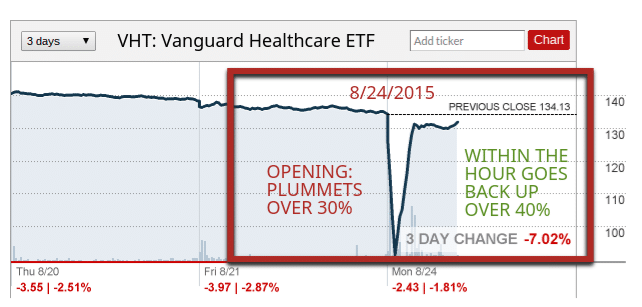

We learned a lot yesterday in Flash Crash 2.0, some of which completely changed what I thought I knew about investing. Dozens of stocks and ETFs, and perhaps many more, separated from reality and thousands of investors were robbed of millions, if not billions of dollars. My article yesterday was specific to the Vanguard Healthcare ETF that collapsed over 30%, but now that the dust has settled we can see that there were many more ETFs than that that fell apart. It’s clear ETFs are no longer safe for folks not being helped by professionals. Continue reading “ETFs Are No Longer Safe For the Average Investor”

We learned a lot yesterday in Flash Crash 2.0, some of which completely changed what I thought I knew about investing. Dozens of stocks and ETFs, and perhaps many more, separated from reality and thousands of investors were robbed of millions, if not billions of dollars. My article yesterday was specific to the Vanguard Healthcare ETF that collapsed over 30%, but now that the dust has settled we can see that there were many more ETFs than that that fell apart. It’s clear ETFs are no longer safe for folks not being helped by professionals. Continue reading “ETFs Are No Longer Safe For the Average Investor”

Category: Investing

all about markets, stocks, bonds, and more

Was Vanguard Hit By a Flash Crash?

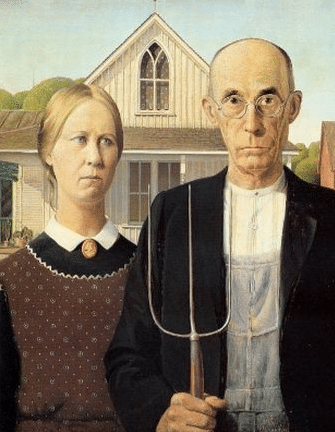

What in the world! Was Vanguard hit by a flash crash or algorithmic trading attack?!?!?!??!?! Look at this Yahoo finance chart above showing the 3 day stock price of VHT, Vanguard’s Health Care Sector ETF. Check out what just happened this morning. The ETF’s price plummeted on opening from over $130 a share to almost below $90 a share, over a 30% drop. In less than an hour it recovered over 40% to about $130 a share. Continue reading “Was Vanguard Hit By a Flash Crash?”

How to Love Losing Money in Investing

Stock markets were down 5% this week, in some cases even more depending on what part of the world you are looking at. We have seen oil fall almost 60% from its peak this year, and Emerging Markets are down over 25% from peak. I made the mistake of checking my investment account on Friday, only to see that my losses have been in the five figures in the past week alone. With markets in Asia opening down at least 5% this morning, I should have another solid four digit dollar loss by the end of the day unless there’s some kind of reversal or Fed speak that suggests they are delaying the rate hike that’s coming. AHHHH what should I do!!!! I’m on a Eurotrip right now. Should I sell everything and hurry back to the US before my holdings fall so much that I can’t even afford a plane ride back? One of the most important things to learn when you put a ton of money in stocks is how to love losing money in investing. Continue reading “How to Love Losing Money in Investing”

What Does a NYSE Trading Halt Mean For You?

As of about 11:30am today, The NYSE trading halt occurred because of some as of yet undetermined technical problem. On top of this major problem, Chinese officials stopped trading in their stock market because of a continued crash, United Airlines flights got grounded across the country, and the Wall Street Journal home page went down. What does all this mean? Should you panic and sell every stock you own? These kind of questions will send you into a frenzy if you are depending on investment income and don’t have a happy place to go to calm down and put things in perspective. However, a serious question remains: does this problem with the stock exchange mean that your money is at risk?

Continue reading “What Does a NYSE Trading Halt Mean For You?”

Investing For Beginners in a World of CNBC

HOT STOCKS NOW! You click links like these because the title is exciting, like a Hollywood breakup or new Panda baby at the zoo. Financial companies know this so they use absurd headlines to lure new investors in and try to make as much money on them as possible. I for one like my stocks like I like my bagels: plain. People often ask me about hot tech startups, IPOs, and what sector I think they should be in. I understand why people think this way because they get their investing advice from Mad Money. Investing for beginners is not nearly as hard as you think when you tune out the noise.

Continue reading “Investing For Beginners in a World of CNBC”

How Tech Workers Can Get Their Finances Ready for A Coming Crash

Think this headline is sensational? Yeah I’d agree it’s a little over the top to suggest tech workers get their resumes updated, but I wanted to make a point about something being overlooked in the tech industry by most Wall Street analysts today: earnings. For the most part, they aren’t there. I’m using data from Yahoo Finance to look at various large tech companies trading on public stock exchanges right now and looking at their earnings data over the past 12 months. All data is the latest available as of 6/30/2015

Continue reading “How Tech Workers Can Get Their Finances Ready for A Coming Crash”

Why Bonds Terrify Me

One of the most common conversations someone will have with their financial advisor is how much do you want in stocks vs bonds? If you can handle more risk for potentially higher return you’d want more in stocks while if you’re really conservative you’d have a lot in bonds. What’s a bond you ask? Basically a borrower takes out a loan and promises to pay you interest in the form of periodic coupon payments and give you the entire lump sum back when that bond matures. Common maturities on bonds include 5, 10, 20, and 30 years. If you invest in your 401k, you probably own some and don’t even realize it. If your parents are approaching retirement they probably have close to half of their portfolio sitting in bonds. Because of the events of the last seven years, bonds terrify me. Bonds as an asset class are the most overvalued they’ve been in at least six decades.

Look Like A Stock Market Genius and Pay Off Your Debt!

What if I told you that I could guarantee you 6% on your money right now without any risk? Would you suspect I was in the mafia? Maybe I was insider trading and trying not to be so obvious as to arouse the suspicion of the authorities. Perhaps I was a stock market genius? Well for a lot of people I can guarantee that return and there’s nothing illegal about the method I’m about to say.

Continue reading “Look Like A Stock Market Genius and Pay Off Your Debt!”