeared at the time. He went to the pension funds and said hey here’s the problem the state has no money I can’t raise taxes anymore because we have the seventh highest income tax rate in the nation. Because of these problems, you need to accept all these reforms and changes to the fund and I promise in exchange I’ll increase the state’s contributions to get us to 100% of what the professionals are telling us that we need to pay to keep the fund around for the future.

Instead, he did a dirty trick. He got them to agree to suspended cost of living adjustments, increased worker retirement ages, and higher worker contributions, and then didn’t live up to his side of the bargain. He was supposed to increase his payments as a % of that ARC payment (the thing that says what they need to pay every year to keep the fund around). He in fact did the opposite. The projected shortfall between what he’s planning on paying and what he is actually going to pay is the largest in state history, at $3.3 billion according to pension360.org. What does he say on the campaign trail? He tells a “truth-lie,” which is something I’m defining as something that’s technically true but is knowingly deceitful. He stands up on the podium and tells people “I’ve made the biggest contributions to the pension fund in New Jersey state history!” Technically if you look up at the chart that’s true. However, the REASON IS THAT THE PAYMENT SHORTFALL IS EXPLODING AND HE’S NOT COMING CLOSE TO CATCHING UP. It’s like someone that just bought a mansion who starts making partial mortgage payments and then brags about the absolute dollar amount they’re paying to the bank. It doesn’t matter what you’re paying. It matters what you owe.

Christie Has Been Sacrificing New Jersey’s Financial Assets for Money Now To Make Him Look Good Today

I used to like Chris Christie. I even thought that he would be a good candidate for President when there was chatter about him running in 2012. My three years in the investment industry where I traded municipal credits and saw how he sold off New Jersey’s future totally changed my opinion of the guy. He’s a disingenuous politician that deceptively uses information to try and sweep massive problems under the rug to make it someone else’s problem when he’s not in charge anymore. If he’s not around to take the blame when the shit his the fan, I’m sure he’s thinking he could still win a seat in the Senate or the House as long as he keeps his nose clean from the mess.

One of the moments I’ll never forget in my career as a bond trader was when New Jersey decided to give a hedge fund $100 million in profit and a bank millions of dollars in fees to sell off a $400 million stream of cash flow for $92 million today. Yes you read that right. I don’t blame the bank or the hedge fund because they acted properly in the deal. They presented their case to New Jersey without any wrong doing or favors involved. They just presented their idea that would make them rich if the state was foolish enough to accept it. The hedge fund’s job is to protect their investors and make money. The bank’s job is to do deals and make deals happen when there aren’t any around. The state’s job is to protect its own interest, but the problem was that it is run by an administration looking for all the gimmicks and tricks they can find to make the state looks better than it actually is, and they are willing to give away the future to do it.

So how is this possible that New Jersey did something like this? There’s an excellent article detailing all of the intricacies of the deal and why they thought it was a good idea from ProPublica here. The background story is that a bunch of legal battles a few decades back forced tobacco companies to make payments based on cigarette shipments to states around the country to make up for higher health care costs caused by smoking. Many of the states sold off this future income stream in exchange for money today. For many states, this actually worked out ok as the resultant cigarette shipments and thus expected future payments decreased as fewer people smoked. Jersey was one of these states that had issued really long term bonds based on payments that were supposed to come in way off in the future. These long dated bonds collapsed in value as cigarette volumes decreased every year faster than expected. The bonds as recently as 2011 were trading at 5 cents on the dollar and were considered almost a sure bet to default and be worth very little.

In comes Claren Road Asset Management, a hedge fund firm specializing in distressed situations. It buys up around 95% of one of the main bonds for 5 cents on the dollar and then goes to the state with its idea. In exchange for giving them $100 million today, the state will pledge the $400 million they are supposed to be paid from the tobacco companies from 2017 to 2023 to new bonds that are going to be issued and sold to the hedge fund. The state would get the supposed benefit of getting access to the $1.6 billion that would have had to go to the defaulting long dated bonds in 2041.

So basically the state bought back these junk bonds for triple the price the hedge fund paid for them, and then sold them new bonds that were way better at a slightly higher price, which the hedge funds immediately resold for another nice profit. If I were an institutional investor, I’d love what Claren Road did, because they did their job. They are not supposed to watch out for New Jersey, because the state officials are supposed to do that. After fees, Jersey only got $92 million for giving up rights to $400 million in payments starting in a few years that sure would have come in handy as that’s when the pension problems are going to start getting really bad. As for the $1.6 billion taxpayers supposedly saved, first of all it’s way off in the future when the pension situation is going to be a non issue because it will have blown up by then or have been fixed somehow, and second that payment is likely going to be a fraction of that amount because more and more people are stopping smoking every year. Also since the money is so far off into the future, you have to discount the value of it and it’s really not worth nearly as much as it sounds, but it’s a great way to sell a deal that you’ll make millions of dollars on to public officials that suck at math.

So a hedge fund made more in profit than the state received in proceeds for rescuing a bottom of the barrel junk bond. The state said they did it to protect their reputation with investors, but when I was trading at that time the 5 cent tobacco bonds were already expected to default and the state’s credit was trading ok. Now the state’s bonds have fallen all the way to junk level status, trading worse than even the state of Illinois. Clearly the market spoke on this deal and it said that Jersey officials were a bunch of idiots, or desperate for money to plug budget holes at any cost to make a certain Governor look good in his run for President.

For further evidence that the Christie administration is willing to do anything to look good now, they started using the New Jersey Turnpike as a cash cow for the general fund. That’s not how it’s supposed to work. They are supposed to use the toll collections to fund projects to improve New Jersey infrastructure. Instead Christie used his own appointed officials to approve a $1.25 billion transfer to the state’s general fund. This action forced the legally separate Transportation Authority to borrow over a billion to make up for this shortfall in what used to be a sound agency. Also, he got the Port Authority to give him $1.8 billion from its funds to pay for various projects that he would have had to pay for himself otherwise.

So in addition to making really dumb bond deals that sell off the state’s future assets, Christie is robbing all of the transportation trust funds and using toll increases meant to cover construction projects to meet current operating needs. He is tapping the Turnpike for all its worth, because that’s the last asset in New Jersey that’s worth anything that has any ability to print enough cash so he can do just enough to get out of office without this thing exploding in his face. He’s hoping it will appear that it was someone else’s fault down the line.

New Jersey is a Financial Disaster, Don’t Rely On It, Rely on You for Your Future

Like I mentioned earlier, New Jersey has one of the highest tax rates of any state in the country at 8.95%. As anyone that lives there knows, the property tax rates are also sky high. The sales tax doesn’t have a lot of room to be raised, and the tolls on all the roads and bridges have been jacked up and are going towards keeping the House of Cards from crashing down for the next couple years so Christie can run for President or maybe get a consolation prize in Congress. I’ve written a piece on how Chicago is in dire straits as well because of exploding pension costs, but the good news there is that taxes are low enough that they could potentially be increased to fix the problem if the political will existed. In New Jersey, that’s not an option. With such high taxes, any more increases could legitimately result in lower revenue as residents and businesses could easily relocate to another state in the big metro regions where all the people in Jersey live. That means an exodus into Delaware and Pennsylvania in the South and New York and Connecticut in the North.

I haven’t even mentioned the icing on the cake yet. New Jersey’s pension fund, like many in this country, assumes it can get an 8% return over time. This assumption is more likely than not to be impossible. Bonds right now barely yield more than 2%, and it’s almost mathematically impossible for bonds to return more than that long term. Most experts predict the stock market will give us 6 to 7% over the next 10 years, lower than the long run average because of higher valuations thanks to the Fed’s easy money policy. That means if Jersey put 100% of its pension fund assets in the stock market, most experts expect it to fall between 1-2% short of the needed return to maintain the already bleak picture I painted for you here.

What would you do if you want to run for President, have record pension shortfalls, and know that if you lower your pension fund’s assumed rate of return it would cause things to spiral out of control even more? Increase risk in your pension fund and double down, and that’s what Christie has done. Investment fees paid to Wall Street managers grew from $125 million to $400 million over 2009 to 2013 since Christie took over. While those numbers are eye popping, they’re not actually the problem. That fee increase tells me that he’s drastically increasing the pension fund’s exposure to private and alternative investments like real estate, hedge funds, private equity and venture capital. These strategies have higher risk reward profiles where you could get the return you need or really get burned.

So if things work out great with New Jersey’s investment portfolio, then the pension fund in Jersey is screwed. If the investments underperform and the bond market sells off and increases New Jersey’s cost of borrowing, the state could implode in the next couple of years.

If you live in New Jersey or know someone that works there, I would do everything I could to make myself mobile and able to move if a court rules that massive tax increases are necessary in the future to make up for the sins of the past. If I had a business there, I would think of backup plans of other states I could move to in case public services needed to be slashed to make pension payments to retirees once things go bad. If I was a teacher, fireman, police officer, or other public servant in New Jersey under 40 years of age, I would do everything in my power to not contribute a dime to the current pension fund, as the money is keeping a sinking ship afloat and future benefits are surely going to be lousy compared to the past. On top of tens of billions in liabilities for future pension payments, New Jersey also owes even more than that for future retiree health care costs. So the problem is even deeper that just pensions. The total structural deficit Christie is running right now is over $10 billion.

New Jersey’s only option down the line is to declare bankruptcy and find out what happens or cram down a much more painful reduction in pension benefits. At the rate things are going, if you’re under 70 years old and you work or live in New Jersey, get ready for financial catastrophe in a couple years unless the State owns up the magnitude of the problem right now and is forced to do what’s necessary to do a package of reforms and to increase the state’s pension contribution so the system can be saved. I know Chris Christie is hoping to be out of town at a Cowboys game with Jerry Jones by then.

Stay vigilant and know that you are the best protector of your own financial security!

Travis