I was buying a Coca-Cola the other day and that got me thinking how much money I would be losing if I made it a habit several times a day for a lifetime. While I was having these thoughts, I saw the guy in front of me at the convenience store ask for a pack of cigarettes, which he paid for with the crumpled up $20 bill in his pocket. Then I started wondering, sure this Coke would cost a bundle if I drank a bunch of them every day and got obese or had another health complication from all that sugar, but how much would it cost me if I was addicted to smoking? Continue reading “I Had No Idea Smoking Was This Expensive”

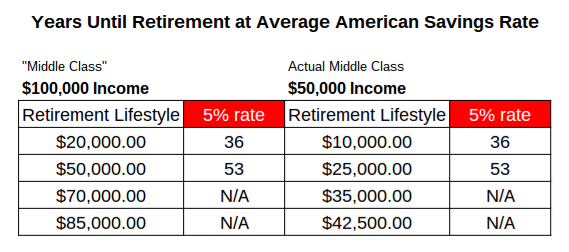

Being a doctor or lawyer is a well worn path along the road of the American dream. You go to grad school and get the big job with great pay that confers a level of societal prestige and cocktail party nodding when you’re asked “What do you do?” that few other professions can match. Why then are there so many doctors and lawyers with deep financial problems? Why do we see countless examples of these folks working well into their 70s?

Being a doctor or lawyer is a well worn path along the road of the American dream. You go to grad school and get the big job with great pay that confers a level of societal prestige and cocktail party nodding when you’re asked “What do you do?” that few other professions can match. Why then are there so many doctors and lawyers with deep financial problems? Why do we see countless examples of these folks working well into their 70s?

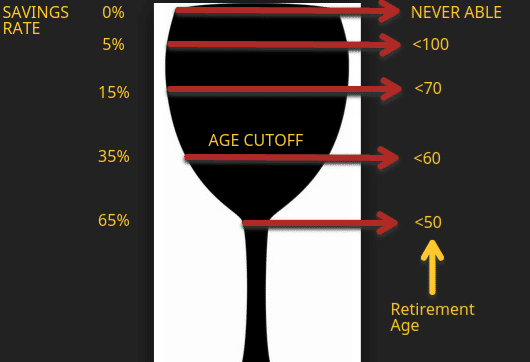

Have you ever wondered how different people can afford retirement at different ages? What is the magic sauce that allows one person to afford retirement in their 40s while another person works until they are 75? The good news is we can show this in terms of a wine glass instead of a more boring bar graph or pie chart. Think about the shaded area representing percentages of American workers and the age cutoffs shown with red arrows. The spending examples I use should be viewed in the context of a household with a solid middle class income. You can discover when you will retire by looking at this glass!

Have you ever wondered how different people can afford retirement at different ages? What is the magic sauce that allows one person to afford retirement in their 40s while another person works until they are 75? The good news is we can show this in terms of a wine glass instead of a more boring bar graph or pie chart. Think about the shaded area representing percentages of American workers and the age cutoffs shown with red arrows. The spending examples I use should be viewed in the context of a household with a solid middle class income. You can discover when you will retire by looking at this glass!