Readers, if you have a question that you’d like featured in Millennial Moola, email me at [email protected]. This fantastic question comes from Jack in Florida: Continue reading “Should I Invest in a Brewery?”

Personal Finance For the N64 Generation

all about markets, stocks, bonds, and more

Readers, if you have a question that you’d like featured in Millennial Moola, email me at [email protected]. This fantastic question comes from Jack in Florida: Continue reading “Should I Invest in a Brewery?”

While promoting my Brexit article Friday on Facebook, I couldn’t resist sharing with my friends that I thought Vanguard’s Europe ETF was a great long term buy. After all, it fell over 10% in a single day. That’s when I started getting a flurry of emails, texts, and other private messages as if I’d just shared an insider tip. Personal finance bloggers love to receive serious thought provoking questions from readers. At the same time, we also love to be entertained. Fortunately, these funny post-Brexit questions pass both tests. Continue reading “What’s an EFT? (And Other Funny Post-Brexit Questions I’ve Received)”

I had to change my article for Friday at the last second. No one realized that the UK would be voting for the Brexit to leave the EU. Private traders hired prestigious polling firms to assure them that the UK would stay. The markets even rallied yesterday on the assumption that the matter had already been decided. Such is the danger when a highly unrepresentative and educated group of rich people in an urban bubble assure themselves of something. Perhaps some of you are freaking out about the parallels that exist between what just happened in the UK and what is going on in the US. I’m here to ruin all the fun and tell you what no one in the news will say today: it’s just not that big of a deal. Continue reading “Brexit: Hogwarts Just Got a Lot Harder To Get Into”

Historically, the German economy is famous for hyperinflation in the 1920s. Workers would earn paychecks and immediately go try to spend them. Consequently, their currency lost significant value every day. Average families needed wheelbarrows to carry their cash to the market to buy bread. We now have the opposite problem where Germans should hide money under the mattress because interest rates there are negative. Poor Germany. Continue reading “Germans Should Hide Money Under the Mattress”

Looking at the latest New Jersey pension performance report made me realize how doomed pensions are for average people in America. If you work in the public sector, you need to be using a 403b and IRA to shelter as much as you can for your golden years. I seriously doubt all but the strongest funds will be able to pay their obligations in 30 years when many Millennial Moola readers will retire. This is mostly due to impossible public pension investment assumptions, and I have the numbers to prove it. Continue reading “Most Public Pension Investment Assumptions Are Impossible”

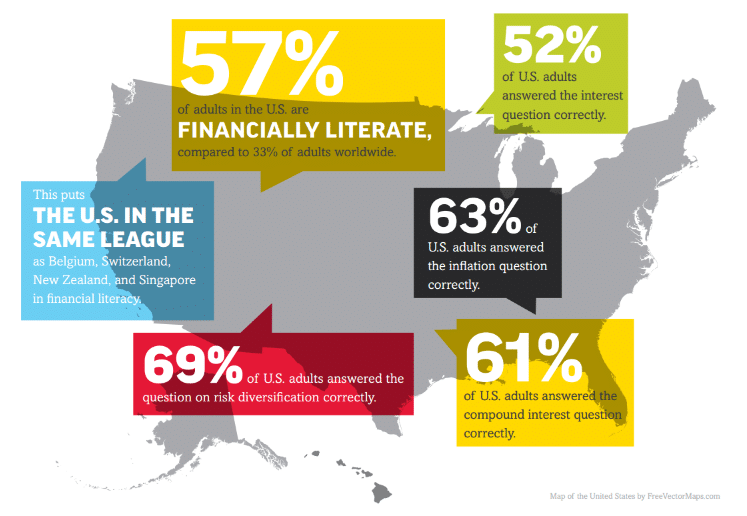

A reader pointed out a fascinating study from George Washington University and Standard and Poor’s. The researchers wanted to discover how many people around the world know what compound is. The survey targeted over 150,000 respondents in 144 countries. The study can be found from its original publisher here. In this post, I am going to focus on the policy implications from the stunning realization that 39% of Americans do not know what compound interest is. Continue reading “How Many Americans Know What Compound Interest Is?”

I got an interesting email from a friend recently who was trying to make heads or tails of her husband’s 401k options. She got a mailer saying that some of the mutual fund choices were going to change and that they needed to make a decision where to direct their new funds. If this ever happens to you, I suggest taking a look at your 401k fees and fund choices. As we will see, her husband’s 401k options might be better at making a finance company rich instead of them. Continue reading “My Husband’s 401k Options Are Changing. What Should We Do?”

When I was traveling around England last fall, I decided to make a stop at Cambridge University to hang out with a friend I made along my travels. Through him, I met another Cambridge university student from Nigeria with whom I also became buddies, who I’ll call TJ. He asked me about a couple guys who were hitting him up for investment money on Twitter, and he wanted to know if they were legit. Continue reading “How To Spot an Investment Scam on Twitter”

Everybody assumes you can only fix your retirement account problems around the end of December. However, that couldn’t be more wrong. In fact, the IRS generously gives a gift that keeps on giving. You have until Tax Day of the following year to make any IRA contributions that can count for the year prior. You can fix your empty IRA problem by looking out for these special cases and seeing if any apply to you. Continue reading “The IRS Time Machine to Fix Your Empty IRA Problem”

Fake. Duplicitous. Phony. Surreal appearance underlying the dark truth of the willingness to take advantage of anyone in its way. I could be talking about Chris Christie’s support of Donald Trump. Unfortunately, I’m not. If you take a look at trading levels, there are a lot of individual investors out there that could lose their shirt when New Jersey bonds default. I’ve written two pieces on the coming disaster of New Jersey’s finances, here and here. Sometime in the next 10 years, the state will have no money to pay its bills. The scary part is, the bond market is completely ignoring it. There are people today paying premium dollars for bonds that could be close to worthless in 10 years. The rating agencies and other institutional investors are wrong because there has never been a looming financial crisis quite like this before. Here’s the evidence. Continue reading “New Jersey Bonds Are Like Chris Christie at a Trump Rally”