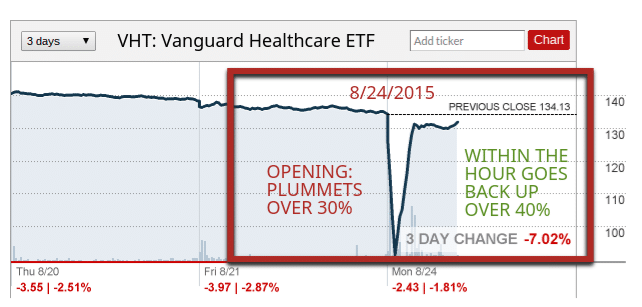

I still can’t shake the feeling I got from how Monday’s Flash Crash 2.0 went down. Investment funds like ETFs are supposed to be stable instruments to build long term wealth, and the SEC let fast money accounts take 30% or more from average retail investors. Before Monday, I never thought that ETFs could separate so drastically from the price of their underlying holdings, but now we know. Now that we have ultra fast computers and everything is run on algorithms, what might the next crisis look like and how can we be prepared? Continue reading “Flash Crash 2.0 Showed Us What the Next Crisis Might Look Like”

Being a doctor or lawyer is a well worn path along the road of the American dream. You go to grad school and get the big job with great pay that confers a level of societal prestige and cocktail party nodding when you’re asked “What do you do?” that few other professions can match. Why then are there so many doctors and lawyers with deep financial problems? Why do we see countless examples of these folks working well into their 70s?

Being a doctor or lawyer is a well worn path along the road of the American dream. You go to grad school and get the big job with great pay that confers a level of societal prestige and cocktail party nodding when you’re asked “What do you do?” that few other professions can match. Why then are there so many doctors and lawyers with deep financial problems? Why do we see countless examples of these folks working well into their 70s?