I’ve been working behind the scenes for months now to produce a simple, free spreadsheet to help with one of the greatest financial problems of our generation, that of student loans. I finally have a student loan analysis tool to share with you after many hours of work, and I’m very excited about it. Click below to download it while you read the rest of the article.

The Millennial Moola Free Student Loan Analysis Tool

Student Loans: My Accidental Side Hustle

I started learning about the maze of loan repayment programs while helping my girlfriend make a plan to repay her medical school debt. There’s IBR, PAYE, the Standard Plan, and now REPAYE. Each of them have unique rules and eligibility requirements. On top of that, if you work in a not for profit job you can even qualify for Public Service Loan Forgiveness.

I realized that choosing the right student loan repayment strategy could be boiled down to a financial analysis of your individual loan situation. In my prior corporate life, I traded bonds for a living, so using Excel to build cash flow models is something I’m familiar with. I started doing flat fee consultations for people with six figure student debt burdens about six months ago. I’m still taking on new clients by the way if this spreadsheet doesn’t give you enough detail.

In the short time I’ve been involved in the student loan space, I’ve discovered that it’s basically the Wild West of middle class personal finance. I read an excellent piece over at Millennial Money Man reporting that “debt relief” companies are charging hundreds or even thousands of dollars to tell you about information you can find out for free by searching the free Federal student loan website.

Student Loan Servicers and Financial Aid Officers Do Not Model Anything For You

People are turning to these scams because the companies that collect their payments are awful. Additionally, they cannot even report accurate information as to how long you have paid your loans and how many qualifying payments you make towards loan forgiveness, much less give you an estimate as to how much different repayment plans cost.

The majority of financial aid officers are similarly useless. One veterinarian I spoke with as part of my student loan consulting practice had almost $400,000 in debt a few years out of school. Her loan counselor told her not to worry, that it was “good debt” that she would figure out how to pay off at some point down the road. This individual had no clue what they were talking about. She had the opportunity to limit her interest accrual by switching to REPAYE, which slowed the accelerating growth of her massive student loans.

I was lucky enough to graduate school without any debt. Even so, that somehow doesn’t stop some extremely annoying robo caller hassling me weekly about an exclusive student loan relief offer I can get by dialing zero after the tone to speak to a representative. If this ever happens to you, try to get off their list. You will be speaking to someone who is better at sales than adding or subtracting with minimal knowledge as to what the heck they are talking about.

How My Student Loan Analysis Tool Works

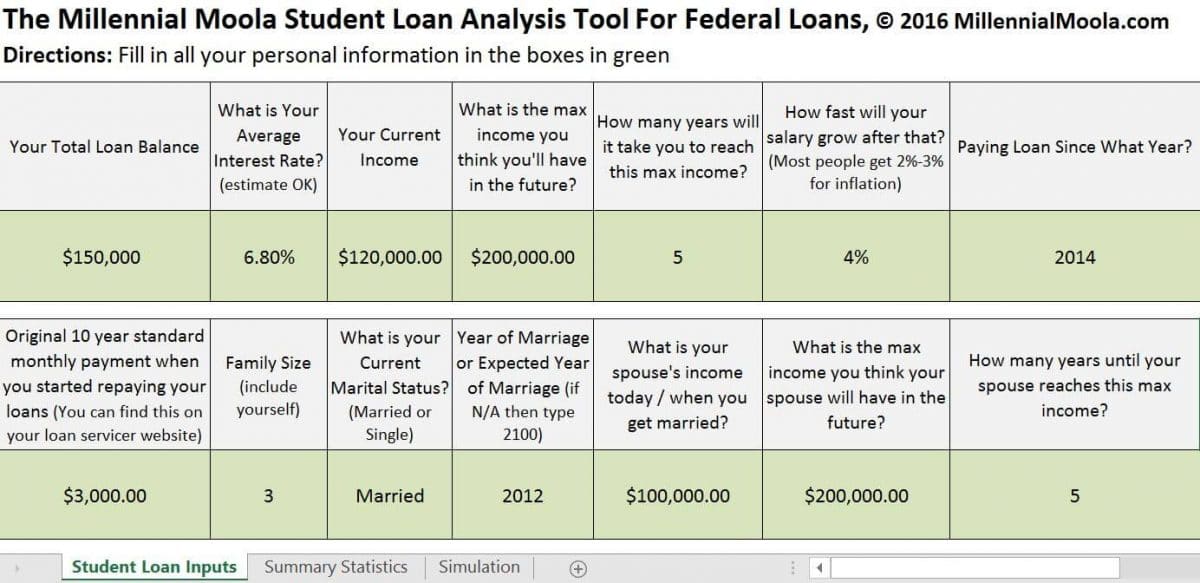

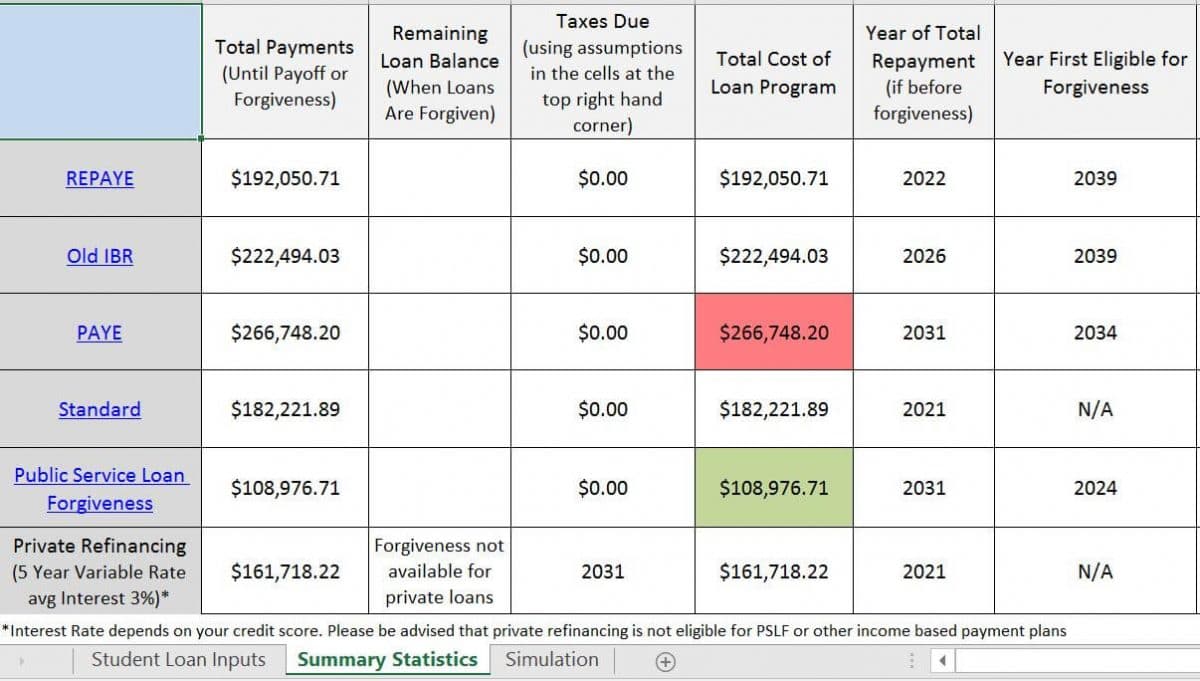

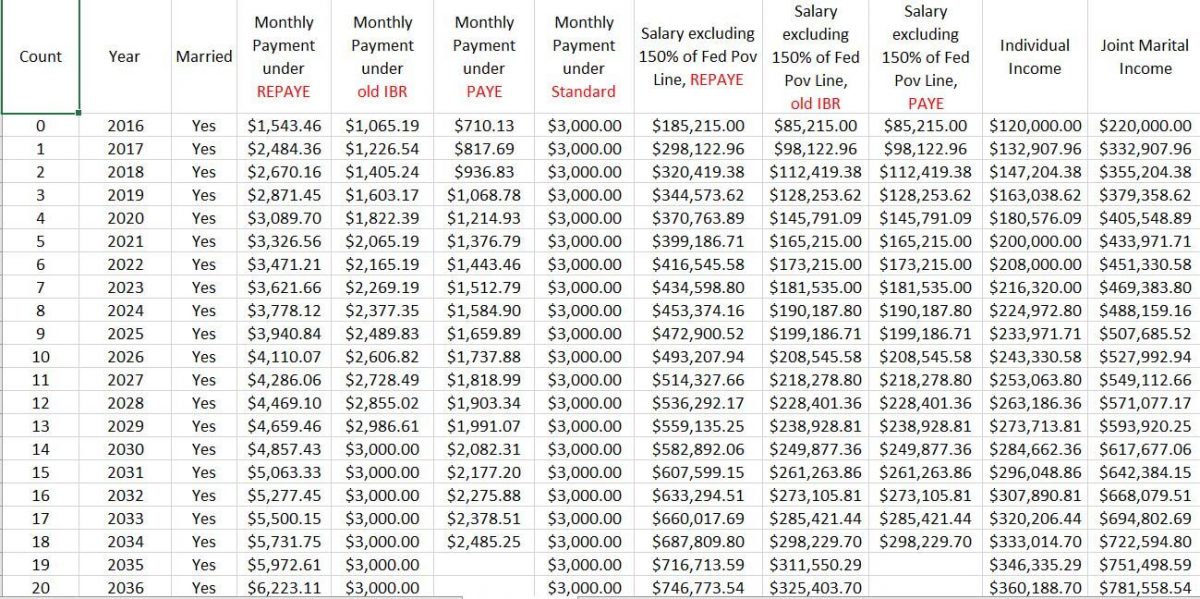

I have a simulation tab that runs all the data you enter in the ‘Student Loan Inputs’ tab. The ‘Summary Statistics’ tab boils all this down for you in an easy to understand page. The red tab is the highest cost repayment plan you could use. The green tab is the lowest. If you work in the private sector, your Public Service Loan Forgiveness row should read N/A. Here’s a sample of what’s going on in the background.

This student loan analysis tool is best used by one person analyzing his or her individual loan situation. While spousal income and spousal income growth is part of the calculations in this tool, I’d recommend a personalized consultation if you both have complicated loan profiles.

Millennial Moola Readers Are the First to Read This, So Please Give Me Feedback in the Comments Section and Through Email

I eventually want to release this spreadsheet to larger distribution channels to help as many people as possible. Even so, I wanted Millennial Moola readers to get the first look. Like I said, I’ve worked on this for months. It’s a passion of mine now to help people figure out their student loan situation so anything you can do to make it as good as possible would be much appreciated.

How is This Free? What’s the Catch?

Fantastic question. There are three catches. The first one being, if the loan spreadsheet finds that private refinancing is the cheapest option for you, please consider using the links to CommonBond to apply to refinance your loans. If you are in the private sector in a for profit job, the majority of the time you will save a lot of money if you use a private refinancing company. Sometimes that’s true even if you work in the public sector.

Apply with the best student loan refinancing bonuses anywhere by checking out Student Loan Planner. These are affiliate links, which means that if you use them this site makes a small commission. Full disclosure, I’d google search student loan refinancing companies and apply to even more than these.

The second catch is that analyzing student loans is extremely complicated because of all the interrelated rules and regulations. I fully expect most people will be able to use this spreadsheet to determine what plan is best for them. However, if you feel like you would benefit from a personalized study of your own loan situation, I’m still taking on clients for a one time fee. If this spreadsheet has any success, I’d expect that rate to go much higher. Please take advantage of me while I’m cheap.

I’ve spent probably over a hundred hours building it and studying the loan system. If you all shared this spreadsheet widely enough, it could literally save fellow millennials billions in interest, millions from scamming companies trying to rip people off, and years of people’s lives slaving away at higher paying jobs just to pay down their debt.

*One final tip. If you’re working in the not for profit sector (hospitals, local, state, or federal government, non-profits, etc) and have student loans, stop what you’re doing right now. Fill this sheet out and mail it back to the Department of Education. They’ll certify if you’re on track for tax-free loan forgiveness or not. The government will not proactively tell you if you’re eligible so check it out.

If you missed the spreadsheet link at the top, here it is again:

The Millennial Moola Free Student Loan Analysis Tool

Please do me the honor of leaving thoughts, suggestions, and replies in the comments section below. I love hearing from you all and it keeps me going. Hope you enjoy the fruits of my labor. If it helped one person, it was worth it!

This is awesome and really helpful. I paid off my student loans already, but Ms. FP has a ton of student loans coming down the pipeline, so its helpful to see this all in a spreadsheet. Will definitely be tinkering with this. Thanks again for putting this together. Looks like a ton of work!

Thanks it definitely took a lot of work. Glad to get it out there for people to use

This looks really helpful! Thank you for taking the time to create this for those of us with student loan debt.

Amanda

Please share it more to folks. I think this could really help people model their options for repaying student loans

Very impressive! You’re right about how confusing student loan repayment options are and with it being a growing problem in our society, I’m sure your tool will help so many people. Thank you for doing this!!

Happy to help thanks for stopping by Crystal

Wow, that looks so helpful! I am in the UK so our loan process is completely different (honestly, I feel so bad for you guys). I will share this on Twitter for my American followers 🙂

Finally, a student loan calculator that actually includes the income-based repayment plans!!!

All other blogs I read only discuss early repayment and don’t take us non-profit workers into account. I’m going to refer other bloggers to this post, for sure. You rock dude, keep up the good work! 🙂

Thanks Michelle please spread the word!

Thanks for this awesome tool! When you say “Your Current Income,” is that gross income? Or are you talking about AGI on your tax return?

I’d say AGI on your tax return

Thanks!

Hi there, great tool! Question–PSLF is the best option for my husband, but how do I know what repayment option we should use to optimize the savings (ie IBR vs PAYE vs REPAYE) based on the spreadsheet results?

Whatever repayment plan results in the lowest monthly payment is the best choice. I run another site, StudentLoanPlanner.com, where I do flat fee loan consults to answer concerns like this. It’s just $150 for individuals right now. Email me at [email protected] if you’re interested. I’d suggest hiring someone like me to double check your plan because even a small mistake can cost you a lot of money with PSLF!

Thanks! This is a great tool.

Question: Have you considered factoring in which repayment options are available based on the type of loan or when it was taken out? Depending on the date taken out, some of these repayment options may not be available. I’m not good enough with excel to do this myself, but I could see some sort of “if” statement linking to the year initiated/consolidated and then conditional formatting to take out any options that aren’t available based on that?

Same on types of loans: perkins vs. stafford, etc.

(I realize I’m being overly picky. As it stands, this is already the best tool I’ve ever seen for this stuff.)

That’s a great compliment Ryan. I could definitely work on building that into the sheet

Are you planning to update this for the New IBR, instead of using the Old IBR formula? What about including ICR?

Hey Jason I actually have most of that modeled in this updated version: https://www.studentloanplanner.com/free-student-loan-calculator/

I don’t model ICR because it’s a universally bad plan