My granddad had a financial advisor who always sent a card on his birthday. At the time, I thought it was so nice that a financial professional would take the time to write a hand written card wishing my granddad well and thanking him for his business. After spending years in the financial services industry, I realize now that in most cases, when your advisor remembers your birthday, it’s the most expensive birthday card you’ll ever get.

Sending Hand Written Cards as a Business Strategy

I had a great conversation with another financial entrepreneur the other day about the future of the advice industry. He told me that in 20 years, the industry standard 1% of assets a year fee will be gone. The reason? Most advisors don’t deliver enough value to be worth that fee.

What should you get when you pay your advisor thousands of dollars a year? You should receive hand holding, tax-loss harvesting, portfolio management, financial planning, estate advice, and more. The advisor should help you find excellent professionals to handle all financial aspects of your life such as taxes, insurance, and legal assistance.

Doing all of that for a customer requires a lot of expertise. It also requires a lot of time, which takes away from other tasks. High fee financial firms spend most of their time on sales training and far less on technical knowledge. They teach their advisors to sell, sell, sell.

That means for most of you reading this, your advisor is probably more interested in speaking at the Rotary Club luncheon than rebalancing your portfolio. He would probably rather prospect for new clients than take care of the ones he already has.

How the Most Expensive Birthday Card You’ll Ever Get Could Cost Thousands

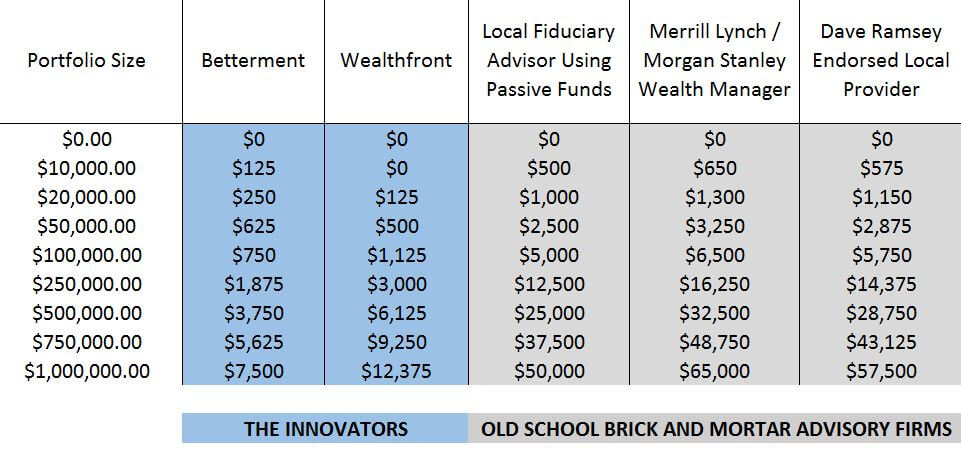

Check out the five year cost of various advisory firms at different account sizes. You can see why advisors at high fee firms like Merrill Lynch/Morgan Stanley/Wells Fargo/Edward Jones and others are so good at remembering birthdays.

The ‘Friend of the Family’ Financial Advisor Strategy

I just started a side hustle providing personal finance coaching to Millennial Moola readers. It seems to go well with my new student loan consulting business. I had my first client a few days ago, and he mentioned something that really struck me. He’s using his current financial advisor because he’s a ‘friend of the family.’ That means the advisor has always advised his family’s assets, they go to church together, participate in the same civic organizations, etc.

It occurred to me that ‘friend of the family’ financial advice is an entire business model within the industry. They are the people who send the most expensive birthday card you’ll ever get. I logged into his account information with my client, and we looked at his investment performance. That ‘friendly advisor’ under-performed the S&P 500 index fund by over 6% annually for the past seven years.

By using a smiling good ole boy as an advisor, my client had cost himself almost 50% of his account value in performance. Unfortunately, that amounted to tens of thousands of dollars. I suggested he fire the guy and move his account to Wealthfront, where he’d pay 0.25% a year with the first $15,000 managed free instead of >1% a year plus 5.75% upfront commissions.

When my client asked how guys like his advisor stay in business, I responded with what he told me. “He’s a friend of the family, he’ll call me if I move the account and ask why, it’s going to be awkward, I’ll see him at church…” Financial advisors sending birthday cards is a nice gesture. However, it has the side effect of developing emotional control over clients.

What If We Chose Other Professionals Based on Who Remembered Our Birthday?

Imagine for a moment that you go to the bathroom at 3am and flush. The toilet starts overflowing, and you can’t stop it with normal means. Do you want the plumber who shows up to be a good ole boy backslapping talker? Do you want him to have great interpersonal skills and send you a birthday card every year? Or do you want him to stop the leak and fix the damage ASAP.

If you had a brain tumor, would you choose a surgeon with a great bedside manner if she had a poor performance record? Alternatively, what if you could choose a slightly awkward surgeon who had an incredibly surgical record? I’d go with her.

I view choosing a competent financial advisor as a similarly obvious decision. If you have parents in or close to retirement, send them to Vanguard Personal Advisor Services, where they’ll get a CFP advisor ready and willing to do hand holding for only 0.3% a year.

As a 20 or 30 something, you should go with the best investment management services out there for a rock bottom price, which in my view are Wealthfront for taxable savings and Betterment for retirement savings. If you have under $100,000 in assets, choose one and start.

Wealthfront and Betterment both pay me a small commission if you go to the account page and register. Vanguard pays me nothing. I recommend these firms because I think you’ll save a ton of money as you can see in the chart above. If you’re interested in what I could do for you through personal finance coaching, reach out to me at [email protected].

I’ve had similar conversations when you see the fees folks are paying for their financial services. It’s just ingrained. You have a friend of the family and he handles it for you. It’s super awkward to do it yourself, and when you say you’ll snag a roboadvisor or something, this friend of the family will inevitably tell you that it’s the wrong move and he can provide more value. How can you just say no, you know what I mean?

The other thing is simply lack of knowledge. We’re all in the PF space, so we think that things like betterment, wealthfront, vanguard, etc are just common knowledge. But in reality, we are the exception. Most people have no idea what this stuff is. They just give money to someone who is supposed to handle it for them. And since they don’t have to actually write a physical check to them, they don’t notice the money they’re paying for their services.

As good as those services are, they still only have $3.5 billion in assets under management each. Merrill and the other wirehouses have hundreds of billions. The roboadvisor bet is as that wealth transitions from older generations, that young people will put it with them.

Great article. For a long time I also had a financial advisor that was a friend of the family. As soon as I became financially literate enough to manage my own money, I just stopped sending him money and instead invested it on my own. Eventually he got the message that I wasn’t interested in his high-fee products and I transferred the account with him to an online broker where I could manage my investments myself. This was a good way to avoid the awkward conversation but only possible because I had an active interest in investing. Now I only get birthday cards from my dentist.

Haha i actually love dentist bday cards , no low cost alternative anyway

Couple things here. Really good financial planners are providing comprehensive planning and coaching.

Vanguard estimated 3% value-add for a financial advisor and Russell Investments sited 4%.

You can build a portfolio on Wealthfront but there is no coaching or genuine financial planning. I have young professional friends using robos who are in 20-80 portfolios based on the risk questionnaire yet they are 40 years from retirement. There is a need for coaching and valuable financial planning.