Have you ever wondered why it’s so freaking hard to get low cost quality financial advice? I wondered that too, but then I had a stunning reality check. During the months of August and September, I was seriously considering becoming a financial advisor myself. I started looking into the process, and I discovered traditional “wealth managers” charge so much money for their services. Regulations, insurance requirements, and business expenses virtually eliminate all possibility of low cost advice. Continue reading “Why It’s So Freaking Hard to Get Low Cost Quality Financial Advice”

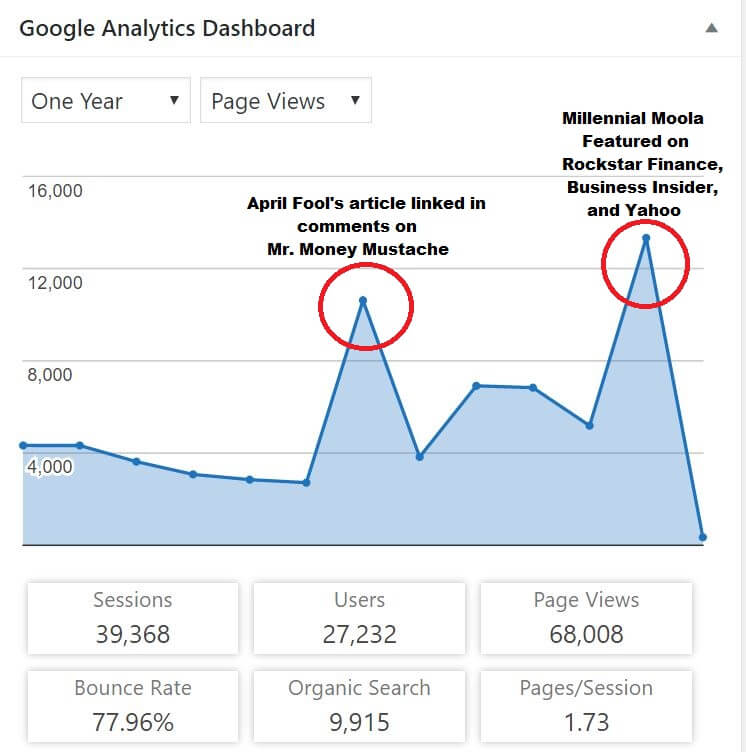

Millennial Moola September 2016 Traffic and Income Report – $682

Exciting news y’all. September 2016 was the most successful month in Millennial Moola history. Can’t wait to share my September 2016 traffic and income report. You know I do this blog for the love of writing and teaching others about personal finance, so I’m not in it for the dollars and eyeballs on my stuff. That said, the more people who read my site and the more money I make, generally the more people value what I’m saying. So my total monthly pageviews for September was about 13,300, and my blog net income for the month was $682. Continue reading “Millennial Moola September 2016 Traffic and Income Report – $682”

It’s Time to Apply For A New Job, Even if You’re Happy

I want to comment on a widespread phenomenon I’ve seen among my friends. Some folks are perfectly content in their jobs, but they feel underpaid. Others stay at their employer because they’re afraid of looking elsewhere. Inertia is a powerful thing. I’m here to tell you that it’s time to apply for a new job, even if you’re happy. Continue reading “It’s Time to Apply For A New Job, Even if You’re Happy”

I want to comment on a widespread phenomenon I’ve seen among my friends. Some folks are perfectly content in their jobs, but they feel underpaid. Others stay at their employer because they’re afraid of looking elsewhere. Inertia is a powerful thing. I’m here to tell you that it’s time to apply for a new job, even if you’re happy. Continue reading “It’s Time to Apply For A New Job, Even if You’re Happy”

Why I Stopped Using Wells Fargo, FIVE YEARS AGO

In the personal finance blogger world, one way to make money is to accept payment to write a “sponsored post.” You give some blah generic advice about why saving is important and then you drop in a line with “and have you ever heard of this fantastic high yielding account with XYZ? Sign up today!” This is the opposite of a sponsored post in that Wells Fargo might have been willing to pay my money NOT TO WRITE IT. I stopped using Wells Fargo five years ago, and it’s looking like it was a great decision after their massive scandal is shaking wall street to the core. Continue reading “Why I Stopped Using Wells Fargo, FIVE YEARS AGO”

You’re a Heck of a Lot Richer than You Think

I have some great news for you. If you’re saving responsibly and have an emergency fund of at least $1,000 in it, you’re a 1% er. No I’m not making that up. A study by GoBankingRates found that 50% of families making between $100,000 and $149,000 a year have less than $1,000 in the bank. A solid 18% of these families don’t even have anything in the bank. Keep reading because I’m about to massively boost your financial self-esteem from how many people suck at managing money. Continue reading “You’re a Heck of a Lot Richer than You Think”

How To Build a Blog in 10 Minutes

It’s never been easier or cheaper in history for an average person to build a blog in 10 minutes. You can turn a blog into a business with virtually no overhead. The hosting company I used to start Millennial Moola is offering a flash sale that lasts for only a couple more days where you can buy 3 years worth of website hosting for $2.95 a month and it includes a free domain registration. Continue reading “How To Build a Blog in 10 Minutes”

Why I’m Starting a Flat Fee Student Loan Consulting Business

I have no idea how businesses get your cell phone number. Somehow, a bunch of scumbag student loan robo-calling businesses have mine. I received a call from somewhere in North Carolina on Monday URGING me to press 1 to speak to a private loan counselor NOW. If you type in ‘student loan consult’ into Google, there are fewer than a half dozen legitimate options. The ones that do exist are ridiculously expensive. There is a massive need for objective, math-based, flat fee student loan consulting. Hence, I have decided to offer consultations for a one time fee. Continue reading “Why I’m Starting a Flat Fee Student Loan Consulting Business”

State Taxes Should Make You Want to Max Your 401k

If you currently live in a high tax state like California, New York, New Jersey, Georgia, or Missouri, if you’ve looked at your paycheck you see a ton of taxes going to the state government. What are the chances you remain in that state at retirement? They’re probably pretty low given that the average person moves almost 12 times during their lifetimes. I suggest taking a look to see if your 401k is tax deductible from your state’s income tax. Most likely it is, and that means you should max your 401k right away if you can afford to. Continue reading “State Taxes Should Make You Want to Max Your 401k”

How Much Money Is Enough to Walk Away?

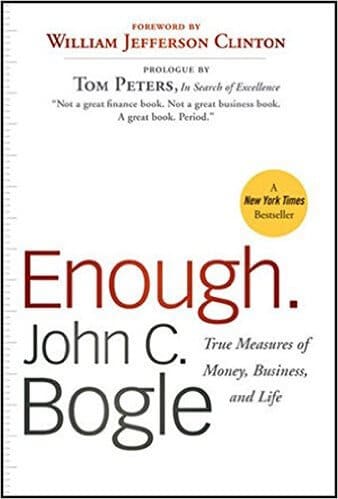

John Bogle, the founder of Vanguard, wrote an interesting book a few years back called Enough: True Measures of Money, Business, and Life.

John Bogle, the founder of Vanguard, wrote an interesting book a few years back called Enough: True Measures of Money, Business, and Life.

In it, he talks about how he accidentally returned about $50 billion back to Vanguard shareholders by making the company a mutually owned business rather than a privately held business like Fidelity. Instead of $50 billion, he’s only worth about $50 million. That’s the first time I was confronted with the thought of how much is enough to walk away. Continue reading “How Much Money Is Enough to Walk Away?”

Why Increased Access to Student Loans Is Mostly Just Good for Greedy Colleges

A paper by the NY Fed that came out recently should embarrass our nation’s colleges and universities. The researchers found that whenever the federal government increases access to subsidized or unsubsidized student loans, colleges take away the majority of this extra help through tuition increases. For every $1 of extra aid intended to help needy students, universities take away 60 cents of it through increasing their tuition prices. Clearly, greedy colleges cannot keep their hands out of the federal student loan cookie jar. Continue reading “Why Increased Access to Student Loans Is Mostly Just Good for Greedy Colleges”