Thanks to Moola Reader Bryan for these questions about how to retire early. I’ll answer them below. Hopefully I can do several more of these kind of quick hit answers to your financial questions. If you have some that you’d like to see me respond to , email me at [email protected]

1) What do you say to emergency expenses and end of life health care cost increases?

2) The 4% rule supposedly gives you a safe, constant, indefinite income. That might be ok if you’re 50 or 60 and only plan to be on it for a few decades. If you’re 25 you’ll be relying on that income for quite a lot longer, and over that time span inflation will kill a constant income.

The Millennial Moola Response on How To Retire Early

- Emergency expenses and high health care costs can wreck your retirement for sure. It’s totally right to wonder what will happen if you suddenly have a $4,000 car repair bill or need early entry into a nursing home. The good news is there has never been an easier time to deal with large unexpected expenses than right now. I’ll deal with emergency expenses first then talk a little about end of life health care costs.

The difficulty with unexpected bills is figuring out where you can get the money in a hurry. If you put all your eggs in the stock market basket, you might be forced into selling some of your holdings at very low prices to meet financial needs. That’s why if you ever plan on retiring early, I would have at least one year’s worth of expenses in the bank. If you ever need a surprisingly large sum, you will be able to avoid giving away other assets you own at fire sale prices. In my first seven months of early retirement, I have tried to keep at least $10,000 in cash just in case something happens that I wasn’t expecting. The lesson here is just to build up your emergency fund. That’s universal advice whether you’re a medical student or successful businessperson. If you’re working, you need 3 to 6 months expenses stashed in cash. If you’re retired early, then I recommend at least a year’s worth of expenses in a bank account to feel secure.

The typical behavior of Americans is to save little to nothing. When a big expense hits, they must turn to credit cards or payday lenders. Since they do not have any savings built into their budget to begin with, it takes them a while to pay off these loans, so they rack up a lot of interest charges. Because most people who go to usurious loan sharks have low credit scores, payday lenders charge really high rates of interest because the customers have little in the way of collateral to secure their loan. These high interest charges are why emergency funds are so important. You could easily be stuck with a 20% payday loan if you don’t save for a rainy day, and that obliterates any investment return you might get for the year.

As for health care expenses, I know the reader asked about long term care expenses, but I want to start with discussing health insurance in general. When I signed up for the ACA Bronze Health Insurance plan this December, I qualified for a $0 a month premium based on my income. This plan will protect my assets by limiting my out of pocket medical expenses to a set, predictable number. Because I went with the Bronze plan, the deductible at over $5,000 is pretty high. However, if I get a devastating illness or another mid five figure medical bill in an auto accident, my losses are limited instead. If I had no health insurance, a hospital could rip me off AND go after my entire life savings. Thank goodness their reach into my pocket is now restricted.

If I really wanted to protect against catastrophe, I could have used cost sharing and signed up for the Silver plan, which carries a lower deductible. Because of the premium subsidies, health insurance expense varies with your income. So if you are an early retiree with nothing but dividends to sustain your lifestyle, there is a good chance you will be getting health care coverage for free. I make no moral judgment as to whether or not the ACA is right or wrong here. My general belief is that you should use all legal programs, loopholes, and subsidies as an individual. Your opposition to an expensive new welfare program will not matter when we have to write the check to China 30 years down the line. By taking advantage of the Affordable Care Act and hacking all its provisions for your benefit, you ensure you’ll at least get some return on the ridiculous taxes we will have to pay in the future.

Now for long term care costs, which the reader was initially interested in. If you become disabled, Medicaid and Social Security will provide you with a base level of support. You will be in some lower income, government supported nursing home, but you will not be on the street. I have seen loved ones live in a variety of these facilities. The ones supported mostly by Medicaid are generally of poor quality. If there is one way to improve your quality of life in your golden years, it might be by spending a little extra on a nicer facility where the aides and nurses check on you more than twice a day.

We all have heard how expensive long term nursing home care can be, so why do we not hear of more struggles when the elderly have to go there? We know that people don’t save, so how can they afford it? A little known fact about Medicaid is that it is essentially a middle class nursing home entitlement. If you look at the breakdown of the program’s budget, about 25% of the total is spent on JUST long term care. There is literally $118 billion a year that pays for middle class retirees who didn’t save enough to stay in nursing homes and assisted living facilities. Like I mentioned before, these places are not usually that nice, but they are staffed by people who will regularly check on you, do all the cooking, help you bathe, get dressed, etc. So there is no scenario where you are out of luck on the side of the street in your older years. The only requirement for using Medicaid nursing home subsidies is that you can’t really have any assets. The money you do have gets spent down first, then the program kicks in. So if you have any elderly family members, it would pay to sit down with a CPA to learn about asset transfer opportunities. Otherwise the nursing home will run through it all.

Long term care insurance policies are popular products with financial advisors. Most of my experience with insurance has been mediocre at best. I do not trust that an insurance company will be around in 60-70 years when I might need long term care. Furthermore, I do not trust that the company with my premiums. Their business model is that they take your money, invest in the stock or bond market, and in 60-70 years the earnings from that money should be enough to pay for my long term care. Even better, if I die early, all that premium money is just gravy for their shareholders. I like saving for long term care by investing and saving aggressively. If you think about most people relying on Medicaid for support, there will always be a well developed market for people that can pay. As long as you don’t need to live in NYC or South Florida, the nursing home fee will be expensive but not outrageous. If I die early and do not need long term care, the higher assets I saved will go to charity and family instead of lining the coffers of an insurance company that might be bankrupt by the time I need them.

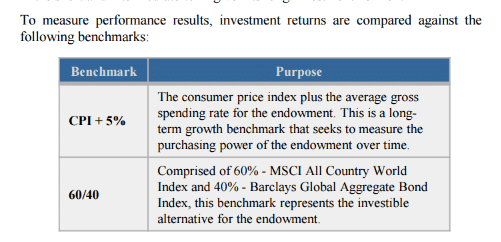

2. Questioning the common 4% rule for retirement spending is smart. You are right that the famous Trinity Study that made the 4% rule popular is based on retiring in your 50s and 60s. However, one only need to look at endowment funds at colleges and universities to see a perpetual spending level is possible. These huge pools of money invest with an unlimited time horizon. Of course they have access to hedge fund and private equity opportunities that you won’t as an individual, but most of those are overrated anyways. I estimate that my university is paying around 3% annually in fees for investment management. Consider the clipping I pulled from their website below. Look at the CPI + 5% box and read it.

Their goal is to produce 5% ABOVE the rate of inflation every year. My goal in early retirement is produce 4% ABOVE the rate of inflation every year. They are using exotic investments and alternatives with high expenses. I’m using index funds with rock bottom expenses. I feel better about me hitting my return assumption then them hitting theirs long term. If you look at pension funds, they expect 8% returns, which is a total joke that will result in the implosion of multiple state retirement plans some day. You do not want to spend 4% of your portfolio then adjust it up for inflation every year because that has a lower probability of working. Just take 4% of your portfolio value at the BEGINNING of each calendar year and put it in the bank. It will go up and down like the stock market, and the down years where you pull out less will preserve your portfolio long term. If you want the technically defined withdrawal rate at which you can retire indefinitely at any age, check out this article from James at Second Forge where he determines the safe level for 70 years + in retirement is around 3.65% with a success rate of 99%.

When you spend your assets down, you are shooting for a 4% REAL return that you spend. The other 2% is inflation that should be reinvested in the portfolio. So you are shooting for a total of about 6-7% a year in returns. Your goal should be to spend only 4% of the 6%-7%. That’s how you keep up with inflation. Obviously in this low interest rate environment you cannot have that many bonds to achieve this, but to retire by 25, that’s a risk I’m willing to take.

Have any thoughts, questions, insults, or differences of opinion on emergency expenses, long term health care costs, or the 4% above? Comment below!

Thoughts on long-term care:

1) It doesn’t make sense for someone in their 20s but definitely does for someone once they hit their 60th birthday. The statistical probability that you’ll need a nursing home starting at that age go up significantly, and the horizon of premiums is 10-15 yrs counting on today’s life expectancy (rather than 65-70 yrs if you are in your 20s today). Get low premiums by shopping around and getting a benefit that suits your care preferences. It make sense for many who would rather not go with the government provided accommodations. I’ve seen them and I would rather not use them if I can avoid/afford it.

2) Be careful with Medicaid-motivated asset transfers. It technically is fraudulent to transfer assets for the sake of qualifying for Medicaid, and the government can go back up to 5 years anyways and undo any financial transaction to claw-back your assets. Pretty huh?

P.S. Good job on milking the ACA 😀

I find it interesting though that the financial administrative folks at my grandparents nursing home were basically encouraging them to give away all their assets over the course of a couple years to prevent the Feds from viewing it as a fraudulent transfer. Long term care policies are great in theory, but they survive from investing the premiums. If they do this badly, they will go bankrupt and not pay. If long term care prices rise faster than their models predict, they will also go bankrupt, or at least try and weasel their way out of paying what they promised. Maybe if you’re a middle class person with modest assets and a pension, a long term care might make some sense. For everyone else, I think it’s best to save a ton in your 20s and 30s and self insure.

Also has anyone had an experience where their grandparents had a long term care policy and it worked out?