Imagine you are a police officer in New Jersey. You put your life on the line to keep the citizens of the state safe. When you are not risking bodily injury, you have to deal with all kinds of unpleasant situations like evictions, traffic stops, or looking for suspects with outstanding warrants for their arrest. All you want is a secure pension when you retire. How would you feel if you discovered that New Jersey stole from the police pension to shore up the failing teachers’ pension?

Clear evidence jersey is pushing out the date of disaster on the backs of police and other public employees

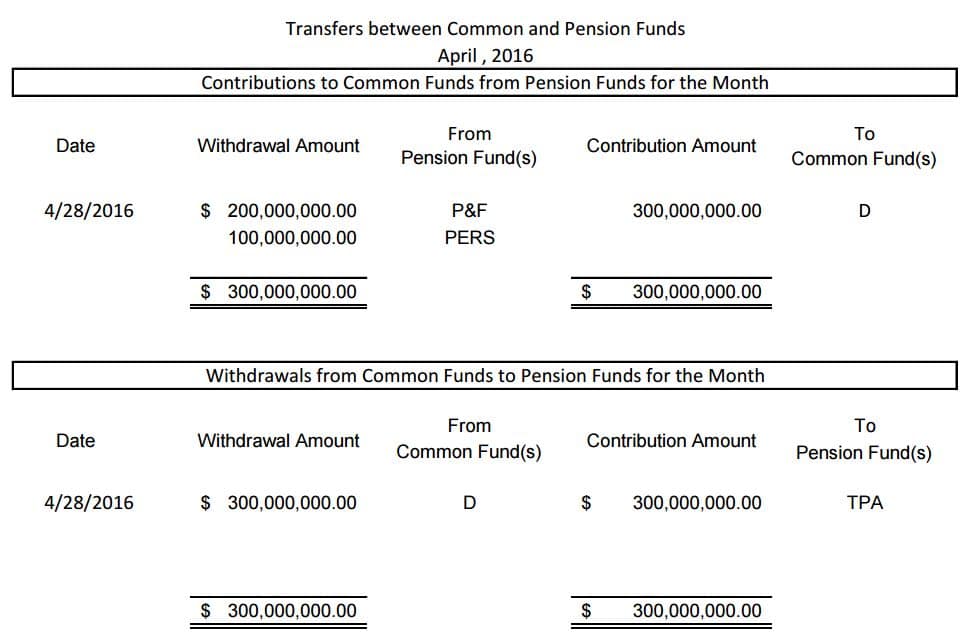

April 2016 is the latest report that Jersey has available. You can find all the monthly reports here. In the picture above, P&F stands for police and fire pension, TPA stands for Teacher’s Pension and Annuity Fund, and PERS stands for Public Employee Retirement system. The transfer is dollar for dollar out of the Police & Fire and Public Employees Pensions into the Teachers’ Pension. So New Jersey stole from the police pension AND the state employees. They just took more from the police.

Why Did they take more from the police and firemen?

In case you have not been following my strange obsession with the deteriorating financial condition of the State of New Jersey, the Teachers’ Pension is only about 28% funded and falling. The Police & Fire pension on the other hand is at just below 53% funded, and the Public Employees Pension is at 38% funded. All these figures are as of June 2015, so they are outdated. The real figures are probably a few percentage points worse.

The Police& Fire pension (P&F), Public Employees pension (PERS), and Teachers’ pension (TPAF) are by far the three largest pension funds in New Jersey. They’re basically the whole thing. Christie probably realizes that if one of the three pension funds becomes insolvent while he is running Trump’s campaign, that would be a national embarrassment. So, he is in effect pushing the day of reckoning for the TPAF to a later date. The other two pensions’ funded ratios will fall and the TPAF’s funded ratio will rise. My guess is that the state is hoping the credit rating agencies do not notice that they are moving money around.

New Jersey stole from the police pension because of its strong funding status in the 1990s

The state has no money to pay for their massive pension obligations. In fact, my back of the napkin calculation is that the state has only paid for $1 of every $4 it owes teachers for their retirement. If one of the three largest pensions failed, pandemonium would ensue. New Jersey could not borrow anymore in the municipal bond markets. It would have to drastically raise taxes in a state where some of the richest residents are already fleeing.

The Police & Fire Pension gets a lot of its funding from local governments. Its members also contribute a higher percentage of their pay. Police officers and firemen have to contribute 8.5% of their pay to the pension fund. The local governments must match this by law. So every year 17% of a police officers pay gets put into the state pension fund for his or her future benefit. On top of this contribution, the State of New Jersey is supposed to contribute.

The magnitude of the fraud committed by the state of New Jersey is evident by simply looking at how badly funded the P&F pension is. How could a pension with a 17% of pay employee contribution every year BE ONLY FREAKING 53% FUNDED!?! The answer is: New Jersey basically did not make much in the way of contributions. Additionally, the state allowed local governments to take an extended contribution holiday until a few years ago. During the 1990s, New Jersey assumed the blockbuster stock market returns would continue indefinitely. That meant it could cut taxes and stop contributing to the pension fund. Only recently did they start viewing the pensions as a major problem.

redistribution from the police to teachers

The state is now effectively redistributing money away from the retirement for police officers to the retirement for teachers. If I was a police officer there, I would be furious. You could make a good argument that the Police pension should be treated as a separate legal entity. Teachers contributed according to a different set of rules after all. Bond defaults or benefit cuts will have to happen eventually anyway. If I was a police officer, I would want to see what happens to the Teachers’ Pension first. If the teachers’ pension sees drastic benefits cuts, I would negotiate a lot softer with the state when our fund started running dry.

The teachers’ pension is at 28% funded and the police pension sits at 53% funded. What would you do the same as an elected official? Would you take money from the richer police retirement fund and move it to the teachers, thus making sure everyone suffers equally? Public pensions are extraordinarily expensive so there is no easy answer. Say that the state of New Jersey contributed the full 17% to the police pension. People are living longer and what worked 30 years ago might not work today.

Even so, to take from one group of employees retirement to shore up another so the credit rating agencies like Moody’s don’t downgrade you to junk bond status is the definition of desperate. Police should demand a fence around their pension fund where the state cannot touch it. In fact, if they could separate from the other state of New Jersey pension funds, it would be a good idea. I found the $200 million withdrawal from the police pension by accident. Hopefully some police officers see it and start advocating for themselves before its too late.

I wasn’t aware that NJ had a pension problem until reading this. Here in Illinois, things are similarly bad. Pensions are great when everyone meets their obligations, IMO, but when one entity starts kicking the can down the road, it always creates big problems.

Things are about equivalent in Illinois. They are actually even worse than Jersey in the city of Chicago. The last I checked their pensions were approximately 25% funded. Only the worst funded plan in Jersey has numbers that low. I wrote a post about that actually,

https://millennialmoola.com/2015/08/05/chicago-is-one-recession-away-from-going-bankrupt/

If you want to see some of the financial challenges that Chicago will face in the coming years, check that out. At the minimum I’d expect huge property tax increases, so be careful buying a home in Illinois

I’m not sure if I’m understanding how this is supposed to work- checking for clarification: What is supposed to happen is that the Police/Fire employees put 8.5% of their pay into a fund, and then the local government matches that amount? This fund is likely an Annuity owned by some private company with a set annuitization in retirement? What did happen is that the government 8.5% was never put in during the 90s (because the stock market went up? – I’m misunderstanding this part because wouldn’t they be on the hook for capturing the gains each year?)? Now the pension fund is only half of what it’s supposed to be funded at (meaning just barely above the employee contributions)? How do they calculate a fully funded pension? Sorry super granular just interested. You can point to a link too if there is information out there on this subject.

Thanks for asking Julie! The state runs all the pension funds. No private companies involved except the state investment committee picks some active managers along with index funds, bond funds, etc. to go in the portfolio. They withdraw from the portfolio, make contributions from the state, local governments, and the employees, and in theory the fund is supposed to pay guaranteed pensions for retired police and firefighters for life. In New Jersey the police and fire ppl are supposed to put in 8.5% of their pay into the pension fund each year. Also, local governments that employ them must match that.

Jersey passed a law allowing local governments to stop contributing that 8.5% for a while. Yes they are still on the hook, but billions of dollars didn’t get put into the fund and that’s hard to recapture that money.

Pensions have funding ratios that determine if they’re healthy or not. Say you have 100,000 employees equally distributed across the age spectrum. An actuary comes in and tells you that the present value of all their benefits is $10 billion. That’s your pension liability. It’s what you’ve promised to the employees. Your pension fund is your assets, of which you spend 5% or whatever each year and distribute the money as benefits. If the ratio of assets to liabilities is at least 80%, then you’re probably fine because you can always mess around with cost of living adjustments or hand out early retirement incentives to get the numbers to work. However, New Jersey is down in the 25%-50% funded range, meaning that their pensions will probably fail without a federal bailout.

I’m also working on a piece about Chicago right now. They have the worst pensions in America, with about a 20% funded status. LMK if you have more questions about this!

What is the likelihood the feds would bail out Chicago or Illinois? Additionally, if they don’t how is it possible that these teachers, firefighters, police have put in 8=9% of their salary for 25-35 years and get absolutely nothing back? As if they took a $300,000 pile of money and set it on fire. How can that be?

There is a 0% chance teachers and firefighters get nothing. My guess is that at a minimum they get what they contributed back in the form of an IRA. They should probably be paid some level of interest on these savings as well. I imagine it would roughly match the rate of return the pension fund got on these savings though I could see offering a lower amount around 3-5%. In terms of feds bailing out chicago and illinois, its possible but with a Chicagoan in the White House right now, since it hasnt happened already, I wouldnt bet on it. Also there are a lot more public pensions that need to be bailed out than just Illinois and Chicago

Teachers, Police and Firemen dont know how lucky they have it, most of the working world get NO pension at all. They have no clue what its like to be in the real world ! I worked for 30 years in a bank and I have No pension, I probably have to keep working till Im in my 70’s while a see retired state employees collecting huge pensions and retired in there 50’s. The taxes we pay in New Jersey to pay these pensions are ridiculous.

Most people don’t understand that the present value of most public employee pensions is equivalent to a 25% retirement match or more when compared to a private 401k type system. New Jersey is definitely going to join the ranks of Illinois as being a state in significant distress when the next big recession happens

The real world? Have you put handcuffs a suspect that pointed a gun at you? Have you been the first one on the scene of a domestic violence call? or run into a burning building to rescue a strangers kid? How about be the person responsible for telling a parent that their child was killed in a car accident? How about put up with hundreds of kids for 8 hours a day while simultaneously being responsible for their education? Maybe you have, but judging by your “30 years in a bank” I’m guessing the policemen, firefighters and teachers have a little more knowledge of the “real world” than you. If you’re that jealous, go walk the beat of a cop, go put on some turnout gear and run up a smokey flight of stairs with an air mask on, go stand at the front of the classroom and teach. I get it, it’s no secret there’s a problem with the pension system and how it was/is managed. Changes probably need to be made. You don’t like the taxes though? good, then move out of the state. But please don’t tell policeman, firefighters or teachers that they don’t “know how good they have it” that’s a gross generalization and it’s out of line.