A small startup named Wealthfront has created an innovation that could kill Vanguard, the company that popularized the index fund in the mid 1970s. Ever since, the investing world has never been the same. I saw a report that Vanguard had taken in more than 100% of the industry cash flow for 2016. That means that the ENTIRE mutual fund industry has fewer deposits this year in aggregate than Vanguard. That’s because customers are withdrawing their money out of high fee funds. Sitting atop trillions of assets under management, what does a behemouth like Vanguard have to fear? It’s called direct indexing.

What is Direct Indexing?

Direct indexing is when an investment company invests in a sampling of the market indexes for you instead of turning to a company like Vanguard to do it. The primary reason for direct indexing is because of taxes. An investment manager seeks to earn an after tax return several percentage points higher than a traditional index fund. They do this through tax optimizing at the individual stock level, something that’s never been available at an average investor level before Wealthfront began offering it to the masses.

Vanguard is famous for investing in the 500 largest companies in the American stock market, thus creating the S&P 500 index fund. They charged a rock bottom price for it too, which has only declined over time. Market cap indexing is great for the average investor, don’t get me wrong. Traditional index investing is tax efficient, incurs low transactions costs, and offers broad diversification at a low price.

Even so, traditional index investing leaves a lot of return on the table for taxable accounts. Imagine a year like 2015 for a moment, where energy stocks tanked. Even though oil stocks entered bear market territory, the rest of the stock market performed well. If you owned a traditional S&P 500 index fund, you felt the pain of the drop in oil stocks without any of the tax benefits.

How Does Wealthfront Operate These Direct Index Accounts?

Wealthfront would have sold individual oil stocks after they collapsed and purchased an Energy ETF to make sure investors do not miss out on any of the price appreciation if oil came back. After 30 days of waiting, Wealthfront sells the Energy ETF and buys back the individual stocks. Using this strategy, your index fund might earn a 3% return in a given year but produce a 5% loss for tax purposes.

In contrast, the S&P 500 index fund would have shown a positive return for taxes. Truly, I expect Wealthfront’s direct indexing service to essentially cover their 0.25% fee. The only catch is you have to invest at least $100,000 to receive this service. If you don’t qualify for their direct indexing service, they have something for the little guy too, with the first $15,000 of assets managed for free.

Direct Indexing Could Devastate Vanguard’s Taxable Account Business

Perhaps I should be more specific and say that this creation could decimate Vanguard’s taxable business. There is not an obvious benefit for retirement accounts with direct indexing. Even so, the mutual fund giant touts its index funds as a great solution for saving after you have filled up all your tax deferred accounts for retirement. Taxable investing is a huge part of Vanguard’s business.

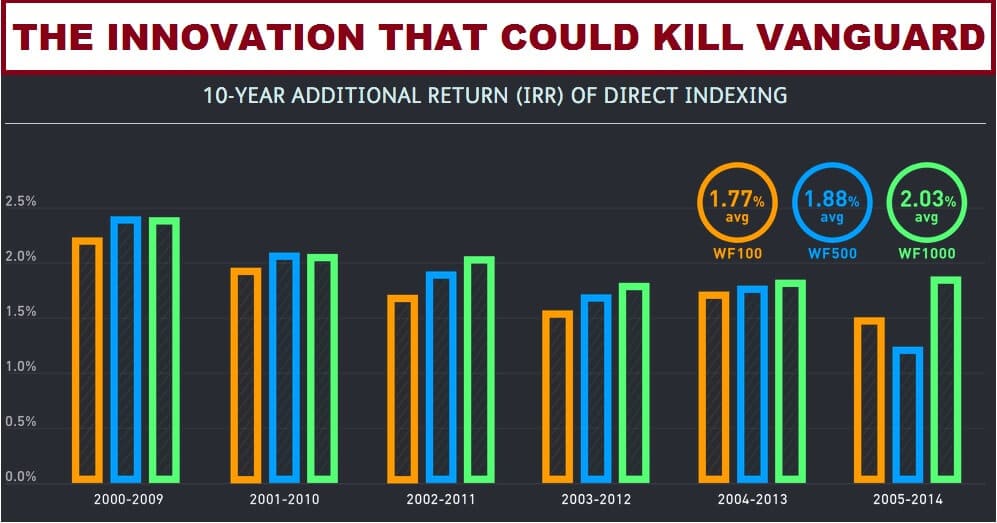

Unfortunately for Vanguard, if you look at the additional return of direct indexing with Wealthfront, the numbers speak for themselves. They buy a 100 stock sample of the S&P 500 to start, and they include more stocks as your account size grows. Their 1000 stock direct index portfolio outperformed the S&P 500 index fund by over 2% after taxes over the past 15 years.

What Tiny Wealthfront Would Need to Do to Slay the Giant Vanguard

Right now, Wealthfront is only able to do this direct indexing in the US stock market. Bond markets are not efficient enough to be churned for taxes in this way. International stock market transactions costs are prohibitively high right now to use this strategy for small account balances.

Still, what if Wealthfront and other investment management startups created a way to offer a direct indexing competitor to ALL of Vanguard’s traditional index funds? Taxable investors might pay Wealthfront an additional 0.10% per year in higher fees but earn up to 2% more per year after taxes across all stock asset classes.

Most of Vanguard’s cash flow right now essentially comes from financial advisors moving client money into ETFs and employers moving to Vanguard’s target retirement funds. The company also receives a huge mountain of cash from individual investors purchasing shares of their index fund in their taxable brokerage accounts.

If Wealthfront figures out this direct indexing product for all asset classes, Vanguard would be relegated to being a provider of retirement savings plans. They would still survive but in a much diminished way from their current dominance of the industry. There are plenty of smart people at Vanguard who I believe are currently thinking about this problem. Aside from data security, it would be my number 1 concern as an executive there.

Investing Keeps Getting Better and Cheaper to Do Well

When our grandparents wanted to invest, they had no choice but to walk into a Merrill Lynch office and pay a steep commission. When our parents wanted to invest, they had to dodge a minefield of high fee active funds and hopefully make their way to Vanguard. Today, we have access to some of the most sophisticated investment management in the world available for 0.25% a year at Wealthfront.

While Betterment has a lower fee for investors with greater than $100,000 in assets, I believe that Wealthfront will prove to be the better value for non-retirement accounts. By all means, if you want someone to manage your IRA and you have more than $100,000 I’d choose Betterment.

If You Have No Idea How to Invest, Open an Account with Wealthfront

For everything else, I strongly suggest 20 and 30 somethings use Wealthfront. If you sign up for an account or look into it through the links I have in this article, I could get a commission. I’m fine with that because I think Wealthfront will help 90% of my readers earn returns they could not obtain on their own if only because of their sophisticated tax optimization of portfolios.

If you’re looking for handholding or have parents close to retirement, then maybe consider a service like Vanguard Personal Advisor Services. They charge only 0.3% a year, and I receive nothing to mention them. Vanguard’s financial advice is actually incredible for people who want hand holding but don’t want to pay for expensive financial advisors who charge 1% or more a year in fees. I don’t believe the investment management will be as good as it will be with Wealthfront, but you’d have access to a real live CFP advisor to talk to.

In the mean time, let’s celebrate. Direct indexing is the innovation that could kill Vanguard. Let’s hope the index fund giant wants to put the ambitious startup in its place and expand tax managed offerings across multiple fund families. The greater amount of competition will lead to lower costs and better returns for investors, of that I’m sure.

Questions for You

- Do you use or have you considered using a roboadvisor to manage your investments? Why or why not?

- What kind of questions do you have about direct indexing? Let me know hopefully I can clear up anything.

To say Wealthfront is going to kill Vanguard is pretty hyperbolic, I think.

I mean, Wealthfront is neck and neck with Betterment when it comes to assets. Right around 3 billion each. These are a drop in the bucket compared to Vanguard’s 3.6 trillion.

With the cost of the robo’s added to the costs of the ETF’s, for a normal person, aka not a high net worth high taxable income person, I question whether these are better choices than a solidly managed diversified fund from Vanguard. Someone who uses the Wealthfront portfolio pays 25 bps + the cost of the ETF’s for an algorithm to invest for them. I can pick some solid funds for less than that or for negligibly more than that. My money is with the latter.

The tax loss harvesting feature is overstated IMO, not really useful unless you’re in a maximum tax bracket. Otherwise it’s noise. I actually tax gain harvested a few years ago. The robo’s don’t do that.

I briefly used Betterment, but then I realized I was a lot smarter than the robot. I mean, they put me in national municipal bonds. My tax bracket doesn’t support muni bonds, and if it did, it should have considered my state taxes and put me me in a California muni fund.

You make some great points TJ, thanks for stopping by. I did try and qualify that I meant vanguards taxable business not it’s retirement busienss. The additional returns would still be present for any investor in the 25 percent marginal bracket at a reduced level , which is almost everyone with over $100,000 portfolio. I estimate that additional return would be between 0.5 and 1 percent , still covering the 0.25 Percent fee. Also, they don’t tack on the vanguard fund cost for the 500 fund direct index replacement , which means the cost difference for that portion is 0.2 percent. If they figure out how to do direct indexing across the portfolio and compress the extra cost to about 0.1 percent, there’s literally no reason someone in a taxable account would use vanguard rationally.

Couldn’t Betterment replicate Wealthfront’s direct indexing feature (if they’re not doing it already)? If so, what advantage does Wealthfront have over Betterment? I’ve been using Betterment

As of now betterment does tax loss harvesting but not direct indexing for accounts over $100,000 , betterment should offer direct indexing in my opinion but it’s technically complicated to do. Betterment is opting for a lower fee instead. In my opinion wealthfront is a better option for taxable accounts, betterments better for retirement accounts. The reason is that direct indexing should outperform traditional indexing by 1 to 2 percent on an after tax basis, esp for someone in NYC or LA

Neat article Travis. And thanks for sharing some of the particular benefits of the WealthFront Robo Advisor. While I’m personally interested in robo advisors and understand the value they bring, for now I’m happy to manage my investment accounts myself. That said, for friends ad family of mine who are less interested in the stock market I think these services are a great value-add.

If you don’t consider yourself an investing nerd, there’s literally no reason why you wouldn’t just use one of the two main robos. Good thoughts Jay

If there becomes significant enough demand for this, don’t you think Vanguard would simply offer it too? Personally, I prefer real estate for taxable accounts as depreciation, accelerated depreciation, 1031 exchanges, tax-free equity harvesting through refinances, all allow for high tax efficiency outside of a retirement account.

yeah that’s a killer solution for taxable accounts especially for high income investors. Problem is that it requires a lot of time, so if you’re willing to have that eat into free hours then its a great financial decision