Home prices in the Bay Area have literally doubled in the past three years. This absurdity has been wrought on us by a combination of a continuation of easy money by the Fed and the biggest private and public market tech bubble since 2000. You should not buy a house in San Francisco unless you enjoy declaring bankruptcy and losing money.

Other Evidence There is a Bubble that Could Pop

This is a 2 bedroom, 1 bath 950 square foot home in Menlo Park, Granted, that city is full of super educated tech workers and has a fantastic climate, proximity to companies with super high paying jobs, and one of the more exclusive zip codes you’ll find in America. However, even with that knowledge based on what you see, how much do you think the price is? $300,000? $600,000? You’d be way off. The listing price is $1,099,000 (!!!!!!)

The same home in Ocala, FL where there isn’t nearly as much economic activity but a comparably nice climate would cost maybe around $100,000. You have a 10x multiple being placed on location, and it’s being driven by the massive payouts that have come in the last three years for tech talent in the Bay Area.

How the Private to Public Tech Pipeline has Fueled the Insanity

Every deal coming from Silicon Valley has seemed bigger than the last one. If you can believe it, Instagram was sold to Facebook back in 2012 for a measly $1 billion. Google followed up with Waze a few months later for $1.3 billion. Whatsapp got snagged by Facebook for $22 billion, Snapchat had a funding round that valued it at $16 billion, and Uber’s financing rounds have place it with a $40 billion + valuation. The dollars per exciting startup idea have soared, bringing up all the other random tech company valuations along with them. With the successful tech companies having such massive prices, the scattershot investment strategy of venture capital firms has raised prices of bad startup ideas as well since these firms are willing throw money at a lot of companies they never would have before.

Public IPOs have also been a way to get company employees paid, as with Facebook and Twitter. All this money has been poring into the pockets of Valley residents and they need something to do with it. The least imaginative thing to do is to drop it on a house, and that’s why prices have skyrocketed, because you have a limited supply constrained by extreme regulation that you find only in California being chased by extreme demand.

The problem now is new employees at big tech companies are on the wrong side of 80 times earnings like with Facebook, and they have way less upside that their early stage brethren. To go along with this lower ceiling for a big payday, they are also dealing with sky high real estate prices. What I think will happen is that you’ll start seeing reach purchases where Facebook and Google employees start paying 4 times income plus bonuses for housing and they will include their significant other’s salaries as well to get them to qualify. Someone making $250,000 a year barely qualifies for a middle of the road house in the Bay Area right now. In other words, you could be a 1%’er and be homeless. That’s how ridiculous things are.

Another key metric is the Price to Rent ratio, which is way out of wack in SF. Some of the places in the downtown area might rent for $3000 to $4000 but be worth $1 to $2 million. That extreme ratio means there is no income to cushion a fall in home prices.

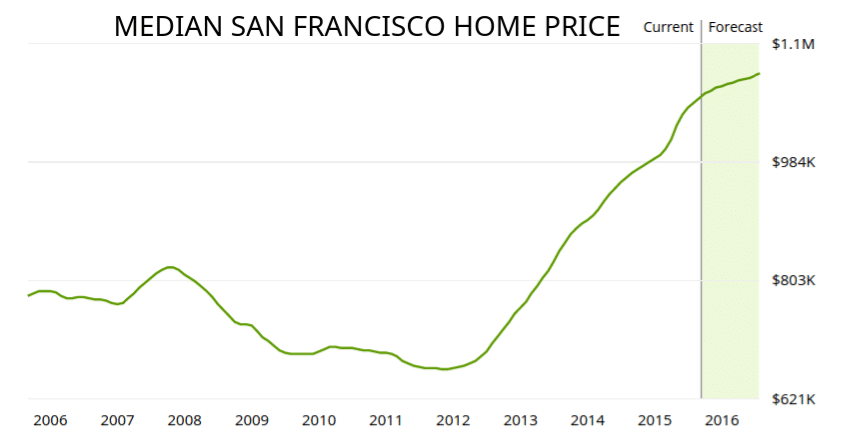

The Zillow chart above shows housing prices in SF have doubled in three years. Given real estate prices are supposed to advance at the rate of inflation long term, per Robert Shiller and other notable academics. Therefore, a 33% annualized return is totally unsustainable and should be a giant alarm bell going off that says the market is overheating in an extreme way.

Quick Thought on Why Tech is So Hot Right Now

I’ve written about this before, but the reason tech has been on fire the past few years is because of the extreme policy of low interest rates. The Fed has set the stage for another bubble, I just don’t know how violently it will pop. If you’re an investor and you have the choice of letting you money sit and do nothing, you would prefer risk taking, which is exactly what the Fed wants to have happen to support prices of risky assets.

Because interest rates are so low, any long term projects that have earnings way out into the future become extremely attractive because the discount rate you use is also very low. Hence a dollar of earnings in 10 years thanks to the Fed is almost as good as a dollar of earnings today. Since a normal interest rate regime might see investors willing to pay something like 25 cents for an expected dollar of earnings in the future, you can see how valuations have tripled in tech in the past three years as investors became convinced low interest rates were here to stay.

Higher Rates Mean Tech Will Fall, That’s Why You Should Not Buy a House In San Francisco

I don’t know when it might happen, but higher interest rates will almost certainly happen in the next five years. Since that’s the typical time frame as to how long you need to be in an area to justify buying a house, anyone buying right now will be affected by how higher rates affects the real estate market.

When these higher rates finally come, investors will look at capital commitments to tech and say, ok I can make more on my risk free assets now, so I’m going to discount ABC Tech company’s future earnings at a higher rate. This causes lower valuations, lower stock prices, and lower payouts to employees, which means fewer dollars chasing real estate.

I predict the crash in Bay Area housing happens not with a whimper but with a bang. When people suddenly don’t have enough money to buy a house, the prices will plummet. If you bought a 2 bed 1 bath house for $1 million how much do you think you could lose on it? $200,000? $400,000?

Since tech was already highly valued in 2012 when this rally began, I think you could lose at least $500,000, or half your purchase price. Since your job and stock options are likely to be similarly devalued at the same time, someone buying a median house with a $300,000 income right now in San Fran could easily be forced into bankruptcy by this situation.

On the other hand, housing prices could keep going up for a couple more years if the Fed leaves rates unchanged. However, prices almost certainly won’t go up like they have the past three years because rates can’t go any lower and cause more tech froth. So the downside is maybe 50%, and the upside is maybe 10-20%. That’s a terrible investment bet.

So if you are in the Bay Area, rent don’t buy. There’s almost no scenario in which you should purchase a home unless you like going to casinos and betting on odds that are stacked horribly against you. When the public and especially the private tech markets finally fall, Bay Area housing prices will fall too. Don’t let yourself be victim to a double whammy of loss of income and loss of assets through bankruptcy because you lose $500,000 on an overpriced home. That is why you should not buy a house in San Francisco.

We just left Los Angeles because of similar insanity. Of course it isn’t as bad as SF but it’s still pretty dang crazy. We got a great house in Southern Georgia about an hour north of Tallahassee, FL for 145500 that’s 1550 sq ft w/ a 2 car garage, and .35 of land. (3/2 and needs some updating but it appraised for 170k so I think a nice kitchen reno to open it up, new flooring, and a little updating in the bathrooms would allow us to get good returns on these upgrades).

A much smaller house a year or so ago that was beyond needing an reno (more like a total gut job),it may have had a garage but probably didn’t, barely any land outside the home in the valley was asking 400k. I feel like it probably went for way more than that and probably needed 100k to be livable (looked like a lot of squatting had happened for a very long time and there was a lot of mold and overall just rotting look to it). And that was the cheapest freestanding house within an hours commute of hub’s job. Palmdale was affordable but with green traffic it was over an hour and you had to be on the 5 to get to his job. I haven’t checked in over a year but I’m sure even palmdale prices are going up.

It’s insane there. People have lost their minds. I have NO idea how people can afford it there and they don’t have insane salaries because they work in hot industries. Most of hub’s coworkers (engineers) RENTED their homes for the last 10+ years and that rent wasn’t cheap. We had to leave and start over here on the east coast to ever make any of this make sense. We can pay $500 extra on the mortgage and be done with this mortgage in about 13 or so years. (we have a 30 year mortgage just in case things get weird).

And renting was getting more insane every year that we were there. Living there not on an inflated salary for tech or entertainment industry means you will have such a hard time getting ahead. It’s just hard and gets harder every year. I don’t know if the LA market will crash and if it does when it will but I’m just happy to have a house that we can so easily afford and can move on with our lives and introduce kids to our family soon. I just feel for everyone else there working a normal job and worst of all those working a minimum wage job.

California real estate policy is a very frustrating thing. Basically current landowners rights are prioritized over creating true affordable housing. Any initiatives you see to create “green space” are actually to block further development and constrain the housing supply in San Fran or LA. The idea being to financially reward current homeowners. Eventually the tech sector is going to fall back to earth and it’s gonna get ugly. I just don’t know when.

Is you take on this still the same to that day? It looks like the market keeps going up despite all the political drama we’re going through, especially true with tech.

I’m wondering if you also consider the FANGS to be exposed to those risks?

Currently in the situation of thinking about buying a home in the bay area and realizing the insanity of dozens of offers with no contingencies and final prices ending up 40% above asking price, what would you suggest as an alternative or investments to do with the cash we had dedicated to a down payment?

It is this paradoxal situation of feeling poor while having a big chunk of cash and not knowing where to go from there… If housing would crash and I suppose the stock market would be dragged with it, what to do then?

Any idea would be greatly appreciated!

Hey Philip. My first thought is being debt free. If you’re in that position then you’re better protected against financial calamity than the majority of Americans. Second would be having a generous emergency fund, possibly allowing you to go to a foreign country and travel some while the world is so bad off economically.

On savings above that, I’d say dollar cost averaging into a balanced portfolio if you’re planning on being financially independent and early retiring, or just a split between US and Intl stocks with the bet that you’ll be buying stock on the way down. If you’re in a high income high beta profession like tech that’s tied to the stock market, I’d have a lot more in bonds and be protecting myself against the eventual tightening that will come. Obviously calling the top of the market is impossible and it’s only gotten worse. That doesn’t mean I don’t stand by my original analysis. I think it’s just when not if the San Fran bay area market comes back to reality, and that will start when stock options at all these early stage companies are not nearly as valuable.