I’ve made it to my early retirement one year anniversary. In June 2015, I hung up my bond trader cleats and decided to embark upon the adventure of a lifetime. Since I “retired” at the age of 25, I’ve traveled to over three dozen countries, learned how to build a website, wrote my first book, started a student loan consulting business, almost finished my second book, and hope this next year has a lot more in store for me! I seriously want to thank my readers for sticking with me and lending your eyeballs to Millennial Moola. I’m lucky to be an American citizen. We live in an age where everyone has access to the tools they need to retire early. Whether my story just merely provides entertainment or inspires you to work towards financial freedom, I’m excited for the road ahead.

The Travels

My favorite place I’ve been to in the past year would have to be the Ukraine. The food is fantastic and approximately $2-$3 a meal. The hostels have faster internet than a lot of places in Philly, and those only cost $5 a night. I treated myself to every dessert imaginable. We bribed the night guard to the National Cemetary in Lviv to let us tour the place at 2am. I even got ripped off in the positive way when a taxi driver took us on a 20 minute drive back to the city. He told us it would be $3, instead he charged us $2.

My second favorite country of the past year is Nicaragua. This place has come a long way since the US involved itself in the tiny country’s civil war. The former leader of the Socialist movement, Daniel Ortega, is currently the President of the country. He must have looked at China and decided to become Communist in name only. All kinds of Western money is flowing into Nicaragua right now. I felt immeasurably safer there than in Guatemala. Additionally, you can walk right up to volcanoes and look down into the boiling caldera.

My First Book Taught Me a Lot That I Will Apply to My Second

I think a lot of people are scared of taking a risk because they hate the idea of failing. I would ask that you consider the consequences of failure. If these consequences are not very high, then go ahead and make an attempt at whatever you thought you wanted to do. I will say that my first book is by no means anywhere close to a commercial success. Still, I learned a massive amount. These lessons will help a lot when my major effort at publishing my second book happens later in 2016.

For one thing, if you work hard on a book, you probably should not give it away for free. If you do, then you should keep it free. I enrolled in the Kindle promotional program, which allowed me to give away my book free for 3 days at the beginning. Hundreds of people downloaded it, which made me feel great. Unfortunately, when the free period expired, I had eliminated a lot of my potential paying customers.

take your time publishing, and make sure all your sales on amazon push you up the rankings

More importantly, all the free downloads did not permanently count towards pushing up my ranking in the free book category. The reason is that since the free giveaway period was promotional, the book reverted to the paid category on Amazon. I took my #2 ranked book on the free list and made it something like #180 on the paid list, all while eliminating most of the people who could have pushed the book up the paid category. I probably distributed it to a wider audience this way. Even so, I limited my ability for the book to be discovered by random people browsing the kindle store.

Another thing I learned is make sure you take a lot of time editing a book. This second book coming out will be in production for at least a couple months. One of my first reviews on Amazon was from a member of the grammar-police. Even though I wrote the book to be entertaining and informal in style, this reviewer slammed me for “not being professional at all.” Admittedly, there were many stylistic problems with my first draft. I had a few friends help me out, and I went back and edited everything. Sadly, that lower ranked review stayed on the page and limited my sales to strangers.

If you write a book, you also need a really cool cover. I asked my little brother for one. He did a great job with the grainy photo I gave him. That said, I should have used a high grade camera and spent more time and money producing a better cover.

These are all great things to learn. I can’t wait to publish my second book. The working title is Millennial Moola: Everything You Need to Know About Money in Your 20’s and 30’s. Be on the look out for it come August or September.

My New Student Loan Consulting Business

While helping one of my friends out with her student loans, my girlfriend suggested that I charge a fee and do a complete financial analysis for people. I asked my friend to be my first customer, and she said yes. I’m very grateful because I’ve helped several people now who have six figure student loans.

I realized there is a HUGE need out there helping people with their giant student loans. Most of the “help centers” are actually affiliated with private refinancing companies. These sales reps can earn commissions or bonuses sometimes that depend on whether you refinance with their company.

I discovered people hunger for objective advice on student loans not driven by product sales

Just as commission-based advisors give conflict ridden, non-objective advice, you can’t expect to receive a professional review of your loan situation from these kind of companies. When I helped my girlfriend with her medical school debt, I could not find very many places to go to for an unbiased opinion about things like: what income based payment plan should I use, should I go for tax-free PSLF, should I consider refinancing to a lower interest rate, if I refinance what should my repayment period be, etc. My experience interacting with federal student loan people and loan servicing companies shows they generally cannot help either.

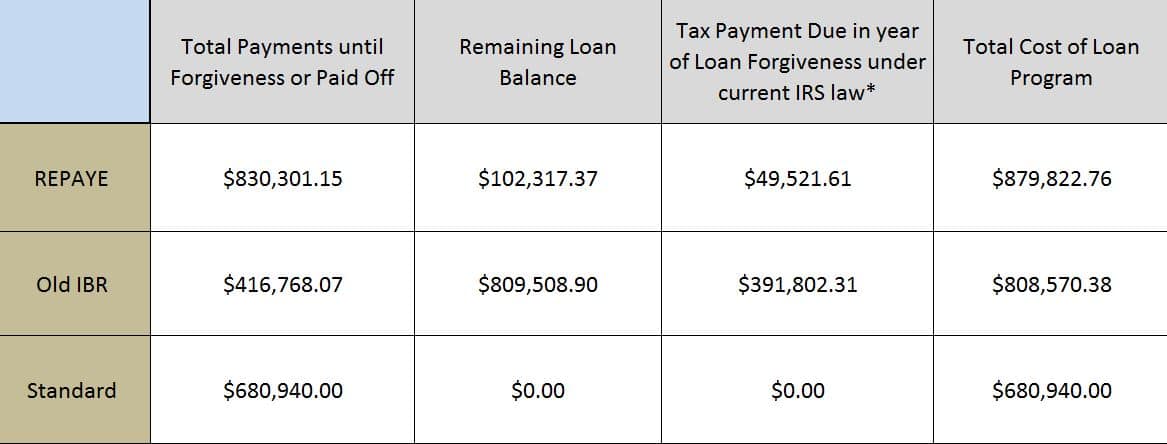

I charge a flat fee of $100 for about two hours of work and a phone call explaining the results. I run a bunch of financial simulations to determine what payment strategy is best for you. Sometimes, I suggest sticking with the payment plan you are already using. Other times, I find huge savings from switching from the old IBR to REPAYE, from IBR to private refinancing, etc. The past few clients I have helped are using payment strategies that could save them an average of $100,000 more than the next best option. If you or someone you know is interested in this service, contact me at [email protected]. I expect to be doing a lot more consultations in the coming year.

How Is Millennial Moola Doing on my early retirement one year anniversary?

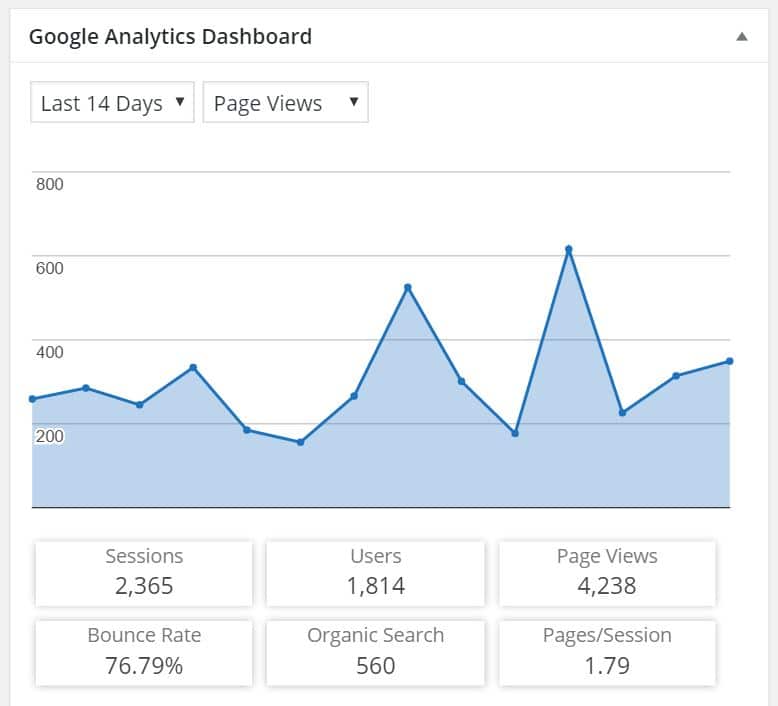

Hey it’s not Mr. Money Mustache or Financial Samurai, but Millennial Moola has grown a lot in one year’s time. I am closing in on 10,000 views a month on average. My organic traffic is growing rapidly.

That means Google looks at Millennial Moola and decides, “Hey this site has been around a year, looks like he’s commented on a bunch of other sites in the personal finance genre and they haven’t all banned him. I guess we’ll move his page up higher in the results when someone searches “How cheap is Ukraine,” “New Jersey Teachers’ pension,” “Financial advice is a ripoff,” and “Where can I retire after two years of working?” Additionally, the online website ranking company Alexa says that Millennial Moola grew from the 12 millionth ranked website in the world to the 2.48 millionth ranked website in the world. Hey I’ll take it.

You should think about starting a blog

If you are thinking about starting a website, it’s actually really easy. All you do is go to a company like Bluehost, which is discounting their normal $3.95/mo fee to $3.49/mo for 36 Months. So for a little over $100, you get three years of total control over “WhateverNameYouWant.com.” Their price generally includes free domain registration as well. You install a free WordPress theme with a one-click install and you can blog away, potentially creating an awesome side income for yourself over time.

I am NOT a technically inclined person. Still, I used Code Academy for html basics such as <img src=””> to post photos and <p> Enter paragraph words here</p> to format the site. I am lucky that I have a Silicon Valley tech worker for a best friend, but most of the stuff you see on Millennial Moola I “programmed” myself.

The older your blog is, the higher Google will rank it in the search engine results. Most professional bloggers just keep at it long enough to rise in these results until their traffic is virtually on autopilot. Several personal finance websites make hundreds of thousands of dollars a year with affiliate income. That means if I include a link to Bluehost, which has one of the lowest fees out there to start a website, I can earn income from this. When you have 10,000 page views a month, you might occasionally make $50-$200 monthly this way. When you have 1 million views monthly, you can see how multiplication of those figures makes could replace your day job.

My goals For Millennial Moola are the same, to educate the n64 generation on personal finance while making it fun

I did not quit my job to try to earn a living as a professional blogger. Please, please, please do not do that unless you have tens of thousands saved up because I have made almost nothing in my first year running Millennial Moola. I never even knew personal blogs could earn revenue for their owners when I started writing.

I worked for three years under a corporate policy that would not allow me to say publicly what I thought about financial markets, personal finance, or basically anything. Large financial companies fear regulatory action or reputation damage, so they issue proclamations that no employees are to engage in any side businesses without permission. No employees may write or comment on public forums period. You may click the like button on social media financial stories, but you must not say anything. I found this incredibly suffocating. Perhaps Millennial Moola was born simply because I had a muzzle on for so long that I couldn’t wait to shout from the mountaintops once I got it off.

Even so, who doesn’t like a little extra income earned by helping people?

That said, if I can make a little extra income, pay for the hosting fees, and enhance the probability that I make it from my early retirement one year anniversary to my two year, why not? I have had literally dozens of inquieries if I would sell ad space on Millennial Moola. I don’t need the money, so the answer is no.

If I can incorporate a small banner from Google Adwords in the bottom of my site, or include paid links to companies like Betterment and Wealthfront that could save you hundreds of thousands of dollars in fees, why not? If I can show you how to pay $5 a month for your phone bill with Republic Wireless, why shouldn’t I help us both out? I’m not trying to pawn off junk cars on people with low credit scores here. I will only ever include links to companies that I think will save you time and money.

Hopefully, this time next year, I can report back that many more readers have come through the door, which will probably lead to higher income for the site. Additionally, I would love for my second book to be a commercial success. Hopefully, I will also have helped dozens if not hundreds of people with their crushing student loan debt for a tiny flat fee of $100.

early retirement one year anniversary, its tough but you make it worth it

None of this is possible without you, the reader. Even if you have enough money to not work, you would go insane without something worthwhile to do. For me, that means educating people about their money. I’m so grateful for the hundreds of comments on this site. Likewise, the many emails I get encourage me to write more. When you are 26 and tell people you are retired, you receive a mix of confusion, shock, disgust, doubt, and encouragement.

Perhaps the biggest grief I get is when I tell people that I don’t have 25 times my annual spending in investments. They call me a fraud and say, “you’re NOT retired then!” I have a sizable figure that’s enough to not work for 15 to 20 years, but not enough to never work again. Haters can call me semi-retired if it makes them feel better.

I plan on making up the difference through random pursuits like blogging, writing books, and my student loan consulting business that just don’t feel like work to me. In the next few months, I’m going to help my grandma sell her house. She wanted to give me a small amount as a commission. She saw no point to paying 6% to a realtor she doesn’t know. Why not? All these money making ventures are now adventures instead of mindless, soul sucking drudgery staring at a glowing computer screen while trapped in an ugly grey cubicle. I hope to have a long life ahead of me with a family of my own. Hopefully this site can help keep me retired when unanticipated expenses happen in my life down the road.

Please Help spread the Word! Like Millennial Moola on Facebook, Twitter, Subscribe, comment, and Tell Your friends

If Millennial Moola made a difference in your life this year, please share it with your friends, family, and neighbors. Please like the site on Facebook, follow me on Twitter, and/or subscribe with your email in the funny cat picture below the article. Word of mouth is the best way to grow anything. If you see a post that you enjoyed, share it on Facebook. If you had a thought while reading an article, comment in the space below. In fact, commenting here on the page is worth five times as much as a comment on social media because it ranks the results higher in Google. I’ll try to respond to each and every comment. I’m grateful that something I wrote affected you enough that you wanted to write something.

You all keep me going! Thanks so much for the love and support. Here’s to a two year early retirement anniversary next year!

Hey fellow millennial! Congrats on 1 year of early retirement. That’s so amazing! I am not close to retirement (just paid off a massive amount of debt) but can appreciate your hustle. I look forward to reading more!

I was really blessed that I never had to confront debt like so many people our age. Congrats on paying down the debt. Hope you make it to early retirement because it sure beats the 9-5!

Great post!

It’s inspiring to read about your journey and maybe I can learn a thing or two from you. I quit my job almost 9 months ago now and have been trying to earn money in all sorts of ways to stay afloat (day trading, dividends, blogging, surveys, freelance writing). I’m currently trying to get more into freelance writing but I still need to land my first client. The route you took is unique with the student loan business. Looking forward to following your journey and learning from you. Congrats on the first year!

Thanks Graham! Keep up the blogging it takes forever to make a dime on it. Same thing with commenting, getting involved on social media, etc. Definitely spend time on people’s sites though rather than just social media bc it’s much better for building community I think. Congrats to you on taking a huge risk but one you will always be happy that you went for!

Congrats on your first year! It gets much easier to build traffic and a community now. It’s like a network effect. There’s so much revenue opportunity online. Folks just need to last long enough to see it through and also focus not too much on revenue either.

S

Yeah it’s pretty easy to just put up paid endorsement articles and the like. Glad I’ve been able to survive and keep it up. Thanks for commenting Sam!

Congrats on your first year! I’m 25 and nowhere close to retiring. As Julie said – I appreciate your hustle!

Thanks the hustle feels great now that I’m doing it for me and not someone else like an employer

Congrats on your first year and thanks for sharing your experience. You’ve done a ton of stuff since you retired. Great job building a consulting business too. I’m sure you’ll get more customers because a lot of people need help with student loans. Keep at it!

I sure hope I can get the word out more about the service. I built a free calculator for people to use if people are interested in modeling it themselves. Thanks so much for stopping by Joe

https://millennialmoola.com/2016/08/29/student-loan-analysis-tool/