My goal here at Millennial Moola is to bring readers financial articles they won’t get anywhere else. While this site’s target audience is millennials, I’ll write about anything if I deem it relevant to the financial health of Americans in general. It’s for that reason I want this week to be focused on the failing financial health of the state of New Jersey. While New Jersey is the worst actor, there will be smaller crises like this one all over the nation over the coming years because of the failure of politicians to make the payments for the benefits they’ve promised to public employees. I estimate that New Jersey will have a $10 Billion hole in its budget by 2026, with no way to pay it besides drastically increases taxes, cutting public retiree benefits, or defaulting on its billions of dollars in municipal debt.

My goal here at Millennial Moola is to bring readers financial articles they won’t get anywhere else. While this site’s target audience is millennials, I’ll write about anything if I deem it relevant to the financial health of Americans in general. It’s for that reason I want this week to be focused on the failing financial health of the state of New Jersey. While New Jersey is the worst actor, there will be smaller crises like this one all over the nation over the coming years because of the failure of politicians to make the payments for the benefits they’ve promised to public employees. I estimate that New Jersey will have a $10 Billion hole in its budget by 2026, with no way to pay it besides drastically increases taxes, cutting public retiree benefits, or defaulting on its billions of dollars in municipal debt.

In most cases, pension benefits to public sector retirees are not outrageously large. The idea of a police captain pulling a $120,000 a year pension is certainly the exception, not the rule. In my recent article on the NJ Teachers’ Pension, I found the average pension to be around $44,000. These are average, hard working middle class people who risk having their secure retirement completely thrown out the window. I feel for them because it isn’t their fault that the past generation of New Jersey politicians have been liars that haven’t kept their promises.

The Magnitude of the Problem

I was reading the New Jersey Fiscal 2016 Budget the other day, and the Christie administration bragged about how much they’ve contributed to their public pensions. While they didn’t intend their boast to be taken this way, it shows just how cataclysmic Jersey’s financial crisis will be when it arrives.

The Governor’s fiscal 2016 budget includes a $1.3 billion contribution to the State’s defined benefit pension funds. This will bring total contributions of the Christie Administration to $4.2 billion, which is $781 million higher than total funding from fiscal 1995 through fiscal 2010.

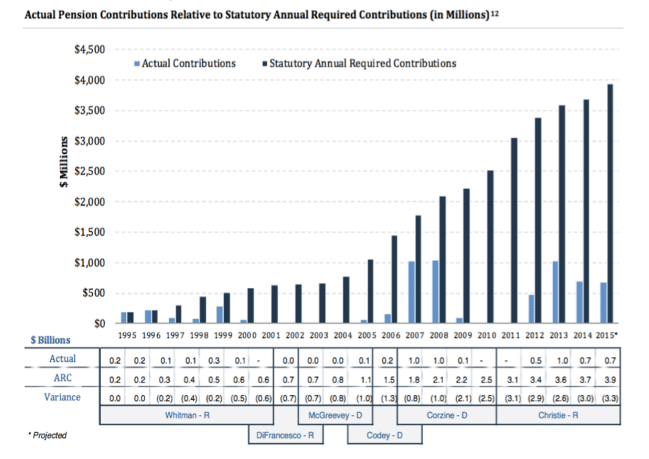

So the payments of the past six years dwarf those made over the prior sixteen. While that would be great news if the payments were even close to what was necessary, they’re a fraction of whats’ due. Take a look at this chart from pension360.org.

The light blue bars show how much New Jersey paid to pensions. The dark blue bars show how much the state should have contributed if it was going to fully pay pension benefits. Christie’s proposed $1.3 billion payment is only one third of what’s due to keep the state’s pension funds from going bankrupt.

All the New Jersey Pension Funds Are In Bad Shape

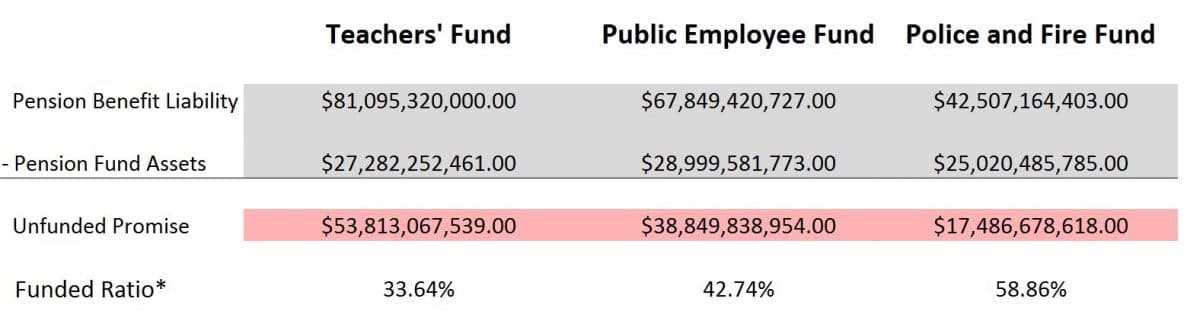

I profiled how the NJ Teachers’ Fund will be gone within 10 years because it’s the most underfunded of the large NJ public pension plans. Only the Judicial Pension Fund is worse, but it’s fairly small in size. However, the Public Employee Retirement System (PERS) at $29 billion is about the same size as the Teachers’ Fund. The other big plan is the Police and Fire Fund, with assets of about $25 billion. All asset valuations are as of June 30, 2014 because that’s the latest New Jersey has reported anything official about their pension funds.

The funded ratios above are even worse today. I just cannot tell you how bad for sure because the financial reporting authorities in New Jersey are late on all of their information, which is a another bad sign in a house of cards that is heading towards collapse. If I had to guess what the current situation looks like, based on spending down assets and market declines, the pension fund values should all be about 15% lower. The Teacher and Public Employee funds probably have another $3 billion added to the liability and Police and Fire probably has another $2 billion. The new funding ratios would be 27.6%, 34.8%, and 47.8% respectively.

You might have noticed that the Police and Fire Pension is actually in better shape. The reason for that is because local municipalities contribute a big portion of the employer contribution, and they’re doing fine and making large contributions. The state portion of the contribution is very small by comparison. When the chaos starts, the police and fire trustees will be sure to argue that their fund must be cordoned off from their weaker brethren. Including the Police and Fire Fund in the general state pension picture makes it look like the state has more time than they actually do. For the massive problems will begin once the state’s weakest plan, the Teachers’, begins to face insolvency. While that plan will run out of money within 10 years, it probably starts facing massive liquidity issues within two to three years.

What Will the Cash Flow Look Like in 10 Years?

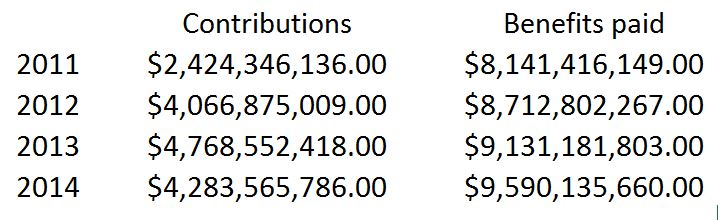

I will repeat my cash flow analysis for the pension fund as a whole as I did for the Teachers’ Fund. This is what the total pension fund cash flow looks like for the previous several years.

In 2015, the contribution level probably stayed around the same level because of revenue collection problems in New Jersey. The benefits paid level probably increased about 5%, the rate it has been going up for the past couple years. My projection in 2016 starts with the assumption that benefits continue to go up at the 5% rate. The State currently has no extra money laying around, and they predict revenue growth of 3.4% , which they’re already behind on. However, to be charitable I’ll use this 3.4% growth rate in contributions starting from a baseline level of $5 billion in 2016. I’m making another massive assumption in their favor that tax collections will not come in low in 2016 even though the stock market is in correction territory and they depend on rich taxpayers with primarily capital gains income for the majority of their revenue.

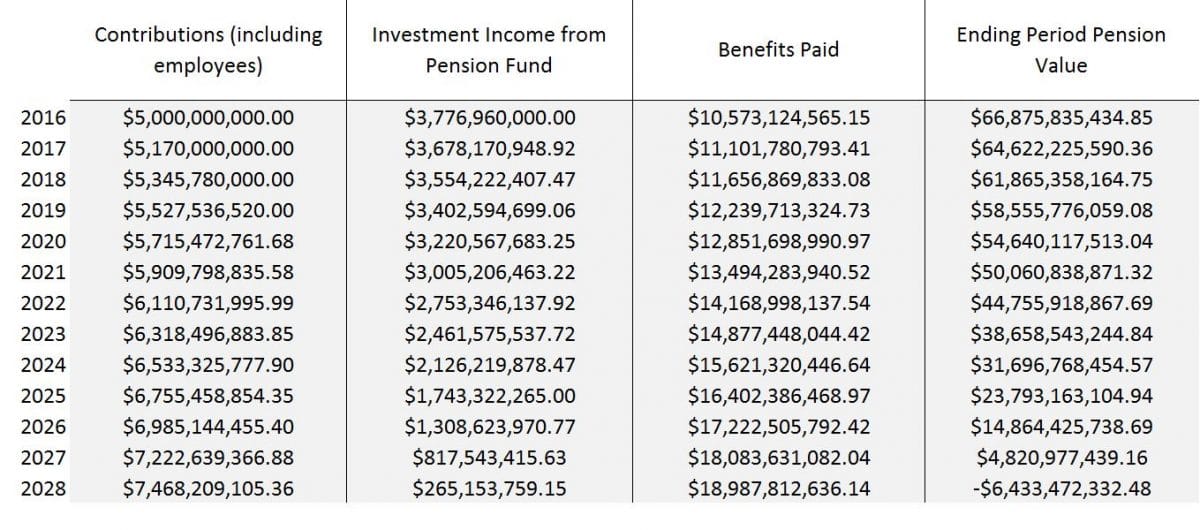

I’m won’t list all my calculations here, because that work has been done already in the Teachers’ article. I assume a realistic investment return of 5.5% instead of their ridiculous 7.9% assumption. I assume that 60% of the pension fund fell 12% and the rest was unchanged as of the latest director’s monthly investment report I have for reference in October 2015. That means the $74 billion pension fund is down to about $68.67 billion. Importantly, I exclude some of the fringe programs funded out of the pension fund like supplemental disability and income programs, so this projection is conservative on the benefits side.

So the pension fund as a whole completely runs out of money in 2028. The problem with this projection is each individual fund is a separate entity. The retired policemen and firefighters will refuse to let their fund subsidize the weaker teachers’ fund. So that’s why the crisis happens in 10 years instead of 12. At the 10 year mark, the cash shortfall for the teachers’ fund alone will account for $5 billion New Jersey must find somewhere. The Public Employee Retirement System will have also failed by then and will account for the other $5 billion the state must fund. Together, there will be a $10 billion net negative cash position in New Jersey’s budget. The hole will get wider once the police and fire fund fails several years beyond that.

Why This is News, and Why It’s Important

Moody’s and S&P are asleep at the wheel. They missed the subprime mortgage crisis, and they’re not using math to see that this crisis is spiraling towards the point where the decisions are between cutting retiree pensions 50%, raising taxes 50%, or defaulting on billions of dollars in interest payments. In fact, New Jersey’s appropriation debt, that it could away from without legal remedy from bondholders, is currently rated at A- by both agencies. It should be rated as junk. More on this in a future article.

Christie is tossing around other alternative plans that will supposedly save the pension or take retirees off of it to a new 401k style system. No big deal, how could he be running for President if there was truly a crisis of this magnitude brewing under the surface? Look in the first several years of my projections. The pension fund decreases in value but it doesn’t look like the kind of disaster that would stop all the presses with news articles. That’s because it’s an investment and actuarial crisis, one news reporters without financial training are not as likely to understand as a current cash shortfall in the billions of dollars.

Chris Christie is trying to buy time. If I had to bet, the late financial and investment reports are on purpose. People read reports, but they are too lazy to take the time to make projections. If he can put off the terrible 2015 pension report long enough, and then the 2016 and 2017 reports after that, he’ll be out of office by 2018 and it will be another Governor’s problem. The current situation allows him to appear as a foe of public unions and run for President without the clear and present danger of a New Jersey financial crisis on his watch. If it happens in 10 years, where will he be? Probably sitting in the owner’s box watching a Dallas Cowboys game.

Anyone with a public pension in New Jersey should be expecting to receive a fraction of it. Taxpayers in New Jersey should expect large tax increases to fund the promises of politicians past. There’s no way around it now. The only thing you can do is prepare.

What are your thoughts? Should benefits be cut, taxes be raised, or should the state default on its debt? Comment below!

While I find you blog informative I believe your last paragraph is most telling “Anyone with a public pension in New Jersey should be expecting to receive a fraction of it. Taxpayers in New Jersey should expect large tax increases to fund the promises of politicians past. There’s no way around it now. The only thing you can do is prepare”….The best people can prepare is to leave which is exactly what people are doing ,in the hopes of reversing this trend the state is cutting the estate tax and making retirees earnings tax ( pensions,401K ) Free up to 100K .It would still be a poor trade off for retirees to stay and watch their property tax increasing at a rapid rate ,while their earnings flatline .

There will be some resolution because I doubt either side is going to be willing to accept the extreme pay cuts. I’m betting they try to work with the feds to dump retiree healthcare benefits onto the federal exchanges, plus property tax increases, plus benefit cuts way off into the future affecting current teachers. It still might not be enough

Hire Mr. Trump as the head of the pension fund

Ha I’m sure that will fix everything