Back on June 30 in “How Tech Workers Can Get Ready For a Coming Crash“, I predicted that a tech stock crash was coming. My rationale was based on the huge size of many of the largest tech companies relative to their earnings. I profiled 11 household names and looked at how they were trading relative to their earnings. I took particular care to warn that many of these big tech names were losing money and could collapse in value. Let’s see how I did.

My Reasons For Believing There’s a Tech Bubble

The house above screams tech bubble to me. It’s a 2 bedroom 1 bath in Menlo Park, listed for $1,099,000. It’s 950 square feet. No matter how strong the labor market is or how perfect the weather in California, that’s a ridiculous price. I wrote about the San Francisco area real estate market in “Why You Should Not Buy a House in San Francisco.” My main thesis is that any property market where the median home value has doubled from an already high level in the past three years is an extremely dangerous place to be a homeowner.

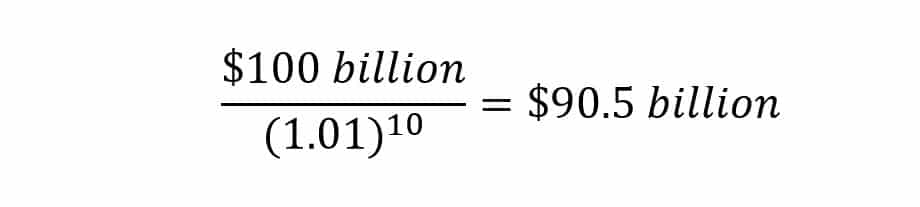

My belief in a bubble extends beyond simple reasons like an inflated property market or highly valued stocks without earnings. The Federal Reserve over the past few years has pumped trillions of dollars into the economy and driven interest rates to near zero levels. When you push the cost of funding to basically zero, prospective gigantic future profits way off into the future do not get discounted almost at all. So if Facebook is going to make $100 billion in 10 years and the discount rate is 1%, how much should you pay for those earnings today?

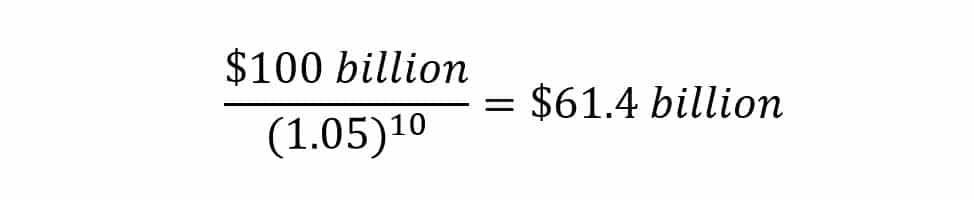

What if interest rates were at more normal levels? How would you value future earnings today? You would need to discount future profits more heavily because of the income you could have earned parking your money in risk free government bonds. When interest rates are so low like they are now, that analysis does not matter very much. However, when treasury bonds pay 5%, you have to do some major discounting on future dollars earned by companies. Let’s look at that $100 billion earned by Facebook in 10 years and discount it by that 5% interest rate instead.

Assuming that these earnings would be added onto Facebook’s valuation, we just wiped off $30 billion from Facebook’s stock market value and all we changed was the interest rate. This example is overly simplistic. First, you would have to take into account many years of earnings not just one. Also, the discount rate is not 1% or 5%, it’s dependent upon many factors. Basically, the market discounts earnings of companies like Facebook based on how risky they think they are and the level of interest rates. Tech company valuations could get slammed going forward as interest rates rise and capital becomes more expensive due to a perceived increase in tech company risk.

Imagine if all the future streams of tech company earnings were discounted more heavily. All tech stocks would fall, and they would fall by a lot. That’s the crux of my argument. Most tech companies now have little to no earnings, thus their valuations are all based on high expected future profits. When these profits get discounted more heavily, these stocks should crash. Notice that this price movement is independent of the success of these companies in the case of a rise in interest rates. Facebook and Google could still deliver the next big thing in this scenario and still get whacked. Now that I’ve explained why I made the prediction I did back in June, let’s look at how I did.

Tech Stocks and the Stock Market in General Got Hit, But That Doesn’t Tell the Full Story

The impetus to do this review article was the collapse of LinkedIn. It fell by 43% or so on Friday and I wanted to see if the rest of tech had fallen as well. One way to look at this is the performance of the Vanguard Technology ETF, which invests in many of the big household names in tech. When I made my prediction it was at 106.23, and on the close of trading on 2/8/2016, it was at 94.67. The right comparison is the Vanguard S&P 500 ETF. When I made my prediction, it traded at 188.84. As of close of trading Monday, it was at 169.94. So tech fell 10.8% and the broad stock market fell 10%. That negative performance seems to suggest there’s nothing to the story. However, you would miss what’s going on if you didn’t look further into what the individual companies are doing.

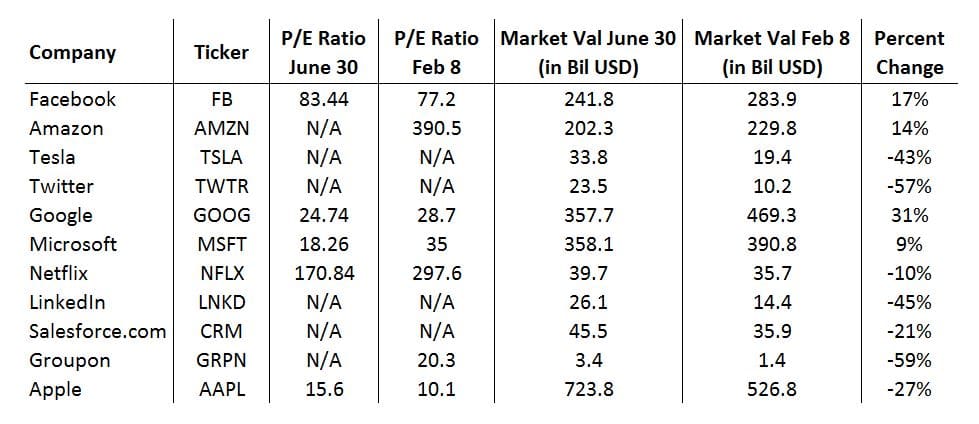

A Look at the Individual Companies I Highlighted

Note that with the exception of Apple, all the huge tech companies did very well. The rest of the smaller household names got slaughtered. Look at the companies without earnings, signified by the N/A. As a whole they performed much worse than the companies with earnings.

Here’s what I think is going on. The largest companies are weighted really heavily in index funds, which is basically what you see reported on the evening news. Since so many huge tech companies went up in price, they shielded the performance of the small tech companies, which got crushed.

Why Is Huge Tech Going Up and Smaller Tech Going Down?

LinkedIn, Twitter, Groupon, Tesla, and other large but not Google/Facebook massive tech companies are comparatively one trick ponies. Sure they have product lines around the edges, but Twitter is 140 character messages. LinkedIn is a professional and less fun Facebook without all the functionality. Groupon is for buying discounted gift cards to restaurants and extreme adventure trips that you might not actually use. Tesla makes luxury electric sportscars for millionaires or millionaire wannabees. When you look at the meat and potatoes of how these smaller but still multi billion dollar companies make their money, the huge profits are way off into the future. In fact, these profits might never happen at all. Naturally, the most financially vulnerable companies in a bubble drop first. When people get scared of this possibility en masse, another tech stock crash could easily happen.

What’s the difference between a Salesforce.com and a Google in terms of financing? Not only does Google earn a ton of money, but it is the big fish in the pond. For some reason, the market decided the past seven months that bigger is better and bid up large tech company valuations accordingly, with the exception of Apple. When tech goes south, you expect the smaller companies would get hit first because they have the least money. They also have weaker financing, which makes them susceptible to things like mass layoffs, declining morale, and a death spiral of “coolness” that slows their growth. LinkedIn fell 43% on Friday based in a decline in revenue. The thing is, the revenue did not go down, the rate of growth just slowed, from 37% to 34% from third to fourth quarter. If small hiccups like that can cause almost half of a company’s value to disappear, imagine if something truly bad happened in tech.

Still Predicting a Tech Stock Crash, I Just Don’t Know When

In Michael Lewis’s bestseller The Big Short, one of the protagonists complains that they made a bet that there would be a coup in Thailand, and they were right. The problem was, somehow they lost money on that bet. Stocks, derivatives, bonds, and anything that gets traded in financial markets often move in the exact opposite direction of what we expect, often for no reason. Right now, the San Francisco housing market is still strong, because Facebook, Google, and other big tech companies are still busing their thousands of developers to work and paying them big bucks. When a cold hits these major companies, and it will at some point, the Bay Area should experience a huge drop in real estate prices. Around the same time, tech company stock prices will come down to Earth and trade at a slight premium to the general market.

The world cannot tolerate money losing, multi billion dollar companies forever. That’s why I’d expect to see some high profile bankruptcies, mergers, or huge layoffs in the next year as interest rates continue to rise and capital costs increase too. There was a tech stock crash in smaller billion dollar technology stocks the past seven months. Now, we can wait for the tech stock crash at their larger brethren.

I’d like to make a distinction. If you work at Google, Apple, or Microsoft, I think you’re in far less danger than if you work at Facebook or Amazon. The reasons all have to do with earnings. Facebook trades at over 2.5 times the multiple of Google’s earnings, and Amazon trades at over 10 times that multiple. Amazon and Facebook could still outperform the stodgier tech stocks, but they sit at a much greater height from which they can fall. If you work at one of these large tech companies, be careful accepting large amounts of stock options (<one third of the total) as part of your compensation instead of cash. If you work at one of the companies above that still has no earnings, I’d make sure my resume was updated because you might need to be using it again very shortly.

Disagree with my prediction that there will be a continued tech stock crash in the next year? Think that San Francisco is actually an attractive real estate market? Comment below!

One thought on “Seven Months Ago I Predicted a Tech Stock Crash, How Did I Do?”