![]() Sorry I’ve be MIA for a while y’all. Becoming an accidental entrepreneur through my biz Student Loan Planner takes more work that I thought it would.

Sorry I’ve be MIA for a while y’all. Becoming an accidental entrepreneur through my biz Student Loan Planner takes more work that I thought it would.

I was chillin’ at home with the new HBO subscription we got watching that Silicon Valley show with my friends. You know, the one with that guy from the Verizon commercial?

Anyway the show is based on a bunch of dudes holed up in an incubator house in the Valley working on this startup called Pied Piper. The company has this blockbuster algorithm and they’re trying to get users, scale, and make money.

A venture capitalist talks to the main character Richard about getting funding. Richard wants to grow revenue in the business, but the VC says “DON’T DO IT!”

Why Doesn’t the VC Want the Startup Founder to Focus on $$$?

The venture capitalist said something hilarious that I think is really important to consider while Amazon trades at like 200 times earnings and everyone thinks Elon Musk’s Tesla will be larger than Detroit’s Big Three combined.

To paraphrase the VC in his colorful language:

Hell no don’t go for revenue growth. F that.

I don’t want to make a little bit of money in a predictable way every year and get rich slow. I want to make a sh*t ton of money right away.

The way you sell for billions is users. Nobody gives a sh*t if you’re making money. Amazon hasn’t made a profit in like 20 years, and nobody gives a crap.

So screw revenue. Get users any way you can. That’s it.

Richard from the show expressed some confusion. He always thought “that the point of a company is to make money.”

He’d be right, except that I truly think we’re living in the second great tech bubble.

No Way is Amazon Freaking Worth $500 Billion

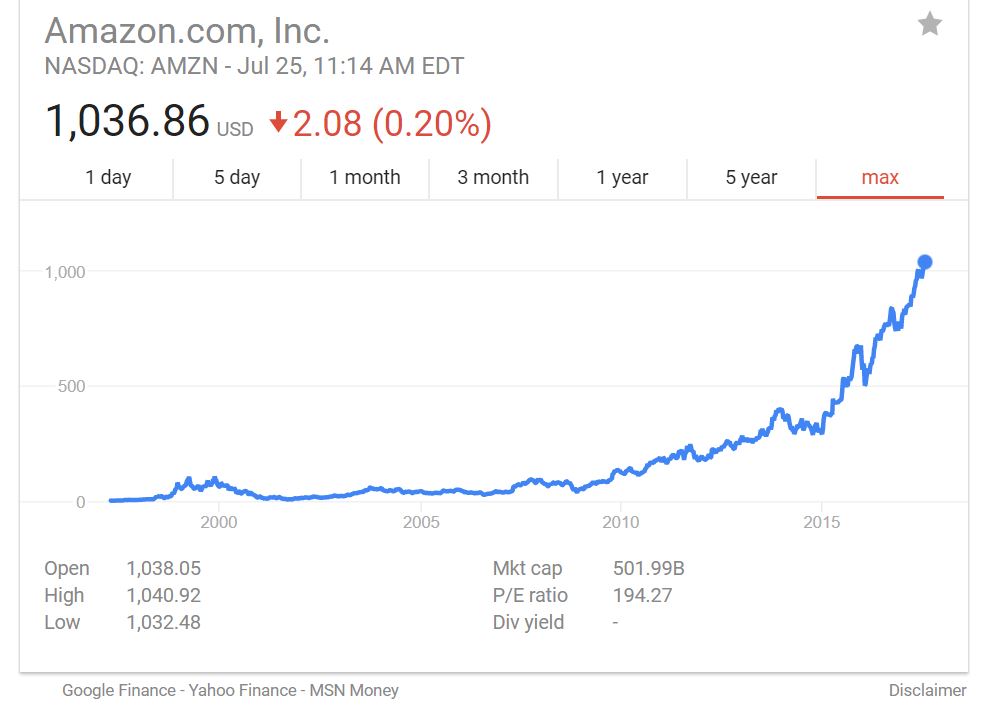

Guess how much Amazon is valued at right now?

What if we took the combined stock market valuations of Coca Cola, Ford, General Motors, Fiat Chrysler, General Mills, and Disney and combined them?

You’d be at a total market cap as of July 25 of about $497 billion. That’s like $5 billion LESS than Amazon.

All those companies combined made tens of billions of dollars in profit. Amazon make less than 10% of that.

Wait Am I an Idiot BC Tech Has Killed It

Don’t take advice from me because I’m a fool. I told my buddy to sell all his bitcoin at $1100 and now it’s like $3000.

I’ve been underweight tech for a long time, and my portfolio has paid the price. I’ve probably under-performed the S&P because of it, along with my affinity for international and EM stocks.

So you should be skeptical about what I say bc other people are clearly smarter than me if they’re making so much money.

But Look Who’s Making the Money

Whenever a bubble is going on, you can get evidence of its existence more easily by looking around and seeing people who would normally never be involved in an investment treating it like their full time job.

When the housing bubble was going on in Florida, a lot of my friends’ parents were buying beach condos, speculating on land, and flipping houses like it was their full time job on HGTV.

Most of those parents though were in real traditional jobs like healthcare professionals, teachers, police officers, pilots, firefighters, etc.

Fast Forward to Today

My buddy who owns the most bitcoin I know is a doctor. He’s very smart and good on him for taking the risk, but he isn’t an expert in investing.

The people getting crazy paid are taking these huge risks on tech company stocks that are backed by little earnings.

As I’ve written before, these valuations are thanks to easy money policy from the Fed. When your discount rate is zero for expected future profits, it can make valuations outrageous.

However, what happens when we get a little inflation going? Workforce participation is going up, unemployment is down, I keep hearing these stories about low wage workers getting raises.

Eventually what happens is that you’ve got more dollars chasing goods and services so you have the price go up.

Our generation hasn’t seen that literally ever. In fact, I bet most people 35 and below don’t even know what inflation is.

So Yeah about Bitcoin and Ethereum

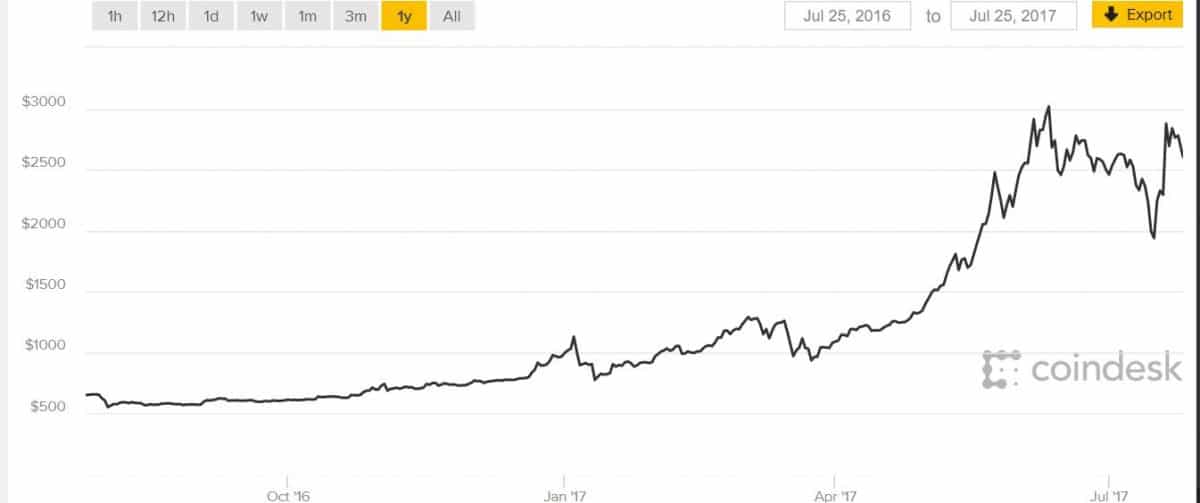

Check out the graph of Bitcoin from Coindesk, and tell me this doesn’t look like a freaking bubble of the worst kind.

Nothing goes up a bazillion percent in like 3 years without there being a bunch of insane level hot money speculation going on. Yes the blockchain technology is valuable. Yes having a decentralized currency free from government interference is nice.

What happens in a crash though? In the next 2008, do people flock to Bitcoin for safety? Heck no.

I think you’d see cryptocurrency values plunge just like peer to peer lending, real estate crowdfunding, and other post 2008 innovations. Why? They’ve never been tested in a true panic.

Amazon is a Company with Earnings Though. No Way is it in Bubble Territory

Check out this graph of their stock price. Particularly take a look at the growth of valuation since 2010.

My fiancee likes to say that’s because Amazon has the biggest online shopping network in the world. It’s going to take over groceries, destroy Walmart, put Netflix out of business, and dominate the world.

Here’s the thing though. If all that happened, if interest rates rose 2% it could slash Amazon’s market cap by half.

Another point of proof that Amazon is in irrational exuberance level? Seattle leads the nation in number of cranes building skyscrapers by a multiple of 3.

So I’m Still Investing, but Boy am I Scared Right Now

Here’s three ways to get ready for the coming tech crash.

First pay down your debt, because when you lose your job otherwise you might have to declare bankruptcy.

Get an emergency fund of 6 months’ expenses. Put it somewhere super safe and be ready to live on those savings potentially by decreasing expenses if you had to.

Keep investing in stocks, but be ready to buy a lot more when they plunge at some point. Anyone with 100% equities needs to look at their balance and think, oh dang this could drop to half of what I have and I gotta be cool with that.

So Ignore Me and Keep the Stock Market Party Going!

We haven’t had a really bad year in the stock market in 9 years. Think about that.

Tech stocks have done nothing but go up and their leaders have only been praised as visionaries, rather than captains of woefully profitless enterprises.

Interest rates have done nothing but go down. Whenever they try to go back up, some random crazy thing happens in the world in Germany where they decide to lend at negative rates and everybody buys our Treasuries and pushes the rates down again.

So something is going to happen, maybe next week, next year, or sometime this decade and it’s going to be really ugly.

Just remember, long term thinking, don’t panic sell, get out of debt, be generous, work on side income streams, develop other skill sets, avoid grad school like the plague, and focus on financial security no matter what the economic environment.

I would argue plenty of people have seen inflation. Increased rents and housing prices as well as healthcare cost but that could just be my personal view on inflation. Either way I do see the tech industry as highly overvalued. Especially when you have companies like Uber and Lyft that are burning through venture capital money.

Great post, Travis. Thanks for sharing your perspective. You definitely make some compelling points. It will be interesting to see when the bubble(s) pop. Also, congrats on your success with Student Loan Planner.

Great post Travis, and good to hear from you. I’m fully invested at the moment, but appreciate what you’re saying – and am also a little nervous about cheap money getting more expensive… Thanks again!