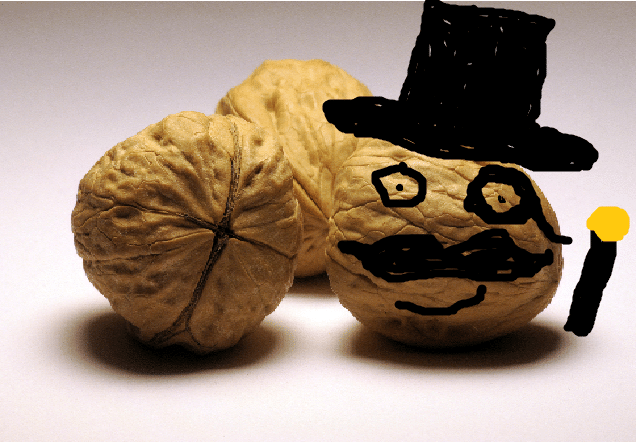

When I wrote that I was tired of being poor and was going back to work to drive luxury cars and live in a 12 foot ceiling apartment, I recognized a huge market need out there existed that was not being fulfilled. That April Fool’s Day post received the most traffic in Millennial Moola history. Screw learning how to save millions of dollars on a five figure salary, payoff giant student loan debt, retire in six years, or pay a fair price for a ripoff like most financial advice, give me funny photos and make silly comments about them dang it! Continue reading “Introducing Millennial Moola’s Irreverent Little Brother, Wealthy Walnut”