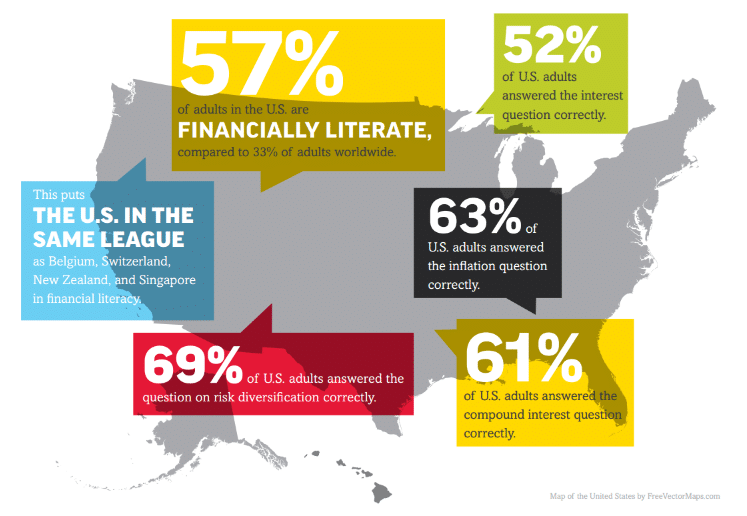

A reader pointed out a fascinating study from George Washington University and Standard and Poor’s. The researchers wanted to discover how many people around the world know what compound is. The survey targeted over 150,000 respondents in 144 countries. The study can be found from its original publisher here. In this post, I am going to focus on the policy implications from the stunning realization that 39% of Americans do not know what compound interest is. Continue reading “How Many Americans Know What Compound Interest Is?”